Table of Contents

Introduction

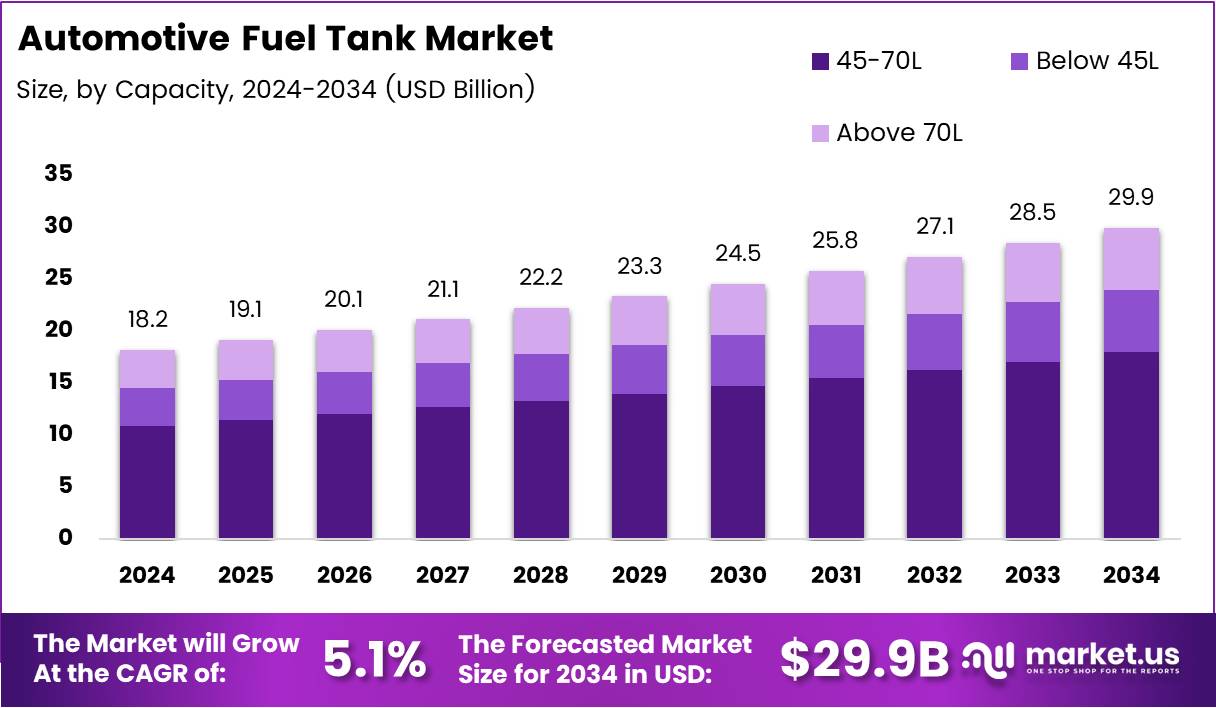

The Global Automotive Fuel Tank Market is projected to reach USD 29.9 Billion by 2034, up from USD 18.2 Billion in 2024, registering a steady CAGR of 5.1% between 2025 and 2034. The market’s expansion reflects the continued dominance of internal combustion engines and the growing focus on fuel efficiency across vehicle segments.

As manufacturers strive to enhance vehicle performance, the adoption of lightweight and durable materials for fuel tanks is rising sharply. Transitioning from metal to plastic and composite tanks, automakers are improving safety, reducing weight, and meeting strict emission norms worldwide.

Additionally, the demand for mid-range fuel capacities and durable storage systems is escalating, particularly in passenger cars and light commercial vehicles. With the surge in global vehicle production and replacement requirements, the automotive fuel tank market is positioned for sustained growth.

Key Takeaways

– The global market is expected to reach USD 29.9 Billion by 2034, growing at a CAGR of 5.1% from 2025 to 2034.

– The 45-70L capacity segment leads with a share of 55.7% in 2024.

– Plastic fuel tanks dominate due to their lightweight, corrosion-resistant, and cost-effective nature.

– Passenger cars hold the largest market share in 2024.

– OEMs lead the sales channel segment with the highest market contribution.

– The Asia Pacific region dominates with 45.8% share, valued at USD 8.3 Billion.

Market Segmentation Overview

The Capacity Segment is led by the 45-70L range, which accounts for 55.7% in 2024. This range meets the balance between efficiency and range, especially for mid-sized vehicles used across cities and highways, thereby ensuring optimum fuel management and driving comfort.

By Material, plastic continues to dominate due to its lightweight design, corrosion resistance, and manufacturing flexibility. It remains the preferred choice for automakers seeking performance and cost efficiency. Aluminium and steel, while durable, occupy smaller shares due to higher costs and weight.

In terms of Vehicle Type, passenger cars contribute the most to fuel tank demand in 2024. Rapid urbanization, rising disposable incomes, and the increasing need for personal mobility continue to strengthen this segment, while light and heavy commercial vehicles provide secondary growth.

By Sales Channel, OEMs maintain their dominance through direct supply integration during vehicle assembly. Their partnerships with automakers ensure consistent demand, while the aftermarket supports replacement needs, repair, and customization.

Drivers

One of the key drivers is the rising demand for fuel-efficient vehicles. Manufacturers are designing advanced fuel tanks that enhance energy storage and optimize distribution, meeting stringent emission regulations. The focus on lowering fuel consumption supports this ongoing transformation.

Another driver is the adoption of lightweight materials and safety innovations. With global emission norms tightening, the automotive industry is transitioning from steel to plastic and composite fuel tanks. This shift reduces vehicle weight and improves both safety and performance under various operating conditions.

Use Cases

Fuel tanks play an integral role in passenger vehicles, ensuring safe and efficient fuel storage for millions of cars worldwide. Their design flexibility allows manufacturers to optimize space and improve aerodynamics without compromising safety.

In commercial vehicles, fuel tanks provide the durability and higher capacity needed for long-haul operations. These tanks help businesses minimize downtime and refueling frequency, supporting cost-efficient logistics operations.

Major Challenges

The market faces challenges such as high production costs of advanced materials like composites and aluminum. Although these materials improve performance, their expensive manufacturing processes limit large-scale adoption, especially in price-sensitive markets.

Additionally, volatility in fuel prices poses uncertainty for both consumers and automakers. Frequent price fluctuations affect fuel consumption patterns and delay investments in new tank technologies, hindering predictable market expansion.

Business Opportunities

A key business opportunity lies in the development of composite and hydrogen-compatible tanks. As the automotive industry embraces hybrid and hydrogen vehicles, manufacturers have the chance to innovate next-generation tanks for alternative fuels.

Emerging economies such as India, Brazil, and Indonesia also present untapped growth potential. Rapid vehicle ownership growth and the expansion of local manufacturing facilities are expected to boost regional demand for cost-effective and durable fuel tanks.

Regional Analysis

The Asia Pacific region dominates the global automotive fuel tank market with a share of 45.8%, valued at USD 8.3 Billion. Countries like China, Japan, and India lead due to their high vehicle production and growing preference for eco-friendly, fuel-efficient vehicles.

In North America and Europe, strong automotive innovation and strict emission norms propel demand for advanced fuel tanks. Manufacturers are focusing on sustainable designs, lightweight materials, and advanced safety technologies to align with regulatory mandates.

Recent Developments

– In June 2024, VOC Automotive secured INR 1.5 crore funding from Corporate Warranty India to expand its two-wheeler service ecosystem.

– In March 2024, Attron Automotive raised Rs 4.75 crore in seed funding led by Venture Catalysts and Anicut Capital, supporting the development of advanced EV motor and controller solutions.

– In March 2024, Attron Automotive announced further investments to strengthen its electric vehicle technologies and enhance its market footprint.

Conclusion

The Automotive Fuel Tank Market is entering a transformative phase driven by sustainability, safety, and innovation. As manufacturers continue to innovate with lightweight materials and intelligent fuel management systems, the market will remain integral to the global automotive ecosystem. The shift toward hybrid and alternative fuel vehicles ensures continued relevance and new growth avenues for fuel tank suppliers worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)