Table of Contents

Introduction

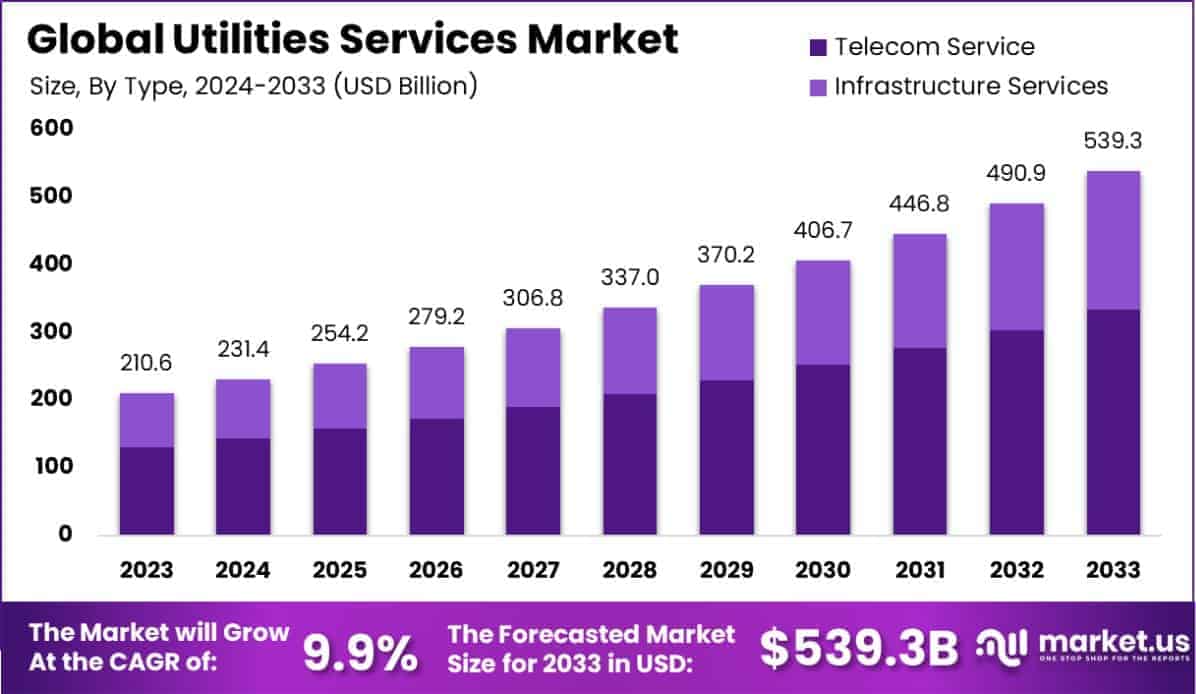

The global utilities services market reached USD 210.6 billion in 2023 and is projected to grow at a CAGR of 9.9%, hitting approximately USD 539.3 billion by 2033. This surge is driven by rapid urbanization, population growth, and increasing demand for clean energy and water services. North America led the market in 2023, accounting for a 30.5% share and generating USD 64.22 billion in revenue. Investments in smart grids, renewable energy integration, and efficient distribution systems are propelling utilities’ modernization globally.

How Growth is Impacting the Economy

The accelerated growth in utility services is stimulating economic development across regions by driving infrastructure expansion and job creation. Investments in smart metering, AI-powered grid systems, and clean water supply infrastructure are creating new employment opportunities while improving service delivery to both residential and commercial users. Governments are boosting public-private partnerships (PPPs), especially in power generation and distribution, which is amplifying foreign direct investments in developing nations.

Additionally, increased emphasis on sustainable energy sources reduces dependence on imports, thus strengthening national energy security and stabilizing fiscal deficits over time. For example, large-scale renewable energy projects in India and Southeast Asia are improving rural electrification, directly uplifting local economies, and improving access to digital and banking infrastructure.

➤ Unlock growth! Get your sample now! – https://market.us/report/utilities-services-market/free-sample/

Impact on Global Businesses

Rising input costs such as raw materials, energy tariffs, and logistics are increasing operational expenditure across industrial sectors. Moreover, global supply chain volatility—especially in semiconductor and transformer components—has disrupted timely delivery and repair cycles for utility equipment. Sector-specific implications include reduced uptime in manufacturing due to irregular electricity supply and higher compliance requirements in water treatment and waste services. Digital transformation is also adding to the cost curve as companies invest in software upgrades and cybersecurity. On the positive side, businesses offering utility-as-a-service models or advanced grid analytics are benefiting from new revenue streams.

Strategies for Businesses

To remain competitive, businesses are focusing on digitization, cost-efficiency, and sustainability. Strategies include:

- Adopting smart metering and automation to improve service efficiency

- Partnering with clean energy providers for hybrid utility supply models

- Regional diversification to reduce geopolitical risks

- Investing in predictive maintenance to reduce downtime

- Enhancing customer engagement platforms to improve satisfaction

Key Takeaways

- Global market value projected at USD 539.3 billion by 2033

- CAGR of 9.9% between 2024 and 2033

- North America captured a 30.5% share in 2023

- Digitization and clean energy are driving transformation

- Supply chain disruptions pose a cost challenge

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=129296

Analyst Viewpoint

The present utilities services market reflects an evolving landscape driven by decarbonization and digitization. Public investments in climate-resilient infrastructure, along with decentralization of energy sources, are setting a positive long-term trajectory. In the near term, analysts foresee more consolidation among smaller utility firms and increased demand for analytics-based solutions. Over the next decade, regions embracing policy reforms and digital upgrades will likely lead in value creation and service innovations.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Smart Grid Integration | Need for energy efficiency and outage reduction |

| Water Purification for Urban Areas | Urban population growth and clean water demand |

| Renewable Energy Monitoring Services | Increasing government mandates for clean energy adoption |

| Predictive Utility Maintenance | Cost savings and better resource management |

| Cloud-Based Utility Billing Platforms | Need for operational efficiency and transparency |

Regional Analysis

North America remains dominant with a 30.5% share, owing to strong investment in smart grids, EV charging infrastructure, and decarbonization policies. The Asia Pacific region is emerging rapidly, fueled by expanding urban centers, industrialization in India and Southeast Asia, and supportive government regulations. Europe continues to drive demand through carbon neutrality targets, especially in Scandinavian nations and Germany. Meanwhile, Latin America and Africa show rising potential due to infrastructure modernization needs and international development funding for clean water and power.

➤ Don’t Stop Here — Check Our Library

- AI Visual Inspection System Market

- Time Series Databases Software Market

- Soldier Systems Market

- Mobile Cloud Market

Business Opportunities

Growing urbanization, stringent emission norms, and the rise of prosumers (producer-consumer hybrids) are opening multiple opportunities. Smart utility services such as remote metering, AI-driven demand forecasting, and solar integration platforms are in high demand. Startups providing SaaS platforms for billing and monitoring are attracting venture capital, while legacy firms are expanding into hybrid grids and storage services. There’s also strong potential in wastewater reuse technologies, especially in drought-prone countries.

Key Segmentation

The market can be segmented into the following:

- By Service Type: Electricity Services, Water Services, Waste Services, Natural Gas Distribution, Renewable Energy Utilities

- By Technology: Smart Grids, Cloud Utility Management, IoT Utility Devices, SCADA Systems

- By End-User: Residential, Commercial, Industrial, Municipal

- By Deployment: On-Premises, Cloud-Based

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Player Analysis

Leading providers in the utilities services market are leveraging data-driven technologies and forming regional partnerships to scale operations. Their strategies include investing in AI-based asset management, acquiring clean energy startups, and modernizing customer-facing platforms to support remote monitoring and real-time billing. Some are aligning operations with SDG goals, especially in underserved markets. Strategic alliances with grid operators and urban developers are also key to expanding service coverage.

- Honeywell International, Inc.

- Deloitte

- PA Consulting Group

- UMS Group

- Bain & Company

- Boston Consulting Group

- McKinsey & Company

- BearingPoint

- Emerton

- KPMG

- Sia Partners

- Analysys Mason

- Coeus Consulting

- Other Key Players

Recent Developments

- March 2025: A major utility launched a blockchain-powered smart metering system in the US

- February 2025: A European provider introduced AI-driven leak detection for water infrastructure

- December 2024: An Asia-based firm secured $600M for solar integration in public utility networks

- September 2024: A new cloud-based utility billing platform was adopted by 50+ municipalities in Latin America

- August 2024: A major merger between two utility service giants created a new global leader in power and water services

Conclusion

The utilities services market is transitioning toward a cleaner, smarter, and more consumer-centric model. With strong growth potential across regions, businesses that embrace innovation and sustainability are expected to lead the next decade of expansion in this essential sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)