Table of Contents

Insurance Analytics Market Size

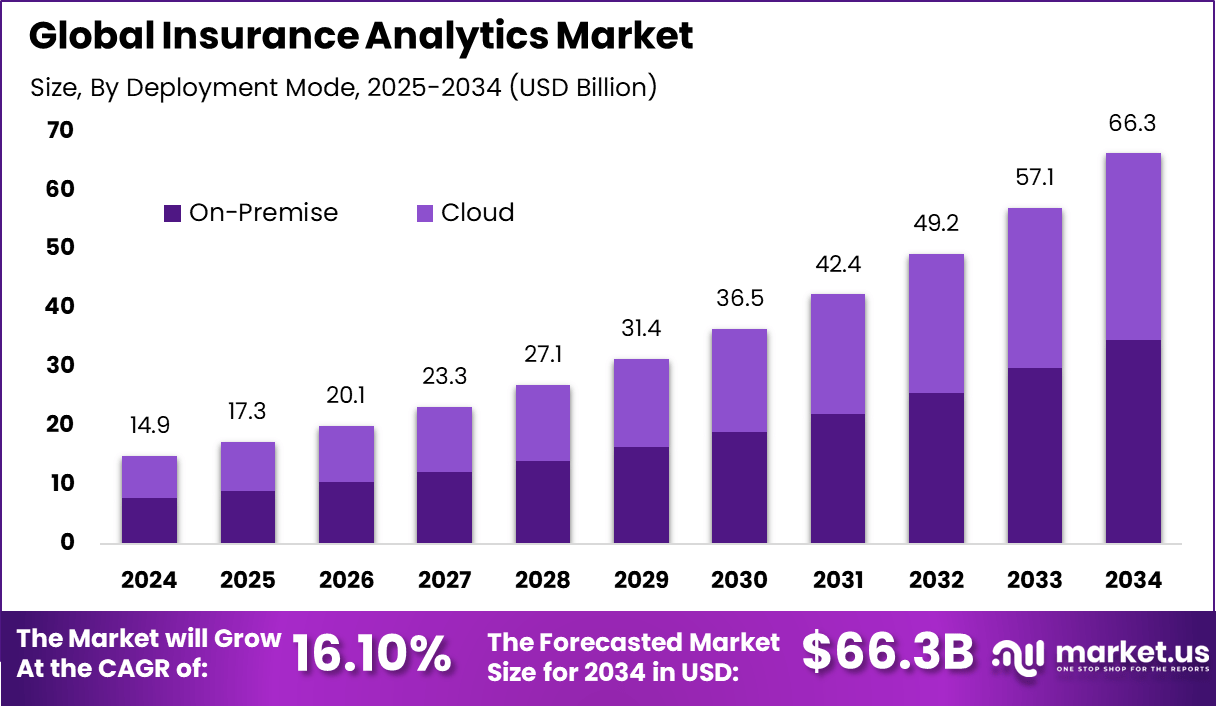

The global Insurance Analytics market generated USD 14.09 billion in 2024 and is expected to expand steadily over the forecast period. Market revenue is projected to increase from USD 17.3 billion in 2025 to approximately USD 66.3 billion by 2034, registering a CAGR of 16.10% throughout the forecast span. This growth is driven by rising adoption of data driven risk assessment, fraud detection, and customer analytics solutions. Insurers are increasingly using advanced analytics to improve underwriting accuracy and operational efficiency.

The insurance analytics market refers to the use of data analysis tools and techniques to support decision making across insurance operations. These solutions analyze structured and unstructured data from policies, claims, customer interactions, and external sources. Insurance analytics platforms support underwriting, pricing, claims management, fraud detection, and customer engagement. Adoption spans life, health, property, and casualty insurance segments. These tools help insurers improve accuracy and efficiency.

Market development has been influenced by increasing data availability and competitive pressure. Insurers generate large volumes of data from digital channels and connected systems. Traditional analysis methods are often slow and limited in scope. Analytics platforms enable deeper insight and faster response. As insurers modernize operations, analytics becomes a core capability.

One major driving factor of the insurance analytics market is the need for better risk assessment. Accurate risk evaluation supports fair pricing and sustainable profitability. Analytics tools process historical and real-time data to improve underwriting decisions. Improved risk insight reduces loss exposure. Risk optimization drives adoption.

Another key driver is the focus on fraud detection and prevention. Insurance fraud leads to financial losses and higher premiums. Analytics platforms identify unusual patterns and suspicious behavior. Early detection improves investigation efficiency. Fraud management requirements support market growth.

Top Market Takeaways

- Tools lead by component with a 67.3% share, showing insurers’ reliance on analytics platforms for visualization, risk modeling, and performance tracking.

- Claims management dominates applications at 31.7%, driven by predictive analytics for fraud detection, faster settlements, and improved accuracy.

- On-premise deployment accounts for 52.2%, reflecting strong preference for local control of sensitive policyholder and claims data.

- Insurance companies represent 73.4% of end-user demand, highlighting heavy investment in analytics for underwriting, pricing, and retention.

- Property and casualty insurance holds 42.1%, supported by real-time risk assessment and claims optimization needs.

- Large enterprises dominate with 70.2%, enabled by their ability to deploy AI and big-data analytics at scale.

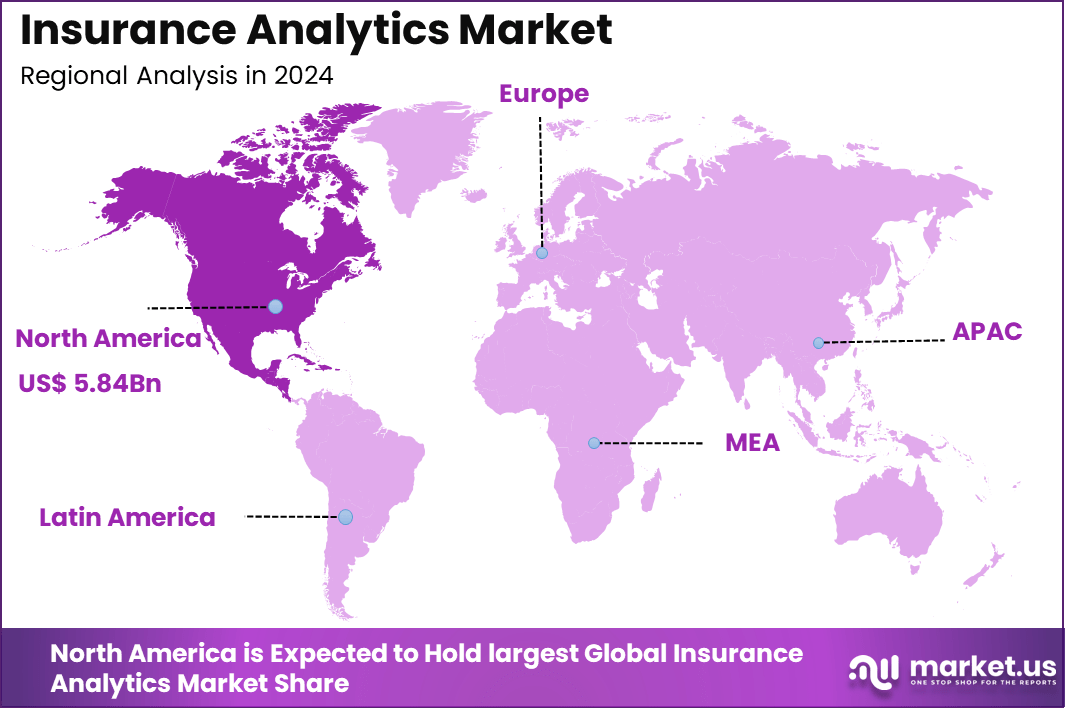

- North America captures 39.2%, backed by mature insurance markets, regulatory strength, and advanced digital adoption.

Insurance Analytics Adoption Trends

- About 86% of insurance firms use analytics in core decision-making processes.

- 76% of insurance executives view data analytics as critical for modernization and competitiveness.

- Only 6% of insurers have reached advanced analytics maturity with enterprise-wide impact.

- Nearly 70% of insurers plan to deploy real-time, AI-driven predictive models within the next two years.

Regional Analysis

In 2024, North America held a dominant position in the global market, accounting for more than 39.2% of total revenue. The region generated around USD 5.84 billion, supported by strong digital transformation across the insurance sector and high adoption of advanced analytics platforms. Mature insurance ecosystems and early use of AI based analytical tools strengthened regional leadership. As a result, North America continues to shape innovation and adoption trends in the insurance analytics market.

Increasing Adoption Technologies

Advanced data processing technologies support insurance analytics adoption. Platforms integrate data from internal systems and external sources. Improved data integration enhances insight quality. Scalable architectures handle growing data volumes. Technology maturity supports wider use. Machine learning technologies also contribute to adoption. Models learn from claims and customer behavior over time. Predictive analysis improves forecasting accuracy. Continuous learning refines decision support. Intelligent analytics increases confidence.

One key reason insurers adopt analytics solutions is improved decision accuracy. Data-driven insights reduce reliance on assumptions. Better decisions improve pricing and risk management. Accuracy supports profitability. Confidence in outcomes improves. Another reason is improved regulatory and compliance support. Analytics helps monitor adherence to policy and legal requirements. Automated reporting improves transparency. Reduced compliance risk supports stability. Governance needs drive adoption.

Investment and Business Benefits

Investment opportunities in the insurance analytics market exist in platforms focused on real-time analytics. Real-time insight supports faster claims and customer interaction. Solutions that enable immediate action attract interest. Speed enhances competitive advantage. Real-time capability supports growth. Another opportunity lies in analytics for customer engagement and retention. Tools that analyze behavior and preferences improve personalization. Targeted offerings increase lifetime value. Customer-focused analytics delivers measurable impact. This area attracts investment.

Insurance analytics improves operational efficiency by automating analysis tasks. Reduced manual effort lowers processing costs. Faster insights improve responsiveness. Efficiency gains support scalability. Operations become more predictable. These solutions also improve financial performance through better risk and claims management. Accurate pricing reduces loss ratios. Early fraud detection lowers payouts. Improved margins support long-term stability. Financial outcomes improve overall performance.

Key Market Segments

By Component

- Tools

- Services

By Business Application

- Claims Management

- Risk Management

- Fraud Detection and Prevention

- Process Optimization

- Customer Management and Personalization

By Deployment Mode

- On-Premise

- Cloud

By End-User

- Insurance Companies

- Government Agencies

- Third-Party Administrators, Brokers and Consultancies

By Insurance Line

- Life and Health

- Property and Casualty

- Auto

- Specialty Lines

By Organization Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Top Key Players in the Market

- IBM Corporation

- LexisNexis Risk Solutions

- Hexaware Technologies Limited

- Guidewire Software Inc.

- Applied Systems Inc.

- Others

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 14.9 Bn |

| Forecast Revenue (2034) | USD 66.3 Bn |

| CAGR(2025-2034) | 16.10% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

| Report Coverage | Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends |

| Segments Covered | By Component (Tools, Services), By Business Application (Claims Management, Risk Management, Fraud Detection and Prevention, Process Optimization, Customer Management and Personalization), By Deployment Mode (On-Premise, Cloud), By End-User (Insurance Companies, Government Agencies, Third-Party Administrators, Brokers and Consultancies), By Insurance Line (Life and Health, Property and Casualty, Auto, Specialty Lines), By Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)) |