Table of Contents

Introduction

Video Conferencing Statistics: Video conferencing is a transformative technology that has revolutionized communication by enabling audio and video meetings and collaborations among geographically separated individuals and groups.

Its evolution from a complex and costly system to an accessible tool has made it indispensable in various sectors. Key components include cameras, microphones, displays, and internet connectivity, offering advantages such as cost savings, time efficiency, and global reach.

Its applications span business, education, healthcare, government, and personal use, yet challenges like technical issues and security concerns persist.

With ongoing innovations, including virtual reality conferencing and AI-powered features. The future of video conferencing is promising as it continues to play a pivotal role in modern communication and collaboration.

Editor’s Choice

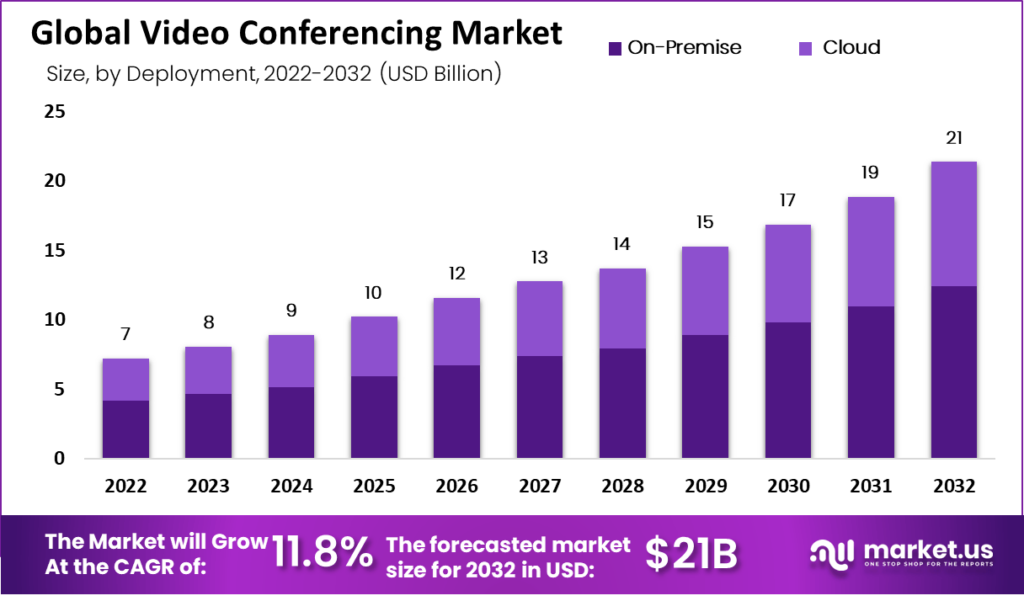

- The video conferencing market has been experiencing significant growth at a CAGR of 11.8%

- In 2022, the global video conferencing market reached a valuation of $7 billion. It’s anticipated to grow to $21 billion by 2032.

- Zoom video conferencing achieved a significant milestone, surpassing Skype’s usage. With an impressive daily tally of 300 million Zoom meetings within the communications industry.

- Video conferencing platforms facilitate recruitment and communication, with 94% of HR leaders attesting to increased productivity through remote work.

- Market penetration for video conferencing software saw a substantial rise of approximately 65% by 2022.

- Notably, the most common challenge encountered in video conferences is software or technical issues, acknowledged by 58% of professionals in a global survey.

- On a positive note, video conferencing in 2022 significantly enhanced the communication experience, as validated by 99% of employees worldwide.

Global Video Conferencing Market Statistics

Video Conferencing Statistics by Market Size and Growth Trends

- The video conferencing market has been experiencing significant growth at a CAGR of 11.8% in recent years, with its revenue steadily increasing yearly.

- In 2022, the market generated $7.0 billion in revenue, and this figure is projected to rise to $8.0 billion in 2023, demonstrating a clear upward trajectory.

- The trend continues with anticipated revenues of $9.0 billion in 2024 and $10.0 billion in 2025, reflecting the growing demand for video conferencing solutions.

- The market is expected to maintain momentum, reaching $12.0 billion in 2026 and further expanding to $13.0 billion in 2027.

- As we move into the late 2020s, the video conferencing market is poised for continued growth. With revenue projections of $14.0 billion in 2028, $15.0 billion in 2029, and $17.0 billion in 2030.

- The trend continues into the early 2030s, with the market reaching an impressive $19.0 billion in 2031 and a projected $21.0 billion in 2032.

- These figures underscore the increasing reliance on video conferencing technology across various sectors and the enduring importance of remote communication solutions in the digital age.

(Source: Market.us)

Key Players in the Video Conferencing Industry Statistics

- In the competitive landscape of the video conferencing market, several key players have established their presence with varying market shares.

- Adobe Systems Incorporated commands a notable share, accounting for 18% of the market. Reflecting its strong position in delivering video conferencing solutions.

- Atlassian Corporation Plc. follows closely with a 14% share, showcasing its significance in the industry. Cisco Systems, Inc., a recognized name in the tech world, holds a 15% share, further contributing to the market’s diversity.

- Huawei Technologies Co., Ltd. boasts a 13% market share, demonstrating its global reach and influence in video conferencing.

- JOYCE CR, S.R.O., and Logitech International S.A. each capture a respective 9% and 11% share. Emphasizing their substantial contributions to the market’s competitiveness.

- In contrast, LogMeIn, Inc. holds a smaller 4% share. At the same time, Fuze, Inc. and other vital players collectively make up 8% of the market. Highlighting the presence of various players in this dynamic industry.

- This distribution of market shares reflects the evolving landscape of video conferencing. Driven by diverse companies striving to meet the growing demand for remote communication solutions.

(Source: Market.us)

Market Segmentation by Application (Consumer vs. Enterprises)

- The video conferencing market is experiencing robust growth, driven by consumer and enterprise applications.

- In 2022, the total market revenue reached $7 billion, with consumer applications contributing $3.36 billion and enterprise applications generating $3.64 billion.

- This trend of expansion is expected to continue in the coming years. By 2023, the total market revenue is projected to increase to $8 billion, with $3.84 billion coming from consumer applications and $4.16 billion from the enterprise sector.

- The growth trajectory remains steady, with total market revenues of $9 billion in 2024, $10 billion in 2025, and $12 billion in 2026.

- During this period, consumer application revenue increased from $4.32 billion to $5.76 billion, while enterprise application revenue grew from $4.68 billion to $6.24 billion.

- As we move into the late 2020s, the market continues to flourish. Reaching $13 billion in 2027, $14 billion in 2028, and $15 billion in 2029.

- Consumer application revenue rises to $6.24 billion, while enterprise application revenue reaches $7.28 billion.

- The growth trajectory accelerates further, with the total market revenue reaching $17 billion in 2030, $19 billion in 2031, and an impressive $21 billion in 2032.

- Consumer application revenue follows suit, increasing from $8.16 billion in 2030 to $10.08 billion in 2032, while enterprise application revenue grows from $8.84 billion to $10.92 billion.

- These figures reflect the increasing reliance on video conferencing in the business world and the consumer space, emphasizing its pivotal role in communicating and collaborating in the digital age.

(Source: Market.us)

Adoption Rates of Video Conferencing

Pre-Pandemic Usage of Video Conferencing

- Before the COVID-19 pandemic, 43.6% of American workers had the potential to engage in remote work. However, a mere 10.8% of the entire U.S. workforce chose to embrace this option.

- In the era preceding the pandemic, the use of video conferencing for work was more prevalent among younger individuals, with 25% of those aged 18 to 29 regularly incorporating it into their work routines, in contrast to the 15% figure observed in the 45 to 60-year-old age group.

- Notably, before COVID-19, most employees (63%) foresaw video technology impacting their work, equal to or surpassing that of augmented reality and virtual reality.

- Additionally, 51% believed that video communication would hold the same level of importance as, or even exceed, that of enterprise collaboration platforms such as Slack and Microsoft Teams.

- Furthermore, 51% anticipated that video technology would be equally or more impactful than AI and machine learning.

More Insights

- Moreover, half of the workforce (51%) believed that video conferencing companies were more innovative, 41% perceived these companies as having more engaged employees, and 31% considered them more successful.

- Regarding fostering collaboration, 55% of employees agreed that companies utilizing video conferencing were more conducive to collaborative work environments.

- Before the pandemic, video conferencing found diverse applications among business professionals, with 80% employing it for one-on-one meetings, 78% for team meetings, 77% for large group meetings, including company-wide town halls, and 62% for customer and partner meetings.

- Lastly, before COVID-19, 51% of workers disclosed that they conducted video calls for work from a home office.

- In comparison, 21% did so from their bedrooms, and an additional 21% even engaged in work-related video calls while on vacation.

- Regarding device preferences, 77% of employees favored laptops or desktop computers for video calls at work, while 31% opted for mobile phones as their primary tool for video conferencing. Webinar platforms enable real-time presentations and meetings over the Internet using video, audio, and screen-sharing capabilities.

(Source: Bureau of Labor Statistics 2018, Lifesize 2019)

Popular Platforms Used For Video Conferencing Statistics During The Pandemic

- During the height of the COVID-19 pandemic, various communication platforms witnessed a surge in usage as people turned to virtual means to stay connected.

- FaceTime was one of the most popular choices, with 47.6% of users relying on it for video calls and chats.

- Facebook Messenger is closely followed, with 44.1% of users using it for communication.

- Zoom, known for its seamless video conferencing, secured a substantial 31.5% usage rate.

- Skype and WhatsApp also played significant roles, with 22.5% and 18.4% of users, respectively.

- Google Duo and Google Hangouts Meet saw 14% and 8.6% usage, while Microsoft Teams and Amazon Chime accounted for 5.7% and 5.3% of users, respectively.

- Houseparty and Marco Polo, known for their social and fun features, had 4.5% and 4% of users, respectively.

- Other platforms comprised 2.3% of the usage, highlighting the diverse choices available to users for their virtual communication needs during the pandemic.

Video Conferencing Statistics by Post-Pandemic Usage

- During the COVID-19 pandemic, 30% of global companies adopted video conferencing for the first time as part of their communication tools.

- In 2018, a quarter (25%) of Americans who hadn’t previously used video chat expressed their intention to use it in the future.

- Amid the pandemic, 70% of full-time employees in the United States transitioned to remote work from their homes.

- Within day-to-day business operations, 58% of companies have integrated video conferencing into their regular practices.

- Notably, approximately 83% of larger companies and 27.6% of small businesses have plans to acquire collaboration tools to support their daily business activities.

- In a post-pandemic scenario, 31% of business travelers intend to reduce travel commitments. This decision stems from the realization that teleconferencing and remote work arrangements are just as adequate as being physically present in the office or traveling.

- Furthermore, 61% of workers have expressed their intent to increase their use of video conferencing beyond the pandemic. This shift is motivated by recognizing that video conferencing is as effective as in-person meetings and offers time-saving benefits.

(Source: Finances Online, Pepperland Marketing, Owl Labs, Finances Online, Oliver Wyman 2020)

Remote Work and Video Conferencing

Video Conferencing Statistics by Bthe enefits of Remote Work

- Remote work offers a range of benefits that respondents have identified based on their experiences and preferences.

- As indicated by 32% of respondents, the most prominent advantage is the ability to enjoy a flexible schedule, allowing them to tailor their work hours to suit their needs better.

- Close behind is the flexibility to work from anywhere, with 25% of respondents valuing the freedom to choose their workspace.

- Eliminating daily commutes is another significant advantage, resonating with 22% of those surveyed, saving time and reducing stress.

- For 11% of respondents, spending more time with family is a significant benefit, fostering a better work-life balance.

- Additionally, 8% appreciate the option to work from the comfort of their homes, while a small portion, 2%, cited other unique advantages of remote work.

- Overall, these findings underscore remote work’s diverse advantages, catering to various personal and professional needs.

(Buffer: State Of Remote Work 2021)

Video Conferencing Statistics by Challenges of Remote Work

- Remote work comes with its set of challenges, as reported by respondents who have experienced this mode of work.

- The most prevalent concern, expressed by 27% of respondents, is the difficulty unplugging from work, blurring the boundaries between professional and personal life.

- Collaboration and communication hurdles were significant issues for 16% of those surveyed, as remote work can sometimes lead to isolation.

- Similarly, 16% reported loneliness, highlighting the social aspects that traditional office environments provide.

- Distractions at home posed challenges for 15% of respondents, impacting their productivity. Staying motivated in a less structured setting was a concern for 12% of individuals.

- Additionally, 7% of respondents faced the issue of being in different time zones than their teammates, which can create coordination challenges.

- A further 7% cited other challenges unique to their remote work experiences.

- These findings underscore the importance of addressing these issues to make remote work more productive and fulfilling for employees.

(Buffer: State Of Remote Work 2021)

- In the global landscape of the videoconferencing software market share in 2022, Zoom emerged as the dominant player, commanding a substantial 55.44% share.

- Microsoft Teams followed as a strong contender with a market share of 20.93%, showcasing its significant presence in the collaborative software arena.

- GoToMeeting held an impressive 12.8% market share, solidifying its position as a reliable choice for virtual meetings.

- Meanwhile, WebEx secured a noteworthy 9.43% share, catering to the needs of various organizations. RingCentral and Google Meet made valuable contributions, with market shares of 5.67% and 5.32%, respectively.

- FaceTime, Skype, Facebook Messenger, and Bluejeans held smaller shares at 3.14%, 2.25%, 0.82%, and 0.62%, respectively, emphasizing the diversity of options available to users for their video conferencing needs.

(Source: Statista)

Recent Developments

Acquisitions and Mergers:

- Zoom acquires Kites GmbH: In mid-2023, Zoom acquired Kites GmbH, a startup specializing in real-time machine translation, for $250 million. This acquisition aims to enhance Zoom’s AI capabilities, making video conferencing more accessible through real-time language translation.

- Cisco acquires Socio Labs: Cisco completed its acquisition of Socio Labs, an event technology platform, for $180 million in late 2023. This merger is expected to expand Cisco’s Webex platform by integrating advanced event management features.

New Product Launches:

- Microsoft Teams Premium: Microsoft launched Teams Premium in early 2024, offering enhanced features such as advanced meeting analytics, AI-driven meeting summaries, and additional security options, aimed at enterprise customers.

- Google Meet Companion Mode: In mid-2023, Google introduced Companion Mode for Google Meet, a new feature that allows in-room participants to access interactive features like polls, Q&A, and chat on their devices, enhancing hybrid meeting experiences.

Funding:

- BlueJeans by Verizon secures $150 million: BlueJeans, a video conferencing platform acquired by Verizon, secured $150 million in funding in 2023 to expand its service offerings and improve its technology, particularly for enterprise customers.

- Hopin raises $200 million: Hopin, a virtual event and video conferencing platform, raised $200 million in early 2024 to develop new features, scale its infrastructure, and expand its global reach.

Technological Advancements:

- AI and Machine Learning Integration: AI and machine learning are being integrated into video conferencing platforms to provide features like background noise cancellation, real-time transcription, and intelligent framing, enhancing the overall user experience.

- Enhanced Security Features: Advances in encryption and security protocols are being implemented to ensure safer and more secure video conferencing, addressing concerns about data privacy and unauthorized access.

Market Dynamics:

- Growth in Video Conferencing Market: The global video conferencing market is projected to grow at a CAGR of 11.4% from 2023 to 2028, driven by the rise of remote work, virtual events, and the need for effective communication tools in hybrid work environments.

- Increased Adoption in Education and Healthcare: Video conferencing is seeing increased adoption in education and healthcare sectors for remote learning and telehealth services, providing flexible and accessible solutions for students and patients.

Regulatory and Strategic Developments:

- EU’s Digital Strategy: The European Union’s digital strategy includes initiatives to support the growth of digital communication tools, including video conferencing, with a focus on enhancing connectivity and digital skills across member states.

- US Data Privacy Regulations: In early 2024, the US introduced new data privacy regulations that impact video conferencing platforms, requiring them to implement stricter data protection measures and ensure compliance with privacy standards.

Research and Development:

- Virtual Reality (VR) Integration: R&D efforts are focusing on integrating VR into video conferencing to create more immersive meeting experiences, allowing participants to interact in virtual environments.

- Improved User Experience: Researchers are working on developing new features to enhance the user experience, such as advanced collaboration tools, real-time language translation, and more intuitive interfaces.

Conclusion

Video Conferencing Statistics – In conclusion, video conferencing has evolved remarkably, propelled by global events and technological advancements.

The statistics and trends discussed underscore its pivotal role in modern communication and collaboration.

The pandemic accelerated its adoption, making remote work, education, and telemedicine integral to daily life.

The market has grown exponentially, with established and emerging players vying for innovation. However, this surge also brought forth concerns about data privacy and security.

Looking ahead, the future promises even more significant innovations, from AI-driven features to virtual and augmented reality integration.

The challenge remains in striking a balance between convenience and security to ensure video conferencing continues to be a transformative force in our interconnected world.

FAQs

Video conferencing is a technology that enables real-time, face-to-face communication between individuals or groups over the Internet. It’s important because it facilitates remote collaboration, saving time and resources while promoting connectivity.

The pandemic acted as a catalyst, driving a surge in video conferencing adoption by businesses, and schools. And individuals turned to it for remote work, learning, and socializing.

Zoom, Microsoft Teams, Cisco Webex, Google Meet, and Slack are among the most popular video conferencing platforms.

Remote work, virtual education, and telemedicine are key growth trends. The adoption of hybrid work models and the integration of video conferencing into various industries are also notable.

Users often prefer specific devices, have preferences for meeting duration and frequency, and encounter challenges like technical issues and meeting etiquette concerns.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)