Table of Contents

Market Overview

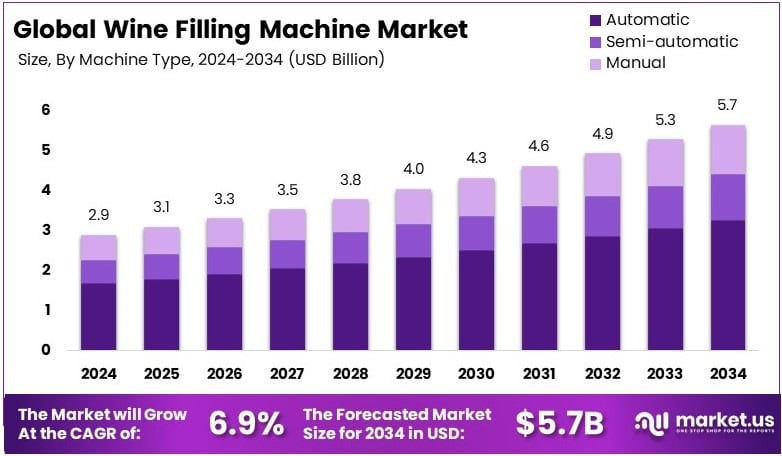

The Global Wine Filling Machine Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 6.9% during the forecast period.

The Wine Filling Machine Market is growing steadily in the global beverage industry. Rising wine consumption is driving the demand for automation. Wineries are adopting machines to increase speed and reduce labor. Modern machines fill 250 bottles per hour, boosting efficiency.

The market benefits from rising demand for premium and craft wines. Small wineries prefer compact and semi-automatic systems. These machines help meet demand and maintain wine quality. Automation ensures product consistency and reduces waste.

There is strong market opportunity due to wine production growth. Emerging economies are investing in wine technology. Governments support this shift through subsidies and schemes. Countries like Italy, France, and India encourage food tech adoption.

Government policies promote modern bottling solutions. Import duties are relaxed for high-grade machines. Regulatory bodies demand hygiene and packaging standards. This drives sales of advanced filling machines.

Companies now focus on smart, eco-friendly machines. Stainless-steel systems meet safety and compliance norms. Manufacturers upgrade to comply with food safety laws. This trend opens doors for new innovations.

The wine industry continues to evolve with automation. Fast filling, low waste, and clean packaging are key trends. The market is set for stable long-term growth.

Key Takeaways

- The Wine Filling Machine Market was valued at USD 2.9 Billion in 2024 and is projected to reach USD 5.7 Billion by 2034 at a CAGR of 6.9%.

- Automatic Wine Filling Machines held the largest market share in 2024 with 58.3%, driven by efficiency and low labor use.

- Gravity Filling Technology led the market in 2024 with 40.1%, favored for its precision and affordability.

- Glass Bottles accounted for the dominant share in 2024 at 56.7%, showing strong demand for classic packaging.

- Direct Sales represented the top distribution channel in 2024 with 52.3%, highlighting direct engagement with wineries.

- Europe emerged as the leading region in 2024 with a 38.4% share, valued at USD 1.11 Billion, due to robust demand and advanced facilities.

Growth Drivers

- Increasing wine consumption across various demographics is creating higher demand for efficient bottling solutions.

- Automation in filling processes is reducing manual labor and operational costs.

- Focus on packaging hygiene and product consistency is encouraging the adoption of high-tech wine filling machines.

- Global expansion of the wine industry, including the rise in boutique wineries and private labels, is fueling market growth.

Challenges

- High initial cost of automated machines may limit adoption, especially among small wineries.

- Maintenance and operational expertise required for advanced machinery can be a barrier.

- Availability of substitutes and used machinery may hinder the new machine sales in price-sensitive markets.

Opportunities

- Emerging economies offer large untapped markets for wine filling machine manufacturers.

- Customization and modular design are attracting businesses looking for flexible production solutions.

- Sustainability trends and growing eco-conscious consumer behavior are driving the need for machines that reduce waste and energy consumption.

Segmentation Insights

Machine Type Analysis

Automatic machines lead with 58.3% share. They are fast and low-labor. Best for large wineries. Semi-automatic holds 30.5%. Good for mid-size production. Manual has 11.2%. Suits small, craft wineries.

Filling Technology Analysis

Gravity Filling leads with 40.1%. It’s simple and gentle. Ideal for wine quality. Vacuum suits premium wines. Pressure holds 19.6%, fast for big output. Volumetric has 12.5%, precise and consistent.

Bottle Type Analysis

Glass Bottles dominate at 56.7%. They keep wine fresh and premium. Plastic is light and cheap. Used for quick-sell wines. Cans and tetra packs are rising. Great for casual markets.

Distribution Channel Analysis

Direct Sales top at 52.3%. Trusted by big wineries. Custom and supported deals. Distributors serve small regions. Online has 14.0%. Easy for small winery buys.

Regional Insights

- Europe leads with 38.4% share, driven by strong wine production and advanced automation.

- North America ranks second with 28.7%, led by U.S. wineries adopting smart filling tech.

- Asia Pacific holds 15.3%, with rising wine demand and tech upgrades in China and Japan.

- Latin America has 10.4%, as Argentina and Chile boost exports with efficient machines.

- Middle East & Africa stand at 7.2%, led by South Africa’s growing modern wine industry.

Competitive Landscape

The global wine filling machine market is moderately fragmented with the presence of multiple international and regional manufacturers. Companies are competing on price, technology, customization, and after-sales support. Players are also expanding their geographic footprint and investing in R&D to innovate new solutions for precision filling, hygiene, and sustainability.

Strategic partnerships, acquisitions, and product launches are common tactics used to stay competitive. Manufacturers are also focusing on integrating smart technologies like sensors, automation controls, and real-time monitoring systems to provide value-added services and ensure consistent wine quality.

Technological Trends

Technology is playing a key role in the evolution of wine filling machines. From IoT-enabled machinery to robotic bottling arms, innovation is focused on making machines more efficient, accurate, and responsive. Integration of touchscreen interfaces, real-time diagnostics, and automated cleaning systems are enhancing user experience and reducing downtime.

Sustainability is also influencing machine design. Companies are developing equipment that uses less water, energy, and packaging material, aligning with global sustainability goals and corporate environmental policies.

Future Outlook

The wine filling machine market is expected to witness sustained growth in the coming years. With evolving consumer preferences, increasing wine production, and advancements in bottling technology, the demand for modern filling machines will continue to rise. The market outlook remains positive, especially in regions with expanding wine industries and increased investment in food and beverage automation.

As wineries look to scale operations and improve packaging efficiency, wine filling machines will play a crucial role in supporting product quality, brand image, and operational profitability.

Recent Developments

- In July 2024, ProMach announced the acquisition of Italy-based MBF, a leading manufacturer of bottling and capping systems. This strategic move strengthens ProMach’s presence in Europe and enhances its capabilities in high-quality filling technologies.

- In May 2024, Omnia Technologies completed the acquisition of ACMI, SACMI Beverage, and Labelling, expanding its portfolio in advanced packaging and bottling solutions. The deal boosts Omnia’s global market reach and integrates cutting-edge automation into its production lines.

Conclusion

The global wine filling machine market is on a steady growth path, driven by rising wine consumption, automation demand, and technological innovation. As wineries seek efficiency, consistency, and sustainability, the adoption of advanced filling systems is accelerating. With strong government support and expansion in emerging economies, the market offers significant opportunities for manufacturers. Strategic acquisitions and smart solutions will shape the future, making this a promising segment for long-term growth.