Table of Contents

Introduction

According to Payment Gateway Statistics, The payment gateway plays a vital role in online transactions, ensuring security between buyers and sellers. Encrypting sensitive information like credit card details ensures safe authorization and completion of purchases.

Merchants can easily integrate payment gateways into their online shops using different methods. These gateways support various payment methods, such as credit/debit cards, digital wallets, and bank transfers, enabling transactions globally in diverse currencies.

Despite transaction fees, payment gateways offer tools for tracking transaction performance and enhancing business operations.

Merchants must understand these fundamentals to establish a reliable and secure online payment system.

Editor’s Choice

- The revenue of the global payment gateway market reached USD 31.0 billion in 2023.

- By 2032, the global payment gateway market is projected to reach USD 161.0 billion, with hosted and non-hosted revenues reaching USD 94.99 billion and USD 66.01 billion, respectively.

- Market share distribution within the global payment gateway sector is delineated by enterprise size, with large enterprises commanding the majority at 55%.

- In 2020, a survey of global payment preferences revealed a notable inclination towards cashless transactions, with South Korea leading the trend, with 77% of respondents expressing a preference for non-cash payments.

- In the Asia-Pacific region, the volume of cashless transactions is set to soar from 494 billion USD in 2020 to 1,818 billion USD by 2030, reflecting the region’s rapid digitalization and expanding e-commerce landscape.

- Digital wallets are expected to experience the most significant increase, rising from 49% in 2022 to 54% in 2026, indicating a growing consumer preference for this convenient and secure payment method.

- Data privacy and cybersecurity emerge as the leading concerns, garnering 48% of responses, reflecting the escalating apprehension surrounding digital information protection.

Global Payment Gateway Market Overview

Global Payment Gateway Market Size

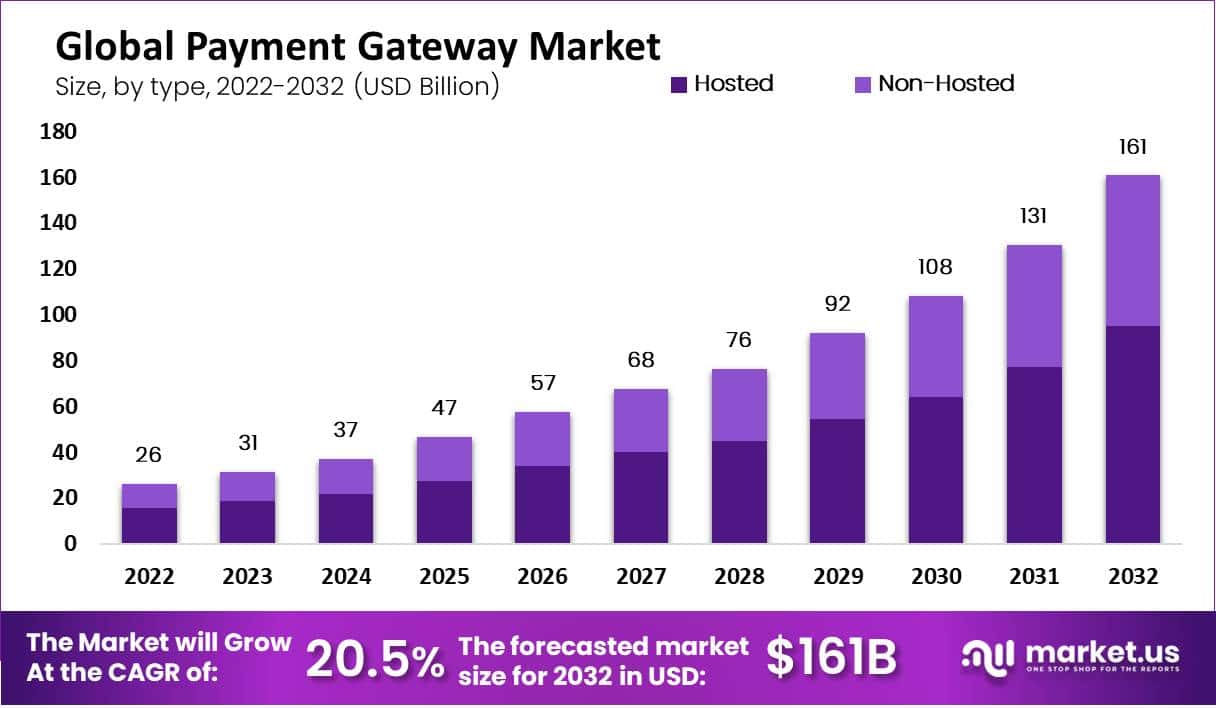

- The revenue of the global payment gateway market has exhibited consistent growth over the years at a CAGR of 20.5%, demonstrating a positive trajectory indicative of the increasing adoption of digital payment solutions worldwide.

- In 2022, the market revenue stood at USD 26.0 billion, a notable increase to USD 31.0 billion in 2023.

- As the demand for seamless and secure online payment processing solutions continued to surge, the market witnessed substantial expansion, reaching USD 92.0 billion in 2029 and USD 108.0 billion in 2030.

- The market is projected to experience even more significant growth, with revenues forecasted to reach USD 131.0 billion in 2031 and USD 161.0 billion in 2032.

Payment Gateway Market Size – By Type

- The global payment gateway market, segmented by type, has demonstrated substantial growth over the forecast period, driven by increasing digital transactions and the proliferation of e-commerce.

- In 2022, the total market revenue reached USD 26.0 billion, with hosted payment gateways contributing USD 15.34 billion and non-hosted solutions generating USD 10.66 billion.

- By 2032, the global payment gateway market is projected to reach USD 161.0 billion, with hosted and non-hosted revenues reaching USD 94.99 billion and USD 66.01 billion, respectively.

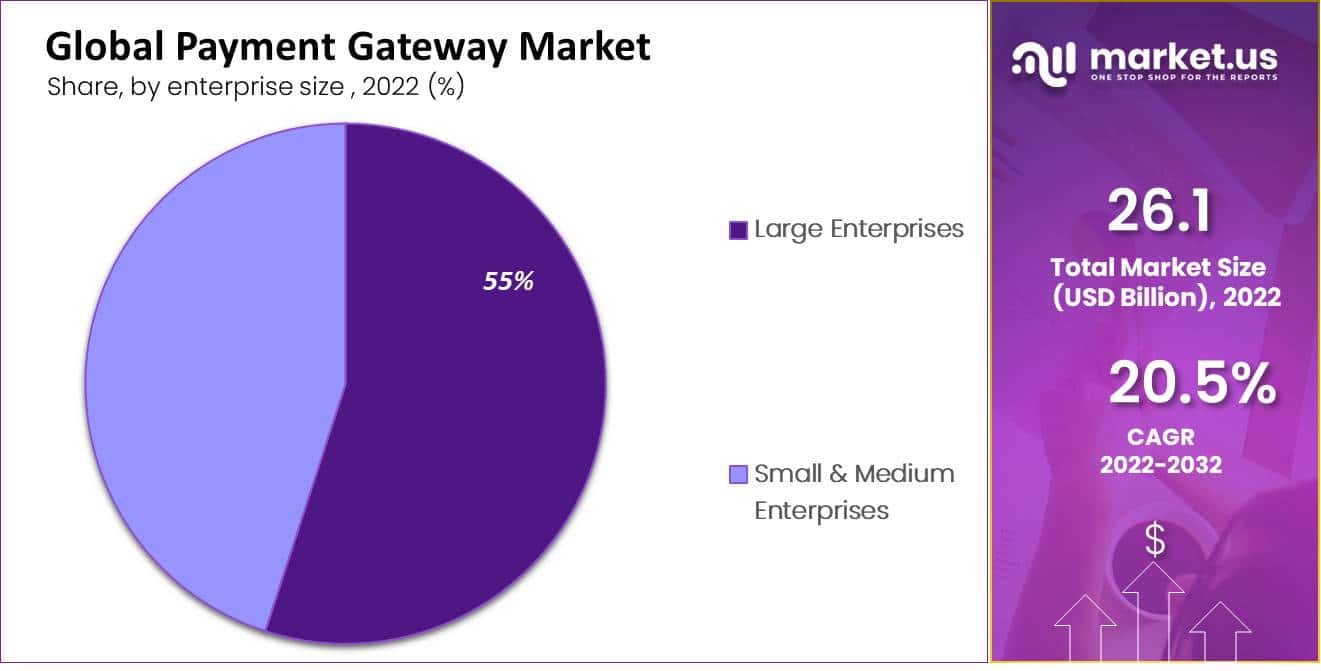

Global Payment Gateway Market Share – By Enterprise Size

- Market share distribution within the global payment gateway sector is delineated by enterprise size, with large enterprises commanding the majority at 55%.

- Conversely, small and medium enterprises (SMEs) constitute a significant segment, holding 45% of the market share.

Regional Analysis of the Global Payment Gateway Market

North America

- In North America, the payment gateway market demonstrates significant growth, with the United States leading the region with a market size of USD 38.63 billion. This substantial figure reflects the country’s advanced technological infrastructure and widespread adoption of e-commerce.

- Canada follows closely behind, with a market size of USD 9.5 billion, indicating a robust presence of payment gateway solutions in the Canadian market.

- Additionally, Mexico contributes to the regional market with a size of USD 4.76 billion, underscoring the growing importance of digital payment systems in the country’s economy.

Europe

- The European payment gateway market showcases notable diversity and growth across various countries.

- Germany leads the region with a market size of USD 10.82 billion, reflecting its strong economy and advanced technological infrastructure.

- The United Kingdom follows closely behind, with a market size of USD 7.59 billion, driven by its established financial services sector and high levels of e-commerce activity.

- France and Italy also contribute significantly, with market sizes of USD 7.37 billion and USD 3.84 billion, respectively, highlighting their positions as key players in the European payment gateway landscape.

- Spain adds to the regional market with a size of USD 2.95 billion.

- Additionally, the rest of Europe collectively accounts for USD 5.27 billion, indicating a diverse array of markets with varying levels of adoption and demand for payment gateway solutions.

Asia- Pacific

- In the Asia-Pacific region, the payment gateway market demonstrates considerable growth and diversity across critical countries.

- China leads the region with a market size of USD 9.81 billion, driven by its large population, thriving e-commerce sector, and rapid digitalization initiatives.

- Japan follows closely behind, with a market size of USD 5.78 billion, reflecting its mature economy and technological advancements.

- India also contributes significantly, with a market size of USD 4.79 billion, fueled by increasing internet penetration and smartphone adoption, particularly in urban centers.

- Additionally, the rest of Asia-Pacific collectively accounts for USD 5.04 billion, indicating a diverse mix of markets with varying levels of development and demand for payment gateway solutions.

Middle East & Africa

- In the Middle East & Africa (MEA) region, the payment gateway market shows varying levels of development and growth across different countries.

- The United Arab Emirates (UAE) leads the region with a market size of USD 2.11 billion, driven by its status as a regional financial hub and growing digital economy.

- Saudi Arabia follows with a market size of USD 1.63 billion, reflecting its efforts to diversify its economy and embrace digital transformation.

- South Africa contributes significantly to the regional market with a size of USD 1.19 billion, driven by its large and increasingly connected population.

- The rest of MEA collectively accounts for USD 2.64 billion, showcasing a mix of emerging markets with growing demand for digital payment solutions.

Latin America

- The payment gateway market in Latin America exhibits diverse characteristics across its constituent countries.

- Brazil leads the region with a market size of USD 2.3 billion, driven by its sizable population, robust e-commerce sector, and increasing adoption of digital payment solutions.

- Argentina follows with a market size of USD 1.04 billion, indicating a significant presence of payment gateway services in the country’s evolving financial landscape.

- Additionally, the rest of Latin America accounts for USD 1.68 billion, showcasing a mix of emerging markets with growing opportunities for digital payment technology.

Preferred Payment Methods Around the Globe

- In 2020, a survey of global payment preferences revealed a notable inclination towards cashless transactions, with South Korea leading the trend, with 77% of respondents expressing a preference for non-cash payments.

- Following closely, Sweden and Russia stood at 74% and 72%, respectively, reflecting the widespread adoption of digital payment methods in these countries.

- The United Kingdom and France also demonstrated a strong propensity towards cashless transactions, with 70% and 67% of respondents favoring non-cash options, respectively.

- China and Spain mirrored this sentiment, with 67% and 61% of respondents embracing cashless payments.

- Meanwhile, Japan and the United States registered slightly lower but substantial figures at 60% and 58%, respectively.

Cashless Transactions Statistics

- In the Asia-Pacific region, the volume of cashless transactions is set to soar from 494 billion USD in 2020 to 1,818 billion USD by 2030, reflecting the region’s rapid digitalization and expanding e-commerce landscape.

- Similarly, Africa is expected to grow substantially, with cashless transactions rising from 59 billion USD in 2020 to 172 billion USD by 2030, driven by increasing smartphone penetration and financial inclusion initiatives.

- Europe and Latin America also anticipate significant increases in cashless transaction volumes, with Europe projected to reach 522 billion USD by 2030 and Latin America expected to get 165 billion USD.

- The US and Canada are poised for steady growth, with cashless transactions forecasted to increase from 180 billion USD in 2020 to 349 billion USD by 2030, underscoring the ongoing shift towards digital payments in North America.

Global E-com Payment Methods

- From 2022 to 2026, there is a notable shift in the distribution of global e-commerce payment methods by share of transaction value.

- Digital wallets are expected to experience the most significant increase, rising from 49% in 2022 to 54% in 2026, indicating a growing consumer preference for this convenient and secure payment method.

- Conversely, credit card usage is projected to decline from 20% to 16%, reflecting a slight decrease in reliance on traditional card-based payments.

- Debit card transactions are also expected to decrease from 12% to 10%, while account-to-account (A2A) transfers are set to increase slightly from 9% to 10%.

- Buy now pay later (BNPL) options are anticipated to gain traction, with their share rising from 5% to 6% over the same period.

Global POS Payment Methods

- Between 2022 and 2026, there are notable shifts in the distribution of global point-of-sale (POS) payment methods by share of transaction value.

- Digital wallets are expected to experience a substantial increase, rising from 32% in 2022 to 43% in 2026, indicating a growing preference for this convenient and secure payment option among consumers.

- Credit card usage is projected to decline slightly from 26% to 24%, while debit card transactions are expected to decrease from 23% to 19%.

- Cash transactions at POS terminals are anticipated to decline significantly from 16% to 10%, reflecting a broader trend toward cashless payments.

- POS financing and prepaid card usage are expected to remain relatively stable at 2% each throughout the forecast period.

India’s UPI as a Rising Payment Powerhouse

- UPI, or Unified Payments Interface, is India’s foremost digital payments platform, offering real-time mobile payment capabilities grounded in Open Banking principles.

- Launched by the National Payment Corporation of India (NPCI) and Reserve Bank of India (RBI) in 2016, UPI aims to foster financial inclusion, promote digital payment usage, and reduce reliance on cash transactions.

- At checkout, consumers can select UPI alongside other payment methods, including digital wallets like Paytm, Google Wallet, BHIM, PhonePe, and WhatsApp.

- The success of UPI has propelled significant growth in Account-to-Account (A2A) transactions and digital wallets’ transaction value share, projected to reach 24% and 54%, respectively, by 2026.

- Furthermore, UPI’s influence extends to digital wallet usage at point-of-sale terminals, with their transaction value share rising from 25% in 2021 to 35% in 2022, expected to surge to 50% by 2026, mainly displacing cash transactions as intended.

Growth of Digital Payments

- In 2021, the trend towards cashless and digital payments continued, reaching record highs in advanced economies (AEs) and emerging and developing economies (EMDEs).

- The total value of cashless payments increased by 14% in AEs and 15% in EMDEs.

- Credit transfers accounted for most of the growth in value as a percentage of GDP, with e-money payments experiencing the most robust growth at 27%, followed by card payments and credit transfers at 4% each.

- The volume of cashless payments also surged, rising by 11% in AEs and 34% in EMDEs, primarily driven by increased card usage. The growth in card payments per person exceeded previous years, indicating sustained adoption of card payments.

Challenges and Concerns

- Data privacy and cybersecurity emerge as the leading concerns, garnering 48% of responses, reflecting the escalating apprehension surrounding digital information protection.

- Following closely behind is digital identity authentication, with 31% indicative of the growing significance of verifying online identities securely.

- Similarly, the use of new technology, at 30%, underscores the evolving landscape where regulatory frameworks struggle to keep pace with technological advancements.

- Local regulatory pressures, also at 30%, highlight the complexities of navigating diverse regional compliance requirements.

- Environmental and climate regulations, at 28%, denote a rising awareness of ESG (Environmental, Social, and Governance) considerations.

- Other notable concerns include KYC (Know Your Customer) obligations and Central Bank Digital Currency (CBDC), both at 27%, reflecting the financial sector’s regulatory challenges.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)