Table of Contents

- Introduction

- Editor’s Choice

- History, Evolution, and Development of Distributed Antenna Systems

- Global Mobile Data Traffic

- Annual Mobile Monthly Data Usage Worldwide

- Industry Revenue of Antennas of Any Type (Including Parts) For Mobile Phones and Other Communication Devices

- RF Front-end and Connectivity Market Size Worldwide

- Global Distributed Antenna System Market Overview

- Distributed Antenna System (DAS) Sites Worldwide

- DAS Nodes Worldwide

- Key Application Areas

- DAS Antenna Specifications

- Key Investments

- DAS Deployment Challenges and Concerns

- Innovations and Developments in Distributed Antenna Systems Statistics

- Regulations for Distributed Antenna Systems

- Recent Developments

- Conclusion

- FAQs

Introduction

Distributed Antenna System Statistics: A Distributed Antenna System (DAS) is a network of spatially separated antenna nodes connected to a common source that enhances wireless communication within buildings, campuses, or urban areas.

DAS improves coverage and capacity by distributing signals via antenna nodes. Head-end equipment, and cabling, with types including passive, active, and hybrid systems.

Benefits include improved signal strength, increased capacity for simultaneous connections, enhanced user experiences, and scalability for growing demands.

DAS is commonly applied in commercial buildings, stadiums, transportation hubs, and for public safety. However, challenges such as initial costs, complexity of design and deployment, and regulatory compliance can arise.

As wireless demand grows, the adoption of DAS is expected to increase. Making it a crucial component of modern telecommunications infrastructure.

Editor’s Choice

- The global distributed antenna system (DAS) market revenue reached USD 10.4 billion in 2023.

- The competitive landscape of the global distributed antenna system (DAS) market is characterized by the presence of several key players. CommScope Inc. holds the largest market share at 15%.

- The global distributed antenna system (DAS) market is segmented regionally. North America holds the largest market share at 38.0%.

- Further, the American Tower Corporation’s ownership of distributed antenna system (DAS) sites worldwide in 2023 presents a varied landscape across different countries. India leads with the highest number at 763 sites.

- By 2020, Boingo Wireless operated a total of 41.2 thousand DAS nodes Demonstrating a consistent upward trajectory in their DAS operations since 2016.

- The deployment of Distributed Antenna Systems (DAS) faces several challenges, as identified by a survey of industry respondents. The most common challenge faced by 63% of respondents involves working with building or venue owners to secure site access, power, and network connections.

- In deploying Distributed Antenna Systems (DAS), industry stakeholders identify several key barriers. The primary challenge, according to 75% of respondents, is the high deployment cost.

History, Evolution, and Development of Distributed Antenna Systems

- The evolution of Distributed Antenna Systems (DAS) began with DAS 1.0. Which primarily utilized coaxial cable technology to boost signals through simple yet effective methods like bi-directional amplifiers (BDAs).

- This version was mostly limited to single-carrier systems, which were simple in design and function. Predominantly enhancing the signal strength of one specific carrier per installation. As technological needs grew, DAS evolved into DAS 2.0, integrating both coaxial and fiber optic cables. Which allowed for more sophisticated signal distribution and support for multiple carriers.

- This version introduced a mix of components, including converters, couplers, and multiple types of antennas. To enhance signal reception and distribution capabilities across larger and more complex venues.

- The most current version, DAS 3.0, represents a shift towards an all-fiber network. Focusing on high-capacity and high-efficiency systems that are capable of supporting dense wireless communication. Demands such as those needed for IoT applications and 5G networks.

- The core architecture of DAS 3.0 includes advanced head-end electronics and a sophisticated configuration of fiber distribution and remote units.

- Throughout its history, DAS has been pivotal in enhancing wireless coverage in challenging environments such as large buildings, hospitals, and campuses. Ensuring robust connectivity for both everyday use and critical emergency communications.

- Its role continues to be vital in the telecom landscape, adapting to the increasing demands for seamless, high-quality wireless access.

(Source: CallMC, Jordan & Skala Engineers, The Network Installers)

Global Mobile Data Traffic

- Global mobile data traffic has seen a significant increase from 2017 to 2022.

- In 2017, the traffic was 11.51 exabytes per month, which rose to 19.01 exabytes in 2018.

- The following year, 2019, saw a further increase to 28.56 exabytes.

- The growth continued in 2020, with traffic reaching 40.77 exabytes per month.

- By 2021, the figure had escalated to 56.8 exabytes, and in 2022. It reached a high of 77.49 exabytes per month.

- This trend highlights a robust expansion in the volume of mobile data being transmitted globally each year.

(Source: Statista)

Annual Mobile Monthly Data Usage Worldwide

- Worldwide annual mobile data traffic has demonstrated remarkable growth from 2012 to the projected figures for 2029.

- Starting at just 0.6 exabytes per month in 2012, the traffic experienced fluctuations in the early years. With figures like 1.43 exabytes in 2013 and 2015, dropping back to 0.6 in 2014.

- From 2016 onwards, a clear upward trend was observed as traffic increased to 2.52 exabytes. Doubling by 2017 to 4.35 exabytes and continuing to rise to 7.15 exabytes in 2018.

- By 2019, it reached 11 exabytes per month, doubling again by 2020 to 22.43 exabytes.

- This growth accelerated in the following years, reaching 33.02 exabytes in 2021 and 47.88 exabytes in 2022.

- It is projected to increase further to 68.22 exabytes in 2023.

- The upward trajectory is expected to continue, with mobile data traffic projected to hit 88.07 exabytes in 2024, 106.2 exabytes in 2025, 130.59 in 2026, 158.76 in 2027, 192 in 2028, and finally surging to 228.67 exabytes by 2029.

- This trend underscores the exponential increase in global data consumption over the years.

(Source: Statista)

Industry Revenue of Antennas of Any Type (Including Parts) For Mobile Phones and Other Communication Devices

- The industry revenue for antennas of any type, including parts for mobile phones and other communication devices in Brazil. It has exhibited fluctuations over the period from 2012 to 2025.

- In 2012, the revenue stood at $211.93 million, followed by an increase to $235.24 million in 2013.

- However, it dipped to $207.44 million in 2014 and further declined to $125.11 million in 2015.

- A significant surge occurred in 2016 when revenue soared to $418.57 million.

- The trend then reversed, with revenue dropping to $140.6 million in 2017. Followed by a mild recovery to $172.85 million in 2018.

- The revenue decreased again in subsequent years. Recording $147.11 million in 2019, $135.71 million in 2020, and $134.82 million in 2021.

- A gradual decline continued, with revenue reaching $128.9 million in 2022. Projected to further decrease to $123.48 million in 2023, $118.21 million in 2024, and expected to be $113.86 million by 2025.

- This trend reflects the dynamic shifts and economic factors impacting the market for mobile communication device antennas in Brazil.

(Source: Statista)

RF Front-end and Connectivity Market Size Worldwide

- The global market size for RF front-end components and connectivity solutions is expected to see substantial growth from 2019 to 2025.

- In 2019, the PA module was valued at $5.38 billion, projected to rise to $8.93 billion by 2025.

- The FEM module, starting at $2.58 billion in 2019, is forecasted to increase to $4.57 billion.

- The AIP module shows remarkable growth, from just $0.06 billion in 2019 to $1.43 billion in 2025. Discrete filters are also set to grow from $3.68 billion to $4.23 billion.

- Other components, such as discrete switches and LNAs, are expected to nearly double. From $0.45 billion to $0.83 billion and $0.4 billion to $0.78 billion, respectively.

- The antenna tuner market is anticipated to rise from $0.57 billion to $1.01 billion, and RFICs from $0.39 billion to $1.22 billion.

- Lastly, the market for connectivity SoCs will increase from $1.72 billion in 2019 to $2.4 billion by 2025. Reflecting significant advancements and expanding applications in the sector.

(Source: Statista)

Global Distributed Antenna System Market Overview

Global Distributed Antenna Systems Market Size Statistics

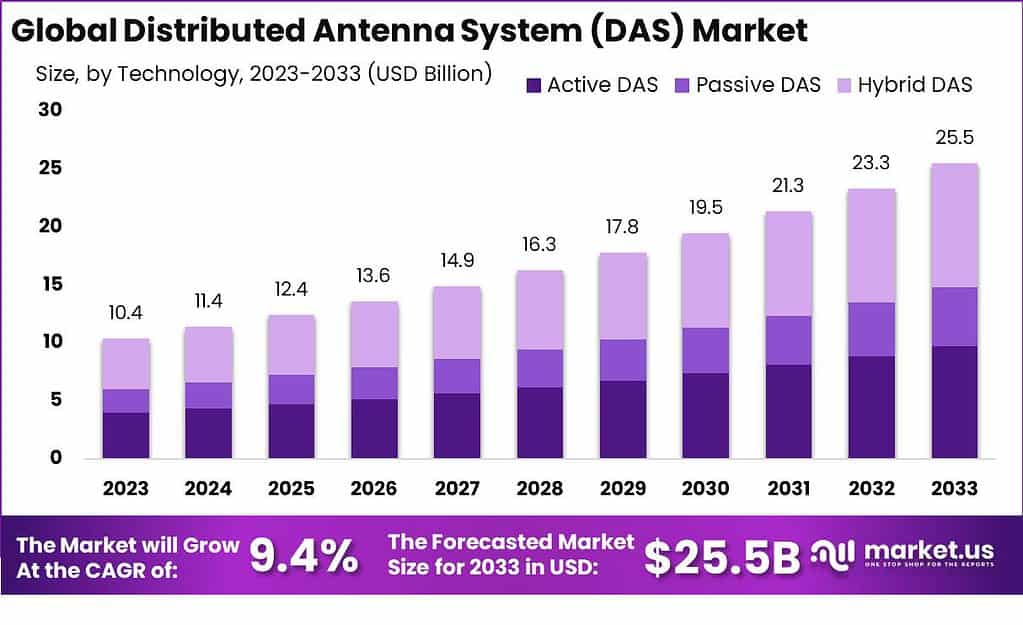

- The global distributed antenna system (DAS) market is projected to experience significant growth over the next decade at a CAGR of 9.4%.

- In 2023, the market revenue was estimated to be USD 10.4 billion, with a steady increase anticipated in subsequent years.

- By 2024, revenue is expected to reach USD 11.4 billion, followed by further growth to USD 12.4 billion in 2025.

- The upward trajectory continues, with revenues forecasted to hit USD 13.6 billion in 2026 and USD 14.9 billion in 2027.

- By 2028, the market is projected to generate USD 16.3 billion, climbing to USD 17.8 billion in 2029.

- This expansion is set to accelerate, with the market anticipated to reach USD 19.5 billion by 2030 and USD 21.3 billion by 2031.

- The trend persists in the following years, with revenue expected to rise to USD 23.3 billion by 2032, culminating in USD 25.5 billion by 2033.

- This consistent growth reflects the increasing demand for DAS solutions globally across various industries.

(Source: market.us)

Competitive Landscape of the Global Distributed Antenna System Market Statistics

- The competitive landscape of the global distributed antenna system (DAS) market is characterized by the presence of several key players.

- CommScope Inc. holds the largest market share at 15%, followed closely by TE Connectivity Ltd. with a 14% share.

- Advanced RF Technologies, Inc. accounts for 13% of the market, while RFI Technology Solutions captures 11%.

- BTI Wireless and Anixter Inc. each hold 9% of the market share.

- Boingo Wireless, Inc. appears twice, reflecting an overall significant presence, with a combined share of 14%.

- CenRF Communications Limited rounds out the competitive landscape with a 7% market share.

- This distribution indicates a highly competitive market with key players maintaining substantial shares.

(Source: market.us)

Regional Analysis of the Global Distributed Antenna System Market Statistics

- The global distributed antenna system (DAS) market is segmented regionally. North America holds the largest market share at 38.0%.

- The Asia-Pacific (APAC) region follows closely, accounting for 27.0% of the market.

- Europe represents 22.0% of the market share, while the Middle East and Africa (MEA) and South America contribute smaller portions, with market shares of 6.8% and 6.2%, respectively.

- This regional distribution highlights North America and APAC as the dominant markets for DAS solutions. Driven by advanced technological infrastructure and growing demand across industries.

(Source: market.us)

Distributed Antenna System (DAS) Sites Worldwide

- The American Tower Corporation’s ownership of distributed antenna system (DAS) sites worldwide in 2023 presents a varied landscape across different countries.

- India leads with the highest number at 763 sites. Although this represents a decrease from previous years, with 822 sites in 2022 and 912 in 2021.

- The United States follows with 452 sites in 2023, showing slight fluctuations from 454 in 2022 and 451 in 2021.

- Chile shows growth with 144 sites in 2023, up from 138 in 2022 and 137 in 2021.

- Brazil’s sites have increased to 122 in 2023 from 121 in 2022 and 109 in 2021, indicating steady growth.

- Mexico’s numbers remain constant at 92 sites across the three years.

- Ghana shows an increase to 37 sites in 2023, up from 36 in 2022 and 28 in 2021. Uganda’s sites have almost doubled from 12 in both previous years to 21 in 2023.

- Both Argentina and Kenya have 11 sites each in 2023, with Kenya showing a slight increase from previous years.

- France has nine sites in 2023, maintaining similar levels to prior years. Colombia has consistently held six sites over the past three years.

- Costa Rica has maintained two sites throughout the observed period. Peru and Spain each have one site, indicating minimal involvement in their respective regions.

(Source: Statista)

DAS Nodes Worldwide

- Boingo Wireless experienced a steady increase in the number of Distributed Antenna System (DAS) nodes it operated worldwide from 2016 to 2020.

- In 2016, the company managed 19.2 thousand DAS nodes.

- This number grew to 23.5 thousand in 2017, followed by a further rise to 29.9 thousand in 2018.

- The growth continued with a significant jump to 38.1 thousand nodes in 2019.

- By 2020, Boingo Wireless operated a total of 41.2 thousand DAS nodes. Demonstrating a consistent upward trajectory in their DAS operations over the five years.

(Source: Statista)

Key Application Areas

- The global market for satellite flat panel antennas in 2023 and its projected size in 2033. Segmented by application, demonstrates varying levels of growth across different sectors.

- In 2023, the defense and government sector led with a market size of $1.58 billion. Which is expected to increase significantly to $6.27 billion by 2033.

- The aviation sector follows, starting at $1.27 billion in 2023 and projected to rise to $5.15 billion in 2033.

- The maritime application shows a market size of $0.96 billion in 2023. With an anticipated growth of $3.69 billion in a decade.

- The automobile sector’s market size is noted at $0.7 billion in 2023. Forecasted to grow to $2.77 billion by 2033.

- Similarly, the telecom sector is expected to expand from $0.65 billion in 2023 to $2.58 billion in 2033.

- The enterprise sector starts at a smaller base of $0.45 billion in 2023, with a projection of $1.77 billion by 2033.

- Space-related applications have a market size of $0.34 billion in 2023, with a relatively modest increase to $0.76 billion forecasted for 2033.

- Finally, the oil and gas sector has the smallest market size in 2023 at $0.33 billion. It is expected to grow to $1.31 billion by 2033. Reflecting diverse and expanding applications of satellite flat panel antennas across industries.

(Source: Statista)

DAS Antenna Specifications

TE DAS Antennas

- TE Connectivity offers a range of cellular DAS (Distributed Antenna System) antennas. Each is designed to meet specific requirements in terms of style, dimensions, frequency bands, VSWR (Voltage Standing Wave Ratio), peak gain, polarization, and PIM (Passive Intermodulation).

- The CFD69716P features an ultra-low-profile circular 2-port design with dimensions of 7.6 mm in height and 250 mm in diameter (0.30 x 9.84 inches). It supports a broad range of frequency bands from 698-960 MHz, 1300-4200 MHz, and 5150-7125 MHz. It boasts a VSWR of less than 1.4:1, a peak gain between 2.8 and 5.7 dBi, linear horizontal polarization at each port, and a PIM of less than –162 dBc.

- The CMD69423P is also a low-profile circular 2-port antenna, measuring 218 mm in height and 43 mm in diameter (8.6 x 1.7 inches). It covers frequency bands of 698-960 MHz and 1300-4200 MHz, has a VSWR of less than 2:1, a peak gain between 3.9 to 6.8 dBi, and supports both vertical and horizontal polarization. Its PIM is rated at less than –150 dBc.

More Insights

- The CFD69383P is another ultra-low-profile circular 2-port model, similar in size to the CFD69716P, with dimensions of 250 mm in height and 8 mm in diameter (9.84 x 0.3 inches). It supports frequency bands of 698-960 MHz, 1350-1550 MHz, and 1690-4000 MHz. This antenna features a VSWR of less than 1.4:1, a peak gain of 3.8 dBi, linear horizontal polarization, and a PIM of less than –158 dBc.

- The CMD69273P, like the CMD69423P, has dimensions of 218 mm in height and 43 mm in diameter (8.6 x 1.7 inches) and is a low-profile circular 2-port antenna. It operates over the frequency bands 698-960 MHz and 1710-2700 MHz, has a VSWR of less than 1.7:1, a peak gain of 3.9 dBi, supports both vertical and horizontal polarization, and has a PIM of less than –154 dBc.

(Source: TE Connectivity)

Cobham DAS

- The Cobham PMR and Tetra antennas designed for different areas within an airport demonstrate specialized configurations to suit varied operational needs.

- In open areas, the low-frequency wideband omni antenna, model XPO2V-150-600/148, offers broad coverage from 150 to 600MHz and a 2dBi gain, effectively accommodating multiple RF operations without the need for a ground plane and with minimal azimuth ripple.

- This Cobham antenna provides robust PMR and Tetra coverage throughout the airport complex.

- For car park areas, the OA1-0.42V/1316 omni antenna is optimized for Tetra (385 to 400MHz) and PMR (450 to 470MHz) frequencies, integrating seamlessly into the Distributed Antenna System (DAS) to facilitate communication within these more confined environments.

- Additionally, an ultra-wideband bi-directional antenna, suitable for wall or ceiling mounting, spans 600MHz to 4GHz.

- This Cobham antenna is designed to be future-proof, supporting system expansion like the inclusion of 3.5GHz and 700MHz bands without necessitating hardware changes, thereby enhancing GSM and Wireless LAN capabilities.

(Source: European Antennas)

CommScope ERA Digital Distributed Antenna System Statistics

- The CommScope ERA Digital Distributed Antenna System (DAS) features various User Access Points (UAPs) designed to cater to different needs. The system configurations include the CAP-L, CAP-M, and CAP-H models.

- All models support four frequency bands. The CAP-L UAP has an output power of 18 dBm or 60 mW, utilizes internal or external antennas, and relies on a copper network connection; it is neither outdoor-rated nor plenum-rated.

- The CAP-M model offers adjustable output power ranging from 18-21 dBm or 60-125 mW, uses external antennas, and can connect via copper or fiber; it is both outdoor and plenum-rated.

- The CAP-H model significantly increases output power to 30 dBm or 1W, and the highest tier, 43 dBm or 20W, uses external antennas and fiber connections and is also outdoor and plenum-rated.

- These specifications highlight the system’s flexibility and suitability for various installation environments, ensuring robust and scalable communication infrastructure solutions.

(Source: CommScope)

Prose DAS

- Prose DAS solutions are comprehensive, supporting a wide range of applications, including GSM, WCDMA, LTE, 5G, and Wi-Fi across frequencies from 698 MHz to 4000 MHz.

- The systems include both active and passive components such as fiber optic master and remote unit repeaters, signal combining racks, and various antennas and cables.

- While passive DAS solutions offer cost-efficiency, they struggle with advanced LTE features necessary for high-speed data transmission, prompting the development of RADiAnt, a next-generation active DAS platform.

- RADiAnt enhances mobile connectivity by integrating antennas, supporting multiple operators and technologies, and simplifying installation with its “Connect and Go” approach, all monitored and controlled remotely via Prose’s Operations Maintenance Center.

- To accommodate diverse environments, Prose combines traditional passive DAS for areas like basement car parks with RADiAnt for high-demand areas like offices.

- SMART DAS further extends this flexibility by offering dynamic capacity routing and scalability. It is suitable for various deployments from small offices to major infrastructures like airports and stadiums, ensuring robust and scalable mobile coverage globally.

(Source: Prose Technologies)

ComFlex NG Series Distributed Antenna System Statistics

- This is an advanced analog DAS that uses RF over fiber and power over coaxial cables to improve wireless coverage inside buildings by connecting them to existing cellular networks.

- The system includes an Active (Antenna) Remote Unit (ARU), a Master Unit (MU) with a built-in power supply, RF Units, and a Fiber Optical Unit (FOU) with BDA Cards.

- It also features a Fiber Expansion Unit (HUB) that supports four frequency bands— PCS 1900MHz, CELL 850 MHz, LTE 700MHz, and AWS.

- Designed for flexibility, the system can handle up to 16 RF inputs, 16 HUBs, and 256 ARUs, making it suitable for both small buildings and larger areas like campuses or warehouses, covering up to 750,000 square feet.

- The ComFlex NG can be installed as either a Part 20 Consumer or Industrial DAS, allowing for easy setup and future upgrades, making it a great choice for different business needs.

(Source: ComFlex)

Key Investments

- From the second quarter of 2018 to the third quarter of 2023, the number of network operators investing in 5G and 5G Standalone (5G SA) for public networks has shown considerable growth.

- In Q2 2018, 134 operators were investing in 5G.

- This number steadily increased over the years, reaching 154 by Q3 2018, 182 by Q4 2018, and surpassing 200 with 201 operators by Q1 2019. By the end of 2019, the count rose to 348.

- The growth continued into 2020 with 381 operators in Q1 and peaked at 388 in Q2 before rising to 402 by Q3, when investments in 5G SA began to be recorded, starting with 52 operators.

- By Q4 2020, 412 operators were investing in 5G, with 61 investing specifically in 5G SA.

- The upward trend persisted through 2021, with 428 operators in Q1, increasing to 481 by the end of the year, and 99 operators investing in 5G SA.

- In 2022, numbers continued to rise, reaching 515 operators for 5G and 112 for 5G SA by the end of the year.

- The growth trajectory sustained into 2023, with 578 operators investing in 5G and 121 in 5G SA by Q3, illustrating a robust and sustained interest in advancing 5G network capabilities globally.

(Source: Statista)

DAS Deployment Challenges and Concerns

DAS Deployment Challenges

- The deployment of Distributed Antenna Systems (DAS) faces several challenges, as identified by a survey of industry respondents.

- The most common challenge faced by 63% of respondents involves working with building or venue owners to secure site access, power, and network connections.

- Planning for site and network comes next, with 56% of respondents citing it as a hurdle.

- Resource allocation for deployment is also a significant issue, reported by 38% of those surveyed.

- Additionally, 31% of respondents encounter difficulties with the availability of cabling for Remote Radio Head (RRH) connections.

- Jurisdictional approval for the size, color, and appearance of RRH and antenna enclosures is a challenge for 19% of respondents.

- However, concerns such as excessive power from macro sites and the availability of nearby macro sites do not appear to be significant, with none of the respondents marking them as issues.

(Source: VIAV Solutions)

DAS Deployment Barriers

- In deploying Distributed Antenna Systems (DAS), industry stakeholders identify several key barriers.

- The primary challenge, according to 75% of respondents, is the high deployment cost.

- Fiber cabling requirements also pose a significant barrier, cited by 31% of those surveyed.

- Passive intermodulation is another issue, affecting 19% of respondents, while multi-party involvement and operational costs are concerns for 13% of respondents.

- Performance issues are noted by 6% of the stakeholders.

- However, additional complexity to the existing macrocell layer does not register as a barrier, with 0% of respondents highlighting it as a concern.

(Source: VIAV Solutions)

Innovations and Developments in Distributed Antenna Systems Statistics

- Innovations and developments in Distributed Antenna Systems (DAS) are being significantly driven by the ongoing rollout of 5G technologies, which promise to enhance data throughput and reduce latency in densely populated or complex indoor environments.

- Companies like Ericsson, Toshiba, and CommScope are at the forefront of this advancement. Ericsson is pioneering the integration of DAS with 6G technologies, focusing on a future where antennas can reconfigure in real-time to respond to network demands, aiming to create a more connected and efficient cyber-physical continuum.

- Toshiba has introduced the ART3711, a 5G DAS that allows multiple mobile network operators to share the same infrastructure, which is crucial in dense urban areas like Tokyo, where space is at a premium.

- Meanwhile, CommScope has leveraged its history with DAS to innovate in areas like fiber optic DAS, supporting high-density and high-capacity needs, which has become essential with the spread of 5G.

- These developments are part of a broader trend where DAS is evolving to not only improve coverage and capacity but also to incorporate new technologies like AI and IoT, which can further enhance the functionality of these systems.

- The synergy between advanced DAS and emerging technologies is poised to create substantial market opportunities, making DAS an integral component of modern telecommunications infrastructure designed to meet the exponentially growing data demands of our digital society.

(Source: ericsson.com, Global Toshiba, CommScope, ABI Research)

Regulations for Distributed Antenna Systems

- Distributed Antenna Systems (DAS) are subject to a complex array of regulations that vary significantly by country and even within regions in the same country.

- In the United States, regulations are promulgated at federal, state, and municipal levels, with significant contributions from industry groups like The HetNet Forum.

- Specific states like Michigan and Ohio have detailed rulings regarding the placement of DAS components in public rights-of-way.

- Following the 9/11 attacks, New York implemented stringent codes for public safety DAS in high-rise buildings to ensure that emergency services maintain communication in critical situations.

- In Australia, DAS regulations align with standards set forth by the Multi-Carrier Forum, adapting to include newer technologies such as 5G.

- The terminology and system classifications may differ from those in the United States and Europe, indicating a localized approach to regulatory frameworks.

- Public safety DAS compliance also hinges on adherence to evolving fire codes, which are periodically updated by bodies like the National Fire Protection Association and the International Code Council.

- Compliance is essential for obtaining occupancy certificates and varies widely by locality, with some regions adopting newer standards more quickly than others.

- This dynamic regulatory environment underscores the necessity for DAS stakeholders to stay informed of current and upcoming legal requirements. To ensure system implementation aligns with local laws and safety standards.

(Source: Day Wireless)

Recent Developments

Acquisitions and Mergers:

- CommScope acquires Airvana: In 2023, CommScope, a global leader in communications infrastructure, acquired Airvana. A provider of indoor wireless solutions, for $200 million. This acquisition strengthens CommScope’s DAS offerings by integrating Airvana’s small-cell and wireless solutions into its portfolio, improving in-building connectivity.

- Corning acquires SpiderCloud Wireless: In early 2024, Corning, a prominent manufacturer of optical communications solutions, completed the acquisition of SpiderCloud Wireless for $150 million. This move aims to enhance Corning’s DAS product line. By offering better indoor wireless coverage, particularly in enterprise and public venue environments.

New Product Launches:

- JMA Wireless launches XRAN 5G-ready DAS: In mid-2023, JMA Wireless introduced its XRAN 5G-ready DAS solution, which provides seamless indoor 5G connectivity for large venues, stadiums, and corporate buildings. The new solution offers a 30% increase in coverage efficiency compared to previous models.

- Comba Telecom introduces Hybrid DAS: In February 2024, Comba Telecom launched its Hybrid Distributed Antenna System, combining both passive and active DAS components. This product is aimed at improving network flexibility and scalability for operators looking to deploy 5G networks across various locations.

Funding:

- SOLiD secures $100 million for DAS expansion: In 2023, SOLiD, a provider of wireless coverage solutions. Raised $100 million in funding to accelerate the development and deployment of 5G DAS infrastructure across North America and Europe. The funds will be used to enhance SOLiD’s product range and expand its market presence.

- Boingo Wireless secures $75 million for airport DAS solutions: In late 2023, Boingo Wireless, was known for providing DAS and Wi-Fi services at airports. Secured $75 million to expand its DAS offerings in airports across the U.S., improving 5G connectivity for travelers.

Technological Advancements:

- 5G integration in DAS: By 2025, 65% of newly deployed DAS systems are expected to be 5G-ready. Driven by the increasing demand for faster and more reliable wireless communication in densely populated areas such as stadiums, airports, and large corporate buildings.

- Edge computing integration: DAS systems are increasingly being integrated with edge computing to reduce latency and improve network performance. By 2026, 40% of DAS deployments will incorporate edge computing solutions, enabling better data processing close to the source.

Conclusion

Distributed Antenna System Statistics – A Distributed Antenna System (DAS) is essential for enhancing wireless coverage. In areas where building materials or complex architecture block direct cellular signals.

Moreover, DAS networks, consisting of multiple antennas linked to a common source, improve signal distribution. Ensuring reliable connectivity and consistent service in densely populated or structurally challenging environments.

As demand for mobile data escalates, DAS is becoming increasingly vital. Particularly with the rollout of 5G, which requires updates to accommodate higher frequencies and advanced features.

Moving forward, DAS is set to integrate more seamlessly with new technologies. Continuing its role as a critical component in the evolution of wireless communication infrastructure.

FAQs

A Distributed Antenna System is a network of spatially separated antennas connected to a common source that enhances wireless service. Within a geographic area or structure spreads cellular and radio frequency (RF) signals more evenly.

A DAS collects a wireless signal from a source, such as a cellular network or satellite. It distributes it through a network of cables to multiple antenna nodes strategically placed throughout a building or area. These antennas then broadcast the signal to provide improved coverage.

DAS is used in environments where wireless coverage is obstructed or insufficient. Such as large buildings, stadiums, hospitals, campuses, and underground facilities like subways and tunnels.

The primary benefits include enhanced cellular coverage and improved data communication speeds. Reduced number of dead zones, better voice quality, and increased capacity in high-demand areas, which help handle more simultaneous users.

Yes, there are two main types: active DAS, which uses fiber optic cables to connect the signal source to the antennas, and passive DAS, which uses coaxial cables. Active DAS is typically more powerful and can cover larger areas than passive DAS.