Table of Contents

Introduction

The global automotive dyno market is projected to experience substantial growth in the coming decade. A dynamometer, commonly known as a dyno, is used to measure the power output of automotive engines and simulate real-world driving conditions. As the automotive industry continues to evolve, particularly with the rising demand for high-performance vehicles, the need for advanced performance testing has surged. This market growth is primarily driven by the expanding automotive sector, including electric vehicles (EVs), and the increasing adoption of stringent emission standards worldwide.

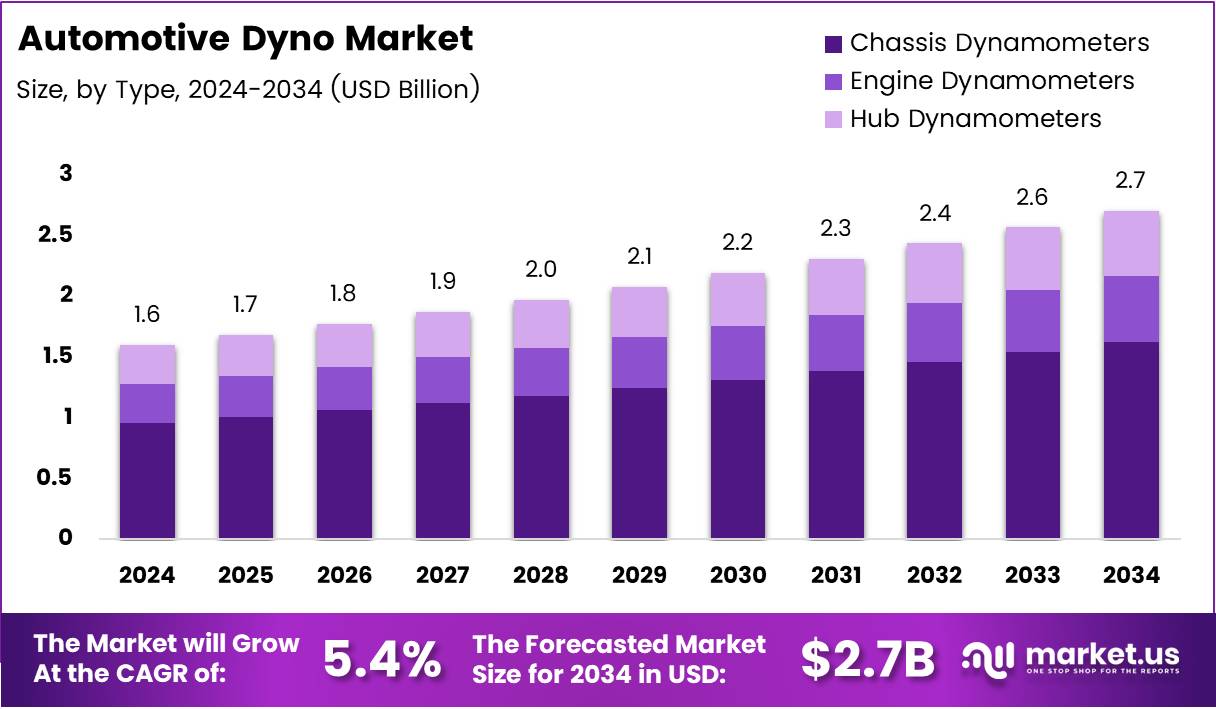

The global automotive dyno market size is expected to be valued at USD 2.7 billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034. This press release delves into the key drivers, challenges, market segmentation, regional analysis, and business opportunities within this dynamic sector.

Key Takeaways

- The global automotive dyno market is set to reach USD 2.7 billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034.

- Chassis dynamometers hold the largest market share, with 57.2% in 2024.

- Mid-power dynos (500 to 1,500 hp) dominate the market, accounting for 47.7% in 2024.

- Automotive OEMs represent the leading segment in the end-use category, holding a 56.9% share in 2024.

- North America holds the largest market share of 43.8%, valued at USD 0.7 billion in 2024.

Market Segmentation Overview

- By Dyno Type: The market is primarily dominated by chassis dynamometers, which accounted for 57.2% of the market in 2024. These dynamometers are widely used for vehicle performance testing as they simulate real-world driving conditions, making them the most versatile option in automotive testing. Engine dynamometers and hub dynamometers, though smaller in market share, serve specialized functions for engine testing and wheel-end analysis, respectively.

- By Power Capacity: The mid-power segment (500 to 1,500 hp) leads the market with a 47.7% share, suitable for testing passenger vehicles, light commercial vehicles, and performance cars. The low-power segment (up to 500 hp) caters to smaller engines and hybrids, while high-power dynos (over 1,500 hp) serve specialized applications like racing and heavy-duty vehicles.

- By End-Use: The automotive original equipment manufacturers (OEMs) are the largest consumers of dyno systems, holding 56.9% of the market share in 2024. This segment benefits from dynos’ role in the vehicle development lifecycle, including powertrain design, production validation, and regulatory certification. Other significant segments include aftermarket service providers, motorsports teams, and commercial vehicles.

Drivers

Several factors are propelling the growth of the automotive dyno market, with a key driver being the increasing demand for high-performance vehicles. Enthusiasts and consumers alike are seeking more powerful engines and improved acceleration, pushing automotive manufacturers to invest heavily in performance testing systems. Automotive dynos are crucial in providing precise measurements of horsepower, torque, and overall engine efficiency.

Another driving factor is the advancement of digital sensors, real-time data collection, and computer-controlled systems in automotive testing technologies. These innovations enhance the accuracy of dyno systems, allowing for more detailed analysis and faster testing cycles. Additionally, stricter fuel efficiency and emissions regulations worldwide have made dyno testing an essential tool for optimizing engine performance and ensuring compliance with environmental standards.

The rise in electric and hybrid vehicles is also fueling market growth. EV manufacturers require specialized dynos to test electric motors, battery systems, and regenerative braking, as these vehicles have different testing requirements compared to traditional internal combustion engines.

Use Cases

- Performance Testing: Dynos are integral in measuring and optimizing engine performance, torque, and power output. They are used extensively in vehicle development, R&D, and validation to ensure the highest performance standards.

- Emissions Testing: As governments worldwide enforce stringent emissions regulations, dynos are vital tools for automakers to measure and optimize emissions levels for both internal combustion engines and electric vehicles.

- Electric Vehicle Testing: As the automotive industry shifts toward electrification, dynos are increasingly used to test the performance of electric motors, batteries, and energy efficiency in electric vehicles.

- Motorsports Testing: High-performance testing is crucial in motorsports, where dynos help teams maximize engine output and fine-tune vehicle performance for competitive racing.

Major Challenges

Despite the promising growth outlook, the automotive dyno market faces several challenges. A significant obstacle is the high initial cost and complex installation requirements of dyno systems, which limits adoption in developing regions. The lack of technical infrastructure and skilled personnel also hampers the market’s expansion in certain geographies.

Regulatory constraints related to noise and emissions from testing facilities pose another challenge. The installation of dynos in urban areas often requires additional investments in soundproofing and emission control systems to comply with stringent environmental regulations.

Furthermore, the maintenance and calibration of dyno systems require specialized knowledge and regular servicing. The lack of skilled operators and service technicians in certain regions makes it difficult for automotive companies to maintain these advanced systems, impacting their efficiency and long-term utilization.

Business Opportunities

The automotive dyno market presents several growth opportunities, primarily driven by the increasing focus on electric vehicle testing. As the EV market expands, dynos are being designed specifically for testing electric motors, batteries, and regenerative braking systems. This shift toward electrification creates a significant demand for specialized testing equipment.

Moreover, the development of cost-effective and portable dyno systems opens up new avenues for smaller automotive businesses and independent testing facilities. These compact and mobile units enable more businesses to access professional-grade testing equipment, democratizing the technology and driving market growth.

The integration of IoT technology and advanced data analytics in dyno systems also presents a considerable business opportunity. These technologies enable manufacturers to collect real-time data and make data-driven decisions, improving vehicle performance and reducing development time.

Regional Analysis

The automotive dyno market is experiencing significant regional growth, with North America currently holding the largest market share of 43.8% in 2024, valued at USD 0.7 billion. North America’s dominance is driven by the presence of leading automotive manufacturers, robust automotive research and development infrastructure, and strong demand for advanced performance testing solutions.

Europe follows closely, benefiting from stringent emissions regulations and the rising emphasis on electric vehicle testing. Countries like Germany and France are at the forefront of automotive R&D, contributing significantly to the market’s expansion.

In the Asia Pacific region, key markets like China, India, and Japan are seeing steady growth due to the rising demand for high-performance vehicles and the adoption of advanced testing technologies. The increasing automotive production and investments in testing infrastructure further boost market expansion in this region.

Emerging markets in Latin America, Middle East, and Africa are expected to witness gradual growth, supported by the expanding automotive industries in countries like Brazil, Mexico, and South Africa.

Recent Developments

- In July 2025, ServiceUp secured USD 55 million in Series B funding to accelerate its growth in the service management sector.

- In February 2025, Dynolt Technologies raised USD 1.7 million in seed funding, aimed at supporting product development for early-stage technologies in the automotive sector.

- In March 2024, Axion Ray closed a USD 17.5 million Series A funding round, which will be used to expand its optical sensing technology for automotive applications.

Conclusion

The automotive dyno market is experiencing robust growth due to rising demand for high-performance vehicles, technological advancements in testing equipment, and the increasing adoption of electric vehicles. Despite facing challenges such as high initial costs and limited market penetration in developing regions, the market is poised for expansion, driven by innovations in testing technology, IoT integration, and the rise of electric vehicle applications. With key regions like North America and Europe leading the market, the automotive dyno industry is set to thrive as vehicle performance and regulatory compliance continue to be top priorities for manufacturers.