Table of Contents

Introduction

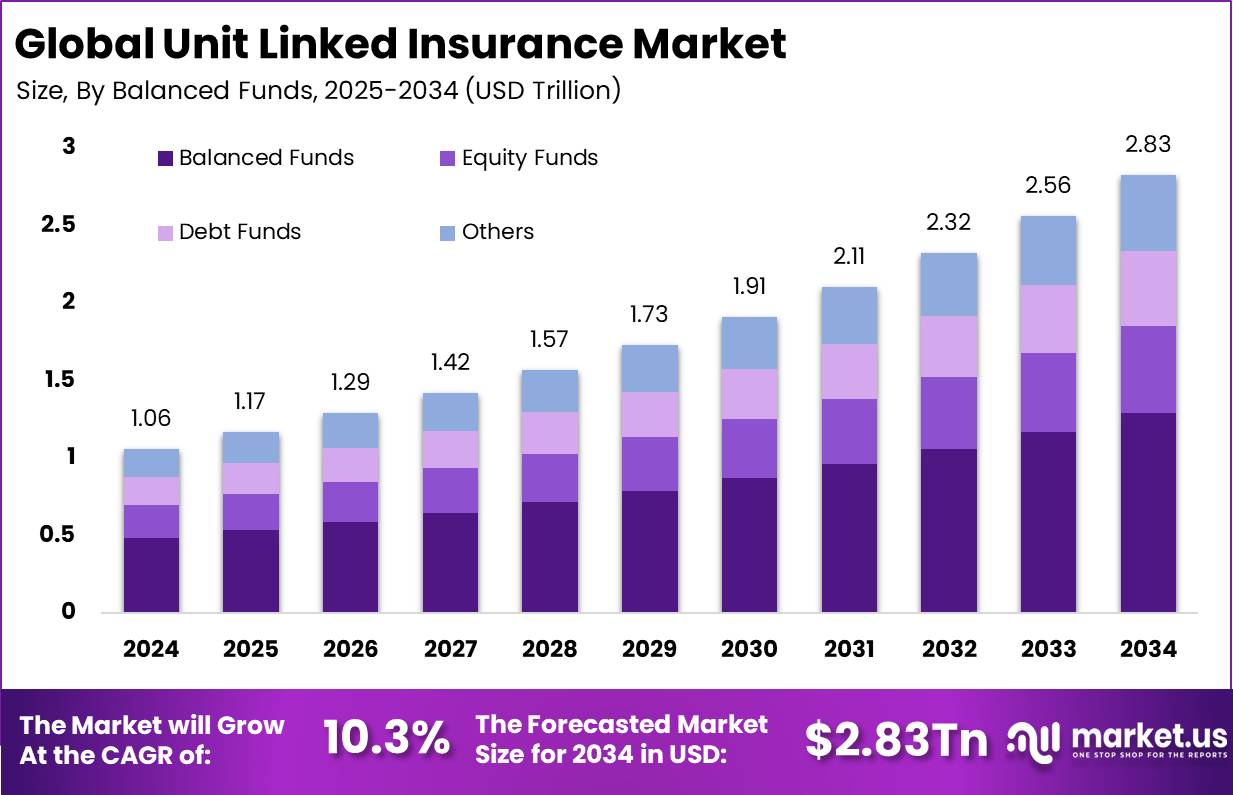

The global unit linked insurance market is expected to escalate from USD 1.06 trillion in 2024 to around USD 2.83 trillion by 2034, posting a CAGR of 10.3%. Asia Pacific currently dominates the market, with revenues of USD 0.55 trillion in 2024, representing more than 52.3% of the total share.

This expansion is being driven by rising insurance penetration in emerging economies, growing investor appetite for wealth-creation plus protection products, and technological enhancements enabling flexible fund allocation and personalised plans. The product’s dual-benefit structure—combining life cover with investment linked returns—is increasingly attractive to middle-income segments navigating low interest-rate environments.

How Growth is Impacting the Economy

Growth in the unit linked insurance market is catalysing broader economic development by channeling household savings into capital markets and insurance ecosystems. As policyholders allocate premiums into market-linked funds, capital flows support equity and debt markets, driving investment in corporate growth and infrastructure projects. Insurance companies expand distribution networks, generate employment in advisory, analytics and fund management roles, and stimulate ancillary services across fintech, analytics and compliance.

The increase in personal financial protection and retirement savings fosters household resilience, reducing reliance on social welfare programmes and enhancing financial stability. In emerging regions where insurance penetration is still low, growth of unit linked products supports financial inclusion and mobilises latent savings into organised financial systems, thereby underpinning long-term economic growth and broadening the tax base.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/unit-linked-insurance-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Insurance and asset-management firms are navigating rising technology and regulatory costs as unit linked offerings become more sophisticated. Investments in digital platforms, fund-switching capabilities, real-time reporting and compliance frameworks are increasing operational expenditures. Supply chains among insurers, fintech vendors, asset managers and data‐service providers are shifting towards integrated ecosystems whereby digital advisory, fund-allocation, and customer analytics converge.

Sector-Specific Impacts

In wealth management and retail banking, firms are embedding unit-linked insurance products into advisory portfolios, requiring greater collaboration between insurers and banks. For asset managers, growing demand for unit-linked plans means higher fund inflows, tailored fund products and bespoke risk-management services. Insurance carriers face evolving risk profiles: policyholders now bear investment risk, shifting product design and actuarial frameworks. In emerging markets, insurers partner with digital platforms and mobile distribution channels to capture younger, digitally-savvy consumers, changing the traditional agent-led model and increasing competition in distribution and servicing.

Strategies for Businesses

Businesses in the unit-linked insurance ecosystem should adopt a multi-pronged strategy: first, invest in digital platforms that allow flexible fund switching, real-time policy tracking and personalised advisory to meet evolving customer expectations. Second, develop modular fund options and dynamic pricing models to align product design with customer investment-risk appetite and regulatory changes. Third, build partnerships across banks, fintechs, and asset managers to broaden distribution reach and enrich product ecosystems. Fourth, enhance compliance frameworks for transparency, investor protection and customer education to mitigate mis-selling risks. Lastly, monitor operational metrics such as premium growth, fund-switch activity, persistency rates and cost-to-serve, using data analytics to refine design and channel strategies.

Key Takeaways

- The unit-linked insurance market is forecast to grow from USD 1.06 trillion in 2024 to USD 2.83 trillion by 2034 at a 10.3% CAGR.

- Asia Pacific holds a dominant share of over 52% in 2024, with USD 0.55 trillion in revenues.

- Growth is redirecting household savings into capital markets, boosting financial inclusion and economic resilience.

- Businesses face rising technology, compliance and servicing costs, while distribution models evolve.

- Sectoral impacts include wealth-management integration, asset-manager fund innovation and insurer product redesign.

- Strategic focus on digital platforms, modular funds, partnerships and analytics-driven metrics is critical for competitive advantage.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=163316

Analyst Viewpoint

At present, the unit linked insurance market is evolving rapidly as households seek both life-protection and investment returns in a low-yield environment. Insurers that adapt to digital distribution, flexible fund allocation and customer education are gaining traction. Looking ahead, the outlook remains positive: regulatory reforms, rising savings in Asia Pacific, deeper capital-market linkages and technological advancements are expected to drive broader adoption. Firms that invest in agile product design, customer-centric digital experience and operational efficiency are poised to lead the next phase of growth and deliver differentiated value across geographies.

Use Case & Growth Factors

| Use Case | Growth Factor |

|---|---|

| Wealth creation plus life cover for middle-income households | Rising demand for investment-linked protection in low interest-rate environments |

| Flexible fund allocation and switching within a policy | Enhanced digital platforms, consumer appetite for control and transparency |

| Distribution via bancassurance and digital channels in emerging markets | Expanding financial inclusion, mobile penetration and insurance awareness |

| Retirement-and long-term savings through unit linked vehicles | Growing ageing populations and need for long-term savings products |

| Cross-selling investment services via unit linked insurance platforms | Insurers partnering with asset managers and fintechs to broaden offerings |

Regional Analysis

Asia Pacific leads the unit linked insurance market with more than 52.3% share in 2024, underpinned by USD 0.55 trillion in revenue. Strong growth in emerging economies, increasing financial-literacy initiatives and rising adoption of hybrid insurance products contribute to this dominance. North America and Europe show steady expansion driven by product innovation and wealth-management integration. Latin America, Middle East & Africa present nascent yet promising markets, especially as digital distribution channels and mobile insurance platforms emerge. Regional growth will depend on regulatory compatibility, distribution infrastructure, financial-awareness levels and capital-market development.

➤ More data, more decisions! see what’s next –

Business Opportunities

The expanding unit linked insurance market offers significant opportunities for technology providers, asset managers, insurers and distribution platforms. Digital-insurtech vendors can capitalise on demand for customer-friendly apps, fund-switch tools and analytics dashboards. Asset managers can develop bespoke funds tailored to insurance vehicles, collaborating with insurers to capture inflows. Insurers can optimise operating models by deploying data-driven advisory, real-time policy monitoring and dynamic pricing. Distribution partners such as banks and fintechs can embed unit linked products within broader financial-services ecosystems. Emerging markets provide green-field opportunities for mobile-first insurance models and tailored-fund offerings aligned with local asset-management maturity and regulatory environment.

Key Segmentation

The unit linked insurance market can be segmented based on product type, distribution channel, end‐user and region. By product: pure unit linked policies, hybrid with riders, retirement-oriented unit linked. By distribution channel: bancassurance, brokers/agents, digital platforms. By end-user: individual retail, high net-worth individuals, institutional investors. By region: Asia Pacific, North America, Europe, Latin America, Middle East & Africa. Key growth dynamics include the rise of digital platforms in distribution, modular fund options in product design, increasing interest from younger cohorts in investment-linked policies, and deeper penetration in emerging markets through mobile and bancassurance partnerships.

Key Player Analysis

Leading participants in the unit linked insurance market are focusing on enhancing product flexibility, digital distribution and fund-management integration. These firms are investing in agile platforms, improving customer experience through apps and portals, and offering modular fund-choice aligned with investor risk-profiles. Strategic partnerships with asset-managers and fintechs expand fund-options, while data-analytics capabilities drive personalised premium and fund allocations. Regulatory compliance, transparency and digital literacy are differentiators. Companies that deliver seamless digital-first advisory, multi-channel distribution and robust backend for fund-switching operations are expected to capture significant market share and set industry benchmarks.

- Allianz Global Investors

- Aviva Investors

- Aegon Asset Management

- Legal & General Investment Management

- M& G Investments

- Old Mutual Wealth

- Prudential Portfolio Management Group

- Standard Life Investments

- Zurich Insurance Group

- Generali Investments

- AXA Investment Managers

- Met Life Investment Management

- Manulife Investment Management

- Sun Life Global Investments

- Swiss Life Asset Managers

- NN Investment Partners

- Voya Investment Management

- Principal Global Investors

- TIAA Investments

- CNP Assurances

- Others

Recent Developments

- A major insurer launched a new unit linked plan with dynamic fund-switching and wealth-tracker analytics to appeal to younger investors.

- Several insurers entered strategic alliances with digital platforms to distribute unit linked policies via mobile apps and bancassurance ecosystems.

- Regulatory bodies in several Asia Pacific countries introduced reforms facilitating flexible investment allocation and transparency in unit linked products.

- Asset managers partnered with insurance carriers to create dedicated fund-options for unit linked policies, tailored by risk-profile and investment horizon.

- Insurers started offering hybrid models combining unit linked insurance with retirement-savings and wellness rewards, targeting long-term retention.

Conclusion

The unit linked insurance market is set to transform life-insurance and investment landscapes by blending protection with wealth‐creation. With robust growth, regional leadership in Asia Pacific and evolving product ecosystems, stakeholders that embrace digitalisation, transparency and customer-centric design are well positioned to lead in this expanding market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)