Table of Contents

Introduction

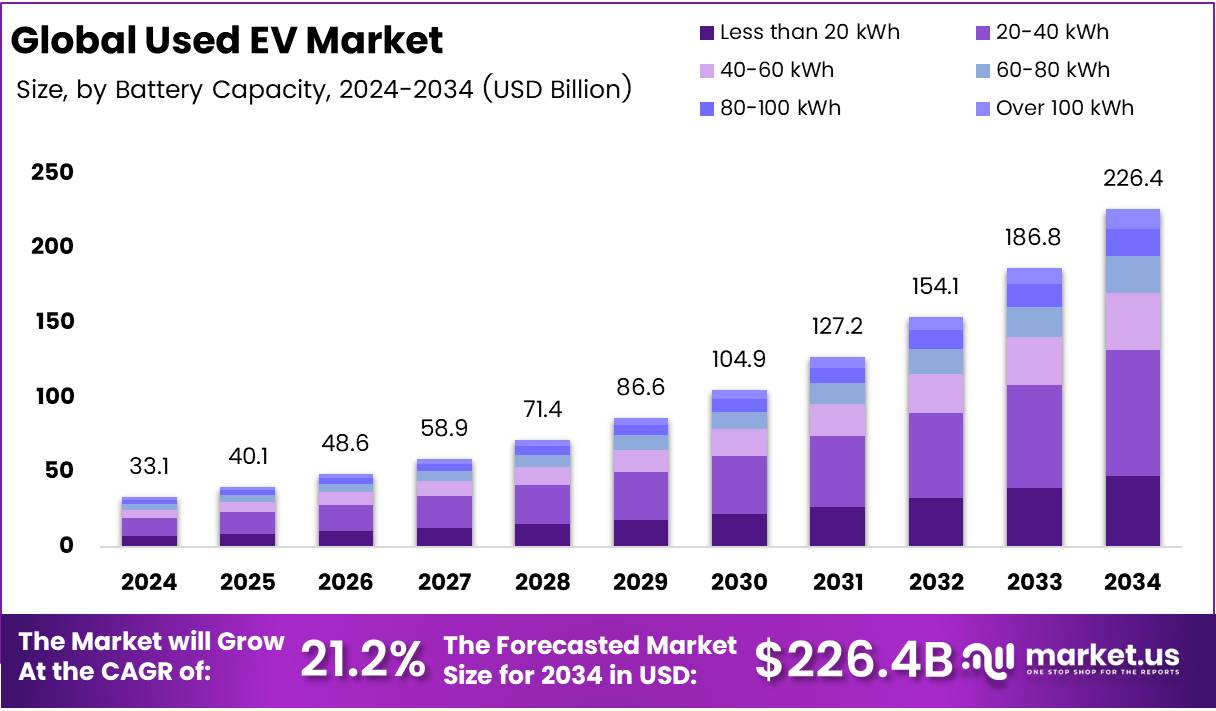

The global Used Electric Vehicle (EV) Market is on the cusp of a remarkable transformation, driven by increasing consumer demand for cost-effective, eco-friendly transportation. With a projected market size of around USD 226.4 billion by 2034, from USD 33.1 billion in 2024, the used EV market is expected to grow at a CAGR of 21.2% from 2025 to 2034. This growth is fueled by advancements in EV technology, government incentives, and a significant shift towards sustainable mobility solutions. As a result, the market for second-hand EVs is becoming increasingly attractive to cost-conscious consumers looking to embrace the benefits of electric mobility without the hefty price tag of new vehicles.

Key Takeaways

- The Global Used EV Market is projected to reach USD 226.4 billion by 2034, growing at a CAGR of 21.2% from 2025 to 2034.

- Passenger Cars dominated the used EV market in 2024, holding a 71.9% market share.

- The 20-40 kWh battery capacity segment led the market in 2024, capturing 37.2% of the share.

- Europe holds the largest market share in the EV market at 45.7%, valued at USD 15.1 billion in 2024.

- 1-3 years old EVs led the market, accounting for 46.7% of the share in 2024.

Market Segmentation Overview

The global used EV market is divided into several key segments based on battery capacity, vehicle type, range, and age. This segmentation allows manufacturers, dealerships, and consumers to better understand the specific demands of the market.

- Battery Capacity: The 20-40 kWh segment leads the market with 37.2% of the share, offering an optimal balance of cost and performance for urban commuters. The 40-60 kWh segment also holds a significant share, providing enhanced driving range for consumers seeking more flexibility. Other segments, including 60-80 kWh and 80-100 kWh, cater to consumers looking for more advanced features and longer driving ranges.

- Vehicle Type: Passenger Cars lead the market with 71.9% market share, as they remain the most practical and affordable option for daily commuting. Commercial Vehicles and Two and Three Wheelers account for smaller shares but are gaining traction in certain regions.

- Range: The Less than 100 Miles range segment dominates the market with 45.5% share. This is due to the growing demand for EVs suitable for short-range urban travel. The 100-200 Miles range also appeals to consumers looking for a balance between affordability and longer trips.

- Age: The 1-3 years segment holds 46.7% of the market share, as consumers prefer nearly-new vehicles with updated technology and lower depreciation. Older segments (4-6 years and 7-9 years) also represent a significant portion of the market, offering affordable alternatives for budget-conscious buyers.

Drivers

- Government Incentives and Tax Benefits: Various countries offer tax rebates, financial subsidies, and incentives to promote EV adoption. These benefits make used EVs more affordable, stimulating demand in the second-hand market.

- Advancements in EV Technology: Continuous improvements in battery technology, driving range, and overall vehicle performance are making used EVs more appealing to a wider range of consumers.

- Rising Fuel Prices: The increasing cost of gasoline and diesel has pushed consumers towards more economical and sustainable transportation options, making used EVs an attractive alternative.

- Environmental Regulations: Stricter emissions regulations are forcing consumers and businesses to look for green alternatives to traditional vehicles. This is accelerating the demand for electric vehicles, both new and used.

Use Cases

- Urban Commuters: Used EVs are ideal for city dwellers who need cost-effective, eco-friendly transportation for short commutes. With battery capacities ranging from 20-40 kWh, these vehicles offer sufficient range for daily city driving, reducing both fuel costs and carbon emissions.

- Commercial Fleets: Businesses in the logistics, delivery, and public transport sectors are increasingly turning to electric vehicles to reduce operational costs. The availability of used EVs from commercial fleets offers affordable alternatives to brand-new models, which helps businesses transition to greener fleets without significant upfront investment.

- Tech-Savvy Consumers: Used EVs equipped with advanced technologies, including Advanced Driver Assistance Systems (ADAS), are attracting tech-savvy buyers. Features such as lane-keeping assistance, automatic emergency braking, and adaptive cruise control enhance the safety and convenience of driving, especially in urban environments.

Major Challenges

- Limited Charging Infrastructure: The lack of widespread charging stations, particularly in remote or rural areas, remains a significant barrier to EV adoption. Consumers are hesitant to purchase used EVs if they cannot rely on convenient access to charging stations.

- Battery Life and Degradation: The health and longevity of EV batteries remain a concern for used car buyers. A decline in battery performance can lead to shorter driving ranges and increased costs for replacements. Certification programs and battery checks are crucial for ensuring consumer confidence in used EVs.

- Higher Upfront Costs for Larger Models: While used EVs are more affordable than new models, high-performance vehicles with larger battery capacities or longer ranges still carry a significant price tag. This limits the market for budget-conscious consumers.

Business Opportunities

- Certification and Inspection Services: Companies offering certified used EVs with reliable battery checks and transparent vehicle histories can attract more buyers. This is especially important as consumers seek assurance about the quality and reliability of second-hand electric vehicles.

- Expanding Charging Infrastructure: Investing in the expansion of charging stations, particularly in rural and remote areas, would reduce one of the primary barriers to EV adoption. Partnerships with government and private entities can help accelerate the rollout of charging infrastructure.

- Fleet Management: Businesses that rely on commercial fleets can find significant savings and sustainability benefits by transitioning to electric vehicles. Companies offering fleet leasing or resale of electric vehicles are well-positioned to tap into this growing trend.

Regional Analysis

- Europe: With a dominant market share of 45.7%, Europe remains the leader in the global used EV market. Strong government incentives, regulations on emissions, and a robust charging infrastructure are key factors driving the growth in countries such as Germany, France, and the UK.

- North America: The U.S. market, supported by federal and state incentives, continues to expand rapidly. Growing investments in charging infrastructure and technology are accelerating EV adoption, making the used EV market a promising sector in North America.

- Asia Pacific: Led by China, the Asia Pacific region is experiencing a shift towards electric vehicles, fueled by significant government support and manufacturing capabilities. India and Japan are also key players in the region’s growing EV market.

- Middle East & Africa: Although the market remains in its infancy, governments in the UAE and Saudi Arabia are focusing on sustainable transportation solutions. The region has great potential for growth in the coming years.

- Latin America: Countries like Brazil and Mexico are beginning to embrace electric vehicles, spurred by increasing environmental awareness and government policies promoting EV adoption.

Recent Development

- CarMax is expanding its EV offerings and focusing on an online platform to make it easier for customers to purchase used electric vehicles.

- Toyota Tsusho, a subsidiary of Toyota, is strengthening its position in the global used EV market by sourcing high-quality used EVs from various regions.

- Cardino, a Berlin-based company, secured €4 million in seed funding in June 2024 to enhance its used EV sales model.

- The International Motor Dealers Association (IMDA) is advocating for a £1,000 government grant to support the used EV market in July 2025.

Conclusion

The used electric vehicle market is poised for substantial growth, driven by the increasing adoption of electric mobility, government incentives, and advancements in EV technology. As consumers become more eco-conscious and cost-sensitive, the demand for used EVs continues to rise. However, addressing challenges like limited charging infrastructure and battery performance will be key to unlocking the full potential of this market. With the right strategies, businesses can capitalize on the burgeoning demand for used electric vehicles and position themselves for success in the years to come.