Table of Contents

Introduction

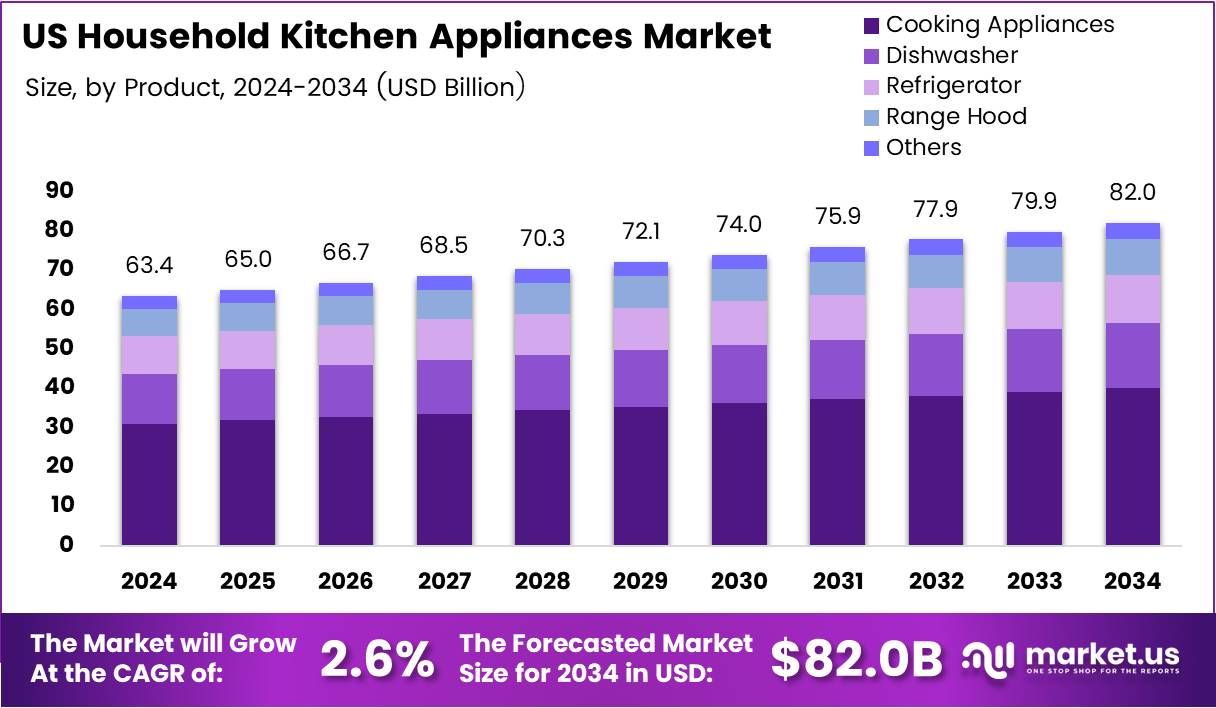

The U.S. Household Kitchen Appliances Market is experiencing robust growth, fueled by increasing consumer demand for advanced, energy-efficient products and technological innovations. With a projected market size of USD 82.0 billion by 2034, up from USD 63.4 billion in 2024, the market is poised to grow at a compound annual growth rate (CAGR) of 2.6% from 2025 to 2034.

Household kitchen appliances, including refrigerators, ovens, dishwashers, microwaves, and more, are essential to daily life, offering enhanced convenience, energy-saving benefits, and evolving with the trends of sustainability and technological integration. This report explores the market’s key dynamics, including its drivers, challenges, emerging trends, and the opportunities that are reshaping the future of kitchen appliances in U.S. households.

Key Takeaways

- The U.S. Household Kitchen Appliances Market is expected to grow from USD 63.4 billion in 2024 to USD 82.0 billion by 2034, at a CAGR of 2.6%.

- Cooking appliances led the product category in 2024, with a 41.5% share, driven by the growing demand for energy-efficient ovens, cooktops, and ranges.

- Conventional technology dominates the market with an 84.7% share, but smart appliances are gaining traction among tech-savvy consumers.

- The demand for sustainable and energy-efficient appliances is increasing, with more consumers willing to invest in high-end models due to competitive pricing.

- Rising urbanization and a preference for space-saving designs are fueling demand for compact and multi-functional kitchen appliances.

Key Market Segments

By Product

- Cooking Appliances: Dominating the market with a 41.5% share in 2024, cooking appliances such as ovens, cooktops, and ranges are central to modern kitchens. Multifunctional and energy-efficient models are particularly driving growth in this segment.

- Dishwashers: A key segment with growing demand for time-saving and hygienic cleaning solutions. While adoption rates remain moderate, this category is expanding as consumers seek convenience in everyday kitchen tasks.

- Refrigerators: These remain a household staple, with a shift toward compact and energy-efficient models due to the influence of urban living and sustainability trends.

- Range Hoods: Although niche, this segment is vital for consumers looking for improved kitchen ventilation and aesthetics, especially in open-plan kitchens.

- Others: A minor but important segment comprising additional appliances like blenders, toasters, and coffee makers that add functionality to kitchens.

By Technology

- Conventional Technology: Holding 84.7% of the market share in 2024, conventional kitchen appliances remain the preferred choice for most consumers due to their affordability, simplicity, and widespread availability.

- Smart Appliances: While still emerging, smart appliances are gaining popularity due to their advanced features such as AI integration, remote control, and energy monitoring. This segment is expected to grow significantly as more consumers embrace connected kitchen solutions.

Drivers

- Rise in Smart Kitchen Adoption: The growing interest in Internet of Things (IoT)-enabled appliances, offering features like remote control, scheduling, and monitoring, is a significant market driver. Consumers seek efficiency, convenience, and automation, particularly in busy, dual-income households.

- Energy Efficiency and Sustainability Trends: Consumers are increasingly prioritizing energy-efficient appliances to reduce their carbon footprint and lower energy costs. This trend is amplified by government initiatives promoting eco-friendly solutions, such as tax credits and rebates for energy-efficient appliances.

- Urbanization and Smaller Living Spaces: With more people living in apartments and urban areas, the demand for compact, multifunctional kitchen appliances is growing. These products help optimize limited space while offering high functionality.

- Technological Advancements: The continuous innovation in kitchen appliances, particularly smart features, has contributed significantly to market growth. Consumers are eager to invest in appliances that enhance their daily routines and integrate seamlessly into smart home ecosystems.

Use Cases

- Smart Kitchens: IoT-enabled appliances allow users to remotely control ovens, refrigerators, dishwashers, and other kitchen devices. This capability improves convenience, energy management, and overall efficiency, especially in households with busy schedules.

- Energy-Saving Appliances: Energy-efficient models, such as refrigerators with advanced cooling technology or dishwashers that use less water and power, are becoming increasingly popular. These appliances help consumers save on utility bills and reduce their environmental impact.

- Urban Kitchen Solutions: In urban areas, where space is at a premium, compact and modular kitchen appliances are in high demand. These space-saving solutions allow residents to enjoy fully functional kitchens without compromising on design or usability.

Major Challenges

- High Initial Cost of Smart Appliances: The premium pricing of smart kitchen appliances, while justified by their advanced features, continues to pose a barrier for price-sensitive consumers. Many are hesitant to invest in such products due to the high upfront cost.

- Safety and Technical Issues: Recalls of kitchen appliances due to safety or technical faults can damage consumer trust and slow down market growth. Manufacturers must improve quality control to mitigate such risks.

Business Opportunities

- AI Integration: Appliances that incorporate AI for predictive maintenance and personalized user experiences present a significant growth opportunity. By learning user behavior, AI-enabled devices can provide smarter assistance, such as suggesting optimal settings and alerting users to maintenance needs.

- Sustainability and Green Manufacturing: The growing demand for eco-friendly appliances presents an opportunity for manufacturers to differentiate themselves through the use of sustainable materials and energy-efficient technologies. This approach will appeal to environmentally conscious consumers.

- Expansion into Rural and Semi-Urban Areas: As internet connectivity and infrastructure improve in rural and semi-urban regions, the demand for modern kitchen appliances is expected to rise. Manufacturers can target these regions to expand their market reach.

Recent Developments

- Government Initiatives: In November 2023, the U.S. Department of Energy released guidelines for tribal governments, enabling them to access funding for home electrification and appliance rebates. These initiatives are expected to stimulate demand for energy-efficient appliances.

- Trade Policies: The imposition of 50% tariffs on steel and aluminum imports, announced in June 2025, may raise the cost of appliance manufacturing and impact pricing strategies for U.S. appliance manufacturers.

- Brand Rebranding: In February 2025, LG Electronics unveiled the rebranding of its SIGNATURE KITCHEN SUITE to SKS, a move that aligns with their strategy to appeal to premium market segments with advanced, high-tech kitchen solutions.

Conclusion

The U.S. Household Kitchen Appliances Market is evolving rapidly, driven by technological innovation, energy efficiency trends, and changing consumer preferences. While challenges such as high initial costs and privacy concerns persist, the market offers significant opportunities, particularly in smart appliances, AI integration, and sustainability. With key players like Whirlpool, General Electric, Samsung, and LG leading the charge, the market is set to continue its growth, driven by both traditional and emerging consumer needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)