Table of Contents

- Introduction

- Editor’s Choice

- Global Surveillance Technology Market Size

- Global Video Surveillance Market Overview

- IP Camera Market Statistics

- Analog and IP Camera Market Worldwide Statistics

- IP Video Surveillance and VSaaS Market Revenues Worldwide

- Volume of Digital Cameras Worldwide

- Revenue Trends for Leading Security Video Surveillance Providers

- Global Adoption Trends of Smart Security Cameras

- Smart Home IP Camera Shipments Worldwide Statistics

- Sales Revenue from Network Video-Surveillance Cameras Worldwide

- User Preferences and Trends

- Key Investments and Spending Trends

- Risks and Challenges

- Innovations in IP Camera Technology Statistics

- Regulations for IP Camera Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

IP Camera Statistics: An IP camera, or Internet Protocol camera, is a digital video surveillance device that transmits data over a network rather than using traditional coaxial cables.

It offers key features such as high-resolution imaging (HD to 4K), Power over Ethernet (PoE) capabilities, and advanced functionalities like motion detection and remote access through web browsers and mobile apps.

Available types include fixed, PTZ (Pan-Tilt-Zoom), bullet, dome, and wireless cameras, each suited for different monitoring needs.

IP cameras are widely used in commercial security, home monitoring, traffic surveillance, and healthcare. Reflecting a significant advancement in surveillance technology that enhances flexibility and integration.

Editor’s Choice

- The global IP camera market revenue reached USD 12.7 billion in 2023.

- The global IP camera market revenue is projected to reach USD 42.7 billion in 2033. With the hardware component increasing to USD 33.48 billion and services reaching USD 9.22 billion. Reflecting robust growth across both sectors of the IP camera market.

- In 2016, the global market for IP cameras was dominated by several key players. Arlo is leading the pack, capturing a substantial 27% of the market share.

- The global market revenue for IP video surveillance and Video Surveillance as a Service (VSaaS) is projected to reach USD 88.03 billion by 2030.

- In 2011, the analog camera market was dominant, generating USD 7.4 billion in revenue compared to the IP camera market’s USD 4.3 billion.

- In 2023, the global landscape of online threats targeting IP cameras varied significantly across different brands. Hikvision cameras were the most affected, constituting 57.93% of all online threats. Indicating a high vulnerability or market penetration that made them a frequent target.

- The US has implemented specific controls, such as the IoT Cybersecurity Improvement Act of 2020. Which governs the federal purchase and use of IoT devices. Including IP cameras, and the recent ECCN 5A001.j, regulating IP network communications surveillance systems.

Global Surveillance Technology Market Size

- The global surveillance technology market is experiencing a robust expansion. Demonstrated by its revenue growth from USD 130.08 billion in 2022 to USD 148.29 billion in 2023.

- This trend is projected to continue, with the market expected to reach USD 234.72 billion by 2027.

- The significant increase over these five years reflects the growing demand and technological advancements within the global surveillance sector.

(Source: Statista)

Global Video Surveillance Market Overview

Video Surveillance Market Size Worldwide

- The global video surveillance market has demonstrated significant growth over the past decade.

- Starting from a market size of USD 26.6 billion in 2016, it rose to USD 30.2 billion in 2017.

- After a few years, the revenue increased substantially to USD 45.5 billion by 2020.

- The upward trajectory continued, with the market reaching USD 62.6 billion in 2023, and it is projected to further expand to USD 74.6 billion by 2025.

- This progression underscores the increasing demand and rapid technological advancements in the video surveillance sector.

(Source: Statista)

Video Surveillance Market Size – By Region

- From 2009 to 2019, the global video surveillance market exhibited substantial growth across various regions.

- In North America, the market size grew from USD 7.3 billion in 2009 to USD 12.3 billion by 2019.

- South America saw its market size increase from USD 1.8 billion to USD 6.8 billion over the same period.

- China experienced a more pronounced growth, starting at USD 3.9 billion in 2009 and soaring to USD 23.4 billion by 2019. Reflecting the rapid expansion and investment in surveillance technology within the region.

- The Asia-Pacific region (excluding China) also displayed steady growth. The market size moved from USD 1.2 billion in 2009 to USD 5.1 billion in 2019.

- Similarly, the EMEA region (Europe, the Middle East, and Africa) grew from USD 2.9 billion to USD 5 billion over the decade.

- This data underscores the increasing global reliance on and investment in video surveillance technologies across diverse geographic regions. Driven by advancements in technology and heightened security needs.

(Source: Statista)

Region-wise Video Surveillance Market CAGR

- Between 2009 and 2014, the global video surveillance market experienced robust compound annual growth rates (CAGR) across various regions.

- North America saw a CAGR of 7.50%, while South America experienced a 14% growth rate. China led the growth with a notable CAGR of 22.20%. Accompanied by the Asia-Pacific region (excluding China) at 17.60%.

- The EMEA region grew at a slower pace, with a CAGR of 4%, and the overall market expanded at a rate of 12.40% during this period.

- From 2014 to 2019, the growth patterns slightly shifted. North America’s CAGR decreased to 3.30%, whereas South America maintained strong growth at 14.30%. China continued to witness significant expansion, though at a reduced rate of 17.50%.

- The Asia-Pacific region (excluding China) also saw a decrease in growth rate to 13.80%. While the EMEA region experienced an increase in its growth rate to 7.20%.

- Overall, the global market’s growth rate adjusted to 11.40% during this latter five-year period. Indicating a sustained but moderating growth trajectory across the regions.

(Source: Statista)

Video Surveillance Camera Market Size Worldwide

- The global video surveillance camera market has exhibited a steady growth trend from 2019, beginning with a market revenue of USD 23.6 billion.

- By 2022, this figure had increased to USD 35 billion, marking a significant advancement in the sector.

- The market is projected to continue its growth trajectory, reaching USD 44 billion by 2025.

- The upward trend is expected to accelerate, with market revenue anticipated to rise to USD 54 billion in 2026 and further expand to USD 62.4 billion by 2027.

- This consistent growth underscores the increasing deployment of video surveillance technologies globally and their evolving capabilities.

(Source: Statista)

IP Camera Market Statistics

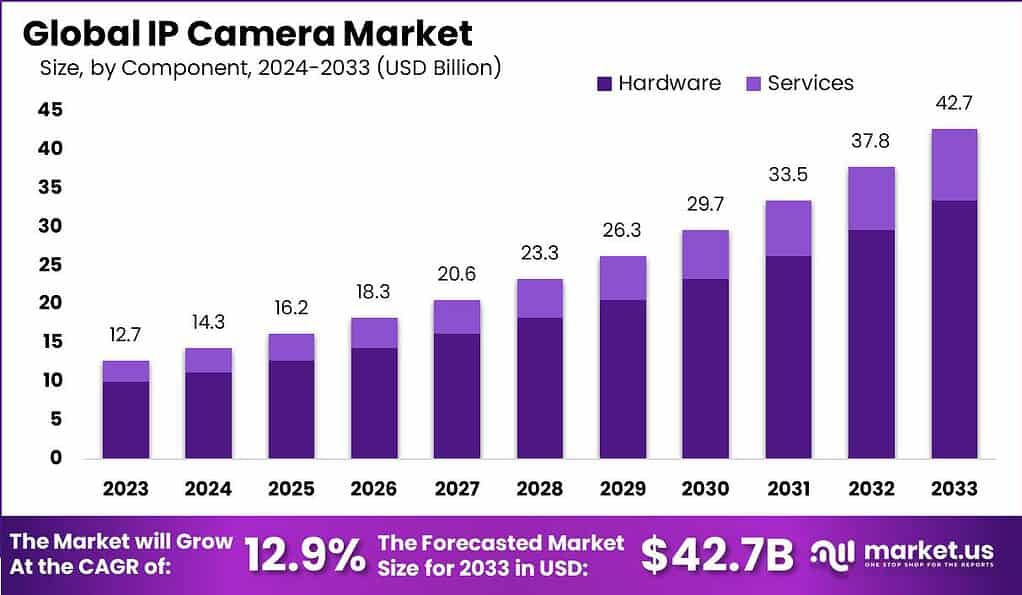

Global IP Camera Market Size Statistics

- The global IP camera market is expected to exhibit significant growth over the forecast period at a CAGR of 12.9%.

- In 2023, the market revenue is projected to reach USD 12.7 billion, and this figure is anticipated to rise steadily in the subsequent years.

- By 2024, the market is expected to generate USD 14.3 billion, increasing to USD 16.2 billion in 2025.

- The upward trend continues with a projected revenue of USD 18.3 billion in 2026. Further reaching USD 20.6 billion in 2027.

- In 2028, the market is forecasted to grow to USD 23.3 billion, followed by USD 26.3 billion in 2029.

- The momentum is expected to maintain pace. With the market size reaching USD 29.7 billion in 2030 and USD 33.5 billion in 2031.

- By 2032, the market is anticipated to generate USD 37.8 billion. By 2033, it is forecasted to hit USD 42.7 billion. Highlighting the strong and sustained growth trajectory of the global IP camera market.

(Source: market.us)

Global IP Camera Market Size – By Component Statistics

- The global IP camera market is poised for considerable growth across its components over the coming decade.

- In 2023, the total market revenue is estimated at USD 12.7 billion, divided between hardware at USD 9.96 billion and services at USD 2.74 billion.

- The trend of growth is expected to continue. With total revenue reaching USD 14.3 billion in 2024, comprising USD 11.21 billion from hardware and USD 3.09 billion from services.

- By 2025, the revenue is projected to further increase to USD 16.2 billion. With hardware accounting for USD 12.70 billion and services for USD 3.50 billion.

- The market is anticipated to expand to USD 18.3 billion in 2026, USD 20.6 billion in 2027, and USD 23.3 billion in 2028. With corresponding increases in hardware and service components.

- By 2029, the market size is expected to reach USD 26.3 billion. Consisting of USD 20.62 billion from hardware and USD 5.68 billion from services.

- The upward trajectory continues, with the market projected to grow to USD 29.7 billion in 2030 and then to USD 33.5 billion in 2031.

- In the final years of the forecast, the market is expected to grow to USD 37.8 billion in 2032 and reach a peak of USD 42.7 billion in 2033. With the hardware component increasing to USD 33.48 billion and services reaching USD 9.22 billion. Reflecting robust growth across both sectors of the IP camera market.

(Source: market.us)

Market Share Distribution of Global IP Camera Industry Statistics

- In 2016, the global market for Internet Protocol (IP) cameras was dominated by several key players. With Arlo leading the pack, capturing a substantial 27% of the market share.

- Nest followed with a significant presence, holding 13% of the market.

- Swann and Samsung also held notable shares, accounting for 10% and 9%, respectively.

- The remaining 41% of the market was distributed among various other companies, indicating a competitive and fragmented market landscape.

- This diversity in market share highlights the varied consumer preferences and the presence of numerous firms catering to different segments of the IP camera market.

(Source: Statista)

IP Camera Market Size in the United States Statistics

- Between 2014 and 2016, the US IP camera market experienced noticeable growth in its quarterly market size.

- Starting in Q1 2014, the market was valued at USD 78 million and saw a gradual increase to USD 83 million by Q2 and USD 94 million in Q3.

- By the end of 2014, the market size peaked at USD 111 million in Q4, indicating a robust growth trajectory.

- In 2015, the market size initially dipped to USD 93 million in Q1 but recovered and continued to grow through the subsequent quarters. Reaching USD 103 million in Q2, USD 119 million in Q3, and significantly surging to USD 152 million in Q4.

- The upward trend persisted into 2016, with the market size starting at USD 122 million in Q1, climbing to USD 139 million in Q2, and maintaining at USD 152 million in Q3.

- This period reflects a strong and steady increase in demand and adoption of IP cameras across the United States.

(Source: Statista)

Market Share Distribution of IP Camera Brands in the US. Statistics

- In the fourth quarter of 2016, the market share distribution among companies in the US IP camera sector showcased significant diversity.

- NETGEAR emerged as the dominant player, capturing a substantial 31% of the market.

- Nest/Dropcam followed with a notable 16% market share.

- Night Owl Security also held a significant portion, accounting for 10%.

- Samsung secured 8%, while both Lorex and Swann Communications each garnered 7%.

- Canary Communications held smaller shares at 3%, and several firms, including Amcrest Technologies, D-Link, Ring, and Dps, each with 2%.

- The remaining market segment was distributed among various other players, collectively constituting 11%.

- This data highlights the competitive landscape of the IP camera market in the United States during the specified period.

(Source: Statista)

Analog and IP Camera Market Worldwide Statistics

- From 2011 to 2017, the global market for analog and IP cameras showcased a notable shift in dynamics.

- In 2011, the analog camera market was dominant, generating USD 7.4 billion in revenue compared to the IP camera market’s USD 4.3 billion.

- However, as technology advanced, a gradual decline in the analog camera market was observed. With revenues decreased from USD 7.5 billion in 2012 to USD 4.4 billion by 2017.

- Conversely, the IP camera segment experienced robust growth during this period. Starting from USD 5.3 billion in 2012, revenue for IP cameras surged to USD 6.6 billion in 2013, and by 2014. It had overtaken the analog market with a revenue of USD 9 billion.

- The growth trend continued, with the IP camera market reaching USD 10.7 billion in 2015, USD 12.4 billion in 2016, and peaking at USD 14.5 billion in 2017.

- This transition underscores the increasing preference for IP cameras over analog cameras, driven by their superior technology and broader functionalities.

(Source: Statista)

IP Video Surveillance and VSaaS Market Revenues Worldwide

- The global market for IP video surveillance and Video Surveillance as a Service (VSaaS) has been on a trajectory of substantial growth from 2019 to 2030.

- In 2019, the market was valued at USD 34.69 billion. Which reflected the solid foundation and growth potential of the sector.

- By 2022, this value will increase to USD 38.47 billion, indicating steady growth amidst evolving technology and increasing market adoption.

- The market is projected to experience a significant surge. The valuation is expected to more than double to USD 88.03 billion by 2030.

- This forecasted growth underscores the expanding reliance on IP video surveillance solutions and VSaaS, driven by advancements in technology. Increased security needs, and the growing integration of AI and cloud-based technologies in surveillance systems.

(Source: Statista)

Volume of Digital Cameras Worldwide

- The global digital camera market experienced fluctuations in unit sales from 2019 to 2029. In 2019, unit sales were at a high of 123.01 million.

- However, there was a noticeable decline in the following years, with sales dropping to 97.89 million in 2020 and further to 95.94 million in 2021. Likely impacted by market saturation and the rise of smartphone photography.

- The market began to recover in 2022, with unit sales increasing to 112.04 million, and this upward trend continued into the subsequent years.

- By 2023, sales rose to 120.51 million, followed by 126.64 million in 2024, and slightly higher increments were observed in the following years. Reaching 128.08 million in 2025 and 129.52 million in 2026.

- The growth remained steady, with sales reaching 131.6 million in 2027, 133.31 million in 2028, and finally, 135.1 million by 2029.

- This gradual increase suggests a stabilization in the digital camera market after initial declines. Reflecting a sustained consumer interest and potential technological innovations reinvigorating the market.

(Source: Statista)

Revenue Trends for Leading Security Video Surveillance Providers

- In the competitive landscape of global security video surveillance manufacturers and service providers, Hikvision Digital Technology led the market with a revenue increase from USD 9,679.9 million in 2021 to USD 9,788 million in 2022.

- Dahua Technology, another major player, saw a slight decline in revenue, moving from USD 4,879 million in 2021 to USD 4,541.7 million in 2022.

- Axis Communication showed significant growth, with revenues rising from USD 1,155.8 million to USD 1,572 million. Similarly, Motorola Solutions experienced growth, with revenue increasing from USD 1,226 million to USD 1,523 million.

- Tiandy Technologies and Hanwha Techwin also saw revenue increases, with Tiandy moving from USD 791.1 million to USD 805.8 million and Hanwha from USD 526 million to USD 775.9 million.

- Unview Technologies, however, faced a decrease, with revenue dropping from USD 902.4 million to USD 762 million. Vivotek’s revenue almost doubled from USD 182.9 million to USD 333.7 million, demonstrating substantial growth.

- CP Plus and Milestone Systems both showed positive revenue changes, with CP Plus going from USD 209.7 million to USD 292.1 million and Milestone from USD 161.2 million to USD 210.3 million.

- On the contrary, Dongguan Yutong Optical Technology and Infinova witnessed declines, with Dongguan reducing from USD 306.4 million to USD 274.3 million and Infinova from USD 235.5 million to USD 153.7 million.

- This data illustrates a dynamic year with various companies experiencing differing trends in revenue, reflecting the evolving market demands and competitive pressures within the global security video surveillance industry.

(Source: Statista)

Global Adoption Trends of Smart Security Cameras

- The adoption of smart security cameras in households worldwide has shown remarkable growth from 2016 to 2027.

- In 2016, approximately 108.18 million households were equipped with smart security cameras.

- This number steadily rose to 150.33 million in 2017 and further to 212.45 million by 2018.

- The growth continued at an accelerated pace, reaching over 303.06 million households in 2019 and significantly jumping to 427.59 million in 2020.

- By 2021, the number of households with smart security cameras nearly doubled from the 2016 figures, totaling approximately 585.64 million.

- This upward trajectory persisted through 2022, with the figures reaching 774.74 million, and is projected to continue to 988.61 million households in 2023.

- The growth is expected to maintain momentum into the latter half of the decade, with estimates showing 1.21 billion households in 2024, 1.47 billion in 2025, 1.64 billion in 2026, and reaching approximately 1.81 billion by 2027.

- This sustained increase highlights the growing global reliance on and trust in smart security technologies to enhance household safety and security.

(Source: Statista)

Smart Home IP Camera Shipments Worldwide Statistics

- The worldwide shipments of smart home IP cameras from 2012 to 2019 demonstrate a significant growth trend over the years.

- Starting from a modest base of 0.1 million units in 2012, the shipments experienced a gradual increase to 0.4 million units in 2013.

- The growth accelerated noticeably in the subsequent years, with shipments reaching 1.3 million units in 2014 and then doubling to 2.8 million units by 2015.

- The momentum continued, as the shipments more than doubled again to 5.4 million units in 2016.

- By 2017, the volume nearly doubled once more, reaching 9.7 million units.

- The trend of rapid growth persisted, with shipments soaring to 16.5 million units in 2018 and further expanding to 25.1 million units in 2019.

- This sustained increase reflects the escalating consumer demand and adoption of smart home security solutions globally.

(Source: Statista)

Sales Revenue from Network Video-Surveillance Cameras Worldwide

- The sales revenue from network video surveillance cameras worldwide saw an increase between the years 2017 and 2018.

- In 2017, the revenue generated was USD 0.97 billion.

- By 2018, this figure had grown to USD 1.1 billion.

- This growth indicates a positive trend in the market for network video surveillance cameras, reflecting an expanding demand and possibly advancements in technology that made these systems more attractive to buyers across various sectors.

(Source: Statista)

User Preferences and Trends

Key Features Valued in Low-Light Security Cameras

- In 2022, a survey among users worldwide highlighted the leading features they value in low-light security cameras.

- The most valued feature, according to the survey, was the lux rating, with 155 respondents indicating its importance for low-light performance.

- Sensor size and camera type, including varifocal and panoramic options, each garnered attention from 103 respondents, underscoring the preference for versatile and high-quality image capture capabilities.

- Close behind, pixel count was considered important by 99 participants, followed by new sensor technology, which was highlighted by 95 respondents, reflecting a trend towards more advanced imaging technology.

- The F-stop rating, which affects the camera’s ability to gather light, was also a significant feature for 54 users.

- Lastly, other less common features were noted by 11 respondents.

- This distribution of preferences illustrates the critical factors consumers consider when selecting low-light security cameras to ensure optimal functionality and performance.

(Source: Statista)

Predominant Usage Patterns of Home Security Camera Systems

- In 2022, a survey of home security camera system owners in the United States revealed several leading habits regarding the use of their systems.

- A majority of respondents, about 52%, reported checking their home security camera footage remotely multiple times a day, especially when away from home for more than a day.

- Close to half of the participants, 48%, reviewed their home security footage daily.

- Both monitoring delivery workers and reviewing footage weekly were habits for 38% of the respondents, indicating a strong preference for keeping a regular watch on activities around their homes.

- Additionally, 32% of the owners used their cameras to monitor their neighborhood, while 29% monitored their kids and pets through these systems.

- The least common use, at 15%, was monitoring domestic workers.

- These statistics highlight the diverse and proactive engagement that individuals have with their security systems to ensure safety and oversight over their domestic environments.

(Source: Statista)

Key Investments and Spending Trends

- Worldwide spending on information security has seen considerable growth across various segments from 2017 to 2024.

- In 2017, expenditure on application security was $2,434 million, rising consistently to $6,670.3 million by 2024. Cloud security spending also showed significant increases from $185 million in 2017 to an anticipated $7,002.6 million in 2024.

- Data privacy and security expenditures experienced similar upward trends, with data privacy allocations growing from $2,563 million in 2017 to $1,667.3 million in 2024 and data security from $8,823 million to $4,333.3 million over the same period.

- Identity access management and infrastructure protection were other areas of significant investment. Growing from $12,583 million and $3,949 million in 2017 to $18,556.5 million and $33,319.6 million by 2024, respectively.

- Integrated risk management, network security equipment, and security services also saw robust increases. Spending on integrated risk management rose from $10,911 million in 2017 to $6,277.7 million in 2024, while network security equipment surged from $52,315 million to $24,360.1 million.

- Security services grew the most, from $5,948 million in 2017 to an expected $89,996.7 million in 2024. Consumer security software expenditures, too, grew from $5,948 million to $8,406.7 million. Reflecting a broad and growing commitment to various aspects of information security across sectors.

(Source: Statista)

Risks and Challenges

- In 2023, the global landscape of online threats targeting IP cameras varied significantly across different brands.

- Hikvision cameras were the most affected, constituting 57.93% of all online threats. Indicating a high vulnerability or market penetration that made them a frequent target.

- D-Link cameras also experienced a substantial share of these threats, accounting for 37.40% of the incidents.

- Conversely, Amcrest cameras were less frequently targeted, with only 1.13% of the threats directed at them.

- Cameras from other brands combined accounted for a smaller fraction of the total, representing 3.21% of the online threats.

- This distribution underscores the varying levels of security challenges faced by different brands in the IP camera industry. Reflecting their market dynamics and possibly their varying security measures.

(Source: Statista)

Innovations in IP Camera Technology Statistics

- In the rapidly evolving field of IP camera technology, recent advancements in 2023 have significantly boosted the capabilities of security systems.

- Hikvision, a leading manufacturer, has introduced new products that leverage artificial intelligence (AI) and advanced imaging technologies. For instance, their ColorVu cameras are designed to deliver vibrancy. Color-accurate video even in low-light conditions using innovative lens and sensor combinations along with supplemental lighting.

- These cameras integrate AI to enhance video analytics, making them smarter and more efficient at recognizing patterns and anomalies in video feeds.

- Simultaneously, Kintronics highlights a shift towards integrating AI across IP camera systems. Improving security through features like facial recognition and unusual behavior detection.

- This integration enables real-time, intelligent responses to potential security threats, thus enhancing safety and operational efficiency.

- Additionally, the introduction of edge and cloud computing technologies allows for decentralized data storage directly on the cameras (using local drives or cloud storage), which optimizes bandwidth and reduces latency.

- This also enables enhanced video analytics capabilities that help in swift decision-making during security incidents.

- These innovations represent a significant leap towards more autonomous, reliable, and effective surveillance systems. AI and advanced processing technologies are at the forefront of transforming IP camera capabilities and their applications in both commercial and residential security.

(Source: Hikvision, SourceSecurity, Kintronics, Pelco)

Regulations for IP Camera Statistics

- Regulations governing IP cameras vary significantly across regions, reflecting diverse priorities around security, privacy, and technology use.

- In the EU, stringent measures like the General Data Protection Regulation (GDPR) and the Cybersecurity Act enhance device security and data privacy.

- The US has implemented specific controls, such as the IoT Cybersecurity Improvement Act of 2020, which governs the federal purchase and use of IoT devices. Including IP cameras, and the recent ECCN 5A001.j, regulating IP network communications surveillance systems.

- Dubai mandates that all commercial buildings use IP cameras with a minimum resolution and connectivity standards under SIRA’s Preventive Systems Law.

- Meanwhile, India targets national security by restricting Chinese-made IP cameras in government installations.

- These regulations aim to balance the increasing use of IP cameras in public and private sectors with essential privacy protections and security requirements.

- Each framework adapts to technological advances and societal expectations. Underscoring the need for ongoing dialogue and updates in legislation to address emerging challenges in IP camera deployment and management.

(Source: Thales Group, Home, IDRW, MechGen Technologies)

Recent Developments

Acquisitions and Mergers:

- Motorola Solutions acquires Ava Security: In 2023, Motorola Solutions expanded its video security portfolio by acquiring Ava Security. A cloud-native video surveillance company, for $400 million. This acquisition strengthens Motorola’s presence in the IP camera market. Integrating Ava’s advanced analytics and AI-powered video solutions into its product offerings.

- Axis Communications acquires 2N: In 2023, Axis Communications, a leader in network video solutions, acquired 2N, a manufacturer of IP intercom systems. The acquisition, valued at $120 million, allows Axis to expand its product range with IP-based video intercom solutions that integrate seamlessly with IP cameras.

New Product Launches:

- Hikvision introduces AI-powered IP cameras: In early 2024, Hikvision, a global leader in IP surveillance cameras, launched its new range of AI-powered IP cameras. These cameras feature real-time facial recognition. Object detection, and enhanced low-light capabilities, aimed at improving security and efficiency in commercial spaces.

- Bosch unveils IP cameras with AI and edge computing: In late 2023, Bosch Security Systems introduced a new series of IP cameras equipped with AI and edge computing capabilities. These cameras process video data locally, reducing bandwidth requirements and providing real-time analytics for smart security solutions.

Funding:

- Eagle Eye Networks raises $100 million for IP camera expansion: In 2023, Eagle Eye Networks, a cloud-based video surveillance company. Raised $100 million in funding to accelerate the development of its AI-powered IP camera solutions and expand its global presence. The company aims to enhance cloud video surveillance offerings for businesses and governments.

- Verkada secures $205 million in Series D funding: In early 2024, Verkada, a provider of cloud-based security cameras. Raised $205 million in Series D funding to expand its product line. Focusing on IP cameras integrated with advanced AI analytics and cloud storage. The funding will also support global expansion and R&D efforts.

Technological Advancements:

- AI and machine learning in IP cameras: The integration of AI and machine learning in IP cameras is becoming more common. Allowing real-time analytics such as facial recognition, behavior analysis, and threat detection. By 2025, over 50% of IP cameras are expected to be equipped with AI capabilities to improve the accuracy and functionality of security systems.

- Edge computing in IP cameras: The adoption of edge computing is on the rise. Enabling IP cameras to process data locally, reducing latency and bandwidth usage. By 2026, 35% of new IP camera systems are projected to feature edge computing, particularly in industries requiring real-time decision-making.

Conclusion

IP Camera Statistics – The IP camera market has experienced significant growth due to advances in technology and increasing security demands, with projections indicating continued expansion.

Technological enhancements, such as higher resolution, cloud integration, and advanced analytics, have broadened the applications of IP cameras.

However, they face notable security challenges, highlighted by their vulnerability to online threats. Consumer habits suggest a shift towards proactive security uses, such as remote monitoring and overseeing home activities.

The competitive landscape remains dynamic, with major brands leading innovation and keeping prices competitive.

Addressing security vulnerabilities and meeting consumer functionality expectations are vital for sustained growth in the IP camera sector.

FAQs

An IP camera, or Internet Protocol camera, is a type of digital video camera that receives and sends data via a network or the internet. Unlike traditional analog CCTV cameras, IP cameras provide higher-resolution video and a more flexible installation.

IP cameras connect to your home or business network via Wi-Fi, Ethernet, or a cellular network. They capture video footage that can be viewed remotely using a smartphone, tablet, or computer, and can store video on network servers, cloud-based storage, or onboard storage such as an SD card.

Benefits include remote viewing and management, high-resolution images, the ability to connect many cameras without the need for separate DVRs, and advanced features like motion detection, night vision, and automatic alerts.

While IP cameras offer many benefits, they can be vulnerable to hacking if not properly secured. It’s important to use strong, unique passwords, keep the camera’s firmware updated, and use secure encryption settings to protect your privacy.

Wired IP cameras are connected via Ethernet cables and often provide a more stable connection with higher data transfer speeds. In contrast, wireless cameras connect via Wi-Fi or other wireless protocols and offer more flexibility in placement.