Table of Contents

Report Overview

The industrial robotics services market is experiencing rapid growth and evolution, fueled by technological innovations and shifting industrial needs. These services play a vital role in ensuring the smooth operation, maintenance, and optimization of robotic systems across diverse sectors, driving improvements in both productivity and operational efficiency.

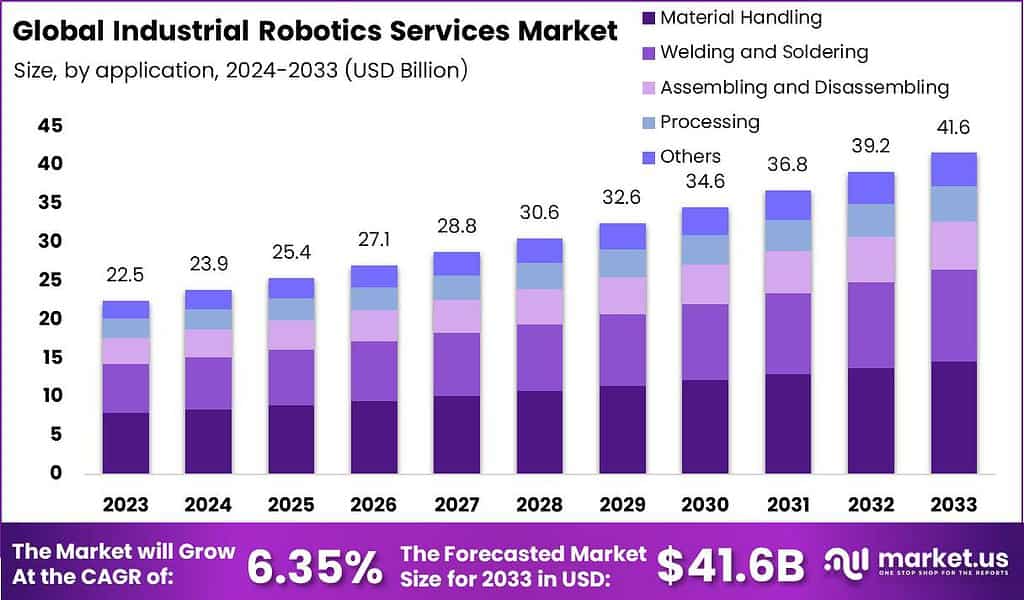

According to Market.us’s analysis, The Global Industrial Robotics Services Market is poised for significant growth, projected to reach USD 41.6 billion by 2033, up from USD 22.5 billion in 2023. This surge represents a compound annual growth rate (CAGR) of 6.35% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific (APAC) region dominated the market, securing a substantial 35.4% share with a revenue of USD 7.9 billion.

Rapid industrialization in the Asia-Pacific, alongside heavy investments in automation technologies, is driving significant market growth. China, Japan, and South Korea are at the forefront, benefiting from strong government support and a solid manufacturing foundation. Ongoing innovations in robotics, including AI integration and IoT connectivity, are key growth drivers, enhancing robots’ intelligence and efficiency.

According to Exploding Topics, the Asia-Pacific region commands over one-third of the global robotics industry’s revenue, underscoring its dominant role in both production and deployment. Countries such as China, Japan, and South Korea are leading adopters, collectively contributing a major portion of the global robot stock. As of 2023, China alone accounts for 41% of all operating industrial robots, followed by Japan (10.2%), the United States (8.9%), South Korea (8.9%), and Germany (6.3%).

While total unit sales of industrial robots declined slightly by 2.1%, amounting to 541,302 units in 2023, the operational stock grew by 9.7%, reaching 4,281,585 units. This reflects a clear trend toward long-term integration of robotics into existing infrastructures, even amid short-term fluctuations in sales volumes.

The robot-to-human ratio in manufacturing now stands at 1 to 71, and global robot density has risen from 151 to 162 units per 10,000 employees, demonstrating growing automation intensity. South Korea leads globally with a density of 1,012 robots per 10,000 employees, followed by China (470), Germany (429), and Japan (419).

From a corporate investment standpoint, 88% of companies are planning to invest in robotics, while 25% of industrial capital is expected to be allocated to automation in the next five years. This surge in investment is likely to further drive growth in sectors such as automotive, electronics, logistics, and heavy manufacturing.

Key Takeaways

- The Industrial Robotics Services Market is poised for robust growth, projected to rise from USD 22.5 billion in 2023 to USD 41.6 billion by 2033, advancing at a steady CAGR of 6.35%. This expansion reflects the accelerating adoption of robotic automation across industries aiming to improve operational efficiency, safety, and throughput.

- In 2023, the Material Handling segment emerged as the dominant application, accounting for 31.8% of the total market share. This dominance is fueled by the rising demand for automated transport, sorting, and stacking systems in warehouses, manufacturing lines, and logistics hubs where speed and precision are critical.

- The Automotive industry remained a key end-user, capturing over 37% of the global market in 2023. The integration of robotics in vehicle assembly, welding, painting, and component handling continues to grow, as automakers aim to enhance productivity, reduce human error, and meet mass customization demands.

- Asia-Pacific (APAC) maintained its leadership in the global market, holding over 35.4% share and generating USD 7.9 billion in revenue in 2023. The region’s dominance is supported by its large-scale manufacturing ecosystems, particularly in China, Japan, and South Korea, along with government-led automation incentives and a thriving electronics and automotive base.

US Tariff Impact

Economic and Market Impacts

- Economic Uncertainty: Economic uncertainty, driven by higher tariffs, disrupts robotics businesses by raising the cost of imported components. This forces companies to adjust operations, delay expansions, or cut plans. The unpredictability of future tariffs complicates long-term planning, especially for firms reliant on international trade. This uncertainty hinders investment in new robotics projects or system upgrades.

- Price Changes for Consumers and Producers: The tariffs have increased the cost of imported components essential for industrial robots, such as sensors, processors, and actuators. Manufacturers, facing higher production costs, have passed these expenses onto consumers, leading to increased prices for robotic services and equipment. This price escalation has been particularly challenging for small and medium-sized enterprises (SMEs), which often operate with tighter budgets and are more sensitive to cost fluctuations.

- Impact on Investments: Tariffs have heightened uncertainty, leading investors to be more cautious, particularly in sectors dependent on global supply chains. Robotics startups have experienced a decline in venture capital funding due to rising costs and market unpredictability.Companies are shifting towards domestic production to reduce trade risks, which could benefit local economies but may raise operational costs and require significant capital for new facilities.

- Stock Market Reactions: Companies in the industrial robotics sector have experienced fluctuations in their stock prices, reflecting investor concerns over rising costs and potential disruptions in supply chains. The broader market has also felt the impact, as the tariffs contribute to economic uncertainty and influence investor confidence across various industries. Companies with substantial exposure to international trade, especially those reliant on Chinese markets, have experienced notable stock price fluctuations.

Impact on Businesses

- Cost Structures and Pricing Strategies: Tariffs on key components like sensors and processors from countries such as China have raised production costs, forcing companies to rethink pricing. Some absorb the costs, while others pass them on, driving up prices for automation solutions. This especially affects SMEs with tighter margins. In response, companies are seeking cost-cutting measures, including redesigning products and investing in R&D for more affordable alternatives.

- Sourcing Adjustments: Tariff-driven cost increases have pushed businesses to rethink sourcing strategies. Many are shifting supply chains to regions like Southeast Asia, Eastern Europe, and Latin America to reduce reliance on tariffed countries and manage geopolitical risks. Some are also exploring reshoring or nearshoring to cut transport costs and strengthen supply chain resilience.

- Disruptions in Supply Chains: Tariffs have disrupted global supply chains, causing delays and shortages in key components for industrial robotics. This has led to production adjustments and temporary shutdowns. Unpredictable trade policies have made demand forecasting and inventory management difficult. In response, companies are adopting AI-driven supply chain technologies to improve visibility and agility.

Impact on End-User Industries

- Manufacturing Sector: Manufacturers are experiencing increased costs for imported components, particularly those sourced from countries facing high tariffs. The disruption of supply chains and production delays due to tariffs has led some companies to explore reshoring or nearshoring to reduce reliance on foreign imports. However, these transitions demand substantial investment and time, creating challenges for manufacturers striving to stay competitive in an unpredictable trade landscape.

- Logistics Sector: The logistics industry is grappling with the repercussions of tariffs through rerouted shipments and congested ports. The sudden changes in trade policies have forced logistics providers to adapt quickly, leading to increased operational costs and complexity. Companies are now prioritizing supply chain resilience, considering diversification of suppliers and investment in automation to navigate the uncertainties introduced by tariff implementations.

- Reduced Demand for Robotics Services Due to Cost Inflation: The increased costs associated with tariffs have led to a reduction in demand for robotics services. Rising expenses for imported components are prompting companies, especially small and medium-sized enterprises, to reconsider investments in automation. With limited financial flexibility, these businesses are slowing the adoption of robotics solutions, delaying broader industry integration.

Geographical Impact

- Asia-Pacific: The Asia-Pacific region, especially China, Japan, and South Korea, has been impacted by U.S. tariffs, particularly in the industrial robotics sector. China faces rising costs and supply chain issues due to tariffs on electronics and machinery. Meanwhile, Japan and South Korea have softened the blow through diversified markets and advanced technology. The region is now shifting toward local production and new markets to maintain growth.

- North America: In North America, U.S. tariffs have raised costs for industrial robotics services, mainly due to higher prices on imported components. This has spurred companies to consider reshoring manufacturing and investing in domestic supply chains, though the process is costly and time-consuming. The tariffs have also introduced market uncertainty, which has slowed investment and adoption in some sectors.

- Europe: European industrial robotics services have been indirectly affected by U.S. tariffs through global supply chain disruptions and rising competition. Exporters to the U.S. face challenges from retaliatory tariffs and a more complex trade landscape, prompting a shift toward regionalized supply chains to reduce trade risks.

- Middle East & Africa: The Middle East and Africa, though not major players in industrial robotics, are seeing emerging opportunities amid U.S. tariffs. Higher import costs are prompting interest in local manufacturing and partnerships, but limited infrastructure and investment remain key challenges.

Impact on Consumers

- Changes in Prices of Goods: The increased tariffs have elevated the cost of importing industrial robotics and related components.Manufacturers facing higher production costs often pass these on to consumers, driving up prices across various goods. For example, the smart home industry has seen price increases due to higher component costs and manufacturing disruptions, while the automotive sector has experienced elevated vehicle prices due to the rising cost of imported parts.

- Availability and Variety of Products: Tariffs have also affected the availability and variety of products in the market. To manage costs, manufacturers may reduce their product range or delay the release of new models. This reduction in variety limits consumer choices, particularly in sectors like electronics and appliances. Additionally, some companies have postponed or canceled product launches due to the uncertainty and higher costs linked to tariffs.

Strategies to Overcome Tariffs

- Diversify the Supply Chain: Reducing reliance on a single country by sourcing components from multiple regions can mitigate the impact of tariffs. For instance, shifting procurement to countries with favorable trade agreements or establishing relationships with domestic suppliers can enhance supply chain resilience.

- Leverage Automation for Cost Efficiency: One of the key reasons for investing in industrial robotics is to reduce labor costs. By further automating processes that were traditionally more labor-intensive, businesses can offset some of the tariff-induced price hikes. Advanced automation tools can also lead to better overall efficiency and productivity, helping companies remain competitive even when facing increased operational costs.

- Explore Government Support and Incentives: The U.S. government offers a range of grants, tax credits, and financial assistance programs to encourage domestic innovation and production. Companies in the robotics sector should explore available programs that support technological advancement and manufacturing within the U.S. This could include tax relief for companies investing in automation or subsidies for businesses manufacturing robotics locally.

Report Segmentations

Application Analysis

In 2023, the Material Handling application maintained a leading role within the industrial robotics services market, securing a significant 31.8% market share. This substantial share can be attributed to the critical function of material handling in automating and streamlining manufacturing and logistics operations. Robotics services in this segment focus on enhancing efficiency and reducing human error in environments where precision and reliability are paramount.

End-User Analysis

Similarly, in the end-user analysis for 2023, the Automotive industry demonstrated a pronounced adoption of industrial robotics services, commanding over 37% of the market share. The automotive sector’s reliance on robotics services is driven by the industry’s need for high precision and consistency in production processes. Robotics technologies in this sector are integral to achieving high throughput rates and maintaining quality standards in the assembly and fabrication stages of automotive manufacturing.

Regional Analysis

In 2023, APAC held a dominant market position in the industrial robotics services market, capturing more than a 35.4% share and generating revenue of USD 7.9 billion. This leading status is largely attributed to the rapid industrialization across several APAC countries and the significant investments in automation technologies by major manufacturing and production industries.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 22.5 Bn |

| Forecast Revenue (2033) | USD 41.6 Bn |

| CAGR (2024-2033) | 6.35% |

| Base Year for Estimation | 2023 |

| Historic Period | 2019-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

You May Also Like To Read

- North America AI Server Market

- Self-learning AI Market

- Retrieval Augmented Generation Market

- Semiconductor Manufacturing Market

- Semiconductor Inspection System Market

Key Market Segments

By Application

- Material Handling

- Welding and Soldering

- Assembling and Disassembling

- Processing

- Others

By End-User

- Healthcare and Pharmaceuticals

- Automotive

Top Key Players in the Market

- ABB Ltd.

- Carl Cloos Schweisstechnik GmbH

- Daihen Corp.

- DENSO Corp.

- FANUC Corp.

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Electric Corp.

- NACHI FUJIKOSHI Corp.

- OMRON Corp.

- Panasonic Holdings Corp.

- Seiko Epson Corp.

- Staubli International AG

- Teradyne Inc.

- Universal Robots AS

- Yaskawa Electric Corp

- Other Key Players

Conclusion

In conclusion, the impact of U.S. tariffs on industrial robotics services is multifaceted, encompassing both challenges and opportunities. As the market continues to evolve, stakeholders must navigate the complexities of cost management, supply chain optimization, and technological advancement to thrive in an increasingly competitive landscape. The future of industrial robotics in the U.S. will depend on the ability of companies to leverage these dynamics effectively, ensuring that they remain at the forefront of innovation and productivity in the manufacturing sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)