Table of Contents

Introduction

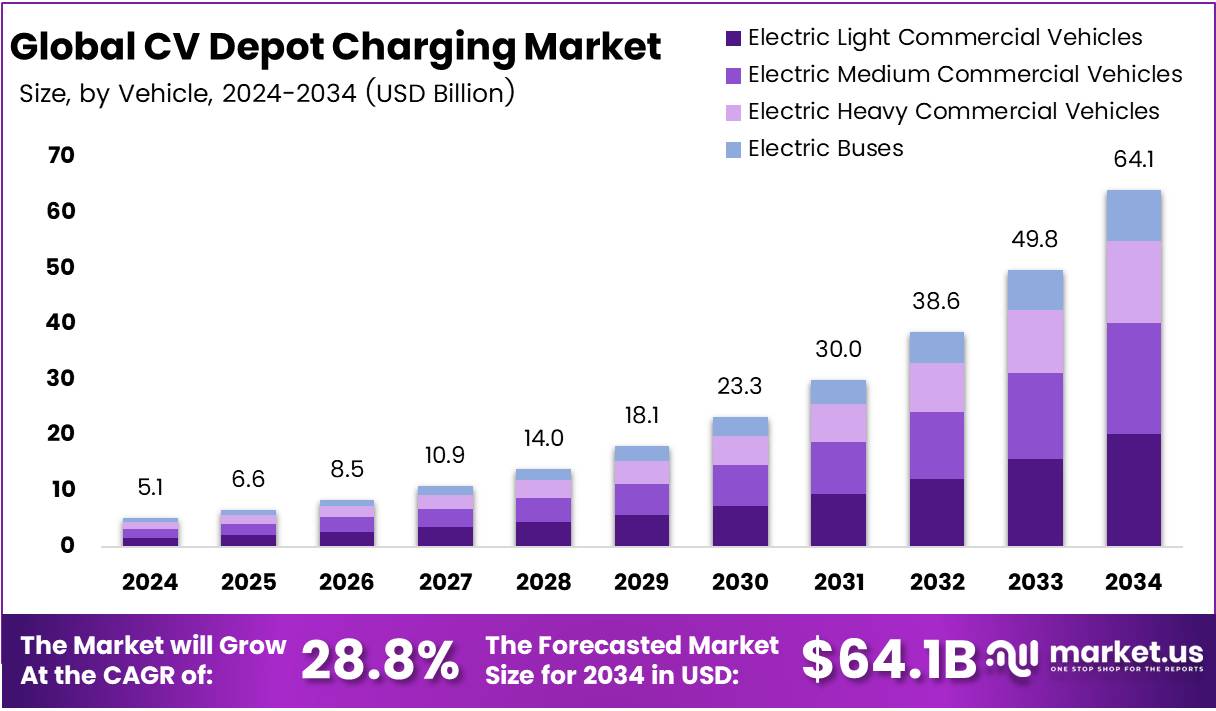

The Global Commercial Vehicle (CV) Depot Charging Market is witnessing substantial growth, driven by the increasing adoption of electric commercial vehicles (EVs) and the rising demand for efficient charging infrastructure. Government policies and regulatory frameworks supporting fleet electrification are playing a significant role in this development. The market for depot charging infrastructure is expected to reach USD 64.1 billion by 2034, up from USD 5.1 billion in 2024, growing at a strong CAGR of 28.8% during the forecast period from 2025 to 2034.

As electrification accelerates, fleet operators worldwide are seeking to implement depot charging solutions to meet sustainability goals, reduce operational costs, and improve fleet efficiency. These solutions offer predictable charging schedules and energy management, optimizing the performance and cost-efficiency of electric commercial vehicles. The growing momentum for electric vehicle adoption, coupled with supportive government policies, is set to drive significant advancements in the depot charging infrastructure market.

Key Takeaways

- The Global CV Depot Charging Market is projected to reach USD 64.1 billion by 2034, growing at a CAGR of 28.8% from USD 5.1 billion in 2024.

- Electric Light Commercial Vehicles (ELCVs) dominate the vehicle segment with a 31.7% share in 2024, driven by urban delivery fleets’ transition to electric vehicles.

- Private Charging Stations accounted for 63.8% of the market share in 2024, offering cost-efficient and reliable charging solutions for fleet operators.

- The 51–150 kW power output segment led the market with a 47.3% share in 2024, offering an optimal balance between fast charging and manageable grid impact.

- North America held the largest regional share of 37.9% in 2024, valued at USD 1.9 billion, driven by government support and widespread fleet electrification.

Market Segmentation Overview

- By Vehicle Type: The market is divided into Electric Light Commercial Vehicles (ELCVs), Electric Medium Commercial Vehicles (EMCVs), Electric Heavy Commercial Vehicles (EHCVs), and Electric Buses (EBuses). ELCVs are expected to dominate, supported by the growing demand for last-mile delivery and urban logistics. EMCVs and EHCVs are also showing increasing adoption as the infrastructure for medium and heavy-duty vehicles improves.

- By Charging Station Type: The market is segmented into private and public charging stations. Private charging stations lead the segment with 63.8% of the market share, offering more control, reliability, and cost efficiency for fleet operators. Public charging stations, although smaller in share, are crucial for long-distance fleet movements and cross-regional operations.

- By Power Output: The power output segmentation includes up to 50 kW, 51-150 kW, and above 150 kW chargers. The 51-150 kW power output category holds the largest share of 47.3%, offering a good balance between charging speed and grid stability.

Drivers

- Expansion of Electric Commercial Fleets: The rapid electrification of heavy-duty commercial fleets is a primary driver for the market. Logistics operators are increasingly turning to electric trucks, buses, and vans to meet stringent emission standards and achieve sustainability goals. This transition is pushing the need for large-scale depot charging infrastructure to support growing electric vehicle fleets.

- Government Support and Regulations: Government policies and incentives are playing a pivotal role in accelerating the adoption of depot charging solutions. With stringent emission regulations in place across Europe, the U.S., and China, governments are investing heavily in charging infrastructure, subsidies for fleet electrification, and grants for establishing charging depots. These incentives are fostering the growth of the CV depot charging market.

Use Cases

- Logistics and Fleet Operations: Logistic companies adopting electric commercial vehicles for last-mile deliveries and urban logistics are key users of depot charging solutions. Fleet operators benefit from reduced operational costs and optimized charging schedules through the installation of private charging stations at their depots.

- Public Transportation: Electric buses are playing an increasingly important role in public transportation electrification. Charging solutions for e-buses are being deployed at centralized depots to support city-wide mass transit systems. Urban policies aimed at improving air quality and reducing emissions are driving the adoption of electric buses, particularly in cities across North America, Europe, and Asia Pacific.

Major Challenges

- Land Acquisition and Real Estate Constraints: One of the major hurdles is acquiring land in urban and industrial zones for large-scale depot infrastructure. In densely populated areas, real estate costs are high, and lengthy approval processes and zoning restrictions often delay the establishment of charging depots.

- Standardization of Charging Technologies: The slow pace of standardization in charging protocols for electric commercial vehicles also poses a challenge. With different manufacturers developing proprietary charging solutions, interoperability issues hinder the scalability of charging networks. This lack of universal standards adds complexity and increases costs for fleet operators.

Business Opportunities

- Integration of Renewable Energy Sources: The integration of solar, wind, and other renewable energy sources into depot charging infrastructure presents a huge opportunity for reducing operational costs and enhancing the sustainability of fleet operations. Energy companies and technology providers are increasingly working together to build sustainable charging depots powered by renewable energy, lowering dependency on the grid.

- Battery Swapping Infrastructure: Battery swapping technology is emerging as a promising solution for commercial fleets. Swapping stations allow quick battery replacements, reducing downtime and increasing fleet efficiency. This model is particularly attractive for high-density fleet operations, such as logistics and public transport.

- Partnerships between OEMs and Charging Infrastructure Providers: OEMs (Original Equipment Manufacturers) and charging infrastructure providers are forming partnerships to accelerate the deployment of depot charging stations. These collaborations facilitate the smooth integration of depot charging into existing energy networks, expanding the market reach and ensuring a seamless transition to electric commercial vehicles.

Regional Analysis

- North America: North America is the dominant region in the CV depot charging market, holding 37.9% of the market share, valued at USD 1.9 billion in 2024. Strong government incentives, infrastructure investment, and the rapid shift towards electric commercial fleets are key factors driving this growth.

- Europe: Europe is expected to see robust growth due to stringent emission regulations and ambitious decarbonization targets set by the European Union. The expansion of charging infrastructure and cross-border electrification projects further supports market penetration.

- Asia Pacific: Asia Pacific is emerging as a high-growth region due to rapid urbanization, government-backed electrification policies, and increasing adoption of electric buses. Countries such as China, India, and Japan are leading the charge with large-scale depot charging initiatives.

- Middle East & Africa: The Middle East and Africa are gradually adopting depot charging solutions, with early-stage adoption in the UAE and South Africa. However, the expansion rate is slower due to grid readiness challenges and investment costs.

- Latin America: Latin America is in the early stages of adopting CV depot charging infrastructure, with Brazil, Mexico, and Chile leading the way. Urban electrification programs and renewable energy integration are encouraging early-stage deployments.

Recent Developments

- In July 2025, Blink Charging acquired Zemetric, Inc., strengthening its position in the EV infrastructure sector.

- In August 2025, VIRTA acquired NORTHE Fleet Management, enhancing its capabilities to offer integrated energy solutions across Europe.

- In September 2024, Siemens merged its eMobility division with Heliox, creating a more agile platform for accelerating EV charging infrastructure development.

- In August 2024, Kazam, an EV charging startup, raised $8 million to support its expansion into urban charging markets.

- In November 2024, Relux Electric secured ₹250 crore in funding to support the scaling of fast-charging infrastructure across South India.

Conclusion

The Global CV Depot Charging Market is poised for substantial growth, driven by the increasing adoption of electric commercial vehicles, government incentives, and advancements in charging infrastructure. As fleet electrification accelerates, the demand for efficient, reliable, and scalable depot charging solutions is expected to rise.

While challenges such as land acquisition and standardization persist, emerging trends like the integration of renewable energy sources and battery swapping infrastructure present significant growth opportunities. With the right investment in technology, partnerships, and government support, the CV depot charging market is set to play a crucial role in the future of sustainable transport.