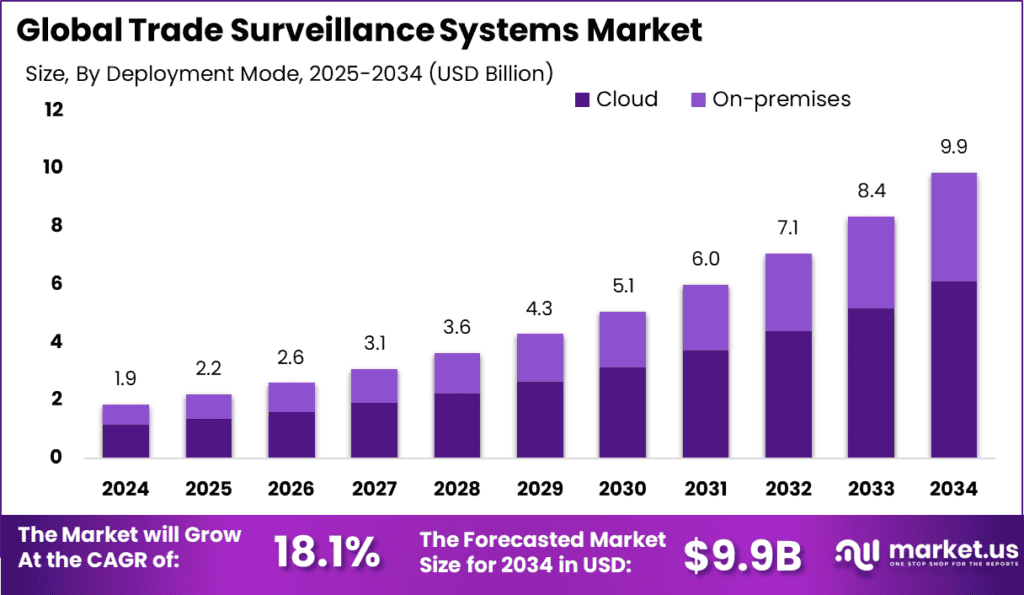

The Global Trade Surveillance Systems Market is projected to reach USD 9.9 billion by 2034, up from USD 1.9 billion in 2024, growing at an impressive CAGR of 18.1% from 2025 to 2034. North America leads the market, accounting for over 38% of the global share, with a revenue of USD 0.7 billion in 2024. The U.S. market alone is valued at USD 0.67 billion in 2024, showing a strong growth trajectory with a CAGR of 16.1%. The market’s growth is driven by the increasing need for monitoring and compliance in financial markets, fueled by rising regulatory requirements and the demand for real-time surveillance technologies.

How Growth is Impacting the Economy

The rapid growth of the global trade surveillance systems market is significantly influencing the global economy. As regulatory bodies tighten compliance requirements and the need for financial market transparency intensifies, organizations are compelled to invest in advanced surveillance solutions. This has created a substantial market for technology providers, driving economic activity in sectors like finance, insurance, and investment.

The expansion of trade surveillance systems is also creating new job opportunities, contributing to a more robust economy. Moreover, as businesses increasingly rely on AI-driven surveillance tools, the market is expected to see a boost in the demand for skilled professionals, including data analysts, cybersecurity experts, and compliance officers. In turn, these trends contribute to global economic growth by fostering innovation, increasing market efficiency, and ensuring greater protection for financial assets.

➤ Buy report here @ https://market.us/report/trade-surveillance-systems-market/free-sample/

Impact on Global Businesses (Rising Costs & Supply Chain Shifts + Sector-Specific Impacts)

The growing adoption of trade surveillance systems is having a noticeable impact on global businesses, particularly by contributing to rising operational costs. As companies invest in advanced surveillance tools to meet regulatory requirements and protect against fraud, they face increased capital expenditure. Furthermore, the need for continuous software updates and system integration results in ongoing costs.

In terms of supply chain shifts, firms are increasingly outsourcing surveillance technology development and deployment to specialized vendors, driving changes in procurement strategies and the global tech supply chain. Sector-specific impacts are evident in industries such as finance, where banks and trading firms must ensure compliance with international regulations, and the insurance sector, where trade surveillance plays a role in reducing risk exposure.

Strategies for Businesses

To navigate the growth in the trade surveillance systems market, businesses should focus on integrating AI and machine learning into their surveillance systems to enhance real-time monitoring capabilities. Additionally, adopting cloud-based solutions can help reduce infrastructure costs and provide scalable services for growing enterprises. Companies must also ensure compliance with the latest regulatory standards by investing in systems that facilitate regulatory reporting and risk management. Collaborating with technology providers that specialize in surveillance tools and analytics will enable businesses to stay ahead of evolving compliance requirements. Lastly, fostering partnerships with cybersecurity firms can help organizations mitigate data breach risks, ensuring the security of sensitive financial information.

Key Takeaways

- The Global Trade Surveillance Systems Market is set to grow from USD 1.9 billion in 2024 to USD 9.9 billion by 2034.

- North America leads the market, capturing more than 38% of the market share.

- The U.S. market is expected to grow at a CAGR of 16.1%, reaching USD 0.67 billion in 2024.

- Increasing regulatory pressures and demand for real-time surveillance systems drive growth.

- Businesses must integrate AI and cloud-based solutions to remain competitive.

➤ Request sample here @ https://market.us/report/trade-surveillance-systems-market/free-sample/

Analyst Viewpoint (Present + Future Positive View)

The present outlook for the global trade surveillance systems market is highly positive, with businesses increasingly adopting real-time monitoring technologies to meet regulatory demands and protect financial transactions. In the future, the market will continue its robust growth, fueled by technological advancements such as AI and machine learning, which will enhance surveillance efficiency and accuracy. As global trade and financial markets become more interconnected, the demand for sophisticated surveillance systems is set to rise. Companies investing in these systems will not only improve compliance but also gain a competitive edge, positioning themselves well for future growth in an increasingly regulated environment.

Regional Analysis

North America is the dominant region in the global trade surveillance systems market, capturing 38% of the market share, valued at USD 0.7 billion in 2024. The U.S. market leads with a strong growth rate of 16.1% CAGR, driven by stringent regulatory frameworks and the increasing adoption of AI-driven surveillance tools. Europe is also experiencing steady growth, with businesses adopting trade surveillance systems to comply with the European Union’s regulations. The Asia-Pacific region, especially countries like Japan and India, is expected to see rapid adoption of these systems due to their evolving financial markets and rising demand for secure trading platforms.

Business Opportunities

The rapid growth of the trade surveillance systems market offers numerous business opportunities for both established players and new entrants. Companies can explore opportunities in developing AI-powered solutions that enhance the accuracy and efficiency of surveillance tools. Additionally, businesses specializing in cloud-based surveillance services can tap into the growing demand for scalable solutions that provide flexibility for financial institutions. Startups focused on offering cost-effective, customizable trade surveillance platforms will find increasing demand from small to mid-sized enterprises (SMEs) that need compliance solutions but lack extensive budgets. Furthermore, partnerships with cybersecurity firms offer a lucrative avenue for improving data security in the trade surveillance landscape.

Key Segmentation

The global trade surveillance systems market is segmented by type, including market surveillance, trade surveillance, and risk management systems. By application, the market includes financial institutions, trading firms, and regulatory bodies. The financial institution segment is expected to grow due to the increasing adoption of surveillance systems for compliance and fraud prevention. Geographically, North America is the largest market, followed by Europe and Asia-Pacific, with the latter expected to grow rapidly due to regulatory developments and rising demand for secure trading solutions in emerging markets.

Key Player Analysis

The trade surveillance systems market is characterized by the presence of a few leading technology providers that offer a wide range of solutions for financial institutions, trading platforms, and regulatory bodies. These companies are focusing on integrating AI, machine learning, and data analytics into their systems to enhance real-time monitoring and detection capabilities. Additionally, many firms are investing in cloud-based solutions to make surveillance systems more accessible and cost-effective for businesses across various sectors. The market is expected to witness increased competition as new players enter the market with innovative solutions targeting niche segments, such as small trading firms or emerging markets.

- Software AG

- Nice Ltd.

- BAE Systems, Inc.

- eFlow Ltd.

- Fidelity National Information Services, Inc.

- Nasdaq, Inc.

- SIA S.P.A.

- Aquis Technologies

- B-Next Group

- ACA Compliance Group Holdings, LLC

- Trillium Management LLC

- Others

Recent Developments

- In 2024, new AI-driven surveillance solutions were introduced to enhance trade monitoring in real-time.

- Several major firms launched cloud-based trade surveillance systems for scalable and cost-efficient operations.

- In March 2025, strategic partnerships between surveillance providers and cybersecurity firms were formed to improve data security.

- New regulatory guidelines have been introduced in the U.S. and Europe, increasing demand for compliance solutions.

- The launch of customizable trade surveillance platforms tailored to small to medium-sized financial firms is expected to drive growth.

Conclusion

The global trade surveillance systems market is poised for significant growth, driven by regulatory requirements and the increasing need for real-time monitoring solutions. Companies embracing AI and cloud-based surveillance technologies will be well-positioned to capitalize on emerging business opportunities in the market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)