Table of Contents

Market Overview

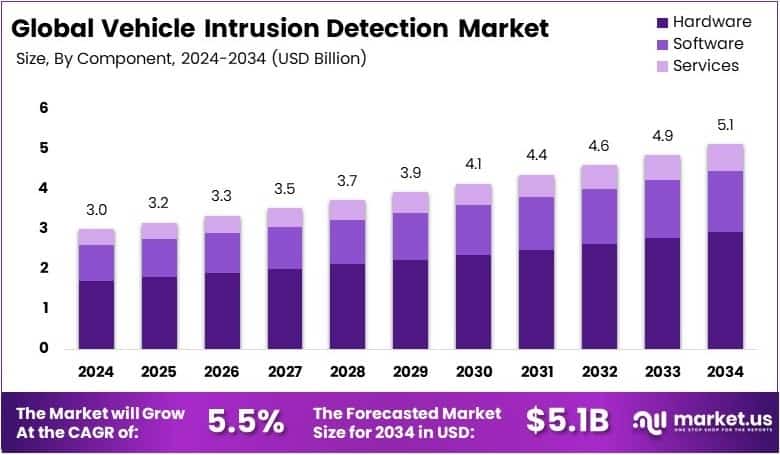

The Global Vehicle Intrusion Detection Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 5.5% during the forecast period.

The Vehicle Intrusion Detection Market is growing fast. Rising car theft cases drive this growth. Automakers want better security systems. Intrusion detection systems are now in high demand. A single audio glass break sensor covers 20 to 25 feet. This makes it cost-effective for large vehicle cabins. These sensors are widely used in luxury and smart vehicles. Fleet operators are also adopting them.

Government support is boosting this market. Several nations are investing in smart mobility. Strict safety rules are being enforced. Automakers must follow these regulations. This drives more use of security technologies. In the EU and U.S., compliance is a major factor. These regulations help reduce vehicle-related crimes.

New tech trends are opening fresh opportunities. Electric and autonomous vehicles need advanced security. Intrusion detection is now a must-have feature. Smart vehicles come with inbuilt detection systems. Consumer awareness is also growing. Buyers now prefer vehicles with extra protection.

The market will grow at a steady rate. Companies are forming partnerships for innovation. The future holds strong potential. Businesses entering now can gain a big edge. The Vehicle Intrusion Detection Market is set for long-term success.

Key Takeaways

- The Vehicle Intrusion Detection Market was valued at USD 3.0 billion in 2024 and is projected to reach USD 5.1 billion by 2034, growing at a CAGR of 5.5%.

- Hardware led the component segment in 2024 with a 57.4% share, driven by demand for advanced security devices.

- Radar-Based Intrusion Detection dominated in 2024 with a 43.8% market share due to its high accuracy and reliability.

- Passenger Vehicles held the largest share in 2024 at 66.6%, fueled by rising consumer demand for vehicle security.

- Active Vehicle Protection Systems captured 54.2% of the market in 2024, supported by strict safety regulations.

- North America led the market in 2024 with a 38.8% share, valued at USD 1.18 billion, due to robust automotive cybersecurity initiatives.

Market Drivers

- Increasing Vehicle Connectivity: Smart features and telematics expose vehicles to more cyber risks, boosting demand for security systems.

- Rising Cyber Threats: Sophisticated attacks on vehicle systems make IDS solutions essential.

- Regulatory Push: Global regulations require OEMs to adopt automotive cybersecurity standards.

- Autonomous & EV Growth: EVs and autonomous cars rely on data-heavy systems, increasing cyber vulnerabilities.

- Consumer Demand: Growing awareness of vehicle safety and data privacy drives IDS adoption.

Market Challenges

- System Complexity and Integration Issues: Installing intrusion detection systems into modern vehicles requires seamless integration with existing electronic control units (ECUs) and communication protocols, which can be technically challenging.

- High Implementation Costs: IDS solutions, especially those with real-time and AI-based capabilities, can be expensive, which may deter adoption, particularly among budget vehicle manufacturers.

- False Positives and Detection Accuracy: An IDS must accurately distinguish between legitimate and suspicious activities. Poor detection accuracy can lead to system errors, performance issues, or safety concerns.

- Rapid Evolution of Attack Methods: Cyber threats continue to evolve, requiring constant updates and system adaptability, which places pressure on IDS developers to maintain effectiveness.

Segmentation Insights

Component Analysis

Hardware leads with 57.4% as it includes essential tools like sensors and cameras for detecting intrusions. Software processes the data, while services ensure smooth setup and maintenance.

Technology Analysis

Radar-based tech dominates with 43.8% due to its accuracy and all-weather performance. Ultrasonic, infrared, and LIDAR also support detection but vary in range, cost, and usage.

Vehicle Type Analysis

Passenger vehicles hold 66.6% share because of high numbers and growing demand for security. Commercial vehicles follow with tailored solutions for cargo and fleet safety.

Application Analysis

Active Protection Systems lead with 54.2% by offering real-time threat response. Remote Monitoring and Emergency Systems also boost safety and vehicle control.

Regional Insights

North America holds the top spot with 38.8% market share, thanks to its advanced automotive industry, strong tech adoption, and consumer focus on safety. Growing EV use and connected cars will keep driving demand.

Europe stays strong due to strict safety rules and quick adoption of new vehicle tech, helping the market grow steadily.

Asia Pacific is growing fast, led by rising vehicle production and security concerns in countries like China and India.

Middle East & Africa are slowly expanding as vehicle safety standards improve and modern tech adoption increases.

Latin America shows early signs of growth, supported by rising car sales and interest in better security features.

Recent Developments

- In December 2024, Triton acquired the Security and Communications Technology product business from Bosch, strengthening its portfolio in mission-critical security solutions.

This strategic move enhances Triton’s capabilities in delivering integrated security and building technologies across Europe. - In June 2023, Eagle Eye Networks received a $100 million primary equity investment from SECOM Co., Ltd., a major player in the global security market.

The funding will accelerate the expansion of its AI-powered cloud video surveillance solutions, geographic footprint, and enterprise-grade features.

Future Outlook

The vehicle intrusion detection market is expected to experience strong, sustained growth in the coming years. With connected, autonomous, and electric vehicles becoming the norm, cybersecurity is no longer optional it is a necessity. Intrusion detection systems will continue to evolve, leveraging AI, machine learning, and cloud computing to provide intelligent and adaptive protection.

Companies that invest in scalable, accurate, and cost-efficient IDS technologies will be well-positioned to meet the needs of the future automotive landscape, where digital safety is just as important as physical protection.

Conclusion

The Vehicle Intrusion Detection Market is set for steady growth, reaching USD 5.1 billion by 2034 at a CAGR of 5.5%. Driven by rising vehicle thefts, EV and autonomous vehicle adoption, and strict regulations, intrusion detection is becoming essential. Hardware and radar-based systems lead due to accuracy and demand for real-time protection. While high costs and integration challenges exist, advances in AI and cloud tech offer strong solutions. With growing consumer focus on safety, companies investing in smart, scalable IDS solutions will gain a clear edge in the evolving automotive landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)