Table of Contents

Introduction

Underwater Drone Statistics: Underwater drones, including Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs), are sophisticated tools used for various applications beneath the water’s surface.

ROVs are tethered to a surface vessel and used for real-time inspections and operations. While AUVs operate independently for pre-programmed missions.

Key components of these drones include a robust hull, propulsion system, sensors and cameras, communication systems, and power supply.

They are employed in scientific research, industrial inspections, environmental monitoring, and defense. Challenges such as depth pressure, communication limitations, battery life, and navigation are addressed through advanced engineering and technology.

Editor’s Choice

- The history of underwater drones, or unmanned underwater vehicles (UUVs), extends back to the 1950s when the Office of Naval Research funded the development of one of the first UUVs, the Special Purpose Underwater Research Vehicle (SPURV).

- The global underwater drone market revenue reached $4.4 billion in 2023.

- By 2032, the market peaked at $12.2 billion, with ROVs at $5.19 billion, AUVs at $4.49 billion, and Hybrid Vehicles at $2.53 billion.

- The distribution of market share by product type within a specific category showcases a diverse range of consumer preferences. The “Heavy Work-Class” products lead with a 38% market share, indicating a robust demand for durable and high-capacity items.

- The Global Remote Drone Identification System market revenue is projected to soar to approximately $1,251.9 million by 2029.

- In 2023, the distribution of the global drone delivery market share by region is expected to be led by Asia Pacific, commanding a substantial 39% of the market.

- Global investments in drone companies reached $1,151 million in 2020.

- The United States mandates registration for drones heavier than 250 grams. With additional requirements for commercial operation under FAA’s Part 107. Including a Remote Pilot Certificate and specific flying conditions such as night operation and over people.

History of Underwater Drones

- The history of underwater drones, or unmanned underwater vehicles (UUVs). Extends back to the 1950s when the Office of Naval Research funded the development of one of the first UUVs. The Special Purpose Underwater Research Vehicle (SPURV).

- Throughout the decades, these drones have seen significant enhancements and diversified applications.

- In the 1960s, the U.S. Navy utilized them for retrieving lost equipment, and by the 1970s. Remotely operated vehicles (ROVs) were assisting in high-profile underwater recoveries and rescues.

- A notable milestone in the 1980s was the use of an ROV to discover the Titanic wreck.

- Over the years, advancements in technology have expanded the capabilities and applications of UUVs. They now play crucial roles in naval operations, ecological monitoring, and infrastructure inspection.

- The 2000s saw further integration of UUVs into combat and non-combat operations. Emphasizing their strategic importance in modern warfare and environmental stewardship.

- By 2020, UUVs like the TLK-150 and Manta Ray, mimic natural marine life forms for stealth and efficiency. Will represent significant leaps in design and functionality, indicating a trend towards more autonomous, durable, and versatile underwater drones.

- These vehicles are increasingly important in both military and civilian contexts. Helping to safely explore and monitor the ocean’s depths where human divers cannot reach.

- The ongoing research and development in this field promise even more sophisticated UUVs in the future. Capable of autonomous operations over longer ranges and durations, powered by innovative energy sources like lithium-water reactions.

(Sources: Droneblog, Submersible Solutions, Unmanned Systems Technology, CeSCube, Drone U™)

Underwater Drone Market Statistics

Global Underwater Drone Market Statistics

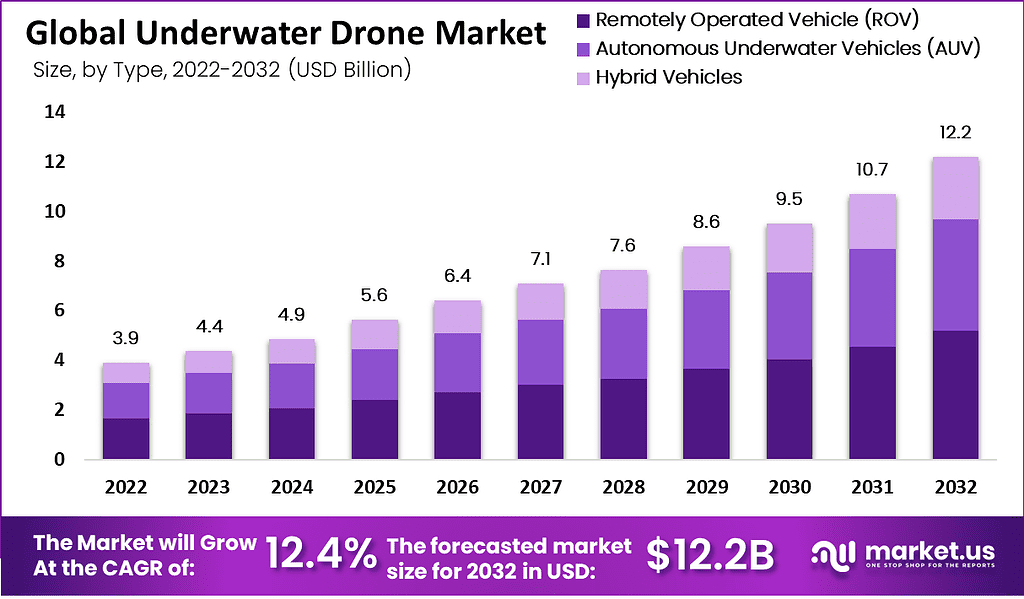

- The global market for underwater drones is projected to experience steady growth from 2022 to 2032 at a CAGR of 12.4%.

- In 2022, the revenue generated by this market was recorded at $3.9 billion.

- The following year, 2023, saw an increase to $4.4 billion.

- The upward trend continues, with the market size reaching $4.9 billion in 2024 and further expanding to $5.6 billion in 2025.

- The growth trajectory is maintained through the subsequent years. With revenues forecasted at $6.4 billion in 2026, $7.1 billion in 2027, and $7.6 billion in 2028.

- The market is expected to accelerate slightly, achieving $8.6 billion in 2029 before climbing to $9.5 billion in 2030.

- The growth remains robust into the early 2030s, with market revenues reaching $10.7 billion in 2031 and $12.2 billion in 2032.

- This consistent expansion reflects the increasing utility and adoption of underwater drones across various applications, signaling a positive outlook for this sector.

(Source: market.us)

Global Underwater Drone Market Size – By Type Statistics

- The global market for underwater drones, segmented by type, shows consistent growth across different categories from 2022 to 2032.

- In 2022, the total market revenue was $3.9 billion, distributed among Remotely Operated Vehicles (ROVs) at $1.66 billion. Autonomous Underwater Vehicles (AUVs) at $1.44 billion, and Hybrid Vehicles at $0.81 billion.

- By 2023, market revenues increased to $4.4 billion, with ROVs generating $1.87 billion, AUVs $1.62 billion, and Hybrids $0.91 billion.

- This upward trend persisted through the decade. With total market revenue rising to $4.9 billion in 2024, $5.6 billion in 2025, and reaching $6.4 billion in 2026.

- By 2027, the market expanded further to $7.1 billion, with ROVs contributing $3.02 billion, AUVs $2.61 billion, and Hybrid Vehicles $1.47 billion.

- In 2028, the market reached $7.6 billion, with increments across all categories. Followed by a more pronounced increase to $8.6 billion in 2029.

- The growth continued, reaching $9.5 billion in 2030 and $10.7 billion in 2031. With significant contributions from all types of underwater drones.

- By 2032, the market peaked at $12.2 billion, with ROVs at $5.19 billion, AUVs at $4.49 billion, and Hybrid Vehicles at $2.53 billion.

- This detailed segmentation reflects the evolving dynamics and increasing adoption of various underwater drone technologies.

(Source: market.us)

Underwater Drone Market Share – By Product Type Statistics

- The distribution of market share by product type within a specific category showcases a diverse range of consumer preferences.

- The “Heavy Work-Class” products lead with a 38% market share. Indicating a robust demand for durable and high-capacity items.

- The following are the “Small and Medium” products, which hold a 25% share. Suggesting a significant interest in versatile solutions suitable for a variety of tasks.

- “Light Work-Class” products account for 23% of the market, highlighting their role in more specialized or less intensive operations.

- Lastly, “Micro” products, although the smallest category, still capture a 14% market share. Reflecting their niche application in scenarios requiring compact and efficient solutions.

- This stratification illustrates a market that values both performance and adaptability across different product types.

(Source: market.us)

Remote Drone Identification System Market Size Statistics

- The Global Remote Drone Identification System market has demonstrated remarkable growth between 2021 and 2029.

- In 2021, the market revenue was relatively modest at $30 million.

- However, a significant expansion is forecasted over the decade, with revenue projected to soar to approximately $1,251.9 million by 2029.

- This substantial increase underscores the escalating demand and adoption of drone identification technologies, driven by heightened security concerns. Regulatory requirements, and the expanding utilization of drones in various sectors.

- This growth trajectory highlights the market’s rapid development and its critical role in integrating drones into national and international airspace systems safely and efficiently.

(Source: Statista)

Drone Delivery Statistics

Global Drone Delivery Market Revenue

- The global drone delivery market has been experiencing a significant upward trajectory in revenue from 2021 to 2027.

- In 2021, the market generated $1.26 billion, reflecting the growing interest and initial adoption of drone delivery services.

- The following year, 2022, saw an increase in market revenue to $1.45 billion. Indicating continued expansion and acceptance of drone technologies in commercial delivery contexts.

- The growth persisted into 2023, with revenue rising further to $1.68 billion.

- This pattern of growth is projected to accelerate markedly by 2027, with revenue expected to leap to $4.35 billion.

- This substantial growth is likely driven by advancements in drone technology. Broader regulatory approvals, and increasing business and consumer reliance on drone delivery services for faster, more efficient delivery solutions.

(Source: Statista)

Global Drone Delivery Market Revenue – By Type

- The projected global drone delivery market revenue, categorized by type for the years 2023 and 2030, exhibits substantial growth across all segments.

- In 2023, the market was dominated by rotary-wing drones. Generating $1,140.3 million in revenue, highlighting their prevalent use in delivery services.

- Fixed-wing drones also show a significant market presence with revenues of $335.4 million. While hybrid-wing drones generate $201.2 million, reflecting their emerging role in the sector.

- By 2030, the revenue forecasts indicate a robust expansion. Rotary wing drones continue to lead with an impressive increase to $3,516.7 million. Underscoring their continued dominance and utility in drone delivery services.

- Fixed-wing drones are expected to reach $831.1 million, and hybrid-wing drones will see a notable rise to $605.3 million.

- This growth trajectory across all drone types illustrates the increasing reliance on drone technology for delivery applications. Driven by advancements in technology, expanding operational efficiencies, and broader regulatory approvals.

(Source: Statista)

Drone Delivery Market Share – By Region

- In 2023, the distribution of the global drone delivery market share by region is expected to be led by Asia Pacific, commanding a substantial 39% of the market.

- This dominance reflects the region’s rapid technological advancements and large-scale integration of drone delivery into commercial and logistical frameworks.

- North America follows with a 30% market share, indicative of robust investment and regulatory environments that support drone technology growth.

- Europe holds a 21% share, benefiting from increasing drone adoption across various sectors, including healthcare and retail.

- The rest of the world accounts for the remaining 10%. Suggesting emerging interest and gradual adoption of drone delivery services in these regions.

- This geographical distribution underscores diverse regional dynamics and the growing global penetration of drone delivery solutions.

(Source: Statista)

Underwater Drone Specifications

SW1000 Underwater Drone Mounted with the Newton NM200EVT-1 Statistics

- The SW1000 underwater drone, equipped with the Newton NM200EVT-1, showcases robust technical specifications designed for advanced underwater operations.

- The drone measures 13.875 inches in height, 10 inches in width and length, and weighs 24 lbs in air while being neutrally buoyant in water. Its construction features hard-anodized aluminum and includes adjustable output high-intensity LED ring arrays with windows made of nuclear-rated glass.

- It operates optimally in temperatures ranging from 40° to 120° F and can be stored between 0° to 125° F. The maximum and minimum scanner-to-target distances are set at 1 meter and 150 mm, respectively, with a watertight depth rating of 50 meters.

- The control unit, slightly larger, stands at 14.75 inches in height. With widths and lengths of 26.75 and 27.50 inches, respectively, and weighs 84.5 lbs.

- It’s housed in a metal electronics rack within a molded, high-impact, airline-transportable case. This unit supports a variety of output ports. Including Ethernet, USB, DVI, VGA, and HDMI, and operates between 40° to 110° F.

- It is powered by a 100/240 VAC 50/60 cycle at 15 Amps and features data storage options like an internal solid-state drive and USB stick data. Both components are critical in ensuring the drone’s performance in challenging underwater environments.

(Source: Newton)

Chasing M2 Underwater Drone Statistics

- The CHASING M2 is a high-performance underwater drone featuring a maximum operational depth of 330 feet (100 meters) and a maximum speed of 3 knots.

- It offers a runtime of 3 hours under optimal conditions, with a 97.68 Wh battery. This drone is capable of capturing ultra-high definition video at resolutions up to 3840 x 2160 (4K) at 30 fps and taking photographs at 12 megapixels. The remote controller, which supports Wi-Fi and HDMI output, has a 2500 mAh battery, ensuring a runtime of over 6 hours. The camera system includes a 1/2.3 inch CMOS sensor with an F1.8 lens, offering a wide field of view of 152 degrees and an adjustable ISO range from 100 to 6400.

- The drone supports a tether length of up to 656 feet (200 meters), stores data on a 64 GB SD card, and is equipped with dual 2000 lumens LEDs with dimming capabilities.

- Its sophisticated sensor suite includes a 3-axis gyro, accelerometer, compass, depth sensor, and temperature sensor, ensuring precise navigation and data collection.

- The CHASING M2 is designed for versatility in underwater exploration and documentation. Making it suitable for a variety of marine applications.

(Source: Drone Addiction)

Seasam Underwater Drone Statistics

- The SEASAM underwater drone is a robust remotely operated vehicle (ROV) with dimensions of 55cm x 45cm x 23cm (approximately 22 inches x 18 inches x 9 inches) and weighs 9 kg (20 lbs).

- It has a slightly positive buoyancy, which is adjustable for various underwater conditions. The drone features a forward and lateral speed of 2 knots. Which can be upgraded to 2.5 knots, and it can operate at depths up to 100 meters (330 feet).

- Its battery has a runtime of 1.5 hours, extendable up to 4 hours. The tether length is initially 150 meters, but it can be extended to 300 meters.

- For illumination, the SEASAM is equipped with two 1000-lumens LED lights, which are also upgradeable. The drone supports ancillary equipment with ball mounts capable of handling a 2kg payload.

- Its camera system includes a 1/2.8-inch CMOS Sony IMX290 low light sensor, capturing Full HD 1080p video at 30 fps with an 80° field of view.

- Internally, the SEASAM is outfitted with a depth sensor, internal temperature monitor, GPS, and a 9-axis IMU. Making it well-suited for a variety of underwater exploration and monitoring tasks.

(Source: Delair Marine)

Blueye Pioneer Underwater Drone Statistics

- The Blueye Pioneer underwater drone is engineered for robust performance in diverse conditions. Featuring IPX8 ingress protection, and is constructed with ABS, aluminum, and polycarbonate materials.

- It measures 485 x 257 x 354 mm and weighs 8.6 kg with saltwater ballast, buoyed by HCP 30 Polymer Foam, and is capable of diving up to 150 meters.

- Powered by four 350 W thrusters, it moves at 1.5 m/s (3 knots) with a 2-hour runtime and operates between –5 and +35°C.

- Its imaging capabilities include a 1/3 inch CMOS sensor that captures Full HD video at 25/30 fps and stores it on a 64 GB SD card.

- The drone is equipped with 3300-lumen LED lights with adjustable brightness and a smart battery pack with a 14.8 V, 6500 mAh capacity.

- It also features an array of sensors, including a 3-axis IMU, depth sensor, and temperature sensor, and a robust tether that extends up to 300 meters.

- This setup positions the Blueye Pioneer as a versatile tool for underwater exploration and inspection.

(Source: Measur)

QYSEA FIFISH V6 Underwater Drone ROV Kit with Industrial Case Statistics

- The QYSEA FIFISH V6 series comprises three models: V-EVO, V6, and V6 EXPERT, each measuring 383 x 331 x 143 mm.

- The V-EVO and V6 weigh 3.9 kg, while the V6 EXPERT is slightly heavier at 4.6 kg. All are rated for a depth of 100 meters and feature 360° omnidirectional movement and Q Steady 2.0 for enhanced stability.

- All models are equipped with a 4K UHD camera system, though the V6 EXPERT offers a higher frame rate capability (60fps) and more powerful LED lighting (6000 lumens compared to 4000 in the V6 and 5000 in the V-EVO).

- Only the V6 EXPERT supports a removable S.D. card with a capacity of up to 128 GB.

- Additional features across the models include A.I. Vision Lock, VR head control, and various mounting options for sports cameras and external lighting.

- The V6 EXPERT stands out with its optional onshore power supply system. Extended battery capacity of 156 Wh, and the standard inclusion of a robotic arm. Indicate its suitability for more demanding industrial applications.

- Optional accessories available include various robotic arms, a wide array of inspection, measurement, and navigational tools, and quality sampling tools. Making the FIFISH V6 series adaptable to a broad range of underwater exploration and operational tasks.

(Source: Theodist)

Gladius Underwater Drone ROV with 4K Camera Statistics

- The Gladius Underwater Drone ROV T1 is equipped with a 4K camera and boasts a weight of 4.4 kg.

- Its dimensions are 380 x 348 x 168 mm, and it can operate at a maximum depth of 150 meters with neutral buoyancy.

- The drone operates in temperatures ranging from –10℃ to 50℃ and has a maximum cruise speed of 3 knots.

- It features six thrusters and six degrees of freedom, including pitch movements up to ±60°.

- The onboard battery supports a runtime of up to 4 hours, and the system recharges in 3 hours via a 63W charger.

- The drone supports a 64 GB SD card for recording high-resolution 4K videos at 30 fps.

- Additional features include IP57 protection, Wi-Fi connectivity with a maximum distance of 50 meters, and a mobile app that supports live broadcasting and social sharing.

- Optional accessories include a robotic arm and an external battery package, enhancing its utility for various underwater tasks.

(Source: Global Sources)

Geneinno Titan Underwater Drone Statistics

- The Geneinno Titan underwater ROV is engineered to explore depths of up to 492 feet, supported by a 656-foot rope.

- It is equipped with an ultra-wide 160° field of view camera featuring an 8MP 1/2.5” CMOS sensor capable of capturing 4K video and streaming 1080p live views to the controller.

- The ROV has six thrusters—four vertical and two horizontal—allowing precise movement and hovering capabilities.

- It offers high and low-speed modes with a top speed of 6.6 feet per minute and comes with two 1500-lumen lights for clear visibility underwater.

- The ROV’s 9000mAh, 10.8 VDC, 97.2Wh battery provides a runtime of four hours. While the wireless transmitter runs for six hours on its 3200mAh, 10.8 VDC, 34.6Wh battery.

- The package includes the Geneinno Titan ROV, a controller, and the 492-foot tether. A wireless transmitter, two dive lens filters, balancing weight, a charger, and a hard-shell case.

- The system’s UPC is 850008168093, marking it as a comprehensive solution for advanced underwater exploration.

(Source: Tanotis)

FIFISH E-GO underwater ROV Underwater Drone Statistics

- The FIFISH E-GO underwater ROV boasts dimensions of 430mm x 345mm x 170mm and weighs 5.7 kg.

- It is equipped with six propellers powered by GFIISH Ring-Wing Motors. Offering six degrees of freedom for precise maneuverability and motion control.

- The ROV can dive up to a depth of 100m and features an advanced camera system with a 1/1.8” sensor. Capable of capturing 4K video and streaming formats, including H.264 and H.265, with storage expandable up to 512GB.

- Its lens provides a wide underwater field of view up to 120° horizontally and 70° vertically, supporting a range from 0.1m to infinity.

- The battery system offers a 2.5-hour operating time, with a capacity of 6.91 kWh², and supports fast charging in just one hour.

- Additional features include two 5000-lumen LED lights, a robust tether system extendable up to 200 meters, and an optional robotic arm with a parallel gripper.

- The ROV’s build also includes a temperature range operation from –10°C to 60°C, and it supports various external accessories through its adaptable port interface with secure plug options. Making it highly adaptable for a variety of underwater tasks.

(Source: KNOTTDEE)

Key Investments

Global Investments in Drone Companies

- Global investments in drone companies have seen significant fluctuations and growth from 2008 to 2020.

- Starting with a modest investment of $30 million in 2008, the figures slightly decreased to $29 million in 2009 before inching up to $33 million in 2010.

- A more substantial jump occurred in 2011, with investments reaching $61 million. Followed by a slight dip to $41 million in 2012.

- The following year, 2013, saw investments more than double to $103 million.

- A significant surge was evident in 2014, with investments rising to $298 million, and the upward trend continued, reaching $507 million in 2015 and peaking at $577 million in 2016.

- Although there was a slight decrease to $474 million in 2017, investments picked up again in 2018 to $535 million, and by 2019, they had nearly doubled to $1,049 million.

- The growth trajectory maintained its momentum into 2020, with investments hitting a record $1,151 million.

- This progression highlights the increasing financial interest and potential seen in drone technology over the past decade.

(Source: Statista)

Investment in Drone Hardware Worldwide

- From 2015 to 2021, worldwide investment in drone hardware exhibited consistent growth across government, consumer, and enterprise segments.

- In 2015, the government sector saw investments of $6.4 billion, while the consumer sector had $1.7 billion.

- By 2016, government investment slightly increased to $6.8 billion. Although consumer investment slightly decreased to $1.65 billion, and enterprise investment began at $0.08 billion. The following years marked steady increases across all sectors.

- By 2017, government investments rose to $7.15 billion, consumers to $1.85 billion, and enterprises to $0.15 billion. In 2018, these figures grew to $7.5 billion, $2.15 billion, and $0.2 billion, respectively.

- The trend continued with more substantial increments by 2019 when government investment reached $7.95 billion. Consumer $2.3 billion, and enterprise investments doubled to $0.4 billion.

- The year 2020 saw government sector investment at $8.35 billion, consumer at $2.6 billion, and enterprise at $0.6 billion.

- By 2021, investments peaked with government at $8.85 billion, consumer at $2.75 billion, and enterprise at $0.9 billion. Indicating robust growth and a broadening acceptance of drone technology across various sectors.

(Source: Statista)

Regulations for Underwater Drones

- In the domain of underwater drone regulations, each country has implemented unique policies and legislation, reflecting diverse priorities and safety concerns.

- For instance, in the European Union, drones heavier than 249 grams require a Basic or Supplementary Certificate. Depending on their weight and operating areas, with stringent rules against operating over crowds or during nighttime.

- Similarly, the United States mandates registration for drones heavier than 250 grams, with additional requirements for commercial operation under FAA’s Part 107. Including a Remote Pilot Certificate and specific flying conditions such as night operation and over people.

- Countries like Canada and Australia also enforce precise guidelines. Such as mandatory registration and adherence to flight height restrictions, to ensure airspace safety and privacy.

- Furthermore, developments in global drone regulations include the standardization of risk assessment and certification processes to align unmanned operations with the safety levels of manned aviation, a movement led by authorities like EASA in Europe and the FAA in the U.S.

- These evolving standards aim to facilitate advanced drone operations, including delivery services and beyond-visual line of sight (BVLOS) missions. Pointing toward a future where drone operations could be as commonplace and regulated as traditional aviation.

(Source: UAV Coach, Drone U™, Drone Laws, Drone Industry Insights)

Recent Developments

Acquisitions and Mergers:

- Teledyne acquires SeaBotix: In 2023, Teledyne Technologies completed the acquisition of SeaBotix, a company specializing in underwater drones, for $150 million. This acquisition strengthens Teledyne’s position in the underwater drone market. Particularly in the defense and commercial sectors, where underwater inspection and surveillance are critical.

- Blue Robotics merges with OpenROV: In 2023, Blue Robotics, a leader in underwater drone components, merged with OpenROV, known for its consumer-grade underwater drones. This merger aims to accelerate product development and expand into both recreational and professional markets.

New Product Launches:

- PowerVision launches PowerRay Explorer: In early 2024, PowerVision introduced its new PowerRay Explorer underwater drone, targeting recreational and professional users. Equipped with a 4K camera and sonar capabilities, this drone is designed for underwater photography and fish-finding, priced at around $1,500.

- QYSEA launches FIFISH V-EVO: In late 2023, QYSEA launched the FIFISH V-EVO, an advanced underwater drone featuring AI-powered obstacle avoidance. 6 degrees of freedom for maneuverability, and 4K recording capabilities, designed for deep-sea exploration and underwater inspections.

Funding:

- Aquabotix raises $20 million for R&D: In 2023, Aquabotix, an underwater robotics company, raised $20 million to expand its research and development efforts in autonomous underwater drones. The funding will be used to enhance AI and machine learning capabilities in drones for applications in defense and marine research.

- Hydromea secures $15 million for underwater drone technology: In 2024, Hydromea, a Swiss underwater drone manufacturer. Secured $15 million to further develop its wireless underwater drones, focusing on improving communication and battery life for long-duration missions.

Technological Advancements:

- AI-Enabled Autonomous Underwater Drones: The use of AI in underwater drones is becoming more prevalent for navigation and data collection. By 2025, it is estimated that 35% of underwater drones will incorporate AI for autonomous missions. Including deep-sea exploration, environmental monitoring, and underwater infrastructure inspection.

- Wireless Communication in Underwater Drones: Wireless communication technology in underwater drones is improving. Allowing for real-time data transmission in marine environments. By 2026, wireless-enabled drones are projected to account for 40% of the market, driven by advancements in underwater communication and sensor technology.

Market Dynamics:

- Growth in the Underwater Drone Market: This growth is driven by the increasing use of underwater drones in sectors such as oil and gas, marine biology, defense, and recreational activities like underwater photography and exploration.

- Increasing Use in Defense and Research: Underwater drones are playing a growing role in defense, with 40% of new underwater drones expected to be used for military and surveillance purposes by 2025. Their ability to conduct covert underwater missions and deep-sea data collection makes them crucial for naval operations.

Conclusion

Underwater Drone Statistics – The underwater drone market has expanded significantly, driven by technological advances and diverse applications in sectors like scientific research, environmental monitoring, and military use.

These drones provide crucial insights into hard-to-reach aquatic environments through advanced cameras and sensors, enhancing our understanding of marine biology, archaeology, and geology.

With ongoing innovations in autonomy, energy efficiency, and artificial intelligence integration, underwater drones are set to revolutionize marine exploration and resource management.

This evolution points to a future where underwater drones are integral to sustainable marine practices and ecosystem protection.

FAQs

An underwater drone, also known as an underwater remotely operated vehicle (ROV), is a robotic device used for exploring aquatic environments. It’s controlled remotely from the surface and is equipped with cameras and sensors to capture and relay underwater data.

Underwater drones are typically tethered to a controller on the surface via a cable. Which transmits power and data, allowing for real-time control and video feedback. They navigate with the help of thrusters and often include buoyancy control systems to adjust depth.

These drones are used for various purposes, including scientific research, underwater infrastructure inspections, search and recovery operations, marine conservation, and filming or photography.

The depth capability of underwater drones varies by model, ranging from shallow waters to several thousand meters deep. Depending on their design and the pressure they can withstand.

Common features include H.D. or 4K video cameras, lighting systems, sonar, GPS, live streaming capabilities, and sometimes additional tools like manipulator arms.

The cost can vary widely based on capabilities, size, depth rating, and additional features. Consumer models may range from a few hundred to several thousand dollars, while professional-grade ROVs can cost tens of thousands.

Challenges include dealing with underwater currents, ensuring reliable data and power transmission over long distances, and navigating around obstacles without a direct line of sight.