Table of Contents

Market Overview

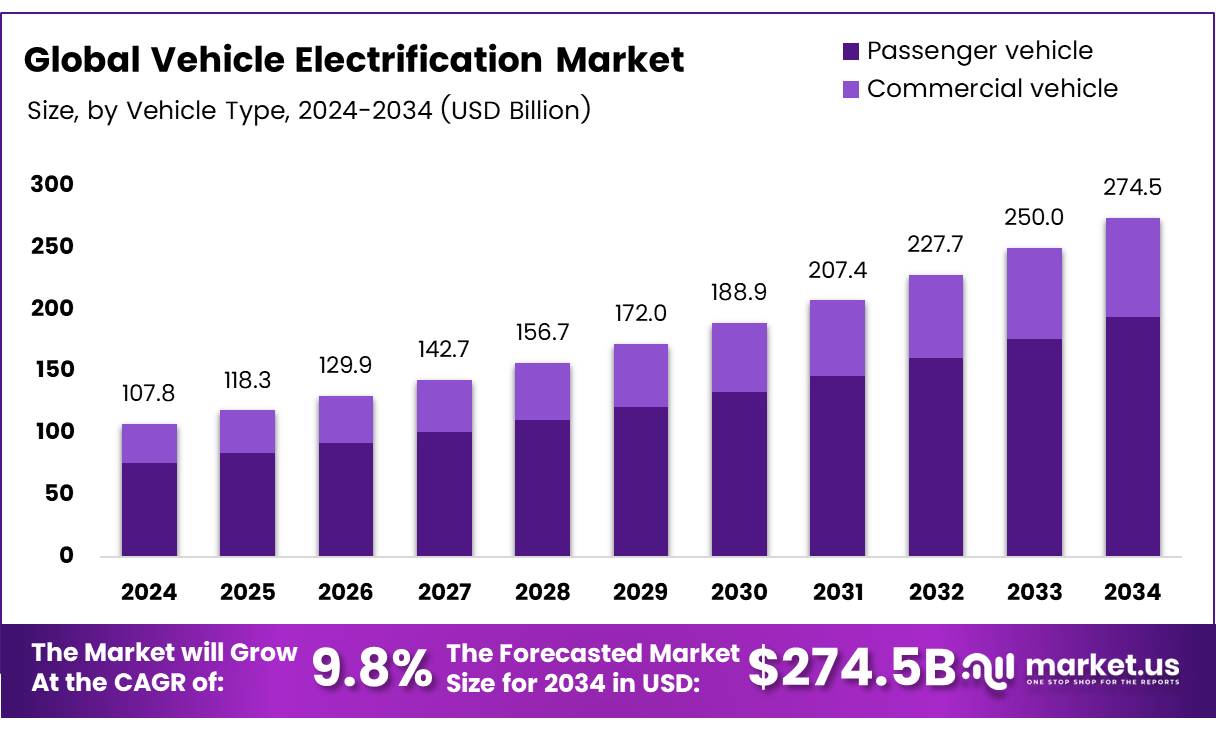

The Global Vehicle Electrification Market size is expected to be worth around USD 274.5 Billion by 2034, from USD 107.8 Billion in 2024, growing at a CAGR of 9.8% during the forecast period.

The vehicle electrification market is growing fast. EV sales will rise by 22% this year, showing high demand. Governments are investing in EVs and infrastructure. Rules on emissions are also getting stricter. These steps push automakers to shift from fuel to electric. In the EU, hybrid and electric car production hit €124 billion, proving strong industry growth.

EVs are far more efficient than fuel vehicles. They convert 85-90% of battery power to motion. Fuel engines convert only 30%. This energy edge helps reduce running costs. HEVs also help save fuel. On highways, they cut fuel use by 39.3%. This appeals to both personal and commercial users.

In the U.S., HEV use is still low. Less than 1% of cars are hybrids. This shows big room for growth. EV makers and suppliers can tap into this demand. Clean energy goals support long-term EV adoption. More policies, tax cuts, and subsidies will boost the market.

The vehicle electrification trend is clear. It offers lower costs, cleaner travel, and better tech. For businesses and investors, it’s a key market to watch. Growth, support, and efficiency make it a smart opportunity.

Key Takeaways

- The global vehicle electrification market is projected to reach USD 274.5 billion by 2034, growing at a CAGR of 9.8%.

- Passenger vehicles led the market in 2024, accounting for 71.6% share due to rising demand and sustainability concerns.

- ICE & Micro-hybrid vehicles held 58.7% share in the By Hybridization segment in 2024.

- The Electric Vacuum Pump dominated the By Product segment with 14.1% market share in 2024.

- Asia Pacific commanded the largest regional market share at 52.4%, driven by robust EV infrastructure and supportive government policies.

Market Drivers

- Sustainability Goals: Global emission targets are accelerating the shift to electric vehicles.

- Tech Innovations: Advances in batteries and powertrains boost EV performance and affordability.

- Fuel Standards: Stricter efficiency rules push automakers toward electrified solutions.

Segmentation Insights

Vehicle Type Analysis

Passenger vehicles led the electrification market in 2024 with 71.6% share, driven by rising fuel prices, eco-awareness, and government incentives. Commercial vehicles are also shifting but face cost and infrastructure hurdles.

Hybridization Analysis

ICE & Micro-hybrid vehicles held 58.7% market share in 2024, due to affordability and existing infrastructure. HEVs, PHEVs, and BEVs are growing, signaling a gradual shift toward full electrification.

Product Analysis

Electric Vacuum Pumps led the product segment with 14.1% share in 2024, crucial for brake systems in EVs. Other components like Electric Power Steering and Start/Stop Systems support overall efficiency and eco-compliance.

Regional Insights

Asia Pacific leads with 52.4% market share (USD 56.0B), driven by strong EV infrastructure and government support, especially in China and Japan.

North America’s growth is fueled by strict emission rules and EV incentives in the U.S. and Canada, boosting adoption among consumers and manufacturers.

Europe led by Germany and Nordic countries, Europe benefits from tough climate policies and strong EV infrastructure backed by renewable energy.

Middle East & Africa still emerging, the region shows potential with urban growth and early EV initiatives in the UAE and South Africa.

Latin America

Progress is slow due to infrastructure gaps, but Brazil and Argentina are investing in electric public transport to drive growth.

Recent Developments

In January 2025, American Axle & Manufacturing announced the $1.4 billion acquisition of GKN Automotive, a strategic decision that will reshape global automotive manufacturing by enhancing its leadership in driveline systems and EV production.

In February 2025, Uno Minda completed the acquisition of a 100% stake in UnoMinda EV Systems for INR 195 crore, aiming to expand its footprint in the EV components market and strengthen its product offerings and capabilities.

In November 2024, the U.S. government allocated $46.5 million in new federal funding to support projects aimed at enhancing the performance, reliability, and resilience of EV charging infrastructure. This funding will help accelerate the deployment of next-generation charging technologies across the country.

In November 2024, EV Connect was acquired by Schneider Electric, a move designed to accelerate the electric vehicle revolution by integrating Schneider’s energy management expertise with EV Connect’s charging solutions.

Conclusion

The vehicle electrification market is set for strong, long-term growth, backed by rising EV demand, supportive government policies, and rapid tech advancements. With benefits like lower costs, cleaner transport, and regulatory momentum, it presents a high-potential opportunity for businesses, investors, and stakeholders worldwide.