Table of Contents

Introduction

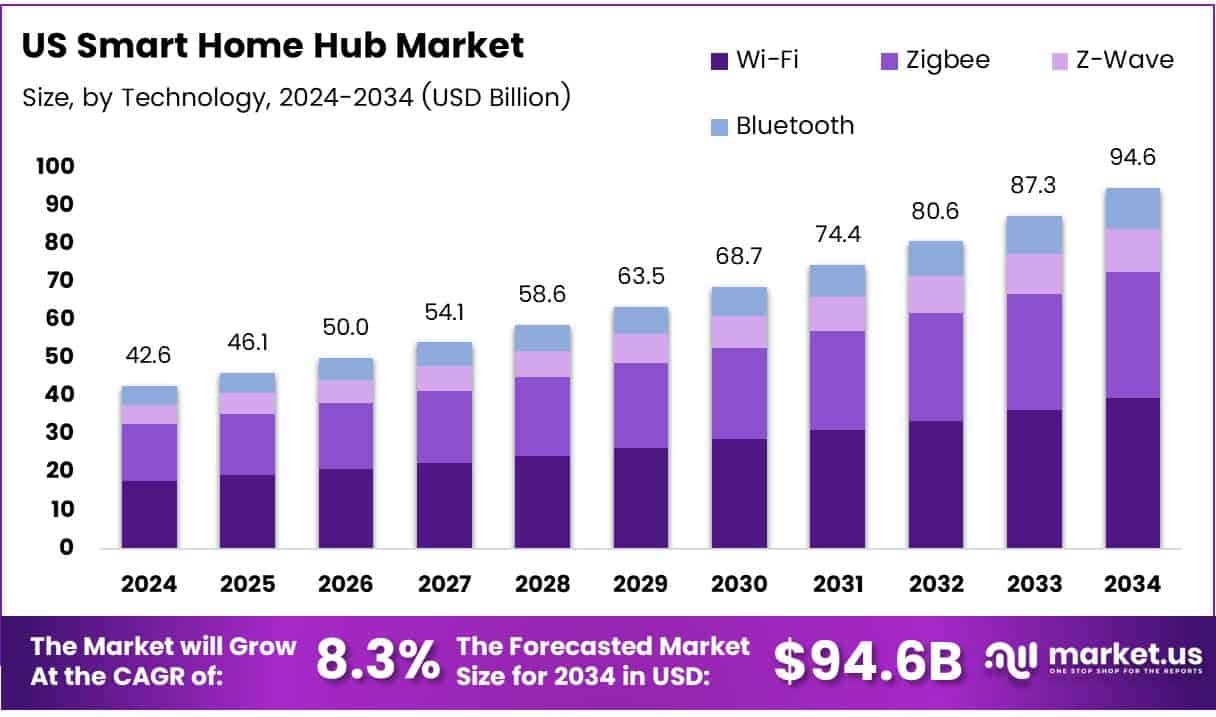

The US Smart Home Hub Market size is expected to be worth around USD 94.6 Billion by 2034, from USD 42.6 Billion in 2024, growing at a CAGR of 8.3% during the forecast period (2025–2034).

Smart home hubs have emerged as the control centers of increasingly interconnected homes. These systems enable seamless communication between a wide array of devices from lights and thermostats to security cameras and smart TVs regardless of the manufacturer or protocol Their pivotal role in ensuring centralized control and streamlined automation has made them indispensable to the modern digital household.With American consumers rapidly embracing smart technologies, smart home hubs are becoming critical to handling

the complexity and scalability of connected environments. By offering interoperability across devices, these hubs enhance user experience, enable automation, and provide a unified ecosystem for managing daily home functions.The evolution of consumer preferences is one of the strongest driving forces behind the market’s rapid growth.

Key Takeaways

- US Smart Home Hub Market is projected to reach USD 94.6 Billion by 2034, growing at a CAGR of 8.3% from 2025 to 2034.

- In 2024, the Hardware segment by component due to its critical role in device functionality and interoperability.

- Wi-Fi technology dominated in 2024 with a 46.2% market share, driven by broad availability and compatibility.

- Home Security and Automation led the application segment in 2024 with a 42.1% share, highlighting consumer emphasis on safety and control.

- Online Stores emerged as the top distribution channel in 2024 owing to their convenience and wide accessibility.

Key Market Segment

The US Smart Home Hub Market is segmented into several key categories. By Component, the market includes both hardware and software, with hardware playing a critical role in device operation. By Technology, the market features connectivity options such as Wi-Fi, Zigbee, Z-Wave, and Bluetooth, with Wi-Fi being the most widely used due to its accessibility and compatibility. By Distribution Channel, the market into online stores, multi-brand stores, and brand stores each serving different consumer preferences. Finally, by Application, smart home hubs are used across various areas such as home security and automation, entertainment, energy management, and healthcare, reflecting growing integration into daily life.

Drivers

The market’s expansion is being driven by a robust consumer interest in home automation, with increasing adoption of smart devices like lighting systems, cameras, and thermostats. Additionally, the proliferation of IoT technologies and smart voice assistants such as Amazon Alexa and Google Assistant are enabling seamless device integration, making smart home hubs indispensable. Government efforts to promote energy-efficient homes and stricter data privacy regulations are also encouraging the use of centralized, secure systems like smart home hubs.

Restraints

- Security and privacy concerns significantly restrain the adoption of smart home hubs in the US.

- Susceptibility to hacking and data breaches raises fears of personal data exposure.

- User hesitation stems from concerns about privacy invasion and potential financial loss.

- Integration issues further slow market growth due to incompatibility among devices.

- Setup complexities lead to user frustration, negatively impacting adoption rates.

Key Players Analysis

In 2024, Amazon.com Inc. continues to lead the U.S. smart home hub market, thanks to its popular Echo devices and Alexa voice assistant. These devices can connect and control a wide range of smart home products, making them a go-to choice for many users. Amazon is also improving its AI and voice technology, which helps it stay ahead in the market.

Apple Inc. remains a strong competitor, especially for users who value privacy and security. Its smart home system, powered by Home Pod and Home Kit, works smoothly with other Apple devices. Apple is also introducing more budget-friendly models like the Home Pod mini to attract more customers.

Samsung Electronics Co. Ltd. is expanding its reach with the Smart Things hub, which connects easily with a wide variety of smart devices. Samsung stands out by integrating its hub into a larger ecosystem of home appliances, giving users a seamless and connected experience.

Recent Developments

- In October 2024, OliverIQ released a new multi-protocol smart home hub, offering a comprehensive “Smart Home as a Service” platform that simplifies device integration and enhances user experience across multiple standards.

- In December 2023, LG unveiled its groundbreaking Smart Home AI Agent at CES 2024, promoting a “Zero Labor Home” concept that automates daily tasks using advanced AI for an effortless living environment.

- In July 2024, LG acquired Athom, the company behind the smart home platform Homey, to integrate robust third-party device connectivity into its ThinQ ecosystem, expanding interoperability across smart devices.

- In March 2024, ServiceNow announced the acquisition of 4Industry and EY Smart Daily Management Application to strengthen its portfolio for smart industrial environments, enabling real-time operations and improved worker connectivity.

- In October 2024, Baker McKenzie advised Haier on the successful completion of its USD 775 million acquisition of Carrier’s commercial refrigeration business, enhancing Haier’s position in the global cold chain and commercial refrigeration market.

Conclusion

The U.S. Smart Home Hub Market is evolving rapidly, shaped by advances in connectivity, artificial intelligence, and integrated applications across security, energy, and health. With consumers demanding more intelligent, secure, and seamless home experiences, smart home hubs are becoming the backbone of connected living. Companies that prioritize interoperability, user-centric innovation, and data security are well-positioned to lead in this expanding landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)