Table of Contents

Introduction

According to Edge Computing Statistics, Edge computing is a computing model that decentralizes data processing, reducing delays and improving performance. It has become important due to the needs of applications such as autonomous vehicles and IoT, which rely on immediate processing.

Edge computing also saves bandwidth, enhances data security, and allows growth. It is critical in areas like autonomous vehicles, industrial IoT, smart cities, 5G networks, and healthcare. It enables faster decision-making and real-time data analysis at the network’s edge, leading to industry transformation and increased effectiveness.

Editor’s Choice

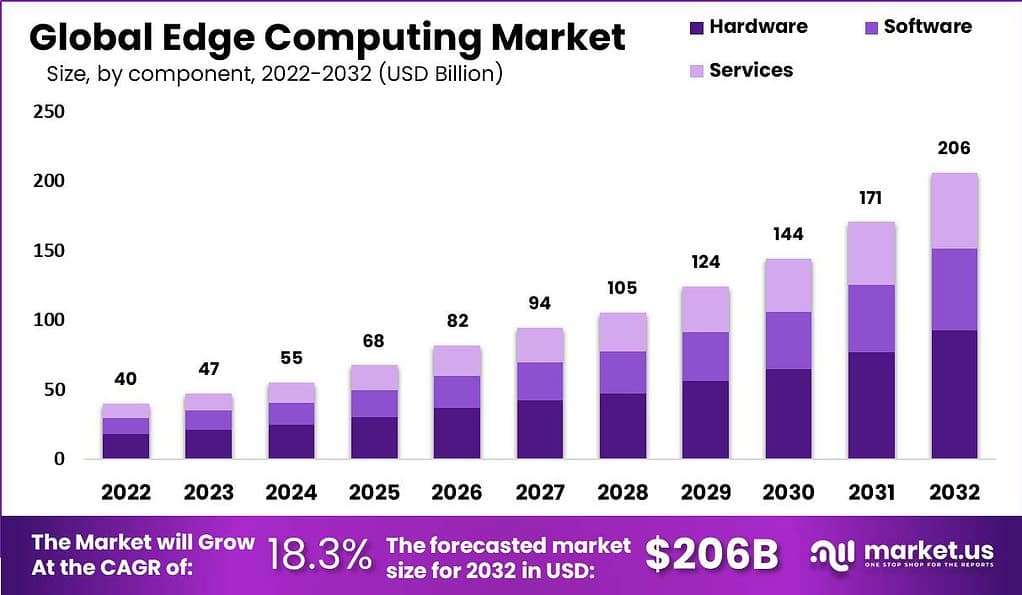

- The revenue generated by the Edge Computing market is projected to experience substantial growth over the next decade at a CAGR of 18.3%.

- In 2022, it stood at $40.0 billion, expected to climb to $47.0 billion in 2023.

- By 2031, the market is expected to reach $171.0 billion; in 2032, it is projected to reach an impressive $206.0 billion.

- North America, Europe, and East Asia are predicted to generate 88% of edge computing revenue by 2030.

- In 2026, approximately 26% of all network edge sites will be in China.

- By 2023, the edge data center market is expected to reach $10.4 billion, followed by $12.2 billion in 2024.

- Currently, over 15 billion edge devices are deployed in the field.

- A survey by Edgegap found that 97% of online gamers experience latency issues.

Global Edge Computing Market Size

- The revenue generated by the Edge Computing market is projected to experience substantial growth over the next decade at a CAGR of 18.3%.

- In 2022, it stood at $40.0 billion, expected to climb to $47.0 billion in 2023.

- By 2031, the market is expected to reach $171.0 billion; in 2032, it is projected to reach an impressive $206.0 billion.

Global Edge Computing Market Revenue- by Component

- The market for Edge Computing is poised for robust growth in the coming years, with significant revenue projections across various components.

- In 2022, the total market revenue reached $40.0 billion, comprising $18 billion from hardware, $11 billion from software, and $11 billion from services.

- As we move into 2023, the market is expected to expand to $47.0 billion, with hardware contributing $21 billion, software $13 billion, and services $13 billion.

- This upward trend continues throughout the forecasted period, with total market revenue reaching $206.0 billion in 2032.

- The hardware, software, and services segments also experience consistent growth, with hardware revenue projected to reach $93 billion, software $58 billion, and services $55 billion by 2032.

Regional Breakdown of the Edge Computing Market

- North America, Europe, and East Asia are predicted to generate 88% of edge computing revenue by 2030.

- These regions have advanced economies, leading to more aggressive edge technology adoption.

- Major telecom companies like AT&T, Verizon, Vodafone, Tencent, and China Unicom drive edge deployments in these areas.

- In 2026, approximately 26% of all network edge sites will be in China.

- China’s mobile operator, China Mobile, is actively rolling out edge computing to reduce backhaul costs.

- In contrast, European mobile operators are expected to be more conservative in deploying edge data centers.

North America

- As per Statista’s findings, North America held the top position as the largest regional market for edge computing in 2020, commanding a substantial 35% market share.

- The report also anticipates a continued expansion of the North American computing market, with a projected value of $94.3 billion by 2025.

- The United States emerged as the primary market within the region, contributing significantly to the overall market share.

Europe

- Europe is another significant market for edge computing. According to the same Statista report, Europe accounted for a 28% market share in 2020.

- The report predicts that the European computing market will continue to grow, reaching a value of 82.5 billion USD by 2025.

- Germany, the United Kingdom, and France are the largest markets in the region.

Asia-Pacific

- The Asia-Pacific area represents another substantial market for computing.

- As outlined in the Statista report, this region held a noteworthy 28% share of the market in 2020, with China emerging as its primary market.

- Projections from the same report indicate a sustained expansion of the Asia-Pacific edge computing market, estimated at USD 91.5 billion by 2025.

Rest of the World

- Outside of the major regions of North America and Asia-Pacific, which held significant market shares, the rest of the world, encompassing Latin America, the Middle East, and Africa, contributed a 9% share of the edge computing market in 2020, as indicated in the Statista report.

- The report’s projections indicate ongoing growth in the edge computing market for the rest of the world, with an expected value of $23.4 billion by 2025.

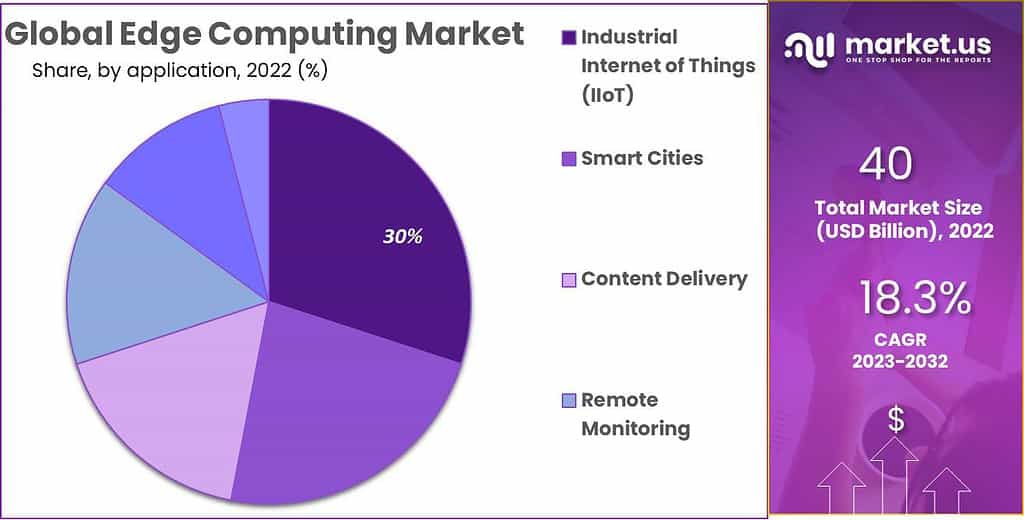

Applications of Edge Computing

- The market for computing applications is diversified, with various sectors harnessing its capabilities to drive innovation and efficiency.

- Among these, the Industrial Internet of Things (IoT) holds the largest market share at 30%, utilizing edge computing for real-time data analysis and predictive maintenance in manufacturing and industrial settings.

- At 23%, smart cities leverage computing for enhanced urban management, traffic optimization, and public services.

- Content Delivery follows closely at 17%, improving multimedia content delivery with low latency.

- Remote Monitoring, accounting for 15%, employs edge computing for real-time monitoring of assets, infrastructure, and even healthcare devices.

Edge Computing Industry-Specific Statistics

Healthcare

- Edge computing holds significant promise within the healthcare sector. As per findings, the computing market’s size in healthcare reached a valuation of $1.12 billion in 2021 and is projected to experience substantial growth at a compounded annual rate of 38.1% between 2022 and 2028.

- The rising utilization of IoT devices drives this remarkable expansion, the imperative for immediate patient monitoring, and the burgeoning requirements for telemedicine services.

Manufacturing

- The manufacturing sector stands out as a prominent adopter of computing technology.

- Statista reports that, in the United States, manufacturing represents the largest share of the edge computing market, making up 24% of the market size in 2025.

- Integrating computing in manufacturing can diminish downtime, boost productivity, and enhance operational effectiveness.

Retail

- Edge computing is steadily gaining ground within the retail sector.

- As reported by Statista, the global value of the computing market within the retail industry reached $0.37 billion in 2021 and is forecasted to experience a significant compound annual growth rate (CAGR) of 38.7% from 2022 to 2028.

- The application of edge computing in the retail landscape has the potential to enhance supply chain management, streamline inventory management, and elevate the overall customer experience.

Transportation

- The transportation sector is witnessing a rising trend in the adoption of computing.

- The global edge computing market’s size within transportation was assessed at $0.24 billion in 2021 and is poised for substantial growth with an anticipated compound annual growth rate (CAGR) of 38.3% from 2022 to 2028.

Edge Device Statistics

Growth of IoT Devices at the Edge

- From 2020 to 2030, the global landscape of edge-enabled Internet of Things (IoT) devices is poised for remarkable expansion across commercial and enterprise markets.

- In 2020, there were approximately 2,303 million commercial edge-enabled IoT devices and 401 million in the enterprise sector.

- The figures for 2030 are projected to reach an impressive 6,469 million for commercial IoT devices and 1,233 million for enterprise IoT devices, highlighting the widespread adoption and integration of edge computing technologies in various industries.

Number of IoT Connected Devices

- The global ecosystem of Internet of Things (IoT) connected devices has been rapidly expanding.

- In 2019, there were 8.6 billion IoT devices worldwide, which continued to surge in subsequent years.

- The IoT landscape is anticipated to grow exponentially, with 17.08 billion devices projected for 2024, 19.08 billion for 2025, and 21.09 billion for 2026.

- This upward trend continues, and by 2030, it is estimated that there will be a staggering 29.42 billion IoT-connected devices globally, underscoring the pervasive integration of IoT technology across various industries and sectors.

Edge Computing Investment Statistics

- Organizations are expected to distribute investments across critical services when allocating resources for their primary edge computing use case.

- The largest portion, at 29.8%, is designated for network-related expenses, encompassing network infrastructure design, deployment, and ongoing maintenance.

- Strategy and planning for computing initiatives account for 23.4% of the total investment, indicating a significant focus on overall strategy and execution.

- Security, which includes designing, deploying, and maintaining security measures, accounts for 22% of the investment, emphasizing the importance of safeguarding data and systems at the edge.

Edge Computing Infrastructure

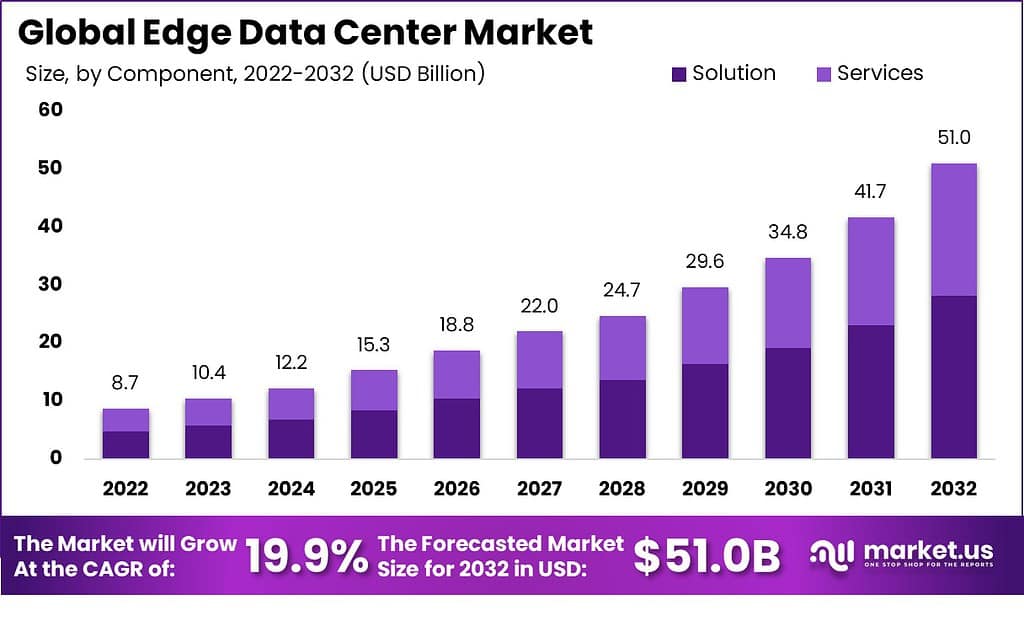

Data Centers

- The edge data center market has grown substantially, reflecting the increasing demand for low-latency computing and data processing capabilities.

- In 2022, the market generated approximately $8.7 billion in revenue, and this upward trajectory continued in subsequent years.

- By 2030, the edge data center market is estimated to reach $34.8 billion, and it is forecasted to continue growing substantially, with revenues expected to reach $51.0 billion by 2032.

Device Deployment

- Currently, over 15 billion edge devices are deployed in the field.

- Edge devices, such as smart cameras and IoT devices, process and analyze data on-site, reducing the need for long-distance data transmission.

- This leads to faster data processing (a few milliseconds or less) and lower costs, enhancing security.

Gaming Latency Issues

- A survey by Edgegap found that 97% of online gamers experience latency issues.

- About 34% of these gamers quit games or sessions due to lag.

- Edge computing can help reduce latency between the user’s device and the cloud where the game is hosted.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)