Table of Contents

Market Overview

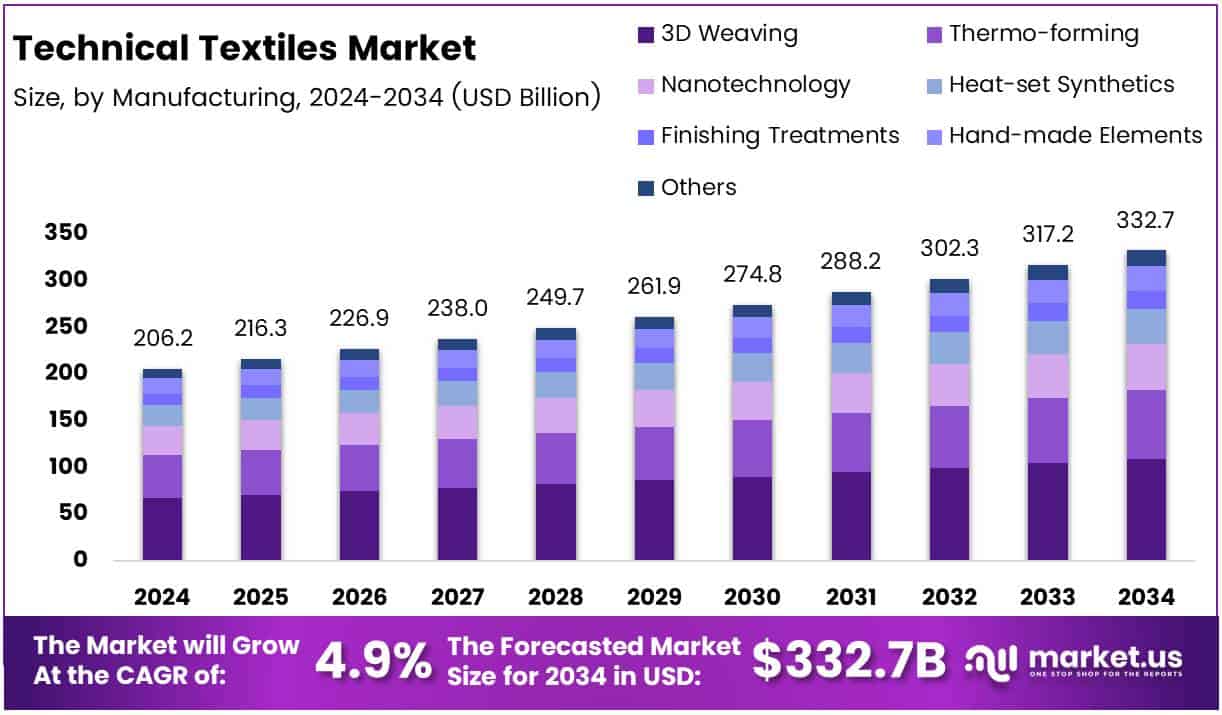

The Global Technical Textiles Market size is expected to be worth around USD 332.7 Billion by 2034, from USD 206.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period.

Opportunities are rising in geotextiles and smart wearables. Geotextiles support road, rail, and irrigation projects. Smart textiles are gaining demand in healthcare and fitness. Eco-friendly technical textiles are also trending. Many firms are now investing in green and bio-based materials. This shift is due to rising eco-regulations and consumer awareness.

Governments are investing big in this market. India launched the PLI Scheme worth ₹10,683 crore. The National Technical Textiles Mission got ₹1,480 crore. These efforts boost R&D and exports. Global rules now demand fire-resistant and medical-grade fabrics. These rules push up certified textile sales.

Growth is strong in Asia-Pacific and Europe. Technical textile firms can benefit from high margins and export potential. Investors should focus on innovation, compliance, and automation to win in this space.

Key Takeaways

- Technical Textiles market will hit USD 332.7 billion by 2034 at 4.9% CAGR.

- In 2024, 3D Weaving led manufacturing with 24.1% share.

- Hometech Textile topped end-use in 2024 with 20.1% share.

- Asia Pacific led globally in 2024 with 47.2% market share.

Growth Drivers

- Rapid urbanization and infrastructure development

- Rising demand in automotive, healthcare, and construction sectors

- Innovation in biodegradable and smart materials

- Supportive government policies for industrial textiles

- Increasing safety and environmental concerns

Segmentation Insights

Manufacturing Analysis

3D Weaving led in 2024 with 24.1% share. It offers strong, flexible fabrics. Thermo-forming makes light, moldable textiles. Nanotech adds durability and protection. Heat-set synthetics stay reliable. Finishing and handmade styles add value. Others segment grows with new tech.

End Use Analysis

Hometech led with 20.1% share in 2024. Demand rose for smart home fabrics. Agro Textiles grew with farming use. Medtech rose with medical needs. Protech met safety demand. Transtech served auto and air sectors. Sportech grew in sportswear. Others grew with new trends.

Technology and Material Advancements

Innovation remains a key driver of the technical textiles market. The development of smart textiles, capable of sensing and reacting to environmental conditions, is reshaping the future of the industry. Nanotechnology, biodegradable fibers, and high–performance composites are enhancing the physical and chemical characteristics of textiles, allowing them to serve a broader range of applications.

Nonwoven technologies, in particular, are seeing increased adoption due to their cost-effectiveness and versatility. These materials are especially in demand in hygiene and medical products, filtration systems, and construction. Likewise, woven and knitted fabrics remain critical in sectors that require precision, high strength, and durability.

The rising use of eco–friendly fibers like polylactic acid (PLA), bamboo, and hemp is also a prominent trend, driven by environmental regulations and consumer preference for sustainable products.

Regional Insights

Asia Pacific led in 2024 with 47.2% share and USD 96.9 Bn. Growth is driven by China, India, Japan, and South Korea. Key sectors include auto, healthcare, and agriculture. Demand grows for geotextiles and medtech use.

North America holds a strong share. The U.S. drives demand in aerospace, auto, and medical sectors. Military and healthcare use boost growth. Advanced tech supports market rise.

Europe grows with eco-friendly textiles. Germany, France, and the UK lead. Green regulations and quality standards fuel demand in auto and industry.

Latin America & MEA grows in farming and auto sectors. MEA sees rise in defense and construction demand. Both regions are still emerging markets.

Challenges

- High cost of advanced materials

- Lack of awareness among end-users in developing countries

- Complex and fragmented supply chains

- Regulatory compliance and standardization issues

- Limited availability of skilled labor for high-tech textile manufacturing

Competitive Landscape

The global technical textiles market is highly competitive and moderately fragmented, with both established companies and startups competing for market share. Leading players focus on technological innovation, mergers & acquisitions, strategic partnerships, and expanding product portfolios to strengthen their positions. Many companies are also investing in sustainable manufacturing practices and digitized supply chain models to maintain competitiveness.

Recent Developments

- In September 2024, a leading technical textiles specialist announced the acquisition of major assets of Heytex Group, aiming to strengthen its portfolio in coated and functional textiles. This move is expected to expand its global manufacturing capabilities and customer reach.

- In June 2025, Garware Technical Fibres revealed plans to acquire Norway-based OTS Cordage, marking a strategic step in global expansion. The acquisition enhances Garware’s marine solutions offerings and strengthens its presence in the European market.

Conclusion

The technical textiles market is positioned for robust long-term growth, supported by technological innovation, expanding industrial applications, and rising awareness of sustainable and high-performance materials. With increasing demand from automotive, healthcare, construction, and defense sectors, and evolving manufacturing capabilities, the market is set to play a crucial role in shaping the future of modern industries.