Table of Contents

Wireless Telecom Infrastructure Market Growth Projections

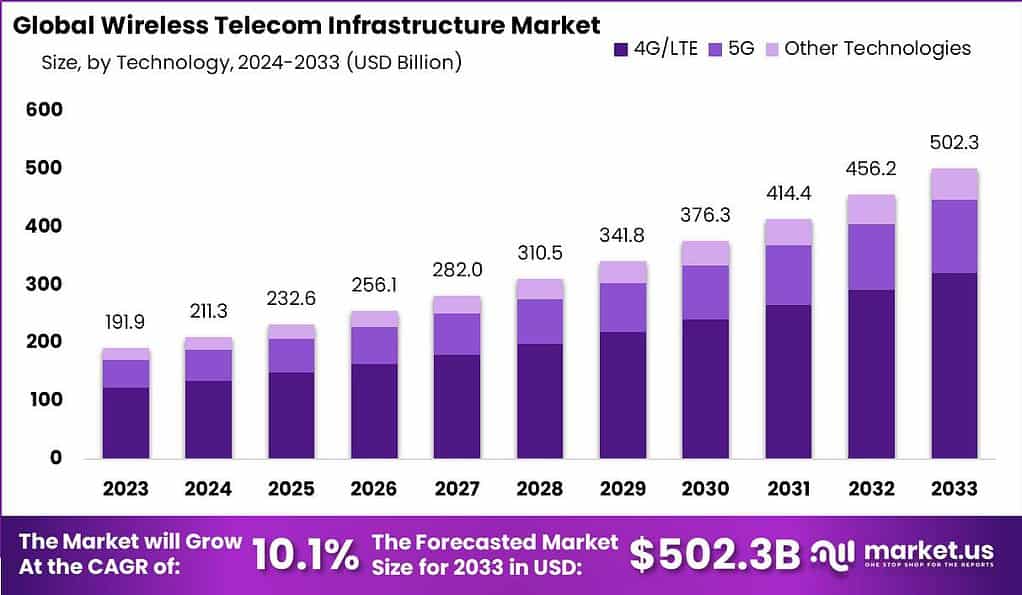

As per Market.us’s report, the Global Wireless Telecom Infrastructure Market is projected to grow significantly in the coming years. The market size, valued at USD 191.9 billion in 2023, is anticipated to reach approximately USD 502.3 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 10.1% during the forecast period of 2024 to 2033.

In 2023, the Asia-Pacific (APAC) region emerged as the market leader, contributing over 35% of the global market share, with a revenue of USD 67.1 billion. This dominance is attributed to the region’s rapid technological advancements, increasing investments in 5G networks, and growing adoption of mobile services.

Wireless telecom infrastructure is a critical framework that consists of various physical and technological components enabling wireless communication and data transfer services. This infrastructure includes towers, antennas, base stations, and data centers that facilitate mobile connectivity without physical cables. These components are essential for the seamless operation of mobile networks, supporting both voice and data transmissions across different geographical areas.

The wireless telecom infrastructure market is a rapidly growing sector driven by increasing demands for more robust and faster data services. This market is crucial for the deployment of next-generation wireless networks, including 5G, which require extensive and sophisticated infrastructure to support high-speed data transmission and connectivity. Key market players are investing heavily in this area to enhance their network capabilities and meet the burgeoning consumer and business demands for improved wireless services.

According to Wireless Infrastructure Association (WIA), the U.S. wireless and mobile industry invested a massive $11.9 billion in 2022 to expand network capacity and coverage. This focused effort highlights the growing demand for seamless connectivity and the industry’s commitment to improving infrastructure. Notably, this figure excludes spending on spectrum purchases or routine maintenance, emphasizing that this was purely about growth and enhancement. On top of that, the total operating expenses for wireless and mobile networks in the U.S. reached over $46 billion last year. This substantial spending reflects the ongoing costs of running, maintaining, and optimizing the networks that millions of Americans rely on daily.

The primary drivers for the expansion of the wireless telecom infrastructure market include the growing penetration of mobile devices and the escalating demand for data-heavy applications such as streaming services, cloud computing, and the Internet of Things (IoT). These applications require substantial and reliable network infrastructure to function efficiently, pushing telecommunication companies to expand and upgrade their existing networks. Additionally, the global shift towards digitalization in businesses and education further accelerates the demand for enhanced telecom infrastructure.

There is a significant demand in the market for advanced wireless infrastructure due to the increasing reliance on mobile and cloud-based applications. This demand is driving investments in technologies that support higher data speeds and reduced latency, ensuring smooth and efficient connectivity for cloud services and real-time applications. The commercial sector, in particular, is a major consumer of advanced wireless infrastructure, utilizing it to improve operational efficiency and digital capabilities.

The wireless telecom infrastructure market presents numerous opportunities, particularly in the development and deployment of edge computing and 5G technologies. Edge computing addresses the need for reduced latency and faster processing close to data sources, while 5G technology is essential for next-generation consumer and business applications, offering significantly higher speeds and capacity. These technologies are not only enhancing the way businesses operate but are also revolutionizing consumer connectivity.

Recent advancements in wireless telecom infrastructure focus on integrating AI and machine learning to optimize network management and performance. These technologies help predict network traffic patterns and allocate resources efficiently, ensuring optimal bandwidth usage and service quality. Innovations in small cell technology and the deployment of fiber networks are also pivotal in meeting the demands for faster and more reliable wireless services, particularly in dense urban areas where traditional large cell towers are not feasible.

Key Takeaways

- The Wireless Telecom Infrastructure Market is poised for impressive growth, with its value projected to reach USD 502.3 billion by 2033, driven by a CAGR of 10.1% during the forecast period. This expansion highlights the increasing reliance on wireless communication technologies across industries, further fueled by advancements like 5G networks and rising global connectivity demands.

- In 2023, base stations emerged as the cornerstone of wireless infrastructure, capturing over 40% market share. These systems are vital for enabling wireless communication, acting as the backbone for data transmission. The demand for base stations has surged, primarily due to the roll-out of 5G technology and the exponential rise in wireless service users.

- The 4G/LTE segment accounted for more than 64% of the market share in 2023, reflecting its established position as the most widely adopted network technology. Its popularity stems from its ability to deliver high-speed data, improved network capacity, and wide geographic coverage. While 5G adoption is gaining momentum, 4G/LTE continues to play a pivotal role, especially in developing markets where it bridges connectivity gaps.

- Telecom operators maintained their stronghold in the market, commanding over 65% market share in 2023. This dominance is attributed to their large subscriber bases and consistent investments in network infrastructure upgrades. Operators are at the forefront of 5G deployments, striving to enhance service quality and meet the growing demand for faster, more reliable wireless communication.

- The Asia-Pacific region led the wireless telecom infrastructure market in 2023, accounting for over 35% of the market share. This leadership can be linked to the region’s rapid technological adoption, robust economic growth, and significant 5G roll-outs in countries like China, Japan, and South Korea. As mobile penetration continues to rise, Asia-Pacific is expected to remain a key growth driver for the industry.

Wireless Telecom Infrastructure Statistics

- 142,100 cellular towers are currently in operation, forming the backbone of communication networks.

- The deployment of 209,500 macrocell sites is driving better network coverage and connectivity, excluding smaller cell deployments.

- 678,700 macrocell sectors have been set up, further enhancing the capacity of macrocells to handle growing data traffic.

- Outdoor connectivity is also improving with 452,200 small cell nodes actively operating across various regions.

- Indoor networks are thriving too, with 747,400 small cell nodes in use. These include private CBRS networks, distributed antenna systems (DAS), small cells, millimeter wave (mmWave), and other licensed frequency bands.

- The number of telecom towers in India increased from 0.74 million in December 2022 to 0.78 million in January 2024, reflecting a steady expansion in infrastructure.

- Similarly, the deployment of BTSs saw a surge, growing from 2.42 million in December 2022 to 2.88 million in January 2024, marking a 19% increase in just over a year.

- One of the most notable developments in 2023 was the significant ramp-up in the deployment of 5G BTSs. The number of 5G BTSs went from 53,590 in January 2023 to 397,923 in November 2023, demonstrating a clear shift towards next-generation network infrastructure.

- As of May 2024, India’s tele-density stands at 85.87%, indicating the broad reach of telecommunication services across the country.

- India’s total telephone subscriber base reached 1,203.69 million in May 2024, underscoring the massive scale of the country’s telecom industry.

- The wireless subscriber base of major telecom operators is as follows:

- Jio: 474.61 million

- Bharti Airtel: 387.76 million

- Vodafone Idea: 218.15 million

- BSNL: 86.32 million

- India’s wired broadband subscriber base stood at 41.31 million in May 2024, with a total of 40.06 million subscriptions recorded in FY24. Despite the dominance of wireless broadband, wired subscriptions have maintained a steady presence.

- Wireless broadband remains the largest segment, with a total of 884.01 million wireless broadband subscribers in FY24. Jio continues to dominate this sector with 469.73 million subscribers, followed by Bharti Airtel with 265.50 million.

- By December 2024, the total number of internet subscribers in India reached 936.16 million, with 38.57 million wired and 897.59 million wireless internet users. This reflects the country’s accelerating internet adoption.

- India’s data consumption has been on the rise, with 50,00,047 GB consumed as of December 2023. Wireless data usage alone grew by 4.01%, from 47,629 PB in September 2023 to 49,543 PB in December 2023.

- The breakdown of data usage by technology for the quarter April to December 2023 is as follows:

- 2G: 45 PB (0.09% of total data usage)

- 3G: 324 PB (0.65%)

- 4G: 42,935 PB (86.66%)

- 5G: 6,239 PB (12.59%)

- The Indian telecom sector generated a gross revenue of Rs. 2.4 lakh crore (US$ 29.00 billion) in FY24. In Q3 FY24, the sector’s revenue stood at Rs. 84,500 crore (US$ 10.12 billion), highlighting its financial strength.

- FDI in the telecom sector has seen significant inflows, amounting to US$ 39.32 billion between April 2000 and March 2024. This is largely attributed to a favorable policy environment, including an increase in the FDI cap to 100% in 2021.

- To support 5G readiness, there is a push for the fiberisation of telecom towers. Currently, 36% of towers are fiberized, and the government plans to deploy an additional 12 lakh towers to enhance the country’s telecom infrastructure.

- The Competition Commission of India (CCI) recently approved the acquisition of 100% of ATC Telecom Infrastructure Private Limited by Data Infrastructure Trust, a move that is expected to strengthen the telecom tower infrastructure in the country.

APAC Wireless Telecom Infrastructure Market Size

In 2023, the APAC region held a dominant position in the Wireless Telecom Infrastructure Market, capturing over 35% of the global market share, which translates to approximately USD 67.1 billion in revenue. This significant market share is primarily due to the rapid expansion of mobile connectivity and the increasing penetration of smartphones across densely populated countries such as China and India. These nations have been instrumental in driving demand for wireless telecom infrastructure through large-scale rollouts of 4G and 5G networks.

Moreover, the push towards digitalization in APAC countries has further fueled the need for robust telecom infrastructure. Governments in the region are actively supporting this growth through favorable policies and substantial investments in technology upgrades. For example, initiatives like India’s Digital India program aim to enhance the digital infrastructure, thereby directly boosting the telecom sector. Additionally, the region’s growing tech-savvy population is increasingly dependent on mobile technology for everyday activities, from e-commerce to digital banking, necessitating strong and reliable wireless network coverage.

The United Arab Emirates (UAE) holds a significant position in the wireless infrastructure market, ranking as the 28th largest globally. With an estimated revenue of $11,782.4 million in 2023, the market is on track for strong growth in the coming years. The projected compound annual growth rate (CAGR) of 8.7% from 2023 to 2027 suggests that the UAE’s wireless infrastructure market size will reach around $16,373.5 million by 2027.

The competitive landscape in APAC is also quite vigorous, with major players like Huawei, ZTE, and Samsung leading the way in not only supplying necessary equipment but also in developing next-generation wireless technologies. These companies are heavily involved in research and development activities aimed at innovating cheaper and more efficient solutions, which has propelled the region to the forefront of the global market.

Emerging Trends

- Standalone 5G Networks: Transitioning from non-standalone to standalone configurations, 5G networks will unleash their full capabilities, including ultra-low latency and network slicing, crucial for advanced applications. This shift facilitates direct communication over 5G infrastructures without relying on 4G systems as an anchor.

- AI and Machine Learning Integration: Artificial intelligence (AI) and machine learning (ML) are becoming pivotal in optimizing network operations and enhancing customer experiences. These technologies are being applied for predictive maintenance, traffic management, and personalizing user interactions, ultimately improving efficiency and service quality.

- Quantum Computing in Telecom: With its superior processing capabilities, quantum computing is set to transform data security and network performance. This advancement promises more robust encryption and faster resolution of complex computational problems.

- Enhanced Private Networks: Increasingly, large enterprises are deploying private cellular networks. These networks support secure and reliable communication, essential for internal operations and handling sensitive information. The trend towards private networks is complemented by technologies like the Citizen’s Broadband Radio Service (CBRS), which simplifies spectrum access for enterprise use.

- Expansion of IoT and Edge Computing: The growth of the Internet of Things (IoT) and edge computing technologies continues to drive telecom innovation. These technologies reduce latency and allow for real-time data processing closer to the source of data collection, enabling more immediate and context-aware responses.

Top Use Cases

- Smart Cities: Leveraging 5G and IoT, smart cities integrate various sensors and connected devices to manage urban services such as traffic, public safety, and environmental monitoring. This use case demonstrates the potential of wireless infrastructure to enhance the efficiency and livability of urban environments.

- Remote Work Solutions: As remote work becomes more prevalent, the demand for reliable and secure telecommunications has surged. Wireless tech like 5G supports high-speed internet and collaboration tools, facilitating effective remote working environments.

- Healthcare Enhancements: Wireless technology is revolutionizing healthcare by enabling remote monitoring and telemedicine, which require real-time, reliable communication infrastructures. This application is crucial for extending healthcare access and improving patient outcomes.

- Autonomous Vehicles and Transportation: The deployment of 5G networks is critical for the development and operation of autonomous vehicles. These networks provide the necessary connectivity and data exchange rates to support vehicle-to-vehicle and vehicle-to-infrastructure communication, enhancing road safety and efficiency.

- Augmented and Virtual Reality (AR/VR): With the high bandwidth and low latency provided by 5G, AR and VR technologies can deliver more immersive and seamless experiences. These applications are increasingly used in gaming, training simulations, and remote collaboration.

Major Challenges

- Regulatory Compliance: Navigating the complex and ever-evolving regulatory landscape poses significant challenges for telecom companies. This includes managing spectrum allocation, complying with data privacy laws, and adapting to new regulations which can be costly and time-consuming.

- Network Security and Privacy: As digital threats increase, telecom companies must prioritize robust security measures to protect sensitive data and maintain customer trust. This involves regular security audits and updates to defense mechanisms against cyber threats.

- Integration and Scalability of Technologies: The shift from traditional to more agile, cloud-based infrastructures like microservices presents integration challenges. Companies need to ensure seamless interaction between different services and scalability as demand grows.

- Economic Viability of 5G: The high costs associated with 5G deployment and the economic justification for widespread coverage, especially in less urban areas, remain a concern. There’s also the challenge of achieving a return on investment amidst economic pressures and technological shifts.

- Technological Evolution and Competition: Keeping up with rapid technological advances and intense market competition is critical. Telecom companies must continuously innovate while managing the cost of deploying new technologies and services that meet evolving customer expectations.

Attractive Opportunities

- 5G Deployment: Despite its challenges, 5G technology offers significant business opportunities, including new service offerings like augmented and virtual reality applications, improved industrial automation, and enhanced healthcare services through remote patient monitoring.

- Private and Virtualized Networks: The expansion of private networks and services, such as Network-as-a-Service (NaaS) and multi-cloud connectivity, provide telecom operators with new revenue streams. These services cater to enterprises needing reliable, secure, and flexible networking solutions.

- Internet of Things (IoT): The proliferation of IoT devices offers telecoms the chance to manage vast networks of connected devices, providing services from smart home automation to large-scale industrial IoT applications, thereby driving considerable data traffic and associated revenues.

- Artificial Intelligence and Automation: Leveraging AI and machine learning can improve service delivery, customer service, and network management, reducing operational costs and enhancing customer experiences. Automation in customer interactions and network management is also becoming a significant focus.

- Sustainability Initiatives: As sustainability becomes a more pressing global issue, telecom companies have the opportunity to lead in green initiatives. This includes reducing energy consumption, optimizing network installations to minimize environmental impact, and promoting recycling and responsible disposal of electronic waste.

Recent Developments

- In July 2024, Belden Inc. took a significant step toward expanding its offerings by acquiring Precision Optical Technologies, Inc. This move will allow Belden to enhance its solutions in the Enterprise Solutions segment and broadband markets, tapping into growing demand for high-performance connectivity. With Precision Optical Technologies’ expertise, Belden is well-positioned to address evolving market needs and strengthen its competitive edge.

- In the same month, LS Cable & System (LS C&S) made a notable announcement regarding its contract to supply submarine cables for a project in the Western United States. The deal, valued at approximately KRW 1 billion, will see LS C&S providing cables for installation in Northern California’s Sacramento River. This contract is a strategic win for LS C&S, significantly boosting its presence in the U.S. market and reinforcing its role as a key player in the growing submarine cable industry.

- Meanwhile, in January 2023, Amazon made a major move into India’s logistics sector with the launch of its Amazon Air service. The cargo fleet, starting with two aircraft, has the capacity to handle 20,000 packages daily. Amazon Air will serve major cities like Bengaluru, Hyderabad, Delhi, and Mumbai, streamlining the company’s delivery operations and reducing shipping times across India. This strategic expansion in India reflects Amazon’s continued investment in improving its supply chain infrastructure to support its massive e-commerce platform.

Conclusion

The wireless telecom infrastructure market is poised for robust growth, driven by the escalating demand for advanced wireless services and the widespread adoption of mobile and cloud-based technologies. With significant investments flowing into the development of 5G and edge computing, the market is set to transform how businesses operate and consumers interact with digital services.

These technological advancements not only promise to enhance connectivity and reduce latency but also open new avenues for innovation across various sectors. As the digital landscape continues to evolve, the strategic expansion and modernization of wireless telecom infrastructure will be crucial in meeting the future demands of a hyper-connected world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)