Table of Contents

- Introduction

- Editor’s Choice

- Test and Measurement Equipment Market Overview

- Industry Revenue of Manufacture of Instruments for Measuring, Testing, And Navigation

- Operating Revenue of Measurement Equipment Manufacture

- Different Test and Measurement Equipment and Their Specifications

- Test and Measurement Export Statistics

- Test and Measurement Equipment Import Statistics

- Regulations for Test and Measurement Equipment

- Recent Developments

- Conclusion

- FAQs

Introduction

Test and Measurement Equipment: These are the essential tools used across industries to assess and analyze various characteristics of materials, components, and systems.

They encompass a range of instruments such as multimeters, oscilloscopes, vernier calipers, and spectrophotometers, facilitating tasks from measuring electrical signals to evaluating material strength.

These tools play crucial roles in ensuring product quality, supporting research and development efforts, and diagnosing faults in systems.

With accuracy, calibration, and safety as key considerations, the future of test and measurement equipment trends towards integration with IoT platforms, miniaturization for increased portability, and automation for improved efficiency.

Editor’s Choice

- The Global Test and Measurement Equipment Market revenue is expected to reach USD 54.2 billion by 2033.

- In the market for test and measurement equipment, organization size plays a pivotal role in determining market share distribution. Large enterprises dominate the market, accounting for 65% of the total share.

- The industry revenue for the manufacture of instruments and appliances for measuring, testing, and navigation in Germany has experienced notable fluctuations from 2012 to 2025.

- The operating revenue of the measurement equipment manufacturing sector in China has shown a consistent upward trend from 2008 to 2020, despite minor fluctuations in some years.

- In 2022, Germany emerged as the leading exporter of measuring or checking equipment, with an export value of USD 4.43 billion, accounting for 17.6% of the global market.

- In 2022, China led the global market for importing measuring or checking equipment, with imports valued at USD 324 billion, accounting for 21.1% of the total market.

- In the United States, regulations such as those outlined by the National Institute of Standards and Technology (NIST) and compliance with standards like ISO/IEC 17025 ensure high precision and calibration in measurement tools.

Test and Measurement Equipment Market Overview

Global Test and Measurement Equipment Market Size Statistics

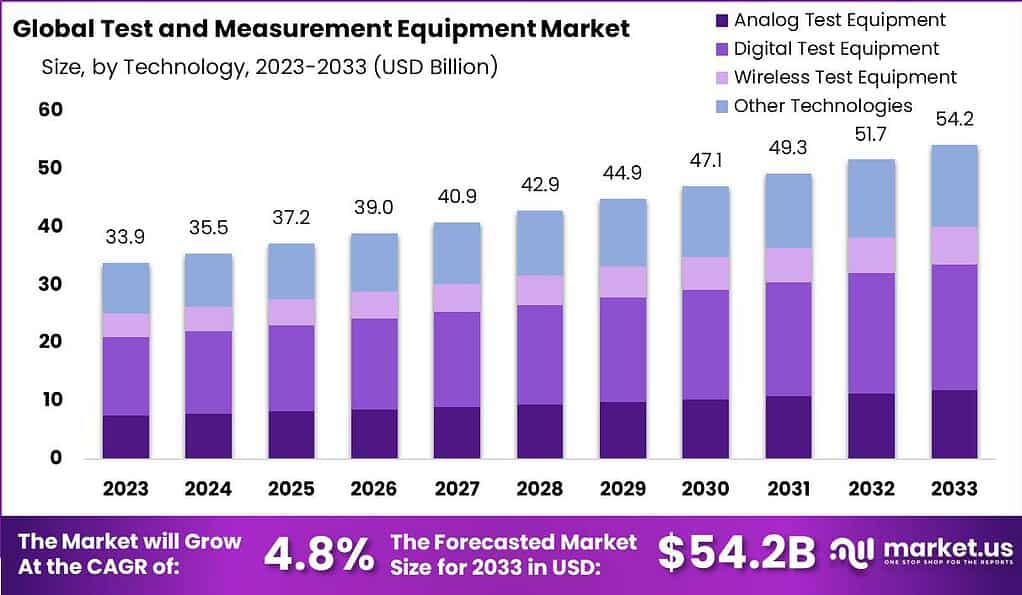

- The Global Test and Measurement Equipment Market is poised for significant growth over the coming decade at a CAGR of 4.8%.

- In 2023, the market revenue is expected to reach USD 33.9 billion.

- This upward trend is projected to continue, with the market expanding to USD 35.5 billion in 2024 and further to USD 37.2 billion in 2025.

- By 2026, the market revenue is anticipated to increase to USD 39.0 billion, reaching USD 40.9 billion in 2027.

- The growth trajectory remains robust, with revenues estimated at USD 42.9 billion in 2028, USD 44.9 billion in 2029, and USD 47.1 billion in 2030.

- The market is expected to achieve USD 49.3 billion in 2031, and by 2032, it is forecasted to reach USD 51.7 billion.

- This growth culminates in a projected market revenue of USD 54.2 billion by 2033.

- The consistent increase in market revenue highlights the expanding demand and advancements in test and measurement equipment globally.

(Source: market.us)

Global Test and Measurement Equipment Market Share – By Organization Size Statistics

- In the market for test and measurement equipment, organization size plays a pivotal role in determining market share distribution.

- Large enterprises dominate the market, accounting for 65% of the total share.

- This significant proportion underscores the extensive resources and capabilities that large enterprises possess, enabling them to invest heavily in advanced testing and measurement technologies.

- In contrast, small and medium enterprises (SMEs) hold a 35% market share.

- While smaller in comparison, this segment’s contribution highlights the growing adoption and integration of test and measurement equipment among SMEs, driven by the need to enhance product quality and compliance with industry standards.

(Source: market.us)

Manufacture of Instruments and Appliances for Measuring, Testing, And Navigation

- The industry revenue for the manufacture of instruments and appliances for measuring, testing, and navigation in Germany has experienced notable fluctuations from 2012 to 2025.

- In 2012, the revenue stood at USD 36.7 billion, increasing to USD 37.72 billion in 2013 and further to USD 40.3 billion in 2014.

- However, a slight decline occurred in 2015, with revenue dropping to USD 36.24 billion, followed by a modest recovery to USD 37.16 billion in 2016.

- A significant surge was observed in 2017, reaching USD 41.51 billion, and this upward trend continued in 2018, with revenues peaking at USD 45.51 billion.

- Despite a decrease to USD 42.28 billion in 2019 and a further decline to USD 38.34 billion in 2020, the market showed resilience, rebounding to USD 39.7 billion in 2021.

- By 2022, the revenue climbed to USD 41.91 billion, and it is projected to continue growing, reaching USD 45.17 billion in 2023, USD 45.94 billion in 2024, and USD 46.46 billion in 2025.

(Source: Statista)

Manufacture of Watches and Clocks

- In contrast, the manufacture of watches and clocks has maintained relatively stable but lower revenue figures.

- Starting at USD 0.58 billion in 2012, the industry saw an increase to USD 0.74 billion in 2013 and 2014.

- A slight decrease to USD 0.72 billion was observed in 2015, followed by further declines to USD 0.67 billion in 2016 and USD 0.66 billion in 2017.

- A brief recovery occurred in 2018, with revenue rising to USD 0.69 billion, but it fell again to USD 0.64 billion in 2019 and USD 0.48 billion in 2020.

- The market stabilized somewhat in the following years, with revenues of USD 0.5 billion in 2021 and USD 0.55 billion in 2022, and projected steady growth to USD 0.64 billion in 2023 and USD 0.65 billion in both 2024 and 2025.

(Source: Statista)

Operating Revenue of Measurement Equipment Manufacture

- The operating revenue of the measurement equipment manufacturing sector in China has shown a consistent upward trend from 2008 to 2020, despite minor fluctuations in some years.

- In 2008, the industry generated USD 1,551 million in revenue, which increased to USD 1,909 million in 2009.

- The upward trajectory continued through 2010 and 2011, with revenues reaching USD 2,351 million and USD 2,515 million, respectively.

- By 2012, the revenue had grown to USD 2,699 million and further to USD 2,885 million in 2013.

- The sector experienced steady growth in the following years, with revenues of USD 2,987 million in 2014, USD 3,181 million in 2015, and USD 3,198 million in 2016.

- However, there was a slight dip in 2017 when the revenue slightly decreased to USD 3,192 million, remaining almost stable in 2018 at USD 3,190 million.

- In 2019, the revenue picked up again, reaching USD 3,330 million, but saw a minor decline to USD 3,307 million in 2020.

- This overall growth trend highlights the resilience and expansion of China’s measurement equipment manufacturing industry over the years.

(Source: Statista)

Different Test and Measurement Equipment and Their Specifications

Multimeter

- Ensuring a digital multimeter’s accuracy is vital and varies by application. For basic tasks like checking live receptacles, a ±3% accuracy suffices, given the typical ±5% voltage variation.

- Yet, precise tasks, like calibrating automotive or medical equipment, demand higher accuracy, such as ±2%.

- This level of accuracy allows readings ranging from 98.0 V to 102.0 V for a displayed 100.0 V value, suitable for some tasks but inadequate for sensitive electronics.

- Accuracy specifications often include added digits, like ± (2%+2), indicating a reading of 100.0 V could range from 97.8 V to 102.2 V. Opting for higher accuracy widens the multimeter’s utility across various applications.

- Resolution denotes the smallest detectable increment displayed by a tool. For instance, comparing rulers with different markings illustrates varying resolutions. When testing a 1.5 V household battery, a digital multimeter with a 3 V range and one mV resolution can detect changes as quickly as 0.001 volts.

- Specifications may specify maximum resolution, representing the smallest discernible value on the meter’s lowest range setting. For instance, a maximum resolution of 100 mV indicates readings displayed to the nearest tenth of a volt on the highest range setting.

(Source: Fluke)

Oscilloscopes

- The chief advantage of oscilloscopes lies in their rapid response compared to other plotting devices.

- General-purpose oscilloscopes boast plotting frequencies of up to 100 million cycles per second (100 MHz), while specialized high-speed ones can achieve speeds of 2,000 MHz.

- Sampling oscilloscopes synchronize their sampling with the data, requiring either an explicit or recovered clock signal, such as the SCL signal on an I2C bus.

- Both real-time and sampling scopes are available with bandwidths exceeding 100 GHz, suitable for the latest high-speed digital applications.

- Sampling scopes, benefiting from sampling over several periods, can utilize ADCs with lower sample rates and higher vertical resolution, often up to 14 bits.

- Real-time oscilloscopes typically feature 4 to 8 permanently installed electronic input channels, whereas sampling oscilloscopes can incorporate a mix of electrical, optical, and TDR channels.

(Sources: Britannica, Key Insight)

Vernier Calipers

- The vernier caliper, invented by French mathematician Pierre Vernier in 1631, is a device for measuring very small distances with an accuracy of 0.1 mm.

- It consists of a fixed jaw for measuring outside dimensions and a movable jaw for inside dimensions.

- This tool can measure values within the range of 0.1 mm.

- Zero error can be positive or negative: a positive error occurs when the reading is above 0.00 mm, like +0.08 mm, while a negative error happens when the reading is below 0.00 mm, such as –0.10 mm.

- The metric vernier scale on a caliper can feature up to 50 divisions, with each division representing 0.02 mm.

(Source: Geeks for Geeks, BYJUS)

Temperature Chambers

- Portable temperature chambers offer high performance in a compact size, boasting easy installation, low power consumption, minimal noise, and essential features found in larger units.

- Despite their small size, they can achieve temperatures ranging from –70°C to over 150°C.

- Benchtop temperature chambers, similar to portable ones, provide cost-effective temperature testing for smaller components like sensors and circuit boards, which is ideal for research and development tasks on a smaller scale.

- These chambers typically range from 0.89 to 5.5 cubic feet, with temperatures ranging from -68°C to 180°C.

- Reach-in test chambers, slightly larger than benchtop models, are floor-mounted with wheels for mobility. They offer a balance of compactness and capacity, ranging from 10 to 64 cubic feet, with temperatures from –68°C to 180°C and a temperature variation of ±1.0°C.

- Walk-in temperature chambers come in various sizes, from 286 to over 1400 cubic feet, often custom-designed. They offer temperature ranges from -40°C to 150°C, catering to diverse testing needs.

(Source: IQS Directory)

Spectrophotometer

- In transmission, light interacting with a sample can be absorbed, reflected, or transmitted.

- The transmitted light is converted into appropriate color scales and indexes, such as APHA for watercolor and purity analysis, ASTM D1500 for petrochemical color analysis, and indices for food and beverage color analysis.

- The simplified mathematical expression involves the transmission coefficient (T), evaluated across the visible spectrum from 400 to 700 nm.

- Besides evaluating the transmission or reflection of visible light, a UV-visible spectrophotometer, calibrated for UV light, can analyze color across both the ultraviolet range (185 – 400 nm) and the visible range (400 – 700 nm) of the electromagnetic spectrum.

- This typical spectrophotometer emits light onto the sample surface at a 45-degree angle and measures the reflected light at a constant 0-degree angle.

(Source: X-rite, HunterLab)

Test and Measurement Export Statistics

Top Exporting Nations of Measuring or Checking Equipment

- In 2022, Germany emerged as the leading exporter of measuring or checking equipment, with an export value of USD 4.43 billion, accounting for 17.6% of the global market.

- China followed closely, exporting USD 3.63 billion worth of equipment, representing 14.4% of the market.

- The United States secured the third position, with exports valued at USD 2.92 billion, contributing 11.6% to the global share.

- Japan and South Korea also made significant contributions, exporting USD 1.85 billion (7.36%) and USD 1.22 billion (4.84%), respectively.

- The United Kingdom exported USD 1.15 billion worth of equipment, capturing 4.57% of the market, while Italy’s exports stood at USD 0.942 billion, accounting for 3.75%.

- Switzerland and Chinese Taipei exported USD 0.759 billion (3.02%) and USD 0.620 billion (2.47%), respectively.

- France rounded out the top ten exporting nations with an export value of USD 0.578 billion, representing 2.3% of the global market.

(Source: OEC World)

Test and Measurement Equipment Import Statistics

Top Nations Importing Measuring or Checking Equipment

- In 2022, China led the global market for importing measuring or checking equipment, with imports valued at USD 324 billion, accounting for 21.1% of the total market.

- The United States followed, importing equipment worth USD 139 billion, which constituted 9.07% of the global share.

- Germany was the third-largest importer, with USD 75 billion in imports, representing 4.89% of the market.

- France imported equipment valued at USD 68 billion, capturing 4.43% of the market, while India imported USD 64.7 billion, accounting for 4.22%.

- The United Kingdom and Mexico also had substantial import values of USD 61 billion (3.97%) and USD 54.2 billion (3.53%), respectively.

- South Korea’s imports stood at USD 50.3 billion, contributing 3.28% to the market, followed by Brazil with USD 41.2 billion (2.69%) and Japan with USD 32.6 billion, representing 2.13% of the global imports.

- These figures underscore the significant demand for measuring or checking equipment across these leading importing nations.

(Source: OEC World)

Regulations for Test and Measurement Equipment

- The regulations governing test and measurement equipment vary by country and are essential for ensuring the accuracy, reliability, and safety of these devices across different industries.

- In the United States, regulations such as those outlined by the National Institute of Standards and Technology (NIST) and compliance with standards like ISO/IEC 17025 ensure high precision and calibration in measurement tools.

- The European Union adheres to regulations under the IEC/EN standards, including IEC 61010-1, which mandates rigorous risk assessments and safety evaluations for electronic testing equipment.

- Similarly, in China, adherence to national standards (GB standards) and periodic updates to align with international norms are critical for maintaining market integrity.

- Saudi Arabia, with its significant investments in industrial development and the Machine Vision 2030 initiative, also imposes strict regulatory standards to ensure quality and compliance in its test and measurement sector.

- These regulations are pivotal in maintaining the high standards required for the global market, ensuring that products meet necessary safety and performance criteria.

(Source: Metlabs)

Recent Developments

Acquisitions:

- Keysight Technologies Acquisition of Eggplant: Keysight Technologies acquired Eggplant, a software test automation company, for $330 million. This acquisition aims to enhance Keysight’s software testing capabilities, particularly in the areas of AI-driven test automation and continuous testing.

- Fortive’s Acquisition of Advanced Sterilization Products: Fortive acquired Advanced Sterilization Products from Johnson & Johnson for approximately $2.7 billion. This acquisition is expected to strengthen Fortive’s position in the healthcare and sterilization sectors.

New Product Launches:

- Keysight Technologies’ Electrical Performance Scan (EP-Scan): In January 2023, Keysight introduced the EP-Scan, a high-speed digital simulation tool designed to support rapid signal integrity analysis for hardware engineers and PCB designers.

- Rohde & Schwarz’s Benchmarker 3: Also in January 2023, Rohde & Schwarz unveiled the Benchmarker 3, a new solution aimed at enhancing network benchmarking for mobile network operators, addressing challenges posed by technological advancements and competitive pressures.

Funding:

- Investment in IoT and AI Integration: Companies in the test and measurement equipment market have been receiving significant investments to integrate AI and IoT technologies into their products. This includes advancements in real-time data analysis and automated testing solutions.

- Expansion Funding for Emerging Markets: Several companies are investing in expanding their manufacturing and service capabilities in emerging markets, particularly in the Asia-Pacific region, to meet the growing demand for advanced testing solutions.

Market Growth:

- Global Market Expansion: The growth is driven by the increasing adoption of electronic devices and the need for precise testing in industries such as automotive, healthcare, and telecommunications.

- Regional Growth: The Asia-Pacific region is expected to hold the largest market share due to the presence of established manufacturing companies and the increasing need for better medical and security equipment. North America also remains a significant market due to its proactive adoption of cutting-edge technologies.

Innovation and Trends:

- AI-Driven Testing Solutions: The integration of AI in test and measurement equipment is enhancing the accuracy and efficiency of testing processes. Companies are focusing on developing AI-driven solutions that can provide real-time analysis and predictive maintenance capabilities.

- Sustainability and Energy Efficiency: There is a growing emphasis on developing energy-efficient and sustainable testing solutions. Companies are investing in technologies that reduce energy consumption and improve the sustainability of their products.

Conclusion

The global test and measurement equipment market is experiencing robust growth, driven by technological advancements and increased demand across diverse industries.

Factors such as the proliferation of IoT and 5G networks, coupled with investments in the automotive, aerospace, and healthcare sectors, are key drivers.

The Asia-Pacific region is poised to lead, fueled by a strong manufacturing base and rising demand for advanced medical and security equipment.

Leading players like Keysight Technologies, Rohde & Schwarz, and National Instruments are expanding their product offerings to maintain competitiveness.

Regulatory standards in key regions ensure the safety and reliability of equipment, underscoring the market’s growth potential.

FAQs

Test and measurement equipment refers to devices used to assess, analyze, and verify the performance, quality, and functionality of electronic, mechanical, or electrical systems. These tools encompass a wide range of instruments, such as oscilloscopes, multimeters, spectrum analyzers, signal generators, and more.

Test and measurement equipment finds applications across various industries, including telecommunications, electronics, automotive, aerospace, healthcare, energy, and manufacturing. It is essential for research, development, quality assurance, production, and maintenance processes.

Test and measurement equipment plays a critical role in ensuring product quality, safety, and regulatory compliance. It helps identify defects, troubleshoot issues, optimize performance, and maintain consistent quality standards, ultimately contributing to improved product reliability and customer satisfaction.

Common types of test and measurement equipment include oscilloscopes for analyzing electronic signals, multimeters for measuring voltage, current, and resistance, spectrum analyzers for frequency analysis, signal generators for producing electrical signals, and power meters for measuring energy consumption.

Emerging trends in the industry include the integration of wireless connectivity and remote monitoring capabilities into testing devices, the adoption of cloud-based data management and analysis platforms, and the development of portable and compact instruments for field applications.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)