Table of Contents

- Introduction

- Editor’s Choice

- Wearable Sensors Market Statistics

- Types of Wearable Sensors Statistics

- Top Wearable Device Companies

- Overall Wearable and Sensors Shipments Worldwide Statistics

- Connected Wearable Devices Worldwide – By Region

- Use of Wearable Sensors and Electronic Devices in Clinical Trials Statistics

- Technological Advancements in Wearable Sensor Technology Statistics

- Regulations for Wearable Sensors Statistics

- Recent Development

- Conclusion

- FAQs

Introduction

Wearable Sensors Statistics: Wearable sensors are pivotal in health and technology. Enabling real-time monitoring of physiological signals and environmental factors through devices like smartwatches and fitness trackers.

These sensors detect heart rate, movement, temperature, and more, utilizing technologies such as optical and electrochemical sensors.

Data collected wirelessly transmits to smartphones or computers, where algorithms process it for insights. Applications range from health monitoring to sports performance optimization and environmental assessment.

Challenges include ensuring accuracy, privacy, user compliance, and regulatory adherence. As technology evolves, wearable sensors promise even greater advancements in personalized healthcare and lifestyle management.

Editor’s Choice

- The global wearable sensors market revenue is projected to reach USD 10.19 billion by 2032.

- In the wearable device market, the top five companies have demonstrated varied growth trajectories. Apple has shown significant performance with a growth of 33.10% in Q4 2022, followed by 24.50% in Q1 2023, 21.10% in Q2 2023, 20.60% in Q3 2023, and a resurgence to 25.30% in Q4 2023.

- In 2022, there was a slight decline for Apple, which shipped 146.3 million units. While Xiaomi’s shipments decreased to 34.7 million units. Samsung shipped 43.1 million units, and other vendors collectively shipped 205.3 million units.

- The global shipments of wearable medical sensors are likely to expand to 160 million units in 2024.

- The use of wearable sensors and tracking devices in clinical trials has seen a significant increase from 2016 to 2021.

- In 2023, the market for wearable medical technology exceeded $100 billion, driven by innovations in sensor technology and the integration of artificial intelligence (AI) for real-time health monitoring and data analysis.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical wearables, and devices must conform to the Medical Devices Rules, 2017. The country is also increasingly aligning with global standards to facilitate the entry of innovative health technologies.

Wearable Sensors Market Statistics

Global Wearable Sensors Market Size Statistics

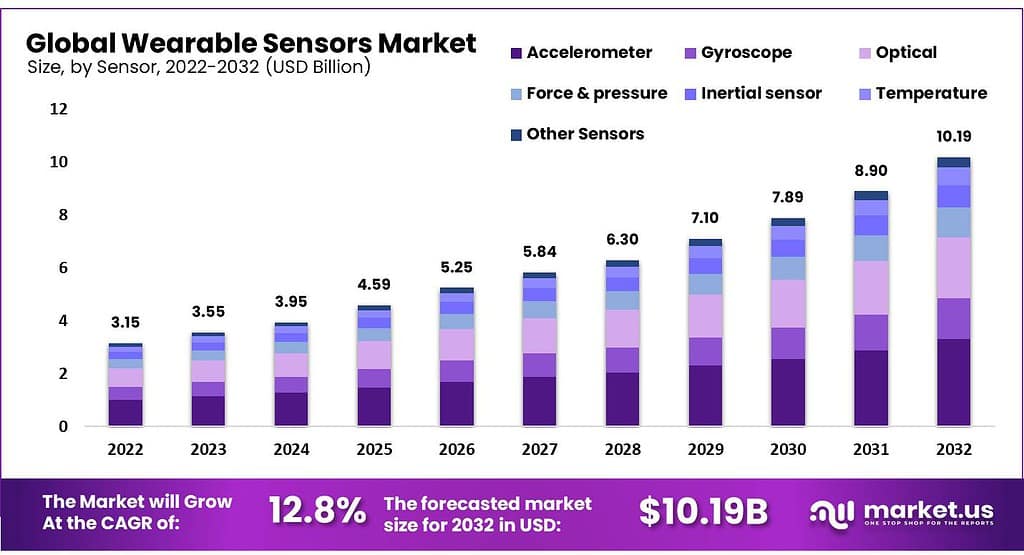

- The global wearable sensors market has experienced substantial growth over the past decade at a CAGR of 12.8%.

- In 2022, the market revenue was valued at USD 3.15 billion, and this upward trend is expected to continue.

- By 2023, the market revenue increased to USD 3.55 billion and further rose to USD 3.95 billion in 2024.

- The following years show a significant rise, with the market projected to reach USD 4.59 billion in 2025 and USD 5.25 billion in 2026.

- This momentum is anticipated to carry forward, with the market expected to achieve USD 5.84 billion in 2027, USD 6.30 billion in 2028, and USD 7.10 billion in 2029.

- The growth trajectory continues into the next decade, with revenues projected at USD 7.89 billion in 2030, USD 8.90 billion in 2031, and an impressive USD 10.19 billion by 2032.

- This consistent increase underscores the expanding adoption and innovation within the wearable sensors market. Driven by advancements in technology and growing consumer demand for health and fitness monitoring devices.

(Source: market.us)

Types of Wearable Sensors Statistics

- Wearable sensors are integral components of modern wearable devices. Offering a range of functionalities essential for health monitoring, fitness tracking, and environmental sensing. Key types of wearable sensors include accelerometers, gyroscopes, magnetometers, heart rate sensors, temperature sensors, and pressure sensors.

- Accelerometers measure motion and orientation changes, utilizing microelectromechanical systems (MEMS) technology to detect movement in three dimensions.

- Gyroscopes complement accelerometers by measuring angular velocity, enhancing the precision of motion tracking in applications like fitness monitoring and navigation.

- Magnetometers detect magnetic fields and, when integrated with accelerometers and gyroscopes. Form inertial measurement units (IMUs) that provide comprehensive motion-tracking data.

- Heart rate sensors typically use photoplethysmography (PPG) technology, which involves light-based measurement to detect blood volume changes in the microvascular bed of tissue, providing accurate heart rate readings.

- Temperature sensors in wearables monitor body or skin temperature, which is crucial for health applications that require continuous temperature tracking.

- Pressure sensors measure force or pressure exerted on the sensor surface and are often used in applications like gait analysis and posture monitoring.

- These sensors, combined with advancements in low-power electronics and wireless communication technologies. Have enabled the development of sophisticated wearable devices that offer real-time health monitoring and data collection.

- The integration of these smart sensors with the Internet of Things (IoT) further enhances their capabilities. Allowing for seamless data transmission and remote health management.

(Source: electronics360, MDPI)

Top Wearable Device Companies

- In the wearable device market, the top five companies have demonstrated varied growth trajectories.

- Apple has shown significant performance with a growth of 33.10% in Q4 2022, followed by 24.50% in Q1 2023, 21.10% in Q2 2023, 20.60% in Q3 2023, and a resurgence to 25.30% in Q4 2023.

- Imagine Marketing’s growth rates were more modest but steady, starting at 4.30% in Q4 2022 and increasing through 2023, peaking at 9.80% in Q3 before a slight drop to 3.90% in Q4.

- Samsung maintained consistent growth with figures of 7.90% in Q4 2022 and around 7-9% throughout 2023.

- Huawei’s growth was also stable, beginning at 5.90% in Q4 2022 and varying between 5.90% and 7.40% across the four quarters of 2023.

- Xiaomi exhibited a similar pattern, starting at 5.50% in Q4 2022 and experiencing steady growth, peaking at 8.40% in both Q3 and Q4 of 2023.

- Collectively, these companies illustrate the dynamic nature of the wearable AI device market, with Apple leading the charge and other companies showing strong, albeit varied, growth patterns.

- The “Others” category also saw substantial contributions, with growth percentages ranging from 43.40% in Q4 2022 to 46.70% in Q4 2023. Highlighting the competitive landscape and the presence of numerous emerging players.

(Source: IDC)

Overall Wearable and Sensors Shipments Worldwide Statistics

Wearable Sensors Unit Shipments Worldwide – By Vendor Statistics

- The global wearables market has seen substantial growth in unit shipments across major vendors from 2015 to 2022. Apple, Xiaomi, Samsung, and other vendors have all contributed to this upward trend.

- In 2015, Apple shipped 11.6 million units, while Xiaomi led with 12.0 million units. Samsung shipped 3.2 million units, and other vendors collectively shipped 27.4 million units.

- By 2016, Apple’s shipments slightly declined to 10.7 million units, whereas Xiaomi increased to 15.7 million units, Samsung to 4.4 million units, and other vendors surged to 43.0 million units.

- In 2017, Apple’s shipments dramatically rose to 33.1 million units. With Xiaomi and Samsung shipping 16.1 million and 5.8 million units, respectively, and other vendors increasing to 48.8 million units.

- The upward trend continued in 2018, with Apple shipping 48.0 million units, Xiaomi 23.3 million units, Samsung 12.2 million units, and other vendors reaching 69.4 million units.

- By 2019, Apple made a significant leap to 111.5 million units. Xiaomi to 41.7 million units, Samsung to 31.4 million units, and other vendors to 117.1 million units.

- The growth continued in 2020, with Apple at 151.4 million units, Xiaomi at 43.5 million units, Samsung at 40.0 million units, and other vendors at 146.1 million units. In 2021, Apple shipped 161.8 million units, Xiaomi 54.4 million units, Samsung 48.1 million units, and other vendors 199.9 million units.

- In 2022, there was a slight decline for Apple, which shipped 146.3 million units, while Xiaomi’s shipments decreased to 34.7 million units. Samsung shipped 43.1 million units, and other vendors collectively shipped 205.3 million units.

- This data highlights the significant expansion and fluctuations within the wearables market over the years. Driven by increasing consumer demand and technological advancements.

(Source: Statista)

Wearable Medical Sensors and Device Shipments Worldwide Statistics

- The global shipments of wearable medical sensors and devices have exhibited a robust growth trajectory in recent years.

- In 2021, the market saw shipments totaling 85 million units.

- This number increased significantly to 100 million units in 2022, reflecting a growing adoption of wearable medical technology.

- The upward trend is expected to continue, with projections indicating shipments will reach 130 million units in 2023 and further expand to 160 million units in 2024.

- This growth is driven by advancements in wearable technology, increasing consumer awareness of health and fitness. And a rising demand for remote health monitoring solutions.

(Source: Statista)

Connected Wearable Devices Worldwide – By Region

- The number of connected wearable devices worldwide has surged significantly across all regions from 2015 to 2022.

- In 2015, North America led the market with 38.65 million connected wearable devices, followed by the Asia Pacific with 30.4 million, and Western Europe with 16.75 million devices. Central and Eastern Europe, Latin America, the Middle East, and Africa had 5 million, 1.83 million, and 4.09 million devices, respectively.

- By 2016, the Asia Pacific region experienced substantial growth, reaching 99.8 million devices. North America also saw a dramatic increase to 127.1 million devices, while Western Europe rose to 54.3 million. Central and Eastern Europe, Latin America, the Middle East, and Africa reported 17.5 million, 12.6 million, and 14 million connected devices, respectively.

- In 2017, the growth trend continued, with North America reaching 217 million devices, the Asia Pacific at 155 million, and Western Europe at 88 million. Central and Eastern Europe, Latin America, the Middle East, and Africa also saw increases, with 28 million, 18 million, and 21 million devices, respectively.

More Insights

- The growth persisted into 2020, with the Asia Pacific at 194.67 million, North America at 180.96 million, and Western Europe at 127.64 million devices. Central and Eastern Europe, Latin America, and the Middle East and Africa reported 45.85 million, 26.08 million, and 25.42 million devices, respectively.

- In 2021, North America saw a significant rise to 378.8 million connected wearable devices. The Asia Pacific reached 258.2 million, Western Europe 159.7 million, Central and Eastern Europe 55.6 million, Latin America 39 million, and the Middle East and Africa 37.5 million devices.

- By 2022, the Asia Pacific region led with 311 million devices, followed by North America with 439 million and Western Europe with 192 million. Central and Eastern Europe, Latin America, the Middle East, and Africa continued to grow, reaching 68 million, 49 million, and 46 million devices, respectively.

- This data underscores the rapid and widespread adoption of wearable technology across all regions. Driven by technological advancements and increasing consumer demand for health and fitness monitoring devices.

(Source: Statista)

Use of Wearable Sensors and Electronic Devices in Clinical Trials Statistics

- The use of wearable sensors and tracking devices in clinical trials has seen a significant increase from 2016 to 2021.

- In 2016, a total of 102 clinical trials utilized these technologies, including 22 smart devices, 21 wristbands, 18 activity trackers, 23 sensors, six remote monitoring devices, and one wearable device.

- By 2017, the number of trials rose to 131, with slight variations in the distribution: 15 Smart Wearables, 25 wristbands, 23 activity trackers, 25 sensors, 14 remote monitoring devices, and four wearable devices.

- In 2018, the total number of clinical trials remained stable at 132, but there was an increase in the use of wristbands (35) and activity trackers (24). While the number of sensors used decreased to 20. Remote monitoring devices were used in 12 trials, and wearable devices in 5.

- The year 2019 saw a slight increase to 142 trials, with notable growth in the use of sensors (42) and activity trackers (28). However, the use of remote monitoring devices dropped to 4, and wearable devices to 2.

More Insights

- The year 2020 marked a significant rise in the total number of trials, reaching 169. This increase was driven by the higher adoption of smart devices (34) and remote monitoring devices (17), although the use of sensors and activity trackers remained stable at 32 and 28, respectively.

- In 2021, the upward trend continued with a total of 213 clinical trials. This year saw a substantial increase in the use of smart devices (59) and wristbands (40), while the use of activity trackers remained stable at 28. Sensors were used in 26 trials, remote monitoring devices in 22, and wearable devices in 10.

- This data highlights the growing integration of wearable technologies in clinical research, driven by advancements in sensor technology and the increasing demand for remote health monitoring solutions.

(Source: Clinical Trials Arena)

Technological Advancements in Wearable Sensor Technology Statistics

- Technological advancements in wearable sensors have significantly enhanced their capabilities and applications in recent years.

- In 2023, the market for Wearable Medical Devices technology exceeded $100 billion, driven by innovations in sensor technology and the integration of artificial intelligence (AI) for real-time health monitoring and data analysis.

- Modern wearable sensors, such as the Tunable, Ultrasensitive, Nature-inspired, Epidermal Sensor (TUNES), can detect a wide range of physiological signals. From minute pulses to muscular contractions and respiration.

- Additionally, advancements in flexible and stretchable materials have led to the development of sensors that can monitor vital signs like heart rate, glucose levels, and blood pressure with high precision.

- The integration of these sensors with mobile health applications enables continuous remote monitoring, providing timely interventions and improving patient outcomes.

- This rapid technological progress is projected to sustain a compound annual growth rate (CAGR) of 15% up to 2030. Reflecting the increasing demand for sophisticated, user-friendly health monitoring solutions.

(Sources: Royal Society of Chemistry, Warable, BMC)

Regulations for Wearable Sensors Statistics

North America

- The regulatory landscape for wearable sensors varies significantly across countries, reflecting differing national priorities and healthcare systems.

- In the United States, the Food and Drug Administration (FDA) classifies wearable sensors that provide medical data or aid in medical diagnostics as medical devices.

- These devices must undergo rigorous testing and obtain FDA clearance before entering the market to ensure safety and efficacy.

(Source: Consumer Protect Safety Commission)

Europe

- In Europe, wearable sensors are regulated under the Medical Device Regulation (MDR), which requires CE marking to demonstrate conformity with health, safety, and environmental protection standards.

- The European Union’s General Data Protection Regulation (GDPR) also imposes stringent requirements on data privacy and protection for wearable devices, given their propensity to collect sensitive health data.

(Source: Warable)

Asia-Pacific

- In China, wearable sensors used for health monitoring must comply with regulations set by the National Medical Products Administration (NMPA), which involves a comprehensive review process similar to the FDA.

- Additionally, China’s Cybersecurity Law mandates strict data security measures. Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) oversees the regulation of wearable medical devices, requiring adherence to both local standards and international guidelines.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical wearables, and devices must conform to the Medical Devices Rules, 2017. The country is also increasingly aligning with global standards to facilitate the entry of innovative health technologies.

- These regulatory frameworks ensure that wearable sensors are safe, reliable, and secure, thereby fostering trust and widespread adoption in the healthcare sector.

(Source: Warable)

Recent Development

Acquisitions:

- Apple’s Acquisition of Beddit: Apple acquired Beddit, a sleep monitoring company, to enhance its health-related features on Apple devices. This acquisition supports Apple’s strategy to integrate advanced health monitoring capabilities into its wearable devices.

New Product Launches:

- Philips’ Next-Generation Wearable Biosensor: Philips launched its next-generation wearable biosensor, the Biosensor BX100, which received FDA clearance and CE mark. This sensor is designed for early detection of patient deterioration, including monitoring COVID-19 patients in hospitals. It offers wireless, continuous monitoring of vital signs like heart rate and respiratory rate.

- Fitbit Sense 2: In 2023, Fitbit introduced the Fitbit Sense 2, which includes advanced sensors for tracking stress, heart health, and sleep patterns. This new model features improved sensors for more accurate health data collection and analysis.

Funding:

- Eight Sleep’s Series C Funding: Eight Sleep, a company specializing in smart mattresses and sleep technology, secured $40 million in Series C funding. The investment will support further development of their advanced sleep-tracking technology and expansion of their product line.

- WHOOP’s Series E Funding: WHOOP, a fitness wearable company, raised $200 million in Series E funding, valuing the company at $3.6 billion. The funding aims to enhance WHOOP’s wearable technology for continuous health monitoring and expand its market presence.

Market Growth:

- Expansion of the Wearable Sensors Market: The growth is driven by increasing consumer demand for health monitoring, advancements in sensor technology, and the rising prevalence of chronic diseases.

- Rising Adoption in Healthcare: The healthcare sector continues to be a significant driver of growth in the wearable sensors market. Wearable devices are increasingly used for remote patient monitoring, chronic disease management, and personalized healthcare, contributing to the market’s expansion.

Innovation in Technology:

- Integration of AI and IoT: Wearable sensors are increasingly integrating Artificial Intelligence (AI) and Internet of Things (IoT) technologies to enhance functionality. AI algorithms help in analyzing health data more accurately, while IoT connectivity allows for real-time data transmission to healthcare providers.

- Development of Sweat Sensors: Advances in wearable sweat sensors are enabling non-invasive monitoring of various biomarkers, such as glucose and electrolytes. These sensors provide valuable health information and have potential applications in sports, fitness, and clinical diagnostics.

Strategic Partnerships:

- Collaboration between Siemens and CardioSecur: Siemens Healthineers collaborated with CardioSecur to integrate advanced ECG monitoring capabilities into wearable devices.

- This partnership aims to enhance cardiac health monitoring and provide real-time insights for patients with heart conditions.

Conclusion

Wearable Sensors Statistics – The wearable sensors market is rapidly expanding due to technological advancements and increasing consumer demand for health monitoring.

These sensors, including accelerometers, gyroscopes, heart rate monitors, and temperature sensors, are now more precise and integrated with AI for real-time health data.

Regulatory frameworks in the U.S., EU, China, Japan, and India ensure safety and data protection for these devices.

The market, projected to exceed $100 billion in 2023, underscores the growing importance of wearable sensors in healthcare. Enabling continuous monitoring and proactive health management.

FAQs

Wearable sensors are electronic devices integrated into wearable items like smartwatches, wristbands, and clothing, used to monitor various physiological and environmental parameters. They measure data such as heart rate, body temperature, steps taken, and even glucose levels.

Wearable sensors use various technologies such as accelerometers, gyroscopes, photoplethysmography (PPG), and bioimpedance to capture data. These sensors convert physical movements or biological signals into electrical signals, which are then processed and displayed on a connected device.

The main types include accelerometers (for movement detection), gyroscopes (for orientation and angular velocity), heart rate sensors (using PPG), temperature sensors, and pressure sensors. Each type serves specific functions in health monitoring and fitness tracking.

Wearable sensors are widely used in healthcare for monitoring vital signs, in fitness for tracking physical activity, in sports for performance analysis, and in safety for monitoring hazardous environments. They help in disease management, remote patient monitoring, and personal fitness optimization.

Regulations vary by country. In the U.S., the FDA oversees wearable medical devices, ensuring safety and efficacy. In the EU, wearable sensors must comply with the Medical Device Regulation (MDR) and General Data Protection Regulation (GDPR) for data privacy. Similar regulatory bodies exist in China (NMPA), Japan (PMDA), and India (CDSCO), each with specific requirements for approval and market entry.