Table of Contents

Market Overview

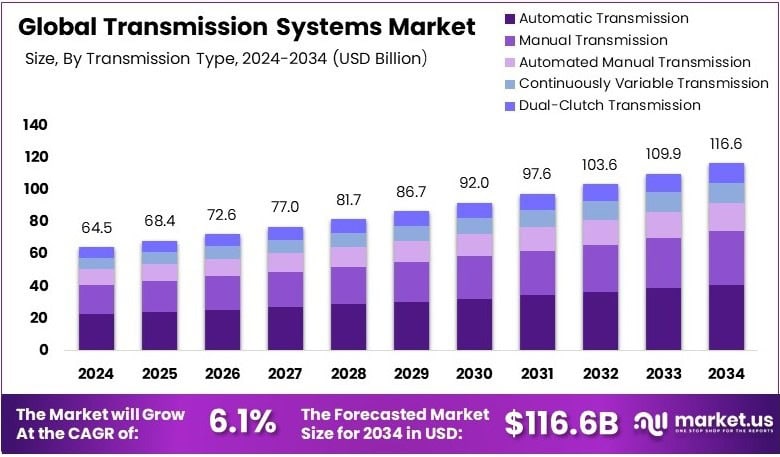

The Global Transmission Systems Market size is expected to be worth around USD 116.6 Billion by 2034, from USD 64.5 Billion in 2024, growing at a CAGR of 6.1% during the forecast period.

The Transmission Systems Market is growing due to rising demand for fuel-efficient vehicles. In Europe, 89–95% of cars sold still use manual gearboxes. This shows a strong preference for control and economy. In the U.S., manual cars are less than 3% of total sales. This shift highlights rising demand for automatic systems.

Globally, AMT-equipped vehicles make up only 1% of all sales. This shows a big growth chance for cost-friendly transmission types. CVT systems have also improved with time. The latest CVTs cut friction by 58% compared to older models. This helps boost fuel efficiency and reduces emissions.

Governments now invest more in clean vehicle tech. Asia and Europe lead in EV and hybrid support. Strict rules push automakers to upgrade transmissions. This drives market demand for advanced systems.

New tech offers better driving and lower emissions. OEMs now focus on electric and hybrid gear systems. Growth will come from tech upgrades and eco rules. The market also gains from smart car trends. Buyers want better mileage and smoother driving.

The future of transmission systems looks strong. Rising investment and new rules will support the market. Strong growth and innovation are set to shape the next decade.

Key Takeaways

- Transmission Systems Market valued at USD 64.5 billion in 2024, projected to reach USD 116.6 billion by 2034 at a CAGR of 6.1%.

- Growth driven by rising demand for automatic transmissions and fuel-efficient systems.

- Automatic Transmission led in 2024 with a 38.5% market share due to convenience and smooth performance.

- Passenger Cars dominated the vehicle segment in 2024 with 61.2% share, boosted by urbanization and higher incomes.

- Asia Pacific held the largest regional share in 2024 at 42.3%, valued at USD 27.28 billion, led by China, Japan, and India.

Growth Drivers

- Electrification of Vehicles: The rising adoption of electric vehicles (EVs) and hybrid vehicles is reshaping the transmission systems segment. While EVs often use simpler single-speed systems, hybrid vehicles still rely on advanced multi-speed transmissions, creating a growing niche demand.

- Technological Advancements: Continuous innovation in transmission technologies, including automated manual transmission (AMT), dual-clutch transmission (DCT), and continuously variable transmission (CVT), is pushing the industry forward. These technologies improve fuel efficiency, driving comfort, and vehicle performance.

- Demand for Fuel Efficiency: With fuel costs rising and environmental concerns mounting, automakers and consumers alike are seeking better fuel economy. Modern transmission systems play a crucial role in optimizing power delivery and reducing energy loss.

- Growing Automotive Sector: Emerging markets, particularly in Asia-Pacific, are experiencing a surge in vehicle production and sales. This growth directly supports the demand for various types of transmission systems across segments such as passenger cars, light commercial vehicles, and heavy-duty trucks.

Market Restraints

- High Development Cost: Advanced transmission systems are expensive to develop and integrate, especially when combined with other powertrain enhancements. This can pose a challenge for manufacturers targeting cost-sensitive markets.

- Complexity and Maintenance Issues: Modern transmissions, while efficient, are often complex and costly to repair or maintain, potentially deterring buyers in certain regions with limited technical infrastructure.

Opportunities

- Integration with Smart Mobility Solutions: There is growing potential in integrating transmission systems with digital vehicle technologies like predictive maintenance, AI-driven diagnostics, and connected mobility platforms.

- Aftermarket and Replacement Demand: As vehicle ownership expands globally, there is also rising demand for replacement and repair of transmission systems, particularly in the aftermarket space.

Market Segmentation

Transmission Type Analysis Automatic Transmission leads with 38.5%. It’s easy and popular in cities. Manual is cheaper but losing demand. AMT is fuel-efficient and used in budget cars. CVT gives smooth drive and better mileage. DCT is fast and used in sports cars.

Vehicle Type Analysis Passenger Cars lead with 61.2%. High global demand drives growth. LCVs are rising with e-commerce. HCVs need strong systems for heavy loads. Off-Highway Vehicles need tough gear for farming and construction.

Regional Insights

Asia Pacific leads with 42.3% share (USD 27.28B). Driven by infrastructure growth. Rapid industrialization fuels demand. China, India boost grid upgrades. Population and energy needs rise. Renewable shift supports market growth.

North America holds 24.5% share (USD 16.9B). Focus on old grid upgrades. Smart grids see high adoption. Renewable use is rising. U.S., Canada drive modern systems.

Europe has 20.1% share (USD 13.86B). Growth from clean energy push. Grid reliability is key. Strong policies support upgrades. Green tech adoption rises.

Middle East & Africa hold 8.2% share (USD 5.64B). Investments in rural electrification. Economic shift fuels demand. Grid expansion drives growth.

Latin America owns 4.9% share (USD 3.38B). Focus on renewable projects. Grid links improving. Market grows with power demand.

Recent Trends

- Lightweight Materials: Use of advanced materials like aluminum and composites is growing to reduce weight and improve fuel efficiency.

- Shift to Electrified Transmissions: Companies are increasingly designing transmissions that cater specifically to the needs of hybrid and electric drivetrains.

- Software Integration: Modern transmissions are increasingly controlled by sophisticated software, enhancing shift responsiveness and fuel economy.

Recent Developments

- In Oct 2024, RSB Transmissions secured new funding from Bain Capital to accelerate growth and enhance its product portfolio in drivetrain solutions. The strategic investment aims to strengthen RSB’s position in the global transmission market.

- In Nov 2024, the U.S. Department of Energy (DOE) announced a funding program of $11 million to support 4 HVDC transmission projects. The initiative focuses on advancing clean energy infrastructure and improving grid reliability.

- In Mar 2025, Adani Energy Solutions Ltd signed a Share Purchase Agreement to acquire Mahan Transmission Ltd. This move is part of Adani’s strategy to expand its transmission footprint in Central India.

- In Jun 2025, IndiGrid announced the acquisition of solar and transmission assets from ReNew for ₹21 billion. This acquisition aims to boost IndiGrid’s renewable energy asset base and enhance long-term returns for investors.

- In Jun 2025, IndiGrid finalized another deal, acquiring additional solar and transmission assets worth ₹2108 crore. The transaction strengthens IndiGrid’s integrated portfolio across the renewable and power transmission sectors.

Conclusion

The transmission systems market is evolving quickly in response to regulatory, technological, and consumer shifts. Electrification, automation, and efficiency are key trends shaping the future. While cost and complexity present challenges, the growing emphasis on performance, sustainability, and smart mobility opens substantial opportunities. Companies that adapt swiftly to these trends and invest in innovation will likely secure long-term competitiveness in this essential automotive component sector.