Table of Contents

Market Overview

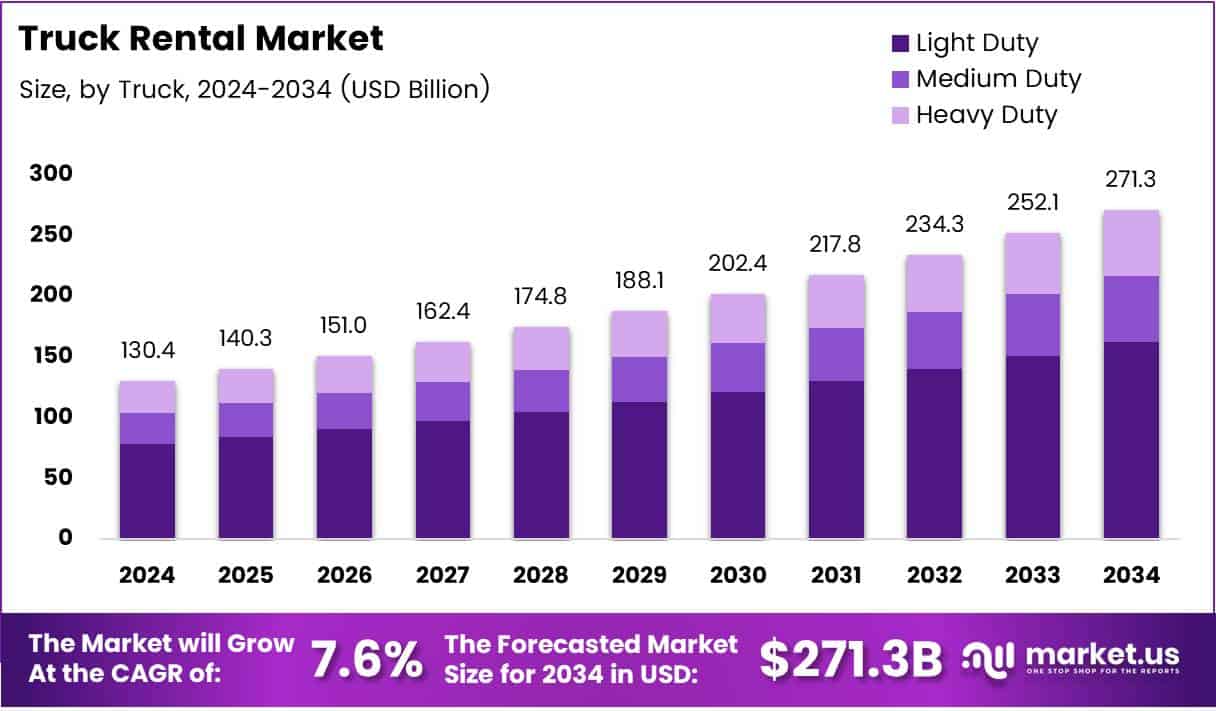

The Global truck rental market is on a steady growth path. It is projected to grow from USD 130.4 billion in 2024 to USD 271.3 billion by 2034, at a CAGR of 7.6%.

Growth is fueled by rising demand, flexible mobility needs, and shifting consumer preferences. In Q4, rental revenue reached USD 125.5 million, up from USD 120.2 million the previous year. This shows the market’s strength despite evolving business and consumer trends.

A key driver is the 57% of consumers who now prefer to rent their own moving trucks. This highlights a shift toward self-service, cost-efficient transport solutions.

In parallel, the automotive equipment rental and leasing industry grew 14.0% in 2023, reaching USD 9.8 billion. This growth opens up vast opportunities for established players and newcomers alike.

Major companies like Enterprise lead the market, offering competitive rates around USD 129 per day. Their widespread presence and flexible service packages give them a strong competitive edge.

Government investment is also playing a major role. Public spending on road infrastructure and transport digitalization is boosting rental demand. Policies promoting eco-friendly fleets are further encouraging innovation.

Key Takeaways

- Market to hit USD 271.3 billion by 2034, up from USD 130.4 billion in 2024.

- Light Duty trucks held a 70.1% market share in 2024.

- Rental and Leasing Companies led the provider segment with 41.3%.

- ICE trucks dominated due to familiarity and fuel availability.

- Short Term rentals outpaced Long Term demand.

- Asia Pacific held the largest share at 41.2% or USD 53.8 billion.

Growth Drivers

Cost Efficiency & Flexibility

Rentals reduce ownership burden. Companies can scale fleets up or down as needed, minimizing fixed costs.

E-commerce Boom

Online shopping has increased demand for last-mile and intercity deliveries. Rental trucks provide the needed flexibility.

Urban Expansion

Growing cities and better roads in emerging markets support truck rental services.

Green Regulations

Tighter emissions rules are pushing companies toward rental fleets. Rentals offer modern, eco-friendly vehicles without upfront investment.

Smart Technology

Telematics, GPS, and fleet software add value. They enhance route planning, safety, and customer service.

Market Segmentation

Truck Type

- Light Duty (70.1% share): Ideal for cities and short hauls.

- Medium Duty: Used for regional deliveries.

- Heavy Duty: Serves construction and industrial needs.

Service Providers

- Rental & Leasing Companies (41.3%): Full-service models with flexible terms.

- OEM Captives: Build on brand loyalty.

- Third-Party Providers: Offer custom, cost-effective options.

Propulsion Type

- ICE Trucks: Preferred for range and fueling convenience.

- Electric Trucks: Gaining traction in cities but face infrastructure and cost challenges.

Rental Duration

- Short Term: Dominates due to seasonal or project-based demand.

- Long Term: Used for consistent operations without ownership costs.

Regional Insights

Asia Pacific

Leads with 41.2% share, driven by e-commerce and infrastructure in China, India, and Southeast Asia.

North America

Strong logistics network and digital fleet management fuel growth.

Europe

Strict emissions laws and shared mobility increase rental needs, especially in urban zones.

Middle East & Africa

Moderate growth from infrastructure projects and diversification efforts.

Latin America

Affordable freight solutions and retail logistics drive demand, especially in agriculture and urban delivery.

Competitive Landscape

The market is competitive and rapidly evolving. Companies are expanding fleets, improving digital tools, and focusing on service quality. Strategic mergers and acquisitions are helping firms grow their presence and offerings.

Sustainability is a core focus. Many are introducing green fleets, including electric and hybrid trucks. Technology is key apps, online portals, and smart systems make renting easier and more efficient.

Challenges & Opportunities

- High operational costs for maintenance and insurance.

- Fleet management complexity across multiple sites.

- Seasonal shortages in high-demand vehicle categories.

Future Outlook

The truck rental market is set for sustained growth. Digital innovation, green transport, and changing delivery models are reshaping the industry. Companies offering smart, scalable, and sustainable solutions will lead the next phase of growth.

Recent Developments

- June 2025: Hylane launched the Netherlands’ first zero-emission truck rental, marking a leap in green logistics.

- Dec 2024: Kingbee Vans acquired Fluid Truck, expanding nationwide reach.

- Jan 2025: Hub Truck Leasing acquired Public Service Truck Renting, enhancing its regional presence.

Conclusion

The truck rental market is well-positioned for long-term success. Flexible mobility, rising e-commerce, and sustainability goals are reshaping transportation strategies. As businesses seek low-risk, high-efficiency logistics, rental models will continue to thrive. Innovation, regulation, and customer preferences will define the future of this dynamic sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)