Table of Contents

Introduction

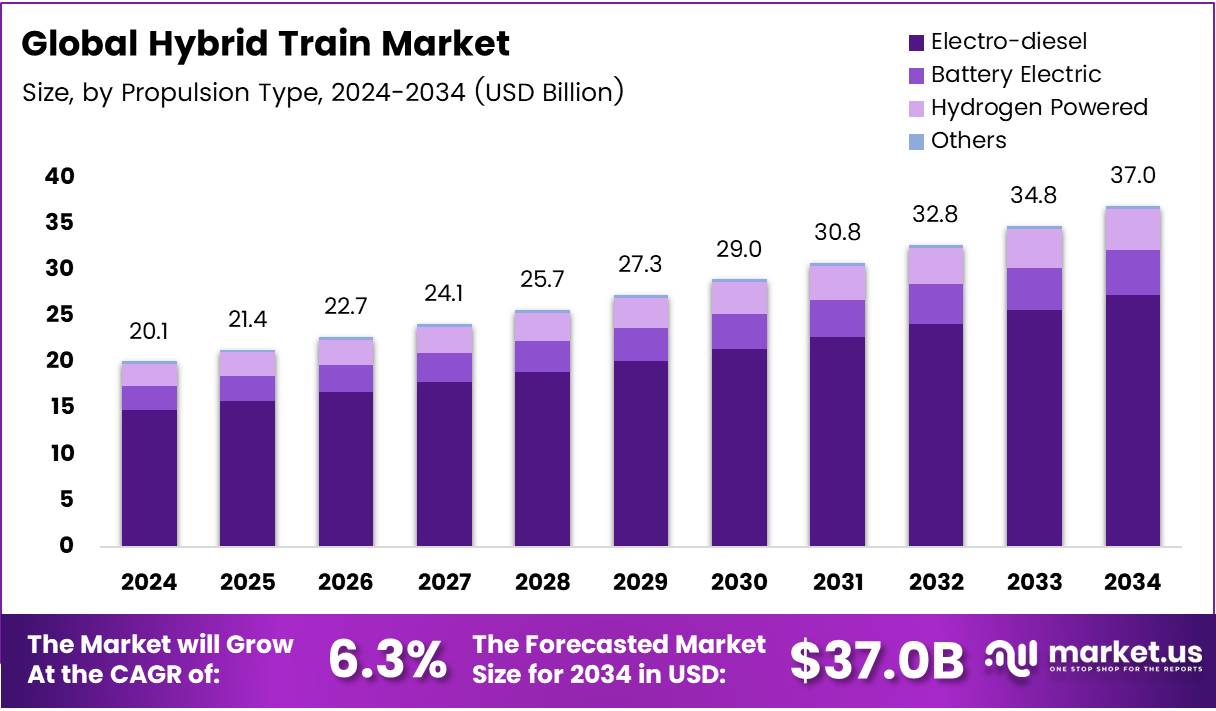

The Global Hybrid Train Market is on a fast track toward transformation, projected to grow from USD 20.1 billion in 2024 to USD 37.0 billion by 2034, registering a CAGR of 6.3% between 2025 and 2034. This surge is powered by rising sustainability goals and advancements in hybrid propulsion systems.

As rail operators worldwide transition toward low-emission technologies, hybrid trains have emerged as a vital bridge between diesel-powered and fully electric railways. Integrating diesel-electric, battery-electric, and hydrogen fuel cell systems, these trains enhance operational flexibility and reduce carbon footprints.

Moreover, government-backed infrastructure initiatives and partnerships with technology providers are accelerating the adoption of hybrid locomotives. With innovations in energy storage, regenerative braking, and smart power management, the global market is set for sustained expansion throughout the next decade.

Key Takeaways

- The Global Hybrid Train Market is projected to reach USD 37.0 Billion by 2034, up from USD 20.1 Billion in 2024, growing at a CAGR of 6.3% during 2025–2034.

- In 2024, Electro-diesel propulsion dominated the market with a 73.9% share, enabling flexible operation on both electrified and non-electrified routes.

- The 100 – 200 Km/h speed segment led the market in 2024 with a 62.8% share, ideal for intercity and regional services.

- The Passenger application segment accounted for 78.3% in 2024, fueled by rising investments in sustainable public transport.

- Europe emerged as the leading regional market with a 34.61% share, valued at USD 6.9 Billion in 2024, driven by advanced rail networks and strict emission norms.

Market Segmentation Overview

By Propulsion Type

The Electro-diesel category, with a 73.9% share, continues to dominate due to its flexibility and compatibility with existing infrastructure. It allows seamless transitions between electrified and non-electrified routes while achieving fuel savings and reduced emissions. Meanwhile, battery-electric and hydrogen-powered trains are emerging as promising zero-emission alternatives.

By Speed

Trains operating at 100 – 200 Km/h lead with a 62.8% share, offering an optimal balance of efficiency and infrastructure requirements. This range supports intercity and regional connectivity without costly upgrades, making it ideal for expanding hybrid train operations. Lower-speed trains serve urban networks, while higher-speed applications remain limited.

By Application

The Passenger segment captured 78.3% of the market, reflecting strong demand for eco-friendly public transit solutions. Governments worldwide are investing in hybrid fleets for commuter and intercity services. Meanwhile, the Freight segment is emerging as logistics operators explore hybrid locomotives to cut emissions and fuel expenses.

Drivers

Increasing Demand for Fuel-Efficient and Low-Emission Transportation

The global shift toward carbon neutrality and energy efficiency is driving hybrid train adoption. These systems combine multiple power sources, significantly cutting fuel consumption and CO₂ emissions. Governments’ emission reduction policies and sustainable mobility goals are reinforcing the appeal of hybrid propulsion in both urban and regional rail networks.

Government Investments and Infrastructure Modernization

Public and private investments are propelling hybrid rail projects globally. Nations like Japan, Germany, and India are channeling funds into infrastructure modernization and fleet upgrades. Financial incentives, grants, and technology collaborations are enabling operators to transition toward cleaner transport systems without major operational disruptions.

Use Cases

Sustainable Urban and Regional Passenger Transport

Hybrid trains are playing a transformative role in urban and intercity transit systems, offering reliable, low-emission transport solutions. By combining battery and diesel power, they operate efficiently on mixed track conditions, ensuring continuity even where electrification is incomplete. This hybrid flexibility supports sustainable urban growth and commuter convenience.

Freight Efficiency and Carbon Reduction

In the freight sector, hybrid locomotives are being adopted to balance performance with sustainability. Operators use hybrid propulsion to minimize fuel use on long routes and reduce dependency on diesel engines. The technology supports logistics operators in meeting emission targets while ensuring cost-efficient, reliable freight operations.

Major Challenges

Limited Charging and Refueling Infrastructure

Despite technological progress, the lack of adequate charging and hydrogen refueling infrastructure remains a barrier. Many rail networks lack the necessary support systems, particularly in developing markets. This constraint slows hybrid adoption and increases dependence on conventional diesel trains in non-electrified zones.

High Maintenance and Integration Costs

Hybrid systems involve complex components such as batteries, inverters, and control units that require specialized expertise. Maintenance and lifecycle management costs remain high, discouraging smaller operators. Furthermore, integrating hybrid systems with existing rail control and signaling infrastructure increases both complexity and project timelines.

Business Opportunities

Expansion in Freight and Regional Connectivity

Hybrid trains present significant growth potential in freight transport, where fuel efficiency and emission reduction are top priorities. Governments are also investing in regional and intercity rail connectivity, making hybrid trains an attractive choice for medium-distance routes that combine performance, flexibility, and cost efficiency.

Strategic Collaborations and Technological Advancements

Partnerships between OEMs and energy storage providers are unlocking new innovations in battery and hydrogen propulsion. These collaborations are improving range, reducing maintenance needs, and optimizing power management. As a result, hybrid train solutions are becoming more scalable and economically viable for mass deployment.

Regional Analysis

Europe Leads with 34.61% Market Share

Europe dominates the global hybrid train market, accounting for 34.61% and valued at USD 6.9 billion in 2024. Strong government policies, the EU Green Deal, and extensive electrified rail networks foster adoption. Countries such as Germany, France, and the UK are leading in hybrid rail investments and technology innovation.

Asia Pacific and North America Show Rising Potential

Asia Pacific is rapidly advancing, driven by urbanization, infrastructure investments, and government focus on sustainable transport. Countries like China, Japan, and India are investing in hybrid solutions to handle growing commuter volumes. Meanwhile, North America is experiencing steady growth with hybrid freight projects and clean energy initiatives in the U.S. and Canada.

Recent Developments

- February 2025 – Sierra Northern Railway acquired RailPower LLC to strengthen hybrid freight operations in alignment with California’s clean transport goals.

- April 2024 – Canadian National (CN) announced the purchase of its first plug-in diesel–battery hybrid locomotive from Progress Rail.

- November 2024 – Norfolk Southern partnered with Alstom to retrofit two locomotives with hybrid propulsion for energy efficiency improvements.

- July 2025 – HŽPP (Croatia) ordered 13 hybrid + battery trains worth EUR 117.9 million from Končar Electric Vehicles to modernize its regional fleet.

Conclusion

The Global Hybrid Train Market is poised for strong expansion through 2034, supported by sustainability initiatives, infrastructure modernization, and technological innovation. As nations transition toward cleaner mobility, hybrid propulsion provides a practical bridge between diesel and fully electric systems.

With rising government support, strategic collaborations, and a growing emphasis on smart and digitalized rail systems, hybrid trains will play a pivotal role in shaping the future of global rail transport. Their flexibility, cost-efficiency, and environmental advantages ensure they remain central to the decarbonization journey of the rail industry.