Table of Contents

Market Overview

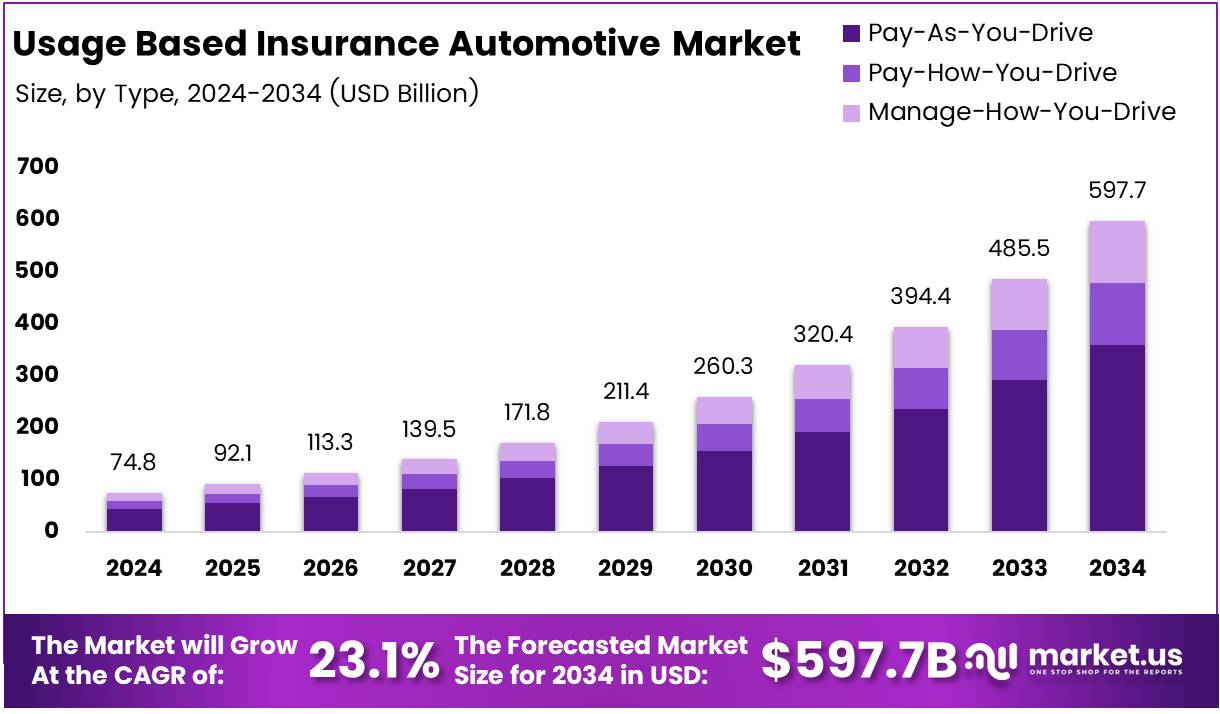

The Global Usage Based Insurance Automotive Market size is expected to be worth around USD 597.7 Billion by 2034, from USD 74.8 Billion in 2024, growing at a CAGR of 23.1% during the forecast period.

The Usage-Based Insurance (UBI) Automotive Market is growing fast. Rising costs in auto insurance push demand for smart pricing models. Auto insurance rates rose 2.6% in March and are up 22% year-over-year. Traditional insurance is expensive and outdated. UBI offers flexible premiums based on driving behavior. Drivers want personalized, fair pricing. Insurers use real-time telematics to assess risks better.

There’s big business opportunity in UBI. Consumers seek savings amid rising costs. Motor vehicle insurance costs jumped 11.3% year-over-year. Maintenance expenses also climbed, up 6.5% from Dec 2023 to 2024. UBI helps insurers lower claim losses. It also improves customer retention. OEMs and tech firms can partner with insurers for data sharing.

Autonomous vehicles support UBI adoption. They promise safer roads. Crashes could drop by up to 90% with automation. Safer driving means fewer claims. That aligns perfectly with UBI goals. Governments are investing in mobility tech. Many regions now support smart insurance systems. Policies are being updated to allow data use while protecting privacy.

Overall, UBI is the future of car insurance. It’s data-driven, cost-efficient, and scalable. Rising costs, tech innovation, and regulation all drive this shift. Companies investing in UBI today gain long-term advantage.

Key Takeaways

- The Global UBI Automotive Market is projected to reach USD 597.7 Billion by 2034, growing at a CAGR of 23.1% from USD 74.8 Billion in 2024.

- Pay-As-You-Drive (PAYD) is the leading type, capturing 60.1% market share in 2024.

- OBD II technology dominates by technology, offering advanced insights into performance and behavior.

- Passenger Autos lead by vehicle type due to high vehicle volume and rising UBI usage.

- Asia Pacific is the top regional market with a 33.1% share, worth USD 24.6 Billion.

Market Drivers

- UBI uses telematics to collect real-time driving data, helping insurers price premiums based on actual behavior.

- Drivers prefer personalized insurance, and UBI offers fair pricing based on how and how much they drive.

- Governments support UBI for promoting safer driving and aligning with road safety and emission goals.

Market Challenges

- Privacy & Data Security: UBI raises concerns over data sharing, requiring strong privacy policies and cybersecurity.

- High Implementation Cost: Launching UBI needs heavy investment in tech, data systems, and skilled resources.

Segmentation Insights

Type Analysis

In 2024, PAYD led the UBI market with 60.1% share due to its simple, mileage-based pricing. PHYD is growing, offering rates based on driving behavior, but still lags behind. MHYD remains niche, focusing on promoting safer driving.

Technology Analysis

OBD II dominated due to accurate data and easy integration. Black Box devices are effective but costlier and harder to install. Smartphones offer a budget-friendly option but lack precision. Other technologies have limited impact.

Vehicle Analysis

Passenger vehicles held the largest share in 2024, driven by high ownership and interest in flexible insurance. Commercial vehicle adoption is slower due to fleet complexity but is expected to grow gradually.

Regional Insights

Asia Pacific led the UBI automotive market in 2024 with 33.1% share and USD 24.6 billion value, driven by rapid telematics adoption, growing vehicle sales, and supportive government policies in countries like China, Japan, and India.

North America follows closely, with strong growth led by the U.S. due to rising demand for personalized insurance, advanced telematics, and insurer adoption of flexible premium models.

Europe is steadily expanding, backed by carbon reduction goals and road safety regulations. Countries like Germany, France, and the U.K. are integrating UBI through connected car technologies.

Latin America is growing gradually, supported by increasing smartphone use and telematics adoption in countries like Brazil and Mexico, despite slower overall uptake.

Middle East & Africa show early-stage adoption, with rising interest in UBI as telematics awareness increases. Growth is expected in markets like UAE and South Africa as demand for personalized insurance rises.

Recent Developments

- In June 2025, Crabi raised an additional $13.6 million in a new funding round to strengthen its presence in the digital auto insurance market. The company plans to use this capital to scale operations and enhance customer acquisition strategies.

- In June 2024, Mexico-based auto insurance platform Crabi announced a $13.6 million financing round. The funds will support product expansion, technology development, and market penetration within Latin America.

- In August 2024, YouSet secured $3.5 million in seed funding to revolutionize the Canadian home and auto insurance space. The company aims to streamline policy bundling and deliver a fully digital, consumer-friendly experience.

Conclusion

The Global Usage-Based Insurance (UBI) Automotive Market is rapidly transforming auto insurance by offering flexible, behavior-based pricing. Driven by rising insurance costs, telematics innovation, and supportive regulations, UBI enables insurers to reduce losses while meeting growing consumer demand for personalization. With major traction in Asia Pacific and increasing adoption in North America and Europe, the market is poised for sustained growth, reaching USD 597.7 Billion by 2034. Companies investing in UBI now will gain long-term competitive advantage in a data-driven insurance future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)