Table of Contents

- Introduction

- Editor’s Choice

- Electric Powertrain Market Statistics

- History of Electric Powertrains Statistics

- Largest Regional EV Markets Based on Sales

- Key Manufacturers in the EV Market

- Electric Vehicle Sales

- Number of Electric Vehicles in Use Worldwide

- Electric Powertrain Activity Across Different Countries and Regions Statistics

- Investments in Electric Powertrain Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Electric Powertrain Statistics: Electric powertrains, essential to modern electric vehicles, comprise several key components.

The battery pack, composed of lithium-ion cells, stores energy. While the electric motor converts this energy into mechanical power for propulsion.

Power electronics manage the flow of electricity between the battery and motor, optimizing efficiency. Some vehicles feature transmissions, though single-speed setups are common due to the motor’s versatility.

Charging systems enable replenishment from external sources, and regenerative braking recaptures energy during deceleration.

Electric powertrains offer advantages such as lower emissions and smoother operation. Positioning them as pivotal in the transition to sustainable transportation.

Editor’s Choice

- The global electric powertrain market revenue reached USD 131 billion in 2023.

- By 2032, the electric powertrain market is projected to cross the trillion-dollar threshold. Achieving a total of USD 1,015 billion, with BEVs alone accounting for USD 730.8 billion. Highlighting a sustained and robust interest in electric powertrain technologies across various vehicle types.

- The distribution of market shares among different electric powertrain types highlights a diverse landscape within the industry. Mild hybrid electric vehicles (MHEVs) hold the largest market share, accounting for 39% of the market.

- In 2021 and 2022, China led the sales of plug-in electric vehicles totaling 3,396,000 units.

- In 2022, global EV sales peaked at 10.2 million units.

- Jaguar Land Rover (JLR) is one of the standout examples in this shift, with a planned investment of £15 billion over five years to transform its operations and vehicle lineup to be predominantly electric by 2030.

- The Biden-Harris Administration earmarked $15.5 billion in 2023 for upgrading existing automotive manufacturing facilities to support electric vehicle (EV) adoption. Comprising $2 billion in grants and up to $10 billion in loans.

Electric Powertrain Market Statistics

Global Electric Powertrain Market Size Statistics

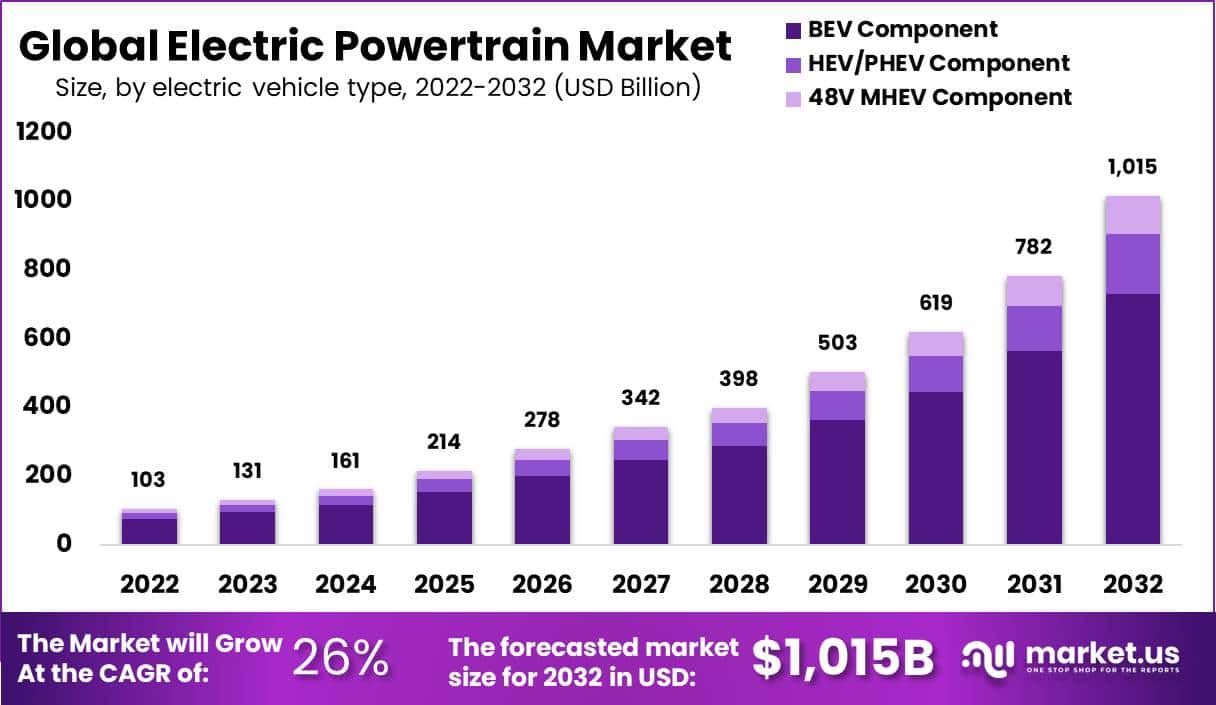

- The global electric powertrain market has demonstrated significant growth. With revenue projections escalating impressively over the decade at a CAGR of 26%.

- In 2022, the market was valued at USD 103 billion. By 2023, it rose to USD 131 billion, reflecting a robust growth trajectory.

- This upward trend continued into 2024 when the market revenue reached USD 161 billion. The following year, 2025, saw a further increase to USD 214 billion, underscoring the accelerating adoption of electric powertrains.

- By 2026, market revenue is projected to reach USD 278 billion, followed by USD 342 billion in 2027.

- The growth persists, and the market is expected to expand to USD 398 billion in 2028. A significant jump is observed in 2029, with revenues soaring to USD 503 billion.

- The momentum is maintained into the next decade, with the market projected to reach USD 619 billion in 2030 and then surging to USD 782 billion in 2031.

- By 2032, the market is anticipated to surpass the trillion-dollar mark, achieving a milestone revenue of USD 1,015 billion.

- This consistent expansion highlights the increasing reliance on and investment in electric powertrain technologies. Driven by global shifts towards sustainable automotive solutions.

(Source: market.us)

Electric Powertrain Market Size – By Electric Vehicle Type Statistics

- The global electric powertrain market has experienced remarkable growth across different vehicle types over recent years.

- In 2022, the market’s value was USD 103 billion, primarily driven by battery electric vehicles (BEVs), which generated USD 74.16 billion.

- Hybrid electric vehicles (HEVs) and plug-in hybrid electric vehicles (PHEVs) also made significant contributions. Totaling USD 17.51 billion, with 48V mild hybrid electric vehicles (MHEVs) adding another USD 11.33 billion.

- By 2023, the market had grown to USD 131 billion, fueled by increases across all categories, with BEVs reaching USD 94.32 billion, HEV/PHEVs at USD 22.27 billion, and 48V MHEVs at USD 14.41 billion.

- This upward trajectory persisted through the decade, with the market expanding to USD 161 billion in 2024 and then to USD 214 billion in 2025. By 2026, revenues had climbed to USD 278 billion, and continued growth led the market to USD 342 billion in 2027 and USD 398 billion in 2028.

- By 2029, the market size reached USD 503 billion, and the expansion carried on into the next decade. Soaring to USD 619 billion in 2030 and USD 782 billion in 2031.

- By 2032, the electric powertrain market had crossed the trillion-dollar threshold, achieving a total of USD 1,015 billion, with BEVs alone accounting for USD 730.8 billion. Highlighting a sustained and robust interest in electric powertrain technologies across various vehicle types.

(Source: market.us)

Electric Powertrain Market Share – By Powertrain Type Statistics

- The distribution of market shares among different electric powertrain types highlights a diverse landscape within the industry.

- Mild hybrid electric vehicles (MHEVs) hold the largest market share, accounting for 39% of the market.

- Battery electric vehicles (BEVs) also command a significant portion, representing 27% of the market.

- Series hybrid powertrains follow with an 18% share, underscoring their relevance in the current market.

- Parallel hybrid powertrains capture 11%, while series-parallel hybrid powertrains. Combining features of both series and parallel systems, have the smallest share at 5%.

- This breakdown illustrates the varying preferences and technological adoptions in the electric powertrain sector.

(Source: market.us)

History of Electric Powertrains Statistics

- The history of electric powertrains reflects a journey of innovation and technological adaptation over the decades.

- Starting around the early 20th century, electric motors were as common as internal combustion engines, particularly in urban settings, due to their smooth operation.

- Significant advancements occurred in the 1960s, with Bosch exploring electric alternatives for lower emissions.

- By the 1970s, experiments with electric buses and hybrid technologies that combined internal combustion engines with electric motors set the stage for future developments.

- This led to the first production of cars with Bosch hybrid technology in 2010 and further innovations in battery electric vehicles. Integrating high-efficiency components like Silicon carbide semiconductors.

(Source: Bosch)

Largest Regional EV Markets Based on Sales

- In 2021 and 2022, the sales of plug-in electric vehicles exhibited significant growth in major markets around the world.

- In 2021, China led the charge with substantial sales totaling 3,396,000 units. This figure soared to 6,181,000 units in 2022, demonstrating a remarkable increase in demand within the region.

- Europe (West and Central) also showed a strong performance. With sales rising from 2,332,000 units in 2021 to 2,683,000 units in 2022.

- North America experienced a notable uplift in sales from 748,000 units in 2021 to 1,108,000 units in 2022, reflecting growing market acceptance.

- The ‘Other’ category, represents smaller markets collectively. Nearly doubled its sales from 291,000 units in 2021 to 551,000 units in 2022.

- These trends highlight the accelerating global shift towards electric vehicles, driven by heightened consumer interest and supportive government policies.

(Source: Statista)

Key Manufacturers in the EV Market

- In 2023, the global plug-in electric vehicle market was characterized by a varied distribution of market shares among leading manufacturers.

- BYD emerged as the frontrunner, capturing a substantial 22% of the market. Indicating a strong presence in the electric vehicle industry.

- Tesla Inc. followed with a 13.2% market share, maintaining its significant role in the sector.

- VW Group held a 7.3% share, reflecting its steady participation in the electric vehicle market.

- Geely-Volvo Car Group closely trailed with a 6.8% share, while SAIC accounted for 5.8% of the market.

- The remainder of the market, amounting to 45%, was held by a diverse array of other manufacturers. Illustrating a competitive and fragmented market landscape where numerous players contribute to the broader push toward electric mobility.

(Source: Statista)

Electric Vehicle Sales

- The global sales of plug-in electric light vehicles have shown a significant upward trend from 2015 to 2022.

- Starting in 2015, the sales were modest, with approximately 0.55 million units sold. The following year, 2016, saw a slight increase to 0.75 million units.

- The growth continued more notably in 2017, with sales reaching 1.18 million units.

- By 2018, the market had gained substantial momentum, doubling the previous year’s figures to 2.05 million units. Sales remained stable in 2019 at around 2.08 million units.

- A notable surge occurred in 2020 despite global economic challenges, with sales climbing to 2.97 million units.

- The upward trajectory took a dramatic leap in 2021, with sales skyrocketing to 6.5 million units.

- This rapid growth persisted into 2022, when sales peaked at 10.2 million units. Reflecting a robust and accelerating adoption of plug-in electric vehicles worldwide.

(Source: Statista)

Number of Electric Vehicles in Use Worldwide

- Between 2016 and 2022, the global population of electric vehicles (EVs) experienced robust growth. Distinguished by type into plug-in electric and battery electric vehicles.

- In 2016, the number of plug-in electric vehicles in use was approximately 808,180 units. While battery-electric vehicles numbered around 1,191,420 units.

- The following year, 2017, saw these figures rise to 1,205,610 for plug-in electrics and 1,937,270 for battery electrics.

- By 2018, the counts escalated further to 1,834,970 plug-in electric and 3,264,800 battery-electric vehicles.

- This upward trend continued in 2019, with plug-in electric vehicles reaching 2,377,460 and battery-electric vehicles climbing to 4,773,120.

- The year 2020 marked a significant increase, particularly for battery electrics, which soared to 6,871,650, while plug-in electrics reached 3,372,730.

- By 2021, these numbers had grown dramatically, with plug-in electrics at 5,224,040 and battery electrics at 11,274,710.

- In 2022, the expansion persisted, with plug-in electric vehicles estimated at 7.9 million and battery electric vehicles at an impressive 18 million, highlighting a continuing trend toward electric vehicle adoption globally.

(Source: Statista)

Electric Powertrain Activity Across Different Countries and Regions Statistics

- The utilization of electric trains across various countries and regions has shown diverse trends from 2000 to 2015.

- In 2000, North America had 73% of its trains electrified, while Europe had a slightly higher percentage at 76%. Japan led with a high rate of 97% electrification, contrasted with Korea and China with 53% and 31%, respectively. Russia’s electrification stood at 81%, India at 44%, South America at 41%, and Africa at the lowest with 21%.

- By 2005, there was a slight increase across most regions; North America rose to 75%, Europe to 79%, and Korea saw a significant jump to 72%. China and India’s figures also grew modestly to 43% and 46%, respectively.

- The year 2010 marked further advances, with North America maintaining 75% but Europe inching up to 80%. Korea and China showed notable improvements, with Korea reaching 81% and China 61%. India’s electrification rate increased to 50%, while South America and Africa rose to 48% and 24%, respectively.

- By 2015, North America and Europe both reached an 80% electrification rate. Japan continued to lead with 97%, while Korea approached near-total electrification at 90%. Russia, China, and India also made progress, with rates of 86%, 75%, and 54%, respectively. South America and Africa continued to see modest increases, reaching 49% and 28% electrification.

- These figures demonstrate the varying pace and commitment to electric train adoption across the globe, reflecting regional priorities and the availability of infrastructure.

(Source: International Energy Agency)

Investments in Electric Powertrain Statistics

Private Sector Investments

- Investments in electric powertrains are surging as automotive companies and suppliers shift their focus toward electric vehicles (EVs). Significant capital is being funneled into the development and production of electric powertrain components, a trend underlined by ambitious investment announcements from major automotive manufacturers.

- For example, automotive OEMs have disclosed investments exceeding $500 billion for general electrification efforts aimed at completion by 2025, although actual figures could be much higher.

- These investments are not only for developing electric vehicles but also for creating in-house capabilities for critical components such as e-drive units and battery packs. However, some elements, like battery cells, may still be outsourced.

- Jaguar Land Rover (JLR) is one of the standout examples in this shift, with a planned investment of £15 billion over five years to transform its operations and vehicle lineup to be predominantly electric by 2030.

- This includes repurposing existing facilities to focus solely on electric vehicle production and component manufacture.

- The strategic pivot toward electric powertrains is driven by a combination of regulatory pressure to reduce emissions, technological advancements that enhance EV feasibility, and a growing market demand for sustainable transport options.

(Source: Mckinsey)

Electric Powertrain Government Investments Statistics

- In 2023, the U.S. government significantly bolstered electric powertrain technologies, demonstrating a strong commitment to advancing transportation electrification and bolstering energy security.

- The Biden-Harris Administration earmarked $15.5 billion for upgrading existing automotive manufacturing facilities to support electric vehicle (EV) adoption, comprising $2 billion in grants and up to $10 billion in loans.

- Additionally, a $13 billion investment was designated to modernize and expand the national power grid, promoting the integration of renewable energy sources and enhancing resilience against severe weather. This funding aims to expand access to affordable, clean electricity and is part of a broader initiative anticipated to attract significant state and private sector investment.

- The Indian government is actively boosting the electric vehicle (EV) sector to promote sustainable transportation and reduce reliance on fossil fuels.

- The second phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II) scheme aims to drive EV adoption across various vehicle categories. Anticipated investments of $20 billion by 2030 prioritize advanced battery production and local EV component manufacturing, supported by production-linked incentives and government funding.

More Investments

- Additionally, lowering the Goods and Services Tax (GST) on EVs incentivizes manufacturers and consumers to transition to electric vehicles, aligning with India’s Automotive Mission Plan and its commitments to cut greenhouse gas emissions under the Paris Agreement by 2030.

- In 2023, the European Union showed a strong commitment to advancing electric powertrain technologies with substantial investments and supportive policies.

- Specifically, the European Investment Bank (EIB) allocated €450 million to build an AESC electric battery gigafactory in Douai, France. This investment is part of a broader strategy to bolster Europe’s shift to decarbonized industries.

- The gigafactory is expected to significantly enhance battery supply for electric vehicles, marking a crucial step in the EU’s push to increase domestic production of essential EV components.

(Source: White House, India Brand Equity Foundation, European Investment Bank)

Recent Developments

Mergers and Acquisitions:

- Tesla acquired Maxwell Technologies, a manufacturer of energy storage and power delivery solutions, in a deal worth approximately $218 million.

- This acquisition is aimed at enhancing Tesla’s battery technology and electric powertrain capabilities.

New Product Launches:

- General Motors introduced its Ultium Drive system, a comprehensive electric propulsion system that integrates electric motors, single-speed transmissions, and power electronics. The Ultium Drive is set to power a range of electric vehicles across GM’s brands, contributing to the company’s electrification efforts.

Funding Rounds:

- Rivian, an electric vehicle startup, secured $2.5 billion in funding led by T. Rowe Price. This funding round will support the development and production of Rivian’s electric powertrains for its lineup of electric trucks and SUVs.

Partnerships:

- Ford Motor Company partnered with Volkswagen to collaborate on electric vehicle technology, including the development of electric vehicle platforms and powertrains.

- This strategic partnership aims to leverage each company’s strengths to accelerate the adoption of electric vehicles in the global market.

Expansion Initiatives:

- Chinese electric vehicle manufacturer BYD announced plans to expand its electric powertrain production capacity in response to increasing demand for electric vehicles.

- The expansion includes the construction of new manufacturing facilities and the deployment of advanced production technologies to enhance efficiency and scale.

Technology Innovations:

- Bosch, a leading automotive supplier, unveiled its new electric axle drive system, designed to simplify the integration of electric powertrains into various vehicle platforms.

- The compact and modular design of the electric axle drive system offers automakers flexibility in electrifying their vehicle portfolios while maintaining performance and efficiency.

Regulatory Developments:

- The European Union introduced stricter emission regulations, incentivizing automakers to accelerate their transition to electric powertrains.

- These regulations, coupled with increasing consumer demand for electric vehicles, are driving investments in electric powertrain technology and infrastructure across the automotive industry.

Conclusion

Electric Powertrain Statistics – The electric powertrain market is rapidly advancing due to a global shift towards sustainable transportation, spurred by significant investments and supportive policies aimed at reducing carbon emissions.

Notably, European initiatives like the “Fit for 55” are enhancing the infrastructure for electric vehicles, focusing on increasing battery production and charging facilities to meet stringent emission targets by 2035.

This transition is further enriched by technological improvements in battery and motor efficiencies, making electric vehicles more viable and leading to economic growth through new jobs in the technology and manufacturing sectors.

As such, the electric powertrain industry is poised for substantial expansion as it drives the automotive market towards a greener future.

FAQs

Electric powertrains primarily consist of a battery pack, one or more electric motors, and a transmission system. The battery serves as the energy storage device, the electric motors convert electrical energy into mechanical energy, and the transmission delivers power efficiently to the vehicle’s wheels.

The most common types include Battery Electric Vehicles (BEVs), which operate solely on electricity, and Hybrid Electric Vehicles (HEVs), which combine an internal combustion engine with electric propulsion. Plug-in Hybrid Electric Vehicles (PHEVs), which can recharge their batteries from an external source, and Fuel Cell Electric Vehicles (FCEVs), which generate electricity from hydrogen.

Electric powertrains offer higher energy efficiency compared to conventional internal combustion engines. They are known for providing high torque at low speeds and having fewer moving parts, which can reduce maintenance costs and contribute to reducing greenhouse gas emissions.

Key challenges include the high initial cost of development and production, the need for widespread and reliable charging infrastructure, and concerns about battery life and performance, especially in extreme weather conditions.

Performance is typically assessed through a range of tests, including component-level testing, subsystem-level testing, and full vehicle system testing. These tests evaluate various aspects such as battery abuse and safety, thermal management, motor efficiency, and overall vehicle dynamics.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)