Table of Contents

Introduction

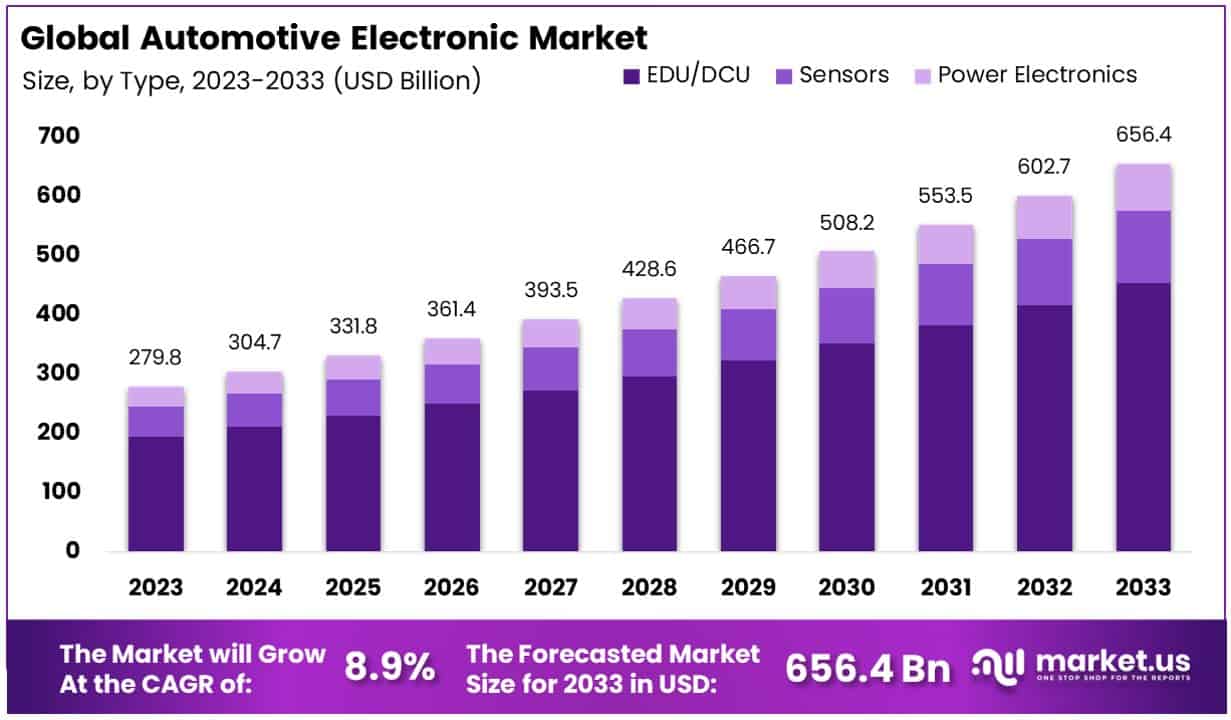

The Global Automotive Electronics Market is projected to reach a valuation of approximately USD 656.4 billion by 2033, up from an estimated USD 279.81 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 8.90% over the forecast period from 2024 to 2033.

Automotive electronics refer to the integration of advanced electronic systems and technologies in vehicles to enhance functionality, safety, comfort, and connectivity. These systems include engine control units (ECUs), advanced driver assistance systems (ADAS), infotainment systems, electronic control for braking and stability, telematics, and more. As vehicles become increasingly connected and automated, automotive electronics serve as the backbone of modern automotive innovations, driving the transition towards smarter, safer, and more energy-efficient mobility solutions.

The automotive electronics market represents the global industry focused on the design, production, and sale of electronic systems used in vehicles. This market encompasses a wide range of components, including sensors, microcontrollers, power electronics, and software systems. It caters to both passenger and commercial vehicles, addressing applications such as autonomous driving, electrification, infotainment, and vehicle-to-everything (V2X) communication. The market is a critical driver of the automotive sector’s evolution, shaping the future of transportation with innovation-led advancements.

The growth of the automotive electronics market is fueled by several interconnected factors. Chief among them is the increasing adoption of electric vehicles (EVs), which rely heavily on sophisticated power management and battery control systems. Moreover, regulatory mandates emphasizing vehicle safety and emission reductions have spurred the integration of advanced technologies such as ADAS and electronic stability controls.

Consumer demand for enhanced in-car experiences, including seamless connectivity and infotainment, further drives growth. Additionally, investments in autonomous vehicle technologies are accelerating the deployment of high-performance sensors and computing hardware, pushing the boundaries of innovation in automotive electronics.

Demand for automotive electronics is surging as the automotive industry undergoes a paradigm shift toward smarter and more sustainable mobility. The rise of EVs and hybrid vehicles has particularly driven the need for advanced power electronics, while growing consumer expectations for safety and convenience are boosting demand for ADAS, infotainment systems, and connected car solutions. Emerging markets in Asia-Pacific and Latin America are also contributing to this demand, as rising disposable incomes and urbanization lead to greater adoption of modern vehicles equipped with electronic systems.

The automotive electronics market presents a wealth of opportunities driven by technological innovation and evolving consumer needs. The rapid electrification of vehicles, supported by government incentives and investments in EV charging infrastructure, offers growth potential for battery management systems and power electronics. The ongoing development of autonomous vehicles represents a significant opportunity for advanced sensors, artificial intelligence (AI)-powered control units, and real-time data processing systems.

Furthermore, the proliferation of IoT and 5G technologies is opening up avenues for connected car solutions and over-the-air (OTA) software updates, enabling manufacturers to deliver a personalized and seamless driving experience. Companies that can innovate and adapt to these trends are well-positioned to capitalize on the expanding automotive electronics landscape.

Key Takeaways

- The automotive electronics market, projected to reach USD 656.4 billion by 2033, is growing at a strong CAGR of 8.90%, much like a rapidly accelerating engine driving the industry forward.

- Electronic and Domain Control Units dominate with 69.3% of the type segment, akin to the central nervous system orchestrating all vehicle functions.

- Powertrain systems, with a 32.9% market share, serve as the beating heart of the industry, powering the transition to electric and hybrid vehicles.

- Passenger cars, commanding 74.6% of the market, lead like the front car of a high-speed train, pulling the entire automotive sector forward.

- Electric and hybrid vehicles, capturing 78.4% of the propulsion segment, are the vanguard of sustainable mobility, blazing a green trail for the future.

- OEMs, accounting for 60.9% of sales, are the foundation stones of vehicle innovation, ensuring seamless integration of advanced systems during manufacturing.

- The aftermarket segment is a reliable support system, like a skilled mechanic extending a vehicle’s functionality and lifecycle.

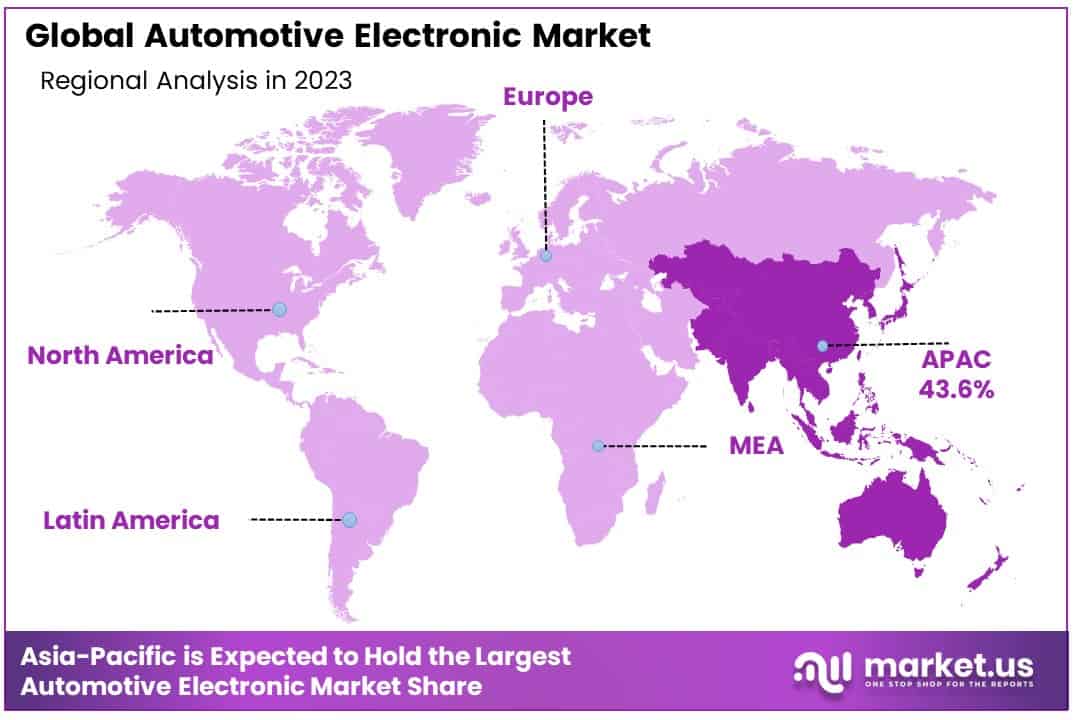

- Asia-Pacific, with a dominant 43.6% market share, acts as the powerhouse of global automotive electronics, driving growth with innovation and production strength.

Automotive Electronics Statistics

- Smaller car tire brands increased their global market share from 29% to 33%.

- Electric vehicles (EVs) made up 4% of global vehicle sales in 2023.

- Europe leads in EV adoption after China, with EVs expected to make up over 30% of car sales by 2030.

- The automotive aftermarket is valued at $85 billion, driven by rising vehicle ownership and maintenance.

- U.S. car dealerships generate an average annual revenue of $74 million, with 1-2% as profit.

- There are 1.4 billion vehicles on the road worldwide as of 2023.

- The average U.S. automotive production worker earns $31,000 annually.

- The U.S. car manufacturing market is valued at $104.1 billion in 2023.

- The auto industry contributes 3% to America’s GDP.

- Over half (53%) of vehicle buyers complete their purchases online.

- Global vehicle registrations reached approximately 1.446 billion.

- By 2024, 88.3 million new cars are expected on global roads.

- Over 923,000 Americans work in vehicle and parts manufacturing, and 1.25 million work at dealerships.

- 60% of auto buyers watch product videos before visiting websites or dealerships.

- The consumer electronics market is estimated at $1.2 trillion globally.

- China accounts for 42% of the global electronics industry.

- Nearly 46% of consumers are open to replacing personal vehicles with other transport modes by 2030.

- 92% of car buyers research online before purchasing.

- 70% of people are willing to share autonomous shuttles, reducing private vehicle trips by 42%.

- The average U.S. passenger car emits 4.6 metric tons of carbon dioxide annually.

- Automakers use over 14 robots per 100 employees, equal to 1,400 robots per 10,000 workers.

- Global EV sales reached 10.6 million in 2022, a 57% rise from 2021.

- The Vehicle-to-Grid (V2G) market is projected to surpass $5 billion by 2024.

- In 2021, EV adoption helped avoid over 40 million tonnes of greenhouse gas emissions.

- By 2030, EVs will represent more than 30% of global vehicle sales.

- The global EV market is valued at approximately $250 billion.

- Over 10 million EVs are currently on the roads worldwide.

- More than 6 million plug-in EVs are sold each year.

- EV sales in the U.S. are expected to grow by 80%.

- Europe aims to reduce greenhouse gas emissions by 40% by 2040 and achieve net zero by 2050.

- The Asia-Pacific EV market is estimated to be worth $123.4 billion.

- Battery Electric Vehicles (BEVs) are expected to generate 67% of the total EV revenue.

- Passenger cars are projected to contribute 62% of revenue in the EV segment.

Emerging Trends

- Rise of Advanced Driver Assistance Systems (ADAS): Automotive electronics are increasingly focused on safety features such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking. The global ADAS market is projected to grow significantly, driven by safety regulations and the increasing adoption of Level 2 and Level 3 autonomous systems.

- Shift Toward Electric Vehicles (EVs): As EV adoption grows, automotive electronics are being tailored to support efficient battery management systems (BMS), regenerative braking, and advanced power electronics. It is estimated that EVs could account for over 40% of new car sales globally by 2030, driving demand for electronic components.

- Connected Vehicle Ecosystems: Automotive electronics now play a key role in vehicle-to-everything (V2X) communication, enabling vehicles to interact with each other, infrastructure, and even pedestrians. This technology underpins the growth of smart city initiatives and is expected to improve traffic efficiency and reduce accidents.

- Integration of Artificial Intelligence (AI): AI is enhancing automotive electronics by enabling predictive maintenance, advanced voice recognition, and personalized in-car experiences. AI-powered systems can process massive amounts of sensor data, making vehicles smarter and more intuitive.

- Miniaturization and Power Efficiency: Electronics in vehicles are becoming smaller and more efficient to support compact designs and optimize energy consumption. Technologies such as gallium nitride (GaN) and silicon carbide (SiC) are being widely adopted in automotive power systems to improve efficiency by up to 20%.

Top Use Cases

- Battery Management Systems (BMS) in EVs: A BMS monitors battery health, prevents overcharging, and optimizes energy use in electric vehicles. These systems are essential for maintaining battery life, reducing thermal risks, and enabling extended driving ranges of up to 400–500 km per charge.

- Infotainment and Smart Cockpits: Automotive electronics power in-car entertainment systems, offering touchscreens, voice control, and real-time navigation. As of 2024, nearly 70% of new vehicles come equipped with smart infotainment systems, enhancing driver experience and passenger comfort.

- Autonomous Driving Features: Electronics facilitate radar, LIDAR, and cameras for self-driving systems, enabling tasks like parking assistance and highway autopilot. For instance, Tesla’s Autopilot and similar systems rely heavily on advanced electronic sensors and processors.

- Vehicle-to-Infrastructure (V2I) Communication: Electronics enable vehicles to communicate with road infrastructure, such as traffic signals and toll systems, improving traffic management and reducing congestion. Studies suggest that V2I can reduce travel delays by up to 30%.

- Over-the-Air (OTA) Updates: Automotive electronics support OTA software updates, allowing manufacturers to fix bugs, enhance performance, and roll out new features remotely. This reduces the need for in-person servicing and enhances user satisfaction.

Major Challenges

- Chip Shortages and Supply Chain Disruptions: The global semiconductor shortage continues to impact automotive electronics production, delaying vehicle deliveries and increasing costs. In 2021 alone, the shortage led to a production loss of over 7 million vehicles worldwide.

- High Development Costs: Designing and integrating advanced electronics, such as ADAS and AI systems, involve significant R&D investments, which can inflate vehicle prices and limit affordability for middle-income consumers.

- Cybersecurity Risks: As cars become more connected, they are increasingly vulnerable to hacking and data breaches. Research indicates that cyberattacks on connected vehicles increased by over 300% between 2018 and 2022, raising concerns about passenger safety and data privacy.

- Complexity of Standards and Regulations: The lack of uniform global standards for automotive electronics makes it challenging for manufacturers to scale their innovations. For instance, ADAS features may comply with regulations in Europe but fail to meet requirements in the U.S. or Asia.

- Thermal Management Issues: High-performance automotive electronics generate significant heat, which can affect system reliability and longevity. Thermal management systems add to the complexity and cost of vehicle electronics, particularly in EVs and autonomous vehicles.

Top Opportunities

- Expanding EV Adoption: With governments around the world pledging to phase out internal combustion engines (ICEs) by 2035 or earlier, the demand for EV-specific electronics, including power inverters, charging controllers, and battery management systems, is expected to skyrocket.

- Growth of 5G-Enabled Vehicles: The rollout of 5G networks provides a significant opportunity for connected car technologies, enabling ultra-fast data exchange for real-time navigation, video streaming, and V2X communication. By 2028, over 75% of new cars are expected to be 5G-enabled.

- Aftermarket Electronics Segment: The aftermarket for automotive electronics, such as advanced infotainment systems, dashcams, and parking sensors, is growing rapidly. This sector provides opportunities to tap into consumer demand for upgrading existing vehicles.

- AI and Machine Learning Integration: Opportunities exist in leveraging AI to enhance automotive safety, predict vehicle maintenance needs, and enable self-learning autonomous driving systems. By 2030, AI-driven cars could account for 20–25% of all vehicles on the road.

- Recycling and Sustainability: With a growing focus on sustainability, the demand for recyclable and energy-efficient automotive electronics is rising. Manufacturers can capitalize on this trend by developing eco-friendly components and circular economy models.

Key Player Analysis

- Robert Bosch GmbH: Robert Bosch GmbH is a dominant player in the automotive electronics sector, with significant investments in ADAS (Advanced Driver Assistance Systems) and electrification solutions. In 2023, Bosch reported €88.2 billion in sales, with the Mobility Solutions segment contributing €56 billion, highlighting its focus on automotive technology. The company continues to lead innovations in EV powertrains, smart sensors, and IoT-connected automotive systems.

- Denso Corporation: Denso Corporation is a leading Japanese company specializing in automotive semiconductors, thermal systems, and electrification solutions. In FY 2023, Denso recorded revenue of ¥6.4 trillion ($44 billion), with 92% of sales attributed to automotive applications. The company has been focusing on solid-state battery technology and EV components, aligning with global EV market expansion.

- ZF Friedrichshafen AG: ZF Friedrichshafen AG is known for its cutting-edge driveline, chassis, and safety systems. In 2023, the company achieved €43.8 billion in revenue, with its electrification and autonomous driving divisions contributing significantly. ZF’s advanced eAxle solutions and radar-based safety systems position it as a frontrunner in next-generation automotive electronics.

- Continental AG: Continental AG, a German powerhouse, focuses on intelligent connectivity, radar systems, and digital cockpit solutions. The company reported revenue of €42.2 billion in 2023, with its Automotive Technologies segment contributing €20 billion. Its innovations in autonomous driving and software-defined vehicle platforms underscore its growing influence in automotive electronics.

- Nvidia Corporation: Nvidia Corporation has emerged as a key player in automotive electronics, particularly in the development of AI-based platforms for autonomous vehicles. Nvidia’s automotive segment generated $1.6 billion in revenue in FY 2023, reflecting a 60% year-over-year growth. The company’s DRIVE platform is widely adopted for advanced autonomous systems, cementing its leadership in automotive AI.

Future Outlook of the Automotive Electronics Industry

The future of the automotive electronics industry is poised for transformative growth, driven by advancements in electric vehicles (EVs), autonomous driving technologies, and connectivity solutions. Key players are heavily investing in R&D to innovate advanced driver-assistance systems (ADAS), battery management systems (BMS), and in-car infotainment solutions. For instance, global EV sales surged to over 10 million units in 2022, highlighting the demand for sophisticated electronics.

Recent funding highlights include Qualcomm’s $100 million investment in automotive AI solutions and Bosch’s commitment of €3 billion toward semiconductor production for vehicles by 2026. Strategic deals are also shaping the market, such as Samsung’s partnership with Hyundai to develop next-gen EV components. Additionally, the industry is benefiting from government support, with the U.S. earmarking $7.5 billion for EV infrastructure under the Bipartisan Infrastructure Law. These trends underscore a robust trajectory for automotive electronics, driven by innovation, sustainability, and smart mobility demands.

Asia-Pacific Automotive Electronics Market

Asia-Pacific emerged as the dominant region in the global automotive electronics market in 2023, commanding the largest market share at 35.6%, with a valuation of USD 43.6 billion. The region’s leadership is attributed to several factors, including the rapid expansion of the automotive sector in countries such as China, Japan, South Korea, and India, which collectively serve as key automotive manufacturing hubs. Favorable government policies promoting electric vehicles (EVs) and advanced driver-assistance systems (ADAS), coupled with significant investments in automotive R&D, have accelerated the adoption of cutting-edge electronic components.

China alone accounts for a substantial portion of the market due to its robust automotive manufacturing infrastructure and its focus on electrification and intelligent mobility solutions. Moreover, rising consumer demand for connectivity features, infotainment systems, and energy-efficient technologies has further propelled market growth in the region. With a strong supply chain network and an increasing number of domestic and global manufacturers, Asia-Pacific is expected to maintain its leadership position in the automotive electronics market over the coming years.

Recent Developments

- In 2023, Diodes Incorporated (Nasdaq: DIOD) introduced the AH371xQ series of high-voltage Hall-effect latches for automotive applications. These devices feature a proprietary Hall plate design for enhanced performance, supporting BLDC motor control, valve operation, and position sensing. The series is tailored for in-vehicle functions like power windows, sunroofs, seat adjustment motors, and cooling fans.

- In May 2024, Continental showcased its cross-domain High-Performance Computer (HPC) integrated with cockpit and driving safety functions in a vehicle. Using the CAEdge framework and Qualcomm’s Snapdragon Ride™ Flex SoC, this innovation demonstrates the potential of Software-defined Vehicles (SDVs) by integrating cloud-based technology for enhanced safety and functionality.

- In 2023, NXP® Semiconductors and Hon Hai Technology Group (“Foxconn”) launched a joint lab at Foxconn’s Nankan Facility in Taiwan to advance software-defined electric vehicles. The collaboration uses NXP’s S32G and S32K3 controllers for service-oriented gateways, vehicle networking, and safe control systems, accelerating the development of EV platforms.

- In 2024, Qualcomm Technologies, Inc. and Google announced a multi-year partnership to develop generative AI-enabled automotive solutions. Leveraging Snapdragon Digital Chassis™, Android Automotive OS, and Google Cloud, the collaboration will create AI-powered in-car experiences, such as voice assistants and immersive navigation, using Qualcomm’s advanced AI systems and Google’s expertise in AI models.

- In February 2024, HARMAN unveiled its latest automotive connectivity solutions at Mobile World Congress. Products like the Ready Connect 5G Telematics Control Unit deliver cost-effective, high-performance connectivity options for automakers while enhancing consumer-grade in-car experiences with automotive-grade reliability.

- In November 2024, Stellantis N.V. and Infineon Technologies AG announced their partnership to design power architectures for Stellantis’ electric vehicles. This collaboration aligns with Stellantis’ mission to provide clean, affordable, and safe mobility through innovative electrification technologies.

Conclusion

The automotive electronics market is set to play a transformative role in reshaping the future of mobility, driven by advancements in electrification, connectivity, automation, and consumer-centric technologies. As the automotive industry continues its shift toward sustainability and smarter vehicles, the integration of advanced electronics will be pivotal in enhancing safety, efficiency, and user experience. However, the industry must address challenges such as supply chain disruptions, cybersecurity risks, and high development costs to fully unlock its potential.

With growing demand across both developed and emerging markets, the sector holds immense opportunities for innovation in areas like autonomous systems, EV power management, and connected vehicle ecosystems. By aligning with evolving consumer preferences and regulatory mandates, the automotive electronics market is well-positioned to define the next era of transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)