Table of Contents

Introduction

Automotive Sensors Statistics: Automotive sensors are miniature yet powerful components that drive the evolution of the modern automotive industry.

They serve as the vehicle’s sensory organs, constantly collecting and transmitting data to optimize performance, safety, and efficiency.

These sensors are strategically positioned throughout the vehicle, measuring parameters. Like temperature, pressure, speed, and emissions, and are integral to the functioning of critical systems.

From enhancing engine performance and emissions control to enabling advanced driver-assistance features. Automotive sensors are at the heart of innovation in the automotive sector.

They are pivotal in achieving goals such as increased fuel efficiency, reduced emissions, and enhanced safety. Making them indispensable components in creating smarter and more connected vehicles.

Editor’s Choice

- The automotive sensors market has demonstrated robust growth at a CAGR of 10.1%.

- The automotive sensors market accounted for $21.0 billion in 2022.

- The Asia-Pacific (APAC) region stands out prominently. Commanding the largest market share at 46.80%, reflecting its robust presence and growth potential.

- Robert Bosch GmbH leads the pack with a significant market share of 16%. Followed closely by DENSO Corporation, holding a substantial share of 14%.

- With the increasing amount of time spent at home. There’s an escalating demand for smart devices, and the IoT sector is on an upward trajectory. With expectations of IoT device sensors reaching $43 billion by 2025.

- In 2023, the world witnessed a 16% rise in the quantity of interconnected IoT (Internet of Things) devices, reaching a total of 16.7 billion devices.

- The McKinsey Institute anticipates robust annual growth of around 30 percent in Level 2 advanced driver assistance systems (ADAS) until 2025. Primarily due to regulatory mandates mandating the inclusion of these sensors in new vehicles.

- The anticipated evolution of proximity sensors in vehicles is substantial. With an increase from four types in a vehicle to nine by the year 2040.

Types of Automotive Sensors Statistics

Temperature Sensors

- From 2016 to 2022, the temperature sensors market has seen consistent revenue growth.

- In 2016, the market generated approximately $5.13 billion, which gradually increased over the years.

- By 2017, revenue reached $5.4 billion, followed by $5.6 billion in 2018, $5.9 billion in 2019, and $6.2 billion in 2020.

- The momentum continued into 2021, with revenue reaching $6.5 billion and further expanded to $6.79 billion in 2022.

- This steady upward trend reflects the growing importance of temperature sensors in various industries. Including automotive, healthcare, and industrial automation, where precise temperature monitoring is vital.

- The market’s consistent growth highlights its integral role in an increasingly interconnected and data-driven world.

(Source: Statista)

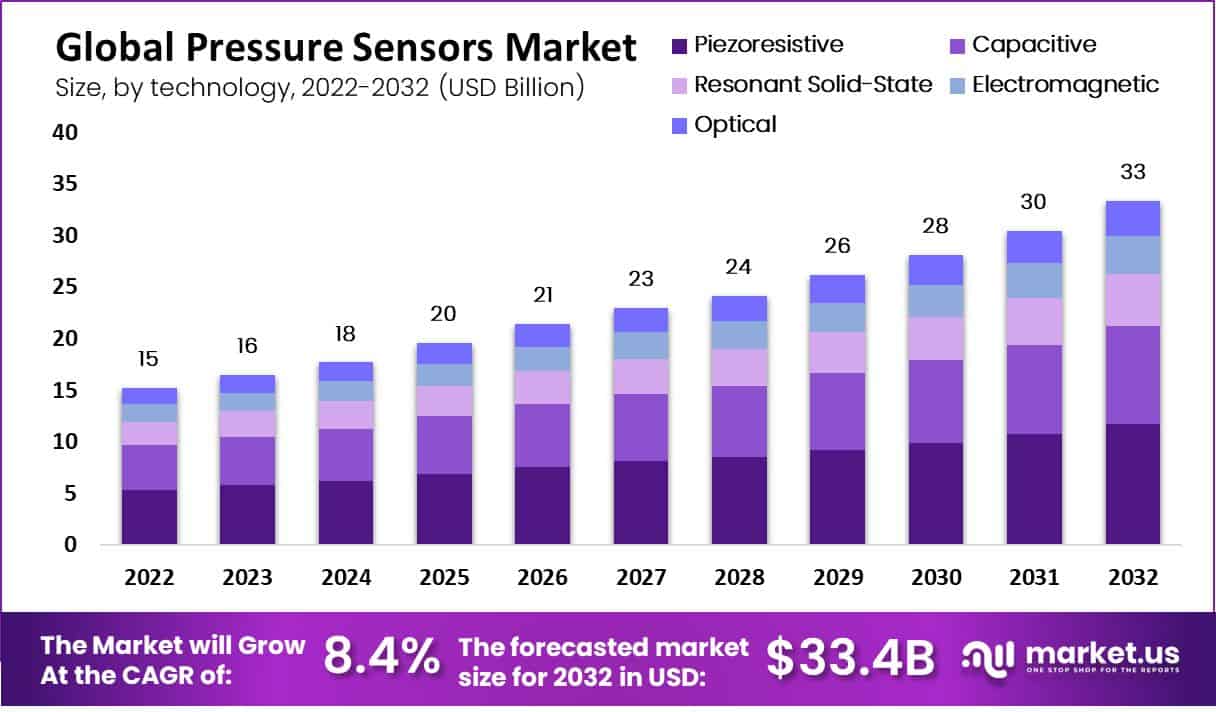

Pressure Sensors

- The revenue generated by the pressure sensors market is on a continuous upward trajectory, demonstrating substantial growth at a CAGR of 8.4%.

- In 2022, the market’s revenue was $15 billion, projected to climb to $16 billion in 2023.

- The market’s expansion further accelerates in the subsequent years. With revenue reaching $18 billion in 2024, $20 billion in 2025, and $21 billion in 2026.

- The trend of steady growth continues throughout the forecast period. With revenue estimates reaching $23 billion in 2027, $24 billion in 2028, $26 billion in 2029, $28 billion in 2030, $30 billion in 2031, and $33 billion in 2032.

- This robust growth underscores the increasing demand for pressure sensors in numerous industries. Including manufacturing, automotive, and healthcare, where they play a pivotal role in ensuring safety, precision, and control in various applications.

- The pressure sensors market is poised for substantial expansion and innovation, reflecting its crucial role in an ever-evolving technological landscape.

(Source: Market.us)

Speed Sensors

- The global market for speed sensors grew, increasing from $8.72 billion in 2022 to $9.41 billion in 2023, with a growth rate of 7.9%.

- Nevertheless, the ongoing conflict between Russia and Ukraine has disrupted hopes for a rapid global economic rebound from the COVID-19 pandemic.

- This conflict has led to economic sanctions, surging commodity prices, supply chain disruptions, and inflation, affecting global markets.

- Projections indicate that the speed sensor market is set to achieve $12.53 billion in 2027. Driven by a compound annual growth rate of 7.4%.

- In 2022, the Asia-Pacific region dominated this market.

- For recent developments, in 2020, the German technology company Robert Bosch LLC introduced advanced wheel speed sensors and other electronics solutions for driver-assistance systems. Enhancing the accuracy and accessibility of data for approximately 230 ADAS and electronics components.

(Source: Report Linker)

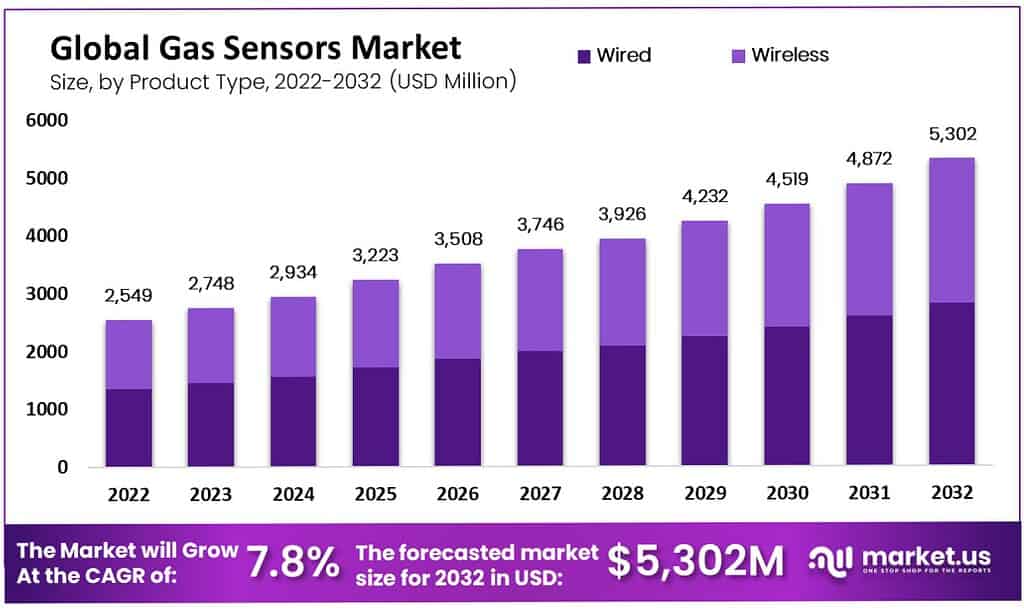

Gas Sensors

- The revenue of the gas sensors market has demonstrated a consistent upward trend. Starting at $2,549 million in 2022 and increasing annually.

- In 2023 the market revenue climbed to $2,748 million, followed by $2,934 million in 2024.

- The growth trajectory continued with revenue figures of $3,223 million in 2025, $3,508 million in 2026, and $3,746 million in 2027.

- The upward momentum persisted, with revenue reaching $3,926 million in 2028, $4,232 million in 2029, and $4,519 million in 2030.

- The market is projected to expand, with revenue anticipated to reach $4,872 million in 2031 and $5,302 million in 2032.

- This data illustrates the increasing significance of gas sensors in various industries, including environmental monitoring, industrial safety, and healthcare. It highlights their crucial role in ensuring safety and controlling air quality in an ever-evolving technological landscape.

(Source: Market.us)

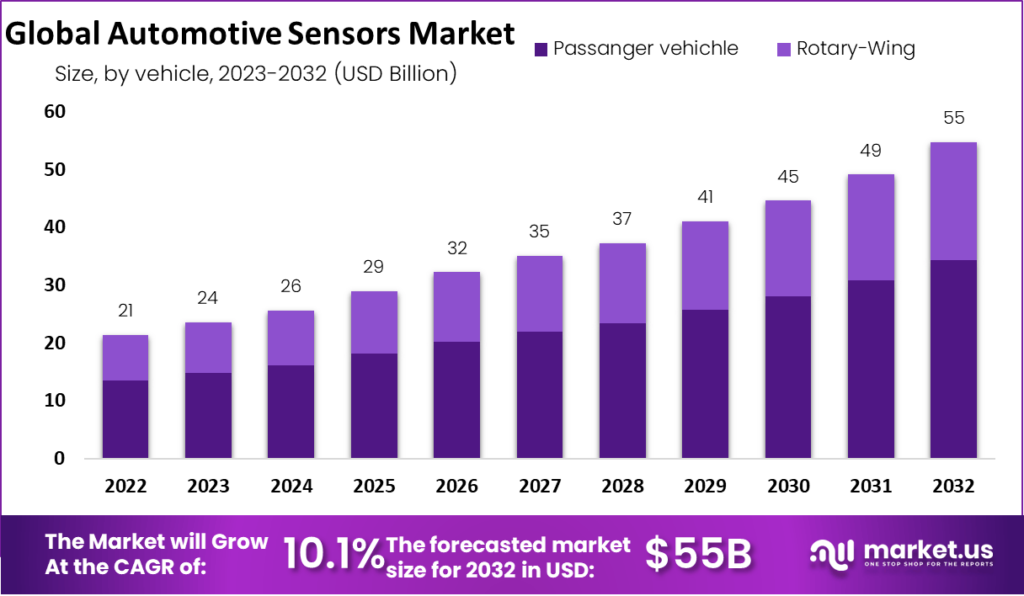

Global Automotive Sensors Market Size Statistics

- The automotive sensors market has demonstrated robust growth at a CAGR of 10.1%.

- Commencing at $21.0 billion in 2022, the market consistently advanced year by year.

- By 2023, market revenue had surged to $24.0 billion, followed by $26.0 billion in 2024.

- The momentum persisted, with revenues of $29.0 billion in 2025, $32.0 billion in 2026, and $35.0 billion in 2027.

- This upward trajectory continued, reaching $37.0 billion in 2028, $41.0 billion in 2029, and $45.0 billion in 2030.

- The market is expected to maintain its expansion, projecting revenues of $49.0 billion in 2031 and $55.0 billion in 2032.

- These figures underscore the growing significance of automotive sensors in the automotive sector, reflecting their pivotal role in driving advancements. In vehicle performance, safety, and connectivity within an ever-evolving technological landscape.

(Source: Market.us)

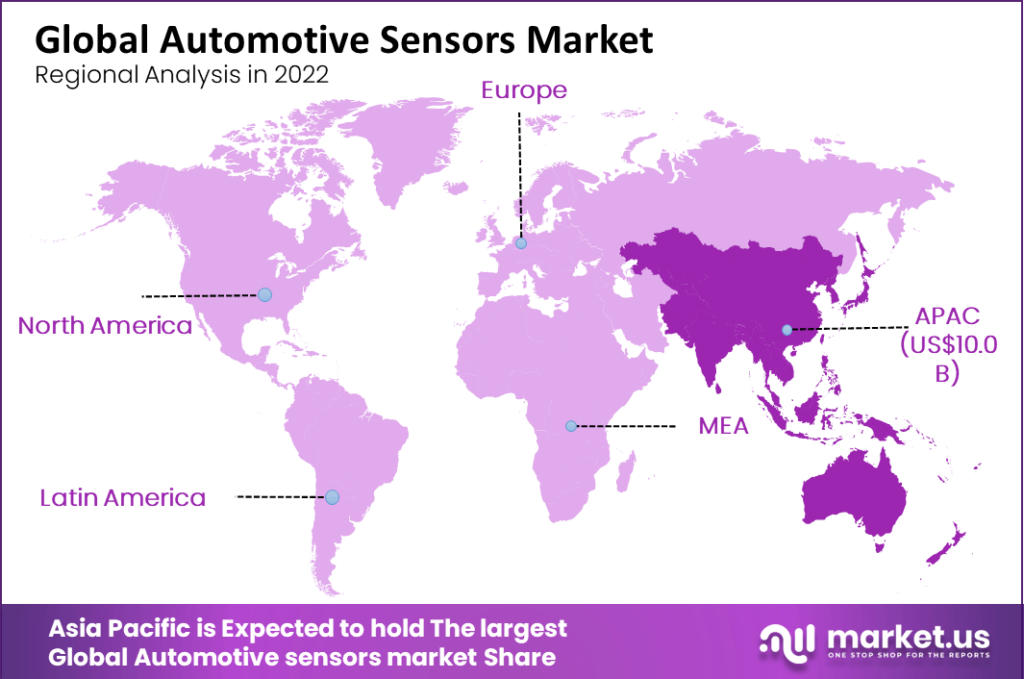

Regional Analysis of Automotive Sensors Market Statistics

- The regional analysis of the automotive sensors market reveals a diverse market share distribution across different regions.

- It accounts for approximately 17.80% of the market in North America, signifying a significant presence in this region. Europe follows closely, holding a substantial share of 24.40%.

- However, the Asia-Pacific (APAC) region stands out prominently, commanding the largest market share at 46.80%. Reflecting its robust presence and growth potential.

- Latin America holds a smaller yet notable portion of the market at 6.86%. While the Middle East and Africa (MEA) region contributes 4.10% to the market share.

- This regional breakdown highlights the dynamic nature of the automotive sensors market, with APAC as a dominant force.

- At the same time, North America and Europe also play substantial roles in this evolving landscape.

(Source: Market.us)

Key Players in Automotive Sensors Market Statistics

- A diverse array of key players marks the automotive sensors market, each contributing to its dynamic landscape.

- Robert Bosch GmbH leads the pack with a significant market share of 16%. Followed closely by DENSO Corporation, holding a substantial share of 14%.

- Infineon Technologies AG and NXP Semiconductor contribute 7% and 10% of the market, underlining their noteworthy positions.

- ST Microelectronics and Valeo each account for 9% of the market share. While Continental AG shares 8% of the market with Valeo.

- Sensata Technologies also plays a prominent role, with a 9% market share.

- Additionally, other key players collectively make up 19% of the market. Indicating the presence of a range of significant players shaping the industry.

- This diverse array of key players highlights the competitiveness and innovation in the automotive sensors market, each contributing to its continued growth and advancement.

(Source: Market.us)

Technological Advancements

Adoption of MEMS Sensors by Automotive Sensors Statistics

- The MEMS sensor market is projected to achieve a value of $75 billion from 2022 to 2032.

- The growing prevalence of electronic devices, coupled with the lightweight and energy-efficient nature of MEMS sensors, has made them a favored choice among consumers.

- Moreover, integrating MEMS sensors into the Internet of Things (IoT) ecosystem is streamlining and simplifying our daily lives.

- With the increasing amount of time spent at home, there’s an escalating demand for smart devices. The IoT sector is on an upward trajectory, with expectations of IoT device sensors reaching $43 billion by 2025.

- MEMS sensors come in various types, including mechanical, optical, and chemical & biological sensors.

- Optical sensors, particularly those aligned with the expanding use of fiber optics, have gained substantial popularity.

- North America and the Asia-Pacific region are focal points for the growth of the MEMS sensor market.

- North America benefits from a thriving consumer electronics industry, while the Asia-Pacific region is embracing eco-friendly electronics and renewable energy solutions, contributing to the surging demand for MEMS sensors.

IoT Connections by Automotive Sensors Statistics

- In 2023, the world witnessed a 16% rise in the quantity of interconnected IoT (Internet of Things) devices, reaching a total of 16.7 billion devices.

- This upward trend is anticipated to persist, with forecasts indicating that by 2027. The global count of IoT connections will exceed 29 billion.

- China has emerged as a prominent contender in the IoT device market, with substantial expansion in cellular IoT connections.

- Among all IoT connections, Wi-Fi constitutes 31%, with the incorporation of advanced Wi-Fi 6 and Wi-Fi 6E technologies leading to more effective communication among IoT devices, particularly in smart homes, buildings, and healthcare.

- Bluetooth accounts for 27% of worldwide IoT connections.

- Bluetooth Low Energy (BLE) is preferred for IoT devices powered by batteries, such as smart home sensors and asset trackers.

- Cellular IoT, encompasses technologies like 2G, 3 G, 4G, 5G, LTE-M, and NB-IoT. Contributes to nearly 20% of global IoT connections.

- The adoption of more advanced technologies within cellular IoT, such as LTE-M and NB-IoT, has played a role in its expansion.

(Source: IoT Analytics)

Advanced Driver Assistance Systems (ADAS)

ADAS Market Size by Automotive Sensors Statistics

- The market revenue for the Advanced Driver Assistance Systems Market (ADAS) has demonstrated a remarkable and consistent upward trajectory over the years at a CAGR of 14.00%.

- In 2022, it stood at $33 billion, steadily increasing yearly.

- By 2023, the market revenue had surged to $38 billion, followed by $42 billion in 2024.

- The growth trend persisted, with revenues reaching $50 billion in 2025, $57 billion in 2026, and $64 billion in 2027.

- This upward momentum continued, with revenue figures of $70 billion in 2028, $80 billion in 2029, and $89 billion in 2030.

- The market is anticipated to maintain its robust expansion, projecting revenues of $102 billion in 2031 and $118 billion in 2032.

- These figures underscore the growing importance of ADAS in the automotive industry, reflecting its pivotal role in enhancing safety, driver assistance, and overall vehicle performance in an ever-evolving technological landscape.

(Source: Market.us)

Adoption of (ADAS) by Automotive Sensors Statistics

- The increasing adoption of driver assistance systems and advanced driver assistance (AD) solutions will be driven by evolving consumer preferences, safety-focused regulations that encourage higher levels of autonomous driving, and technological advancements such as the availability of powerful computers, advanced software, and light detection and ranging (LiDAR) sensors.

- To illustrate, the McKinsey Institute anticipates robust annual growth of around 30% in Level 2 advanced driver assistance systems (ADAS) until 2025, primarily due to regulatory mandates mandating the inclusion of these sensors in new vehicles.

- Looking ahead to 2030, the institute estimates suggest that 12% of vehicles will come equipped with Levels 3 and 4 AD capabilities, a substantial increase from the 1% reported in 2025.

(Source: McKinsey)

Energy Use Implications

- The anticipated evolution of proximity sensors in vehicles is substantial, with an increase from four types in a vehicle to nine by the year 2040.

- This expansion translates to a rise in the number of sensors from 17 in 2015 to 32.

- Assuming that the “Types of Proximity Sensor” aligns with the number of sensor systems, and considering the ultrasonic backup sensor system as a representative of advanced driver assistance systems (ADAS), solely the manufacturing and operational energy consumption of ADAS systems contributes 4.0 gigajoules (GJ) to the total energy usage over the lifespan of a 2015 vehicle.

- This figure could potentially increase to 8.9 GJ or even more for a 2040 vehicle, as the number of sensors is expected to grow independently from the types of sensors employed.

- Projected for 2024, automotive sensor sales are set to reach 11 billion units, marking a substantial increase from the 7.5 billion units recorded in 2017.

More Insights

- This growth in sensor demand will result in a corresponding rise in the total energy consumed during the manufacturing phase of automotive sensors, increasing from approximately 1050 petajoules (PJ) in 2017 to 1540 PJ by 2024.

- The expanded use of sensors will also elevate the overall energy consumption during their operational lifetime, increasing from 780 PJ to 1150 PJ.

- It’s worth noting that energy consumption during the operational phase is expected to be higher, particularly as many sensors continually consume energy while the vehicle operates.

- Additionally, the contribution of Gasoline-for-Electricity to the energy used during the operational phase will increase from 0.54 megajoules (MJ) to 106 MJ if the duration of sensor operation extends from 10 seconds per trip to the entirety of each trip, assuming an average trip duration of 20.6 minutes.

- These adjustments would result in total energy consumption for automotive sensors throughout their lifetime of 980 PJ in 2017 and 1440 PJ in 2024.

(Source: U.S. Department of Energy, Office of Scientific and Technical Information)

Recent Developments

Acquisitions and Mergers:

- Bosch acquires SBG Systems: In early 2023, Bosch acquired SBG Systems, a company specializing in inertial sensors and positioning systems, for $450 million. This acquisition aims to enhance Bosch’s capabilities in advanced driver-assistance systems (ADAS) and autonomous driving technologies.

- Sensata Technologies acquires Xirgo Technologies: Sensata Technologies completed its acquisition of Xirgo Technologies, a provider of telematics and data analytics solutions, for $400 million in late 2023. This merger is expected to strengthen Sensata’s portfolio in connected vehicle solutions.

New Product Launches:

- Continental’s Lidar Sensor: In mid-2023, Continental launched its new Lidar sensor, HFL110, designed for autonomous vehicles. This sensor provides high-resolution 3D environmental mapping, enhancing the vehicle’s ability to detect and respond to its surroundings.

- Valeo’s SCALA 3 Lidar: Valeo introduced the SCALA 3 Lidar in early 2024, featuring improved range and accuracy for better object detection and classification, aimed at enhancing safety in autonomous driving applications.

Funding:

- Aptiv raises $500 million: In 2023, Aptiv, a global technology company, secured $500 million in funding to accelerate the development of its next-generation sensor technology for autonomous vehicles and advanced driver-assistance systems.

- Innoviz Technologies secures $250 million: Innoviz Technologies, a leading provider of high-performance solid-state Lidar sensors, raised $250 million in early 2024 to expand its manufacturing capabilities and invest in R&D for automotive sensor innovations.

Technological Advancements:

- AI Integration in Sensors: Advances in AI and machine learning are being integrated into automotive sensors to improve object detection, classification, and decision-making processes in real time, enhancing the safety and efficiency of autonomous driving systems.

- Sensor Fusion: Sensor fusion technology, which combines data from multiple sensors (Lidar, radar, cameras, etc.), is being developed to provide more accurate and reliable environmental perception for autonomous vehicles.

Market Dynamics:

- Growth in Automotive Sensor Market: The global automotive sensor market is projected to grow at a CAGR of 10.2% from 2023 to 2028, driven by increasing demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and autonomous driving technologies.

- Rising Demand for EV Sensors: The rise of electric vehicles is driving demand for specialized sensors that monitor battery performance, manage energy consumption, and ensure safety, contributing to the growth of the automotive sensor market.

Regulatory and Strategic Developments:

- EU’s Euro NCAP 2025 Roadmap: The European New Car Assessment Programme (Euro NCAP) has introduced a 2025 roadmap that includes stringent safety requirements for autonomous and connected vehicles, emphasizing the integration of advanced sensors for crash prevention and occupant protection.

- US Department of Transportation’s AV Policy: The US Department of Transportation released an updated policy for autonomous vehicles in early 2024, highlighting the need for robust sensor technologies to ensure safety and reliability in autonomous driving systems.

Research and Development:

- Advanced Lidar Technology: R&D efforts are focusing on developing next-generation Lidar technology with improved range, resolution, and affordability to make it more accessible for widespread use in autonomous vehicles.

- Smart Sensors for Predictive Maintenance: Researchers are developing smart sensors that can predict maintenance needs by monitoring vehicle components’ health in real time, aiming to reduce downtime and improve vehicle reliability.

Conclusion

Automotive Sensors Statistics – In conclusion, automotive sensors are increasingly vital in the automotive industry, driven by technological advancements and changing consumer preferences.

These sensors are instrumental in improving vehicle performance, safety, and connectivity, resulting in steady market growth and rising revenues.

The adoption of advanced driver assistance systems (ADAS) and the expansion of the Internet of Things (IoT) emphasize the importance of sensors in modern vehicles.

As the automotive landscape evolves, more advanced sensor types and systems will become integral to vehicles, with regulatory priorities shifting towards safety and autonomous driving capabilities.

Looking ahead to 2030 and beyond, the energy consumption and manufacturing processes of sensors will face greater scrutiny, given their increasing integration into vehicles.

Automotive sensors play a pivotal role in shaping the future of the automotive industry, from enhancing safety to enabling more intelligent and efficient vehicles.

FAQs

Automotive sensors detect and measure various physical parameters within a vehicle, such as temperature, pressure, proximity, and motion. They play a crucial role in monitoring and controlling different systems in a vehicle, enhancing safety, efficiency, and performance.

Common automotive sensors include temperature, pressure, proximity, accelerometers, and gyroscopes. These sensors are used for various purposes, from engine performance monitoring to driver assistance systems.

Automotive sensors are integral to safety systems such as anti-lock brakes (ABS), airbags, and electronic stability control (ESC). They provide real-time data about the vehicle’s status and surroundings, enabling these safety features to react promptly in critical situations.

Automotive sensors are a fundamental component of autonomous vehicles. They provide data on the vehicle’s environment, allowing it to make decisions and navigate autonomously. Sensors like LiDAR, radar, and cameras are crucial for perception and situational awareness.

Automotive sensors optimize fuel efficiency by monitoring engine performance, air-fuel mixture, and exhaust emissions. This data adjusts engine parameters, reducing fuel consumption and emissions.