Table of Contents

Introduction

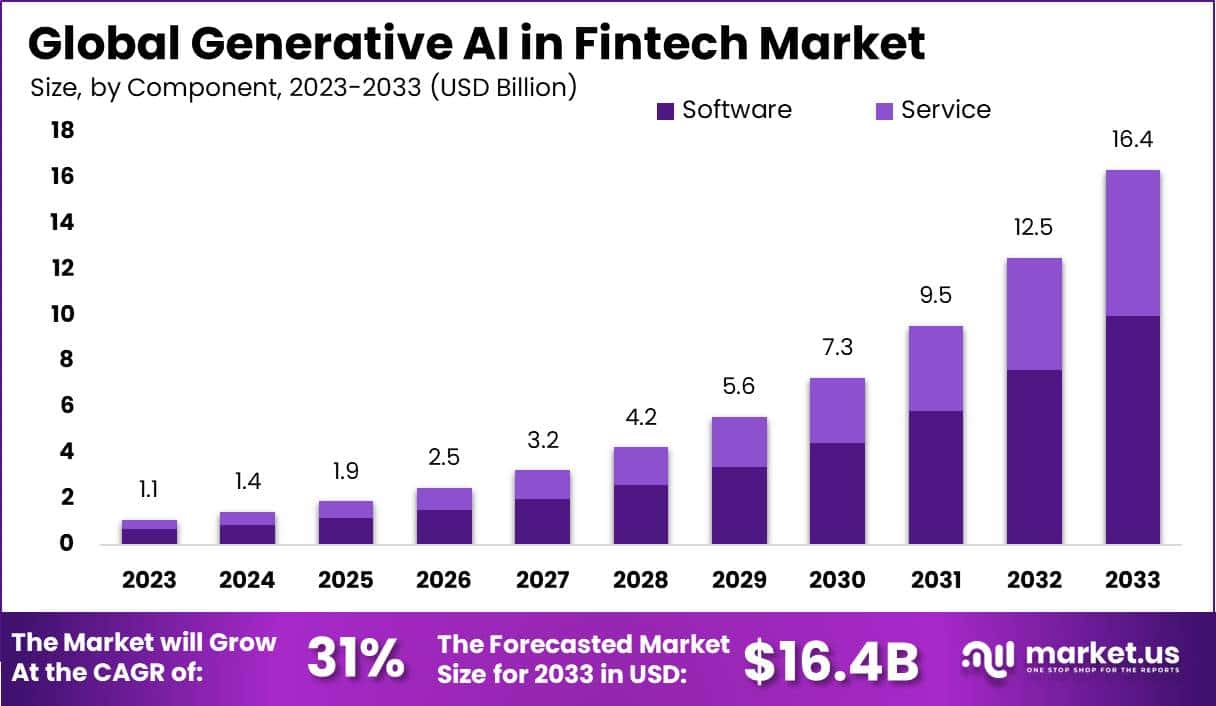

The Generative AI in Fintech Market is poised for significant growth, with projections indicating that it will surpass USD 6,256 million by 2032, marking a substantial increase from USD 865 million in 2023, at a robust CAGR of 22.5%.

Generative AI has emerged as a transformative force in the tech industry, enabling companies to automate intricate processes and realize various benefits such as cost reduction, minimized errors, enhanced customer experiences, and heightened efficiency. One of the primary drivers of generative AI adoption is its role in credit card fraud detection, facilitated by the utilization of Generative Adversarial Networks (GANs) to discern between authentic and fraudulent transactions, thereby alerting banks promptly.

In the financial services sector, particularly within the fintech market, generative AI stands out as a key enabler of growth. It revolutionizes the delivery of financial products and services by leveraging technology to enhance operations and customer experiences. Notably, AI plays a pivotal role in automation, offering round-the-clock customer support through AI-powered chatbots and virtual assistants. This not only boosts operational efficiency but also elevates overall customer satisfaction levels.

Moreover, generative AI algorithms excel in analyzing vast datasets to personalize recommendations and offers for customers, thereby augmenting customer happiness and retention rates. Another critical aspect where AI shines in fintech is risk assessment, enabling financial institutions to gauge risks associated with diverse financial instruments and investments accurately. By harnessing machine learning algorithms, these institutions can make more informed decisions, guided by comprehensive risk assessments.

Key Takeaways

- The Generative AI in Fintech Market is projected to exceed USD 6,256 million by 2032, showing a substantial rise from USD 865 million in 2023, with a notable CAGR of 22.5%.

- In 2022, the software segment within the generative AI in fintech market held a dominant position, capturing more than a 70% share.

- Based on deployment on-premises segment has dominated the generative AI in the fintech market.

- The compliance & fraud detection segment held the largest share, followed by business analytics & reporting in the market in 2022.

- Retail and banking firms use generative AI for models to train know-your-customer (KYC) processes at the time of account opening.

Generative AI in Fintech Statistics

- The Generative AI market in fintech is experiencing rapid growth, with projections indicating a surge from USD 13.5 billion in 2023 to an impressive USD 255.8 billion by 2033. This represents a robust Compound Annual Growth Rate (CAGR) of 34.2% from 2024 to 2033.

- Investment in AI by Financial Services: In 2023 alone, the financial services industry invested an estimated USD 35 billion in AI technologies. Banking took the lead, contributing about USD 21 billion to this investment.

- Adoption Rates: A significant 78% of financial institutions are either currently implementing or planning to integrate generative AI into their operations.

- Impact on Value Chain: About 61% of these institutions expect generative AI to profoundly enhance efficiency and responsiveness across their value chains.

- Consumer Acceptance: Overall, 36% of consumers are open to managing their finances using generative AI. This acceptance jumps to 52% among those under 50, indicating a stronger inclination towards AI within younger demographics.

- Primary Applications in FinTech:

- Security: Approximately 13% of AI applications are focused on improving security measures.

- Market Research and Data Analytics: Nearly 15% are dedicated to enhancing market research and data analytics capabilities.

- Lending Automation: Around 17% of the applications aim at automating lending processes.

- Customer Credit Checks: Another 13% facilitate customer credit assessments.

- Claims Assessment Automation: Close to 20% of generative AI applications are used in automating claims assessments.

Emerging Trends

- Enhanced Personalization in Financial Services: The integration of Generative AI into fintech is increasingly focusing on personalized financial services. These services leverage vast amounts of data to provide tailored financial recommendations and insights, significantly enhancing user experience and engagement.

- Automation of Compliance and Fraud Detection: Generative AI is being widely adopted for automating complex compliance procedures and enhancing fraud detection capabilities. This includes improvements in monitoring transactional data and identifying patterns indicative of fraudulent activities.

- Advancements in Financial Trading: AI technologies are revolutionizing financial trading by optimizing algorithmic trading strategies. This involves analyzing market data to identify trends and make real-time trading decisions, which can lead to improved investment returns.

- Growth in AI-driven Cybersecurity Measures: With increasing digital transactions, there’s a notable rise in the use of Generative AI to strengthen cybersecurity frameworks within the financial sector. This includes reducing data breaches and enhancing the overall security of financial systems.

- Expansion of AI Capabilities Across Business Functions: High-performing financial institutions are increasingly embedding AI across multiple business functions. This includes product development, risk management, and customer service, aiming to generate new business models and increase the value of existing offerings.

Top Use Cases for Generative AI in Fintech

- DNS Security: Improving the security of financial systems against cyber threats by analyzing and recognizing patterns within DNS data.

- Data Augmentation: Enhancing the performance of machine learning models used in fintech by augmenting existing datasets, which improves the accuracy and robustness of financial predictions .

- Conversational AI for Customer Interaction: Banks and financial institutions are utilizing AI-driven chatbots to provide 24/7 customer support and enhance customer interaction, making the services more accessible and efficient.

- Streamlined Credit Scoring and Issuance Processes: Generative AI is being used to refine credit scoring models by analyzing diverse data points, which leads to more accurate assessments of creditworthiness and potentially faster loan processing.

- Regulatory Compliance and Risk Management: AI technologies are playing a crucial role in ensuring compliance with financial regulations and managing various financial risks, by automating the monitoring and analysis of compliance data.

Major Challenges

- Data Security and Privacy: As financial institutions integrate generative AI into their operations, ensuring the security and privacy of sensitive data remains a critical challenge. Mismanagement can lead to data breaches, significantly impacting customer trust and compliance with regulations.

- Accuracy of AI Outputs: The reliability of generative AI in producing accurate and relevant outputs is crucial, especially in high-stakes financial environments where errors can have significant consequences. Current generative AI applications may still require human oversight to ensure the accuracy of their tasks and outputs.

- Integration with Existing Systems: Merging generative AI with existing financial systems poses significant challenges, particularly in terms of compatibility and minimizing disruptions to current operations. This integration often requires substantial investment in both time and resources.

- Regulatory Compliance: Adhering to evolving financial regulations while implementing cutting-edge AI technologies is a complex challenge. Financial institutions must navigate the regulatory landscape to effectively use AI without violating compliance standards.

- Risk of Enhanced Fraud: With the advancement of generative AI, there is an increased risk of sophisticated fraud, such as through the use of AI-generated “deep fakes” that can manipulate data or impersonate individuals. This makes it crucial for financial institutions to enhance their fraud detection systems and educate their customers on the potential risks.

Market Opportunities

- Enhanced Decision Making: Generative AI can significantly improve decision-making processes in fintech by analyzing large datasets quickly and providing insights that can lead to better financial strategies and product offerings.

- Operational Efficiency: By automating routine tasks and processes, generative AI can help financial institutions achieve higher operational efficiency, reducing costs and freeing up human resources for more complex tasks.

- Improved Customer Experience: AI-driven tools can enhance the customer experience by providing personalized financial advice, optimizing user interfaces, and offering faster and more accurate services.

- New Product Development: Generative AI enables financial institutions to innovate and develop new financial products and services by leveraging advanced data analysis capabilities. This can help institutions stay competitive in a rapidly evolving market.

- Expansion into New Markets: With the ability to process and analyze data at scale, generative AI opens opportunities for fintech companies to expand into new geographical markets and customer segments that were previously unreachable.

Recent Developments

- In August 2023, UK-based FinTech company Bud Financial launched the Bud.ai platform, an AI-driven system designed to transform transaction data into customized banking experiences. This platform aids financial institutions in extracting valuable insights about their customers, facilitating personalized services on a large scale. Additionally, Bud introduced Jas, a generative AI chat interface that evolves into an action-oriented bot. Jas provides personalized recommendations and performs tasks, thereby enhancing customer interaction and improving workflow efficiencies.

- Earlier, in May 2023, Trovata, a leader in bank APIs and cash management, unveiled Trovata AI. This innovative tool incorporates OpenAI’s ChatGPT technology to streamline cash management and business intelligence tasks for finance, accounting, and treasury operations. Supported by major banks and managing over $100 billion for mid-market and enterprise clients, Trovata AI merges ChatGPT’s advanced language capabilities with financial analytics. This integration allows for swift financial scenario planning and report generation, with users able to interact with the system in a conversational manner to quickly gain insights and produce reports. These developments reflect the growing trend of leveraging generative AI to enhance the efficiency and personalization of financial services.

- In September 2023, Bank of America collaborated with Palantir to enhance their capabilities in fraud detection through a new system grounded in machine learning technology. This system analyzes vast data sets, learning continuously from evolving trends to identify and flag suspicious activities more effectively. Such advancements in fraud detection are crucial as they help in minimizing the incidence of financial fraud, ensuring greater security for financial transactions. This initiative reflects a growing trend in the financial sector where major institutions are increasingly leveraging AI to improve the accuracy and efficiency of their security measures.

Conclusion

In conclusion, the generative AI in fintech market holds immense potential and is set to revolutionize the financial industry. The integration of generative AI technologies has introduced new possibilities and capabilities in areas such as fraud detection, risk assessment, investment analysis, customer service, and personalized financial advice. By leveraging advanced algorithms and machine learning models, generative AI enables financial institutions to process and analyze vast amounts of data rapidly, leading to more accurate predictions and insights.

This technology can detect anomalies and patterns that traditional methods might miss, thereby enhancing fraud detection and prevention measures. Additionally, generative AI enables sophisticated risk assessment models, allowing financial institutions to make informed decisions and mitigate potential risks. It also empowers investment professionals by providing them with powerful tools for data analysis, portfolio optimization, and automated trading strategies.