Table of Contents

Introduction

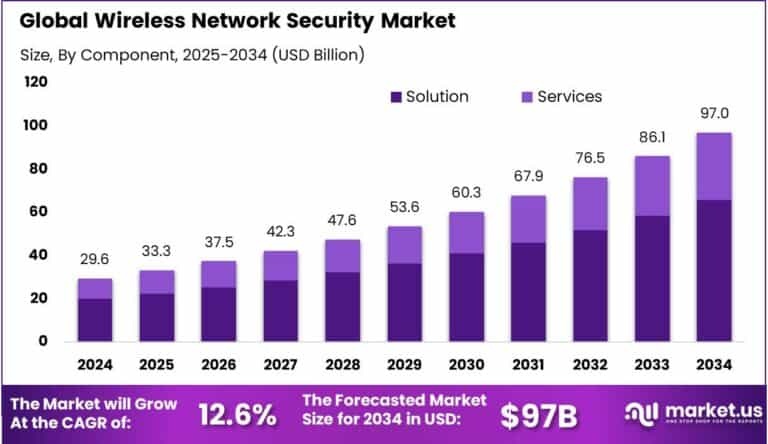

The global wireless network security market is projected to grow from USD 29.6 billion in 2024 to USD 97 billion by 2034, registering a CAGR of 12.6%. In 2024, North America led the market with a 36% share, generating USD 10.6 billion in revenue. The U.S. segment accounted for USD 10.04 billion, growing at a CAGR of 10.4%, driven by increasing reliance on secure wireless communication in enterprises and government sectors. Rising cyber threats and the expansion of IoT and 5G networks are key growth factors propelling demand for robust wireless security solutions globally.

How Tariffs Are Impacting the Economy

Tariffs imposed on wireless network security hardware and related components increase manufacturing and operational costs, resulting in higher prices for end-users and service providers. Elevated tariffs contribute to inflation, reducing disposable income and slowing economic growth. Supply chain disruptions caused by tariff policies force companies to seek alternative sourcing, often at higher costs or with longer lead times, delaying deployment of critical security infrastructure.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/wireless-network-security-market/free-sample/

(Use corporate mail ID for quicker response)

Retaliatory tariffs exacerbate trade tensions, leading to market uncertainties that hinder investments in cybersecurity innovations. Collectively, these factors slow down technology adoption, affecting industries dependent on secure wireless communication and digital transformation.

Impact on Global Businesses

Businesses in wireless network security face rising costs due to tariffs on hardware, software licenses, and cloud infrastructure. Supply chain adjustments, including supplier diversification and localization, increase operational complexities and capital expenditure. Telecommunications providers, enterprises, and government agencies experience delays in deploying security solutions, impacting compliance and risk management. Sector-specific impacts include heightened vulnerability to cyberattacks due to delayed updates or infrastructure expansion. Emerging markets, reliant on imported technologies, face increased barriers to adoption. Firms must innovate, optimize costs, and enhance supply chain resilience to sustain competitive advantage amid tariff pressures.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148823

Strategies for Businesses

Companies adopt diversified sourcing strategies to mitigate tariff exposure, investing in local manufacturing and regional partnerships. Embracing cloud-based security solutions reduces hardware dependency and improves scalability. Leveraging predictive analytics aids in anticipating tariff changes and optimizing procurement. Automation enhances operational efficiency, lowering overall costs. Engaging with policymakers to advocate for favorable trade regulations complements business strategies. Continuous R&D investments in advanced wireless security technologies ensure competitive differentiation. Overall, agility, innovation, and collaboration remain vital to navigating tariff-driven challenges and sustaining growth.

Key Takeaways

- Wireless network security market expected to grow at 12.6% CAGR through 2034

- Tariffs raise costs and disrupt supply chains in security hardware and software

- Deployment delays impact risk management and regulatory compliance

- Supply diversification and cloud adoption are key mitigation strategies

- Predictive analytics supports proactive tariff risk management

Analyst Viewpoint

The wireless network security market is on a steady growth path, fueled by increasing cyber threats and expanding wireless infrastructure such as 5G and IoT. Tariff-related cost pressures pose challenges but also drive innovation and localization. Market players are focusing on cloud solutions and strategic partnerships to maintain agility. The future outlook remains positive as investments in secure wireless communication intensify globally, enabling sustained expansion despite trade uncertainties.

Regional Analysis

North America dominates with a 36% share in 2024, led by strong cybersecurity regulations, advanced infrastructure, and significant government and enterprise investments. The U.S. market drives regional growth with widespread 5G deployment and IoT integration. Europe follows with steady growth supported by stringent data protection laws and growing digitalization. Asia-Pacific exhibits rapid expansion potential due to increasing wireless adoption and rising cyber threats. Regional differences reflect varying regulatory environments, technological maturity, and investment priorities.

➤ Discover More Trending Research

Business Opportunities

Growing cyber threats and increasing wireless network deployment create vast opportunities for advanced security solutions, including AI-driven threat detection and zero-trust architectures. Expansion of 5G and IoT ecosystems fuels demand for scalable and flexible security platforms. Emerging markets offer growth potential due to rising digitalization and regulatory focus on cybersecurity. Collaborations between security providers and telecom operators enable innovative, integrated solutions. Additionally, demand for managed security services and cloud-based offerings opens new revenue streams.

Key Segmentation

Component

- Hardware

- Software

- Services

Deployment Mode

- Cloud-based

- On-premises

Security Type

- Network Access Control

- Endpoint Security

- Intrusion Detection and Prevention

- Encryption

End User

- Enterprises

- Telecom Service Providers

- Government

- BFSI (Banking, Financial Services & Insurance)

Key Player Analysis

Leading companies focus on delivering comprehensive wireless security solutions integrating AI, machine learning, and automation for enhanced threat detection. Investments in cloud platforms enhance scalability and flexibility. Strategic partnerships with telecom operators and technology firms expand market reach. Emphasis on compliance, user experience, and real-time monitoring strengthens competitive positioning. Market leaders prioritize R&D to stay ahead of evolving cyber threats and offer customized solutions catering to diverse industry needs.

Top Key Players in the Market

- ADT Inc.

- Amazon Web Services, Inc.

- Broadcom, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Dell Technologies, Inc.

- Fortinet, Inc.

- Hewlett-Packard Enterprise Development LP (Aruba Networks)

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Juniper Networks, Inc.

- Motorola Solutions, Inc.

- Palo Alto Networks, Inc.

- Sophos Ltd

- Pwnie Express

- SonicWall Inc.

- Other Key Players

Recent Developments

In 2025, major providers launched AI-enabled wireless intrusion detection systems and cloud-native security platforms. Increased collaborations with telecom companies accelerated 5G network security adoption. Regulatory advancements prompted enhanced compliance-focused solutions.

Conclusion

The wireless network security market is set for robust growth driven by rising cyber threats and wireless infrastructure expansion. Despite tariff challenges, innovation and strategic agility support continued market momentum. Investments in cloud and AI technologies will fuel future opportunities globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)