Table of Contents

Introduction

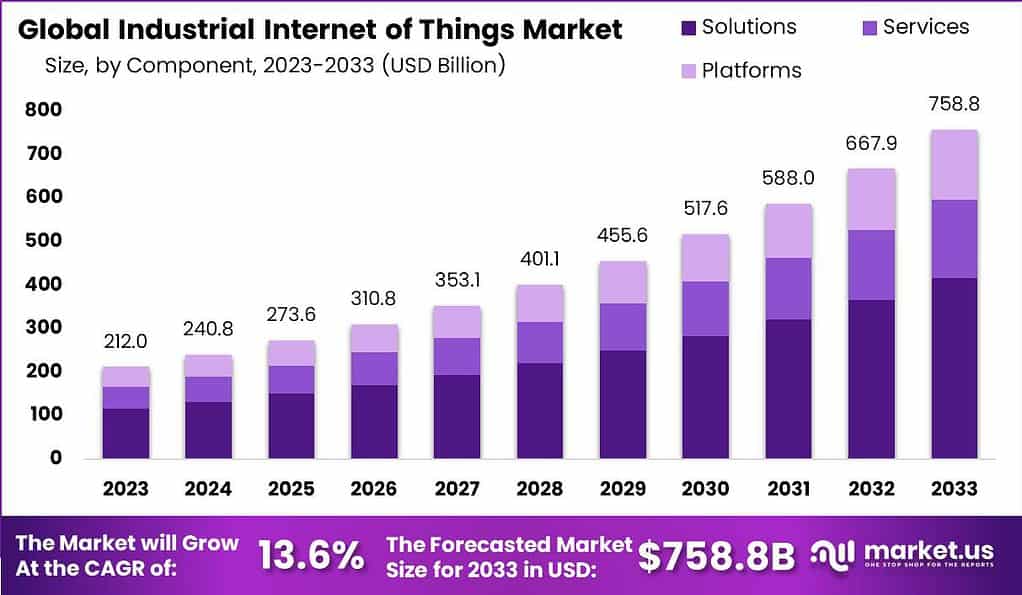

The Industrial IoT market is expected to transform in the coming years. The market is projected to grow from USD 212.0 billion in 2023 to an estimated USD 758.8 billion by 2033, with a compound annual growth rate (CAGR) of 13.6% during the forecast period. This growth is due to the integration of advanced technologies across various industries, which aims to optimize operational efficiency, data-driven decision-making, and innovation.

The expansion of the IIoT market is driven by the adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics across various industries. These technologies facilitate real-time data access and analysis, enhancing operational efficiency and productivity. For example, there is a significant drive towards automation and digital transformation in the manufacturing sector, promoting the uptake of IIoT solutions in regions like Europe and Asia Pacific. Furthermore, the proliferation of affordable sensors and processors is making IIoT technologies more accessible, contributing to market growth.

Despite the promising outlook, the IIoT market faces several challenges, including concerns related to cybersecurity threats and the protection of data privacy. As industrial systems become increasingly interconnected, the potential for cyber-attacks and data breaches increases, posing significant risks to operational security. Additionally, issues surrounding the interoperability and connectivity of different devices within the IIoT ecosystem remain a barrier to seamless integration.

Recent developments in the IIoT sector are characterized by a flurry of mergers and acquisitions, highlighting the strategic realignments and investments companies are making to harness the transformative power of IIoT technologies. For instance, Cisco acquired Splunk for $28 billion in September 2023 to strengthen their data analytics and cybersecurity capabilities essential for IIoT ecosystems. Chevron Corp’s acquisition of Hess Corp for $53 billion in October 2023 is another significant move in the energy sector to enhance operational efficiencies and integrate advanced IIoT technologies.

Furthermore, the acquisition landscape showcases a diversity of sectors engaging in IIoT, from healthcare with Boston Scientific’s acquisition of Axonics for $3.7 billion, to cybersecurity with HPE’s acquisition of Juniper Networks for $14 billion, both in January 2024. These deals reflect the expansive application of IIoT solutions across different industries and indicate a strong market confidence in IIoT’s potential to drive innovation, efficiency, and competitive advantage.

Key Takeaways

- The Industrial IIoT market is projected to reach approximately USD 758.8 billion by 2033, up from USD 212.0 billion in 2023, showing a robust CAGR of 13.6% during the forecast period from 2024 to 2033.

- In 2023, the Solutions segment held the largest market share in the IIoT market, accounting for over 54.8%.

- The Services and Platforms segments also play critical roles in the IIoT ecosystem, contributing to the market’s growth and functionality.

- Manufacturing emerges as the leading end-use industry for IIoT, capturing more than a 20.4% market share in 2023.

- The Energy & Power sector follows closely, leveraging IIoT for advanced monitoring and management of energy distribution networks.

- Transportation & Logistics, Mining, Oil & Gas, Healthcare, and Other End-Use Industries also witness significant adoption of IIoT solutions, driving market expansion.

- Asia-Pacific (APAC) dominates the IIoT market with over 38.9% market share in 2023, driven by its thriving manufacturing sector and rapid industrialization.

- Key players in the IIoT market include ABB Ltd., Siemens AG, IBM Corporation, Intel Corporation, Schneider Electric SE, and others, focusing on innovation and collaboration.

Industrial IoT Statistics

- Smart Factory Initiatives: 86% believe these will greatly enhance manufacturing competitiveness within five years.

- Efficiency Gains: 98% of companies expect improvements by using digital tech in manufacturing.

- Digital Factories in Europe: 91% are investing in this area, with a focus on core regions.

- Digitization Opportunities: 90% see more opportunities than risks from digitization.

- Investments in Germany: 93% planning to invest in digital factories consider Germany as a key location for the next five years.

- Investment Focus: 77% of investments will target new or expanded digital factories in Germany and Western Europe within five years.

- ROI Expectation: 50% expect a return from digital operations within five years, anticipating a 12% total efficiency gain over this period.

- Digital Technology Usage: 85% report widespread use in their factories.

- Capacity Increase: 64% plan to boost capacity in their home country.

- Discrete Manufacturing Investment: Predicted to spend $40 billion on IoT platforms, systems, and services.

- IoT in Logistics: 63% of experts see IoT revolutionizing supply chain operations, with 96% in the sector planning to increase IoT spending in the next three years. 82% aim to implement IoT solutions in the next two years, and 70% foresee significant operational changes due to IoT. 51% expect IoT to help in process automation.

- IoT in Healthcare: 73% use IoT for maintenance and monitoring, and 80% believe it promotes innovation.

- IoT in Agriculture: Can increase crop yields by 1.75 times and reduce water usage by up to 8%.

Recent Developments

- Honeywell Acquires SCADAfence: In July 2023, Honeywell acquired SCADAfence, a cybersecurity solutions provider for operational technology (OT) IoT networks, emphasizing digitalization, sustainability, and OT cybersecurity.

- Cisco Launches New Cloud Services: February 2023 saw Cisco launching new cloud services within its IoT Operations Dashboard, enhancing industrial asset visibility and secure management capabilities.

- Intel’s New Processor Launch: Intel Corporation launched its 12th generation Intel Core processors in March 2022, aiming to enhance business performance in the industrial IoT sector.

- Sustainability and IoT: The European Space Agency tested Sateliot’s “Store & Forward” mode, offering 5G NTN NB-IoT connectivity for applications like water management in rural areas. This initiative is part of a broader move towards sustainable IoT solutions.

- Renesas Acquisitions: Renesas Electronics agreed to buy Sequans Communications for $249 million in August 2023, expanding its IoT sector reach. This follows a series of IoT-focused acquisitions by Renesas aimed at enhancing its product offerings in IoT, automotive, and industrial markets.

- Automated Visual Inspection: IoT AI technologies now support businesses with automated visual inspection capabilities, using sensors, cameras, and AI to detect abnormalities on assembly lines, thereby ensuring top quality.

- Energy Optimization and Sustainability: IoT technologies are being used to optimize industrial energy usage and consumption, leading to safer, more efficient operations and a reduced environmental footprint. This approach aligns with the movement towards creating smart cities with lower CO2 emissions.

- Manufacturing and Agricultural Business Technology: IoT technologies in manufacturing and agriculture help optimize operations, make data-driven decisions, and ensure worker safety through wearable devices.

Key Players Analysis

- ABB Ltd. is making significant contributions to the Industrial Internet of Things (IIoT) sector through its ABB Ability™ solutions. These solutions integrate ABB’s extensive industry knowledge with innovative connectivity and software technologies, enabling businesses to make data-driven decisions in real-time. This approach enhances operational safety and intelligence while promoting resource efficiency and a low-carbon future. ABB’s broad range of digital solutions aims to automate, optimize, and future-proof industries, driving them towards greater performance and sustainable development.

- Siemens AG plays a pivotal role in the Industrial Internet of Things (IIoT) by offering solutions that capture real-time data from connected products, plants, machines, and systems. Their technology facilitates operational efficiency, enhances product quality, and enables new business models through an integrated Edge, IIoT, and lifecycle analytics solution. Siemens helps organizations tackle challenges like sustainability pressures and supply chain disruptions by transforming outdated equipment into intelligent systems with better performance monitoring. This approach significantly reduces unplanned downtime and boosts productivity.

- IBM Corporation is actively engaging in the Industrial Internet of Things (IIoT) by leveraging its IBM Cloud technologies to harness the data from billions of connected devices worldwide. This integration enables businesses to gain critical insights, improving their operations and fostering the development of innovative business models. Through the IBM Watson IoT Platform, IBM facilitates the management of connected devices, allowing applications to access both live and historical data. This is essential for creating analytics-driven applications aimed at enhancing operational efficiency.

- Intel Corporation is a major player in the Industrial Internet of Things (IIoT) sector. They focus on helping industries take advantage of connected devices to gather and analyze data. Intel offers effective technology solutions that enable the integration of IoT into industrial operations, with the aim of improving efficiency, productivity, and innovation across various sectors. Their goal is to transform traditional industrial environments into smart, interconnected systems that can adapt and respond to changing operational demands efficiently.

- Schneider Electric SE is also a significant contributor to the Industrial Internet of Things (IIoT) sector. They transform industrial enterprises through smart manufacturing, digital factories, and connected industries. Schneider Electric’s IIoT solutions leverage sensors, secure connectivity, and platforms to enhance productivity, efficiency, sustainability, and cybersecurity across both new and legacy manufacturing facilities. By focusing on these areas, Schneider Electric enables businesses to capture the business value of digital transformation and foster innovation in their operations.

- Rockwell Automation, led by CEO Blake Moret, focuses on enhancing industrial productivity through the Industrial Internet of Things (IIoT). The company helps manufacturers and industrial operators discover practical IoT applications, delivering measurable business benefits by transitioning from pilot IoT projects to scalable deployments. Key drivers for IIoT adoption include reduced computing and connectivity costs and the merging of information and operations technology. Rockwell Automation’s partnership with Cisco exemplifies its commitment to providing secure, efficient connectivity from the plant floor to the enterprise network.

- Honeywell International Inc. is making strides in the Industrial Internet of Things (IIoT) by implementing solutions that significantly improve efficiency, safety, and security within facilities. Their efforts are focused on leveraging IIoT to manage the supply chain more effectively and profitably, as well as enhancing resource utilization. A significant number of decision-makers have recognized the tangible benefits of IIoT investments, indicating a positive impact on industrial operations.

- General Electric Co. has played a pivotal role in shaping the Industrial Internet of Things (IIoT) by focusing on integrating advanced analytics and machine learning to enhance operational efficiency and performance across various industries. Their commitment to digital transformation is evident in their development of IIoT software solutions, which aim to transform industrial data into actionable insights, thereby driving significant productivity and financial outcomes for businesses in sectors like power generation, manufacturing, and aviation.

- NEC Corporation is using Internet of Things (IoT) technologies to create smarter, more progressive communities. With over 120 years of expertise, NEC’s IoT solutions are making environments more energy-efficient, promoting sustainable economic development, improving resource management, and enhancing both individual and collaborative workforces through actionable intelligence. NEC aims to orchestrate a brighter world by transforming opportunities into proven solutions and services, advancing human potential, and delivering social change.

- Cisco Systems, Inc. plays a transformative role in the Industrial Internet of Things (IIoT) by offering end-to-end IoT solutions that securely connect assets, applications, and data in real-time. Their technology supports transformative business changes in various environments, demonstrating Cisco’s commitment to improving business outcomes through IoT. Cisco’s solutions unify networking and security within a single architecture, simplifying the technological landscape and reducing costs and complexities. This approach not only addresses the immediate needs of smart manufacturing but also caters to the broader spectrum of industries navigating the transition to digital operations, reinforcing Cisco’s status as a leader in driving IoT security and innovation.

- Amazon Web Services (AWS) is continuously improving its capabilities in the Industrial Internet of Things (IIoT) sector by introducing new services and features. Recently, AWS has made significant updates, such as supporting cross-account sharing in the Systems Manager Parameter Store, launching a feature for generating AWS CloudFormation templates for existing resources, and including public IPv4 addresses in the AWS Free Tier.

- PTC Inc. is a leading name in the Industrial Internet of Things (IIoT) sector, providing innovative solutions that connect, monitor, analyze, and act on industrial data. PTC’s recent developments highlight their continued leadership and commitment to advancing IIoT technologies. For instance, PTC has collaborated with Rockwell Automation to boost IoT and augmented reality (AR) software adoption among manufacturing companies, showcasing the practical application of IIoT in enhancing operational efficiency and product innovation. This partnership emphasizes PTC’s strategy to expand its digital transformation offerings, making advanced IIoT capabilities more accessible to industries seeking to adopt smart manufacturing practices. Through such initiatives, PTC is not only enhancing its product portfolio but also strengthening its position as a key enabler of industrial digital transformation.

Conclusion

The market for Industrial IoT is on the verge of significant growth, fueled by technological advancements and the increasing demand for operational efficiency across various industries. However, for the IIoT framework to reach its full potential, it is crucial to address cybersecurity concerns and ensure compatibility among diverse systems. By adopting the right strategies and innovations, the IIoT market can overcome these challenges, offering lucrative opportunities for businesses to transform their operations and thrive in the digital era.