Table of Contents

- Introduction

- Editor’s Choice

- Global Payment Gateway Market Overview

- Preferred Payment Gateway Methods Statistics

- Cashless Transactions Statistics

- Global E-com Payment Gateway Methods Statistics

- Global POS Payment Gateway Methods Statistics

- India’s UPI as a Rising Payment Powerhouse

- Growth of Digital Payments

- Payment Gateway Challenges and Concerns Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Payment Gateway Statistics: The payment gateway plays a vital role in online transactions, ensuring security between buyers and sellers.

Encrypting sensitive information like credit card details ensures safe authorization and completion of purchases.

Merchants can easily integrate payment gateways into their online shops using different methods. These gateways support various payment methods.

Such as credit/debit cards, digital wallets, and bank transfers, enabling transactions globally in diverse currencies.

Despite transaction fees, payment gateways offer tools for tracking transaction performance and enhancing business operations.

Merchants must understand these fundamentals to establish a reliable and secure online payment system.

Editor’s Choice

- The revenue of the global payment gateway market reached USD 31.0 billion in 2023.

- By 2032, the global payment gateway market is projected to reach USD 161.0 billion. With hosted and non-hosted revenues reaching USD 94.99 billion and USD 66.01 billion, respectively.

- Market share distribution within the global payment gateway sector is delineated by enterprise size, with large enterprises commanding the majority at 55%.

- In 2020, a survey of global payment preferences revealed a notable inclination towards cashless transactions. South Korea leading the trend, with 77% of respondents expressing a preference for non-cash payments.

- In the Asia-Pacific region, the volume of cashless transactions is set to soar from 494 billion USD in 2020 to 1,818 billion USD by 2030. Reflecting the region’s rapid digitalization and expanding e-commerce landscape.

- Digital wallets are expected to experience the most significant increase, rising from 49% in 2022 to 54% in 2026. Indicating a growing consumer preference for this convenient and secure payment method.

- Data privacy and cybersecurity emerge as the leading concerns, garnering 48% of responses. Reflecting the escalating apprehension surrounding digital information protection.

Global Payment Gateway Market Overview

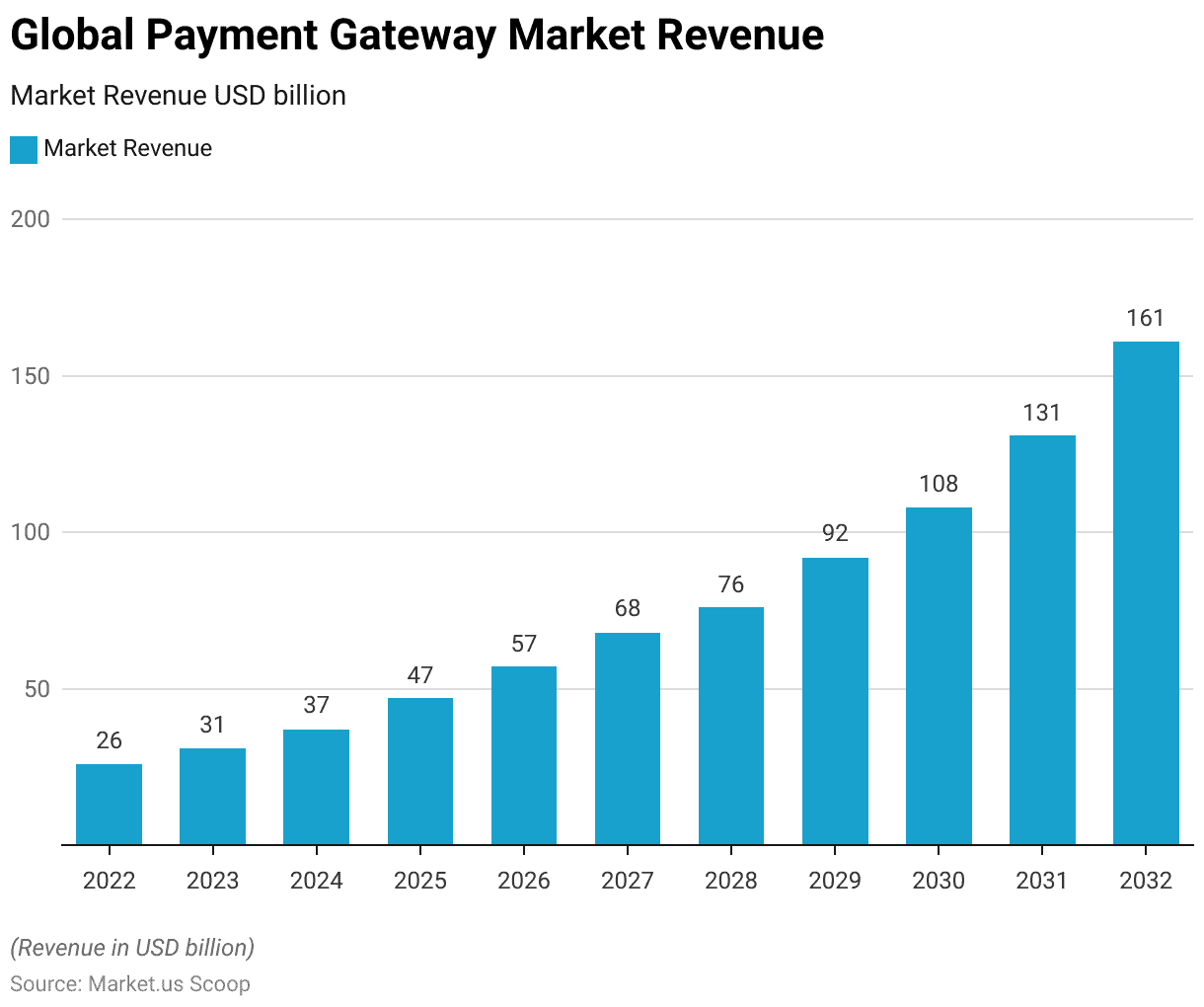

Global Payment Gateway Market Size Statistics

- The revenue of the global payment gateway market has exhibited consistent growth over the years at a CAGR of 20.5%. Demonstrating a positive trajectory indicative of the increasing adoption of digital payment solutions worldwide.

- In 2022, the market revenue stood at USD 26.0 billion, a notable increase to USD 31.0 billion in 2023.

- Building upon this momentum, the market continued its upward trend. Reaching USD 37.0 billion in 2024, USD 47.0 billion in 2025, and USD 57.0 billion in 2026.

- The growth trajectory remained robust, with revenues climbing to USD 68.0 billion in 2027 and USD 76.0 billion in 2028.

- As the demand for seamless and secure online payment processing solutions continued to surge. The market witnessed substantial expansion, reaching USD 92.0 billion in 2029 and USD 108.0 billion in 2030.

- The market is projected to experience even more significant growth, with revenues forecasted to reach USD 131.0 billion in 2031 and USD 161.0 billion in 2032.

- This steady progression underscores the pivotal role of payment gateways in facilitating the transition towards a digital economy. As businesses and consumers increasingly rely on electronic transactions for their financial needs.

(Source: Market.us)

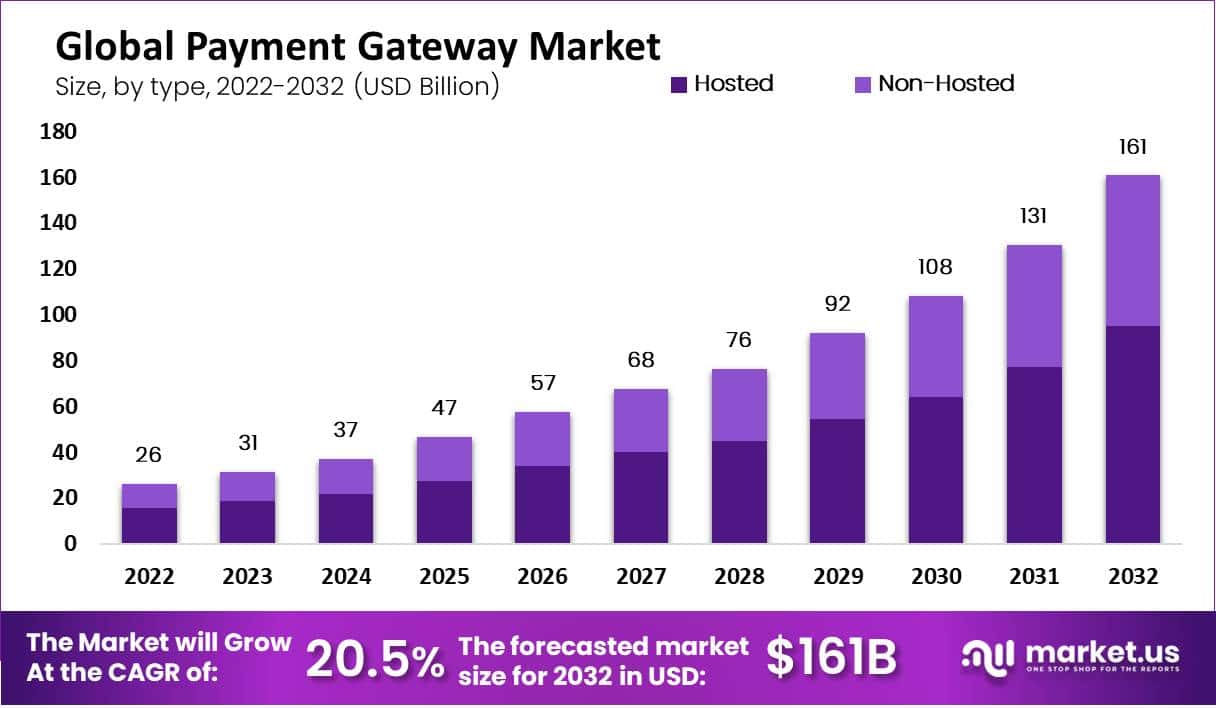

Global Payment Gateway Market Size – By Type Statistics

- The global payment gateway market, segmented by type, has demonstrated substantial growth over the forecast period. Driven by increasing digital transactions and the proliferation of e-commerce.

- In 2022, the total market revenue reached USD 26.0 billion. With hosted payment gateways contributing USD 15.34 billion and non-hosted solutions generating USD 10.66 billion.

- This trend continued in subsequent years, with the total market size expanding to USD 31.0 billion in 2023, USD 37.0 billion in 2024, and USD 47.0 billion in 2025.

- Hosted payment gateways maintained dominance, accounting for most revenues, while non-hosted solutions also experienced steady growth.

- By 2032, the global payment gateway market is projected to reach USD 161.0 billion. With hosted and non-hosted revenues reaching USD 94.99 billion and USD 66.01 billion, respectively.

- This robust growth trajectory underscores the pivotal role of payment gateways in facilitating secure and efficient online transactions across various industries and sectors.

(Source: Market.us)

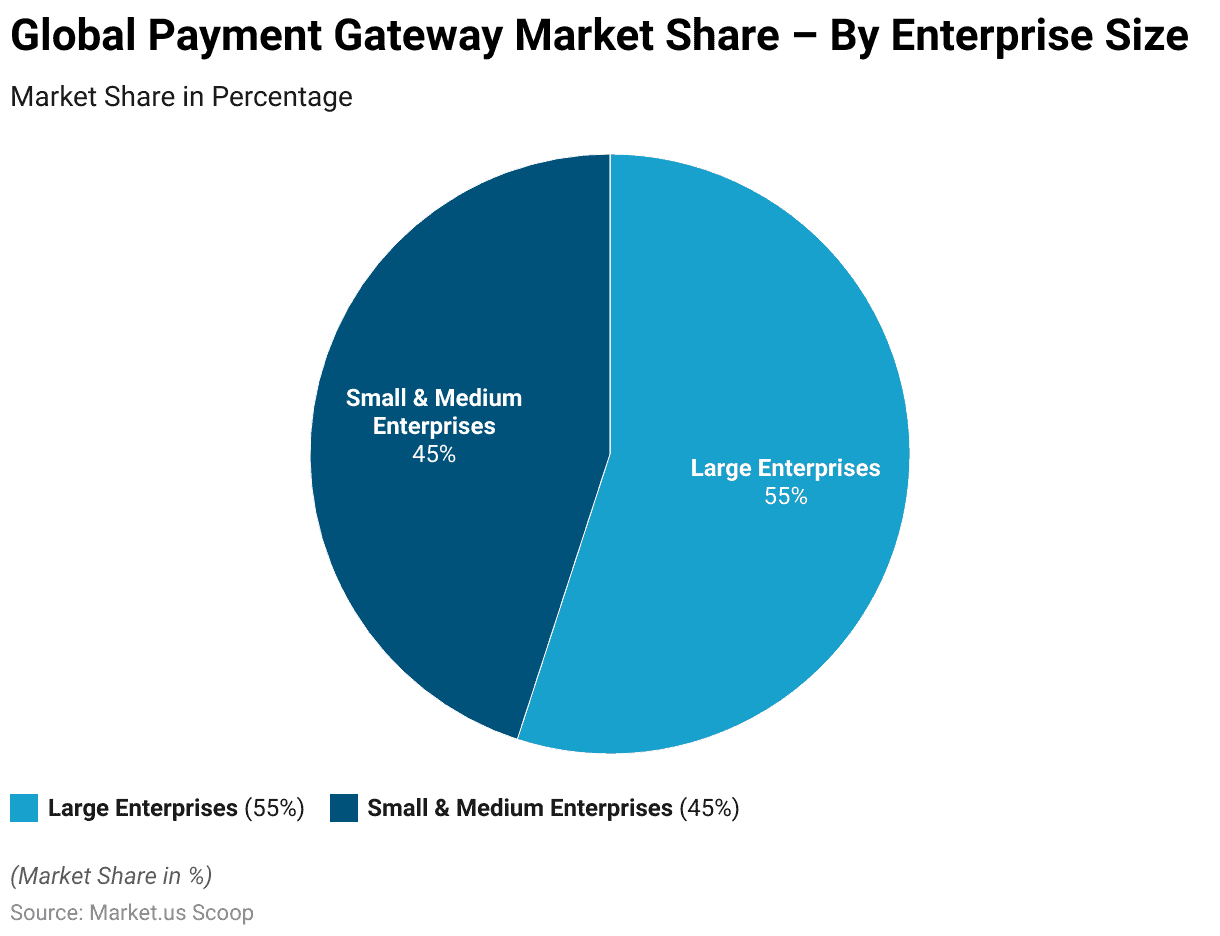

Global Payment Gateway Market Share – By Enterprise Size Statistics

- Market share distribution within the global payment gateway sector is delineated by enterprise size, with large enterprises commanding the majority at 55%.

- Conversely, small and medium enterprises (SMEs) constitute a significant segment, holding 45% of the market share.

- This breakdown underscores the nuanced landscape of the payment gateway market. Where large corporations and SMEs play pivotal roles in shaping its dynamics and growth trajectory.

- Such a distribution suggests a diverse clientele and underscores the importance of tailored solutions to meet the distinct needs of enterprises across the spectrum of sizes.

(Source: Market.us)

Regional Analysis of the Global Payment Gateway Market Statistics

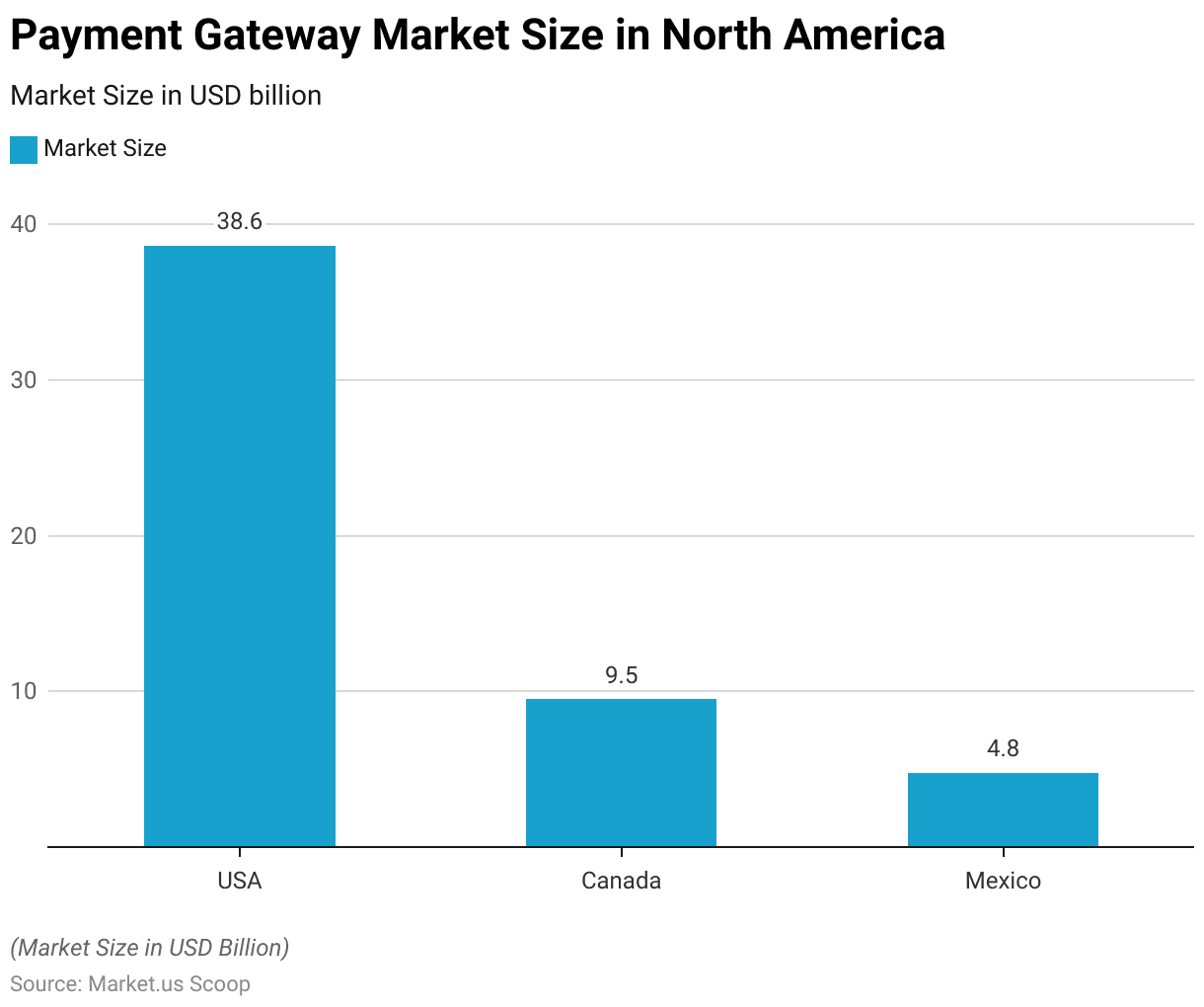

North America

- In North America, the payment gateway market demonstrates significant growth, with the United States leading the region with a market size of USD 38.63 billion. This substantial figure reflects the country’s advanced technological infrastructure and widespread adoption of e-commerce.

- Canada follows closely behind, with a market size of USD 9.5 billion. Indicating a robust presence of payment gateway solutions in the Canadian market.

- Additionally, Mexico contributes to the regional market with a size of USD 4.76 billion. Underscoring the growing importance of digital payment systems in the country’s economy.

- These figures illustrate North America’s prominence in the global payment gateway market. Driven by the diverse economic landscapes and increasing consumer demand for secure and convenient online payment options.

(Source: Statista)

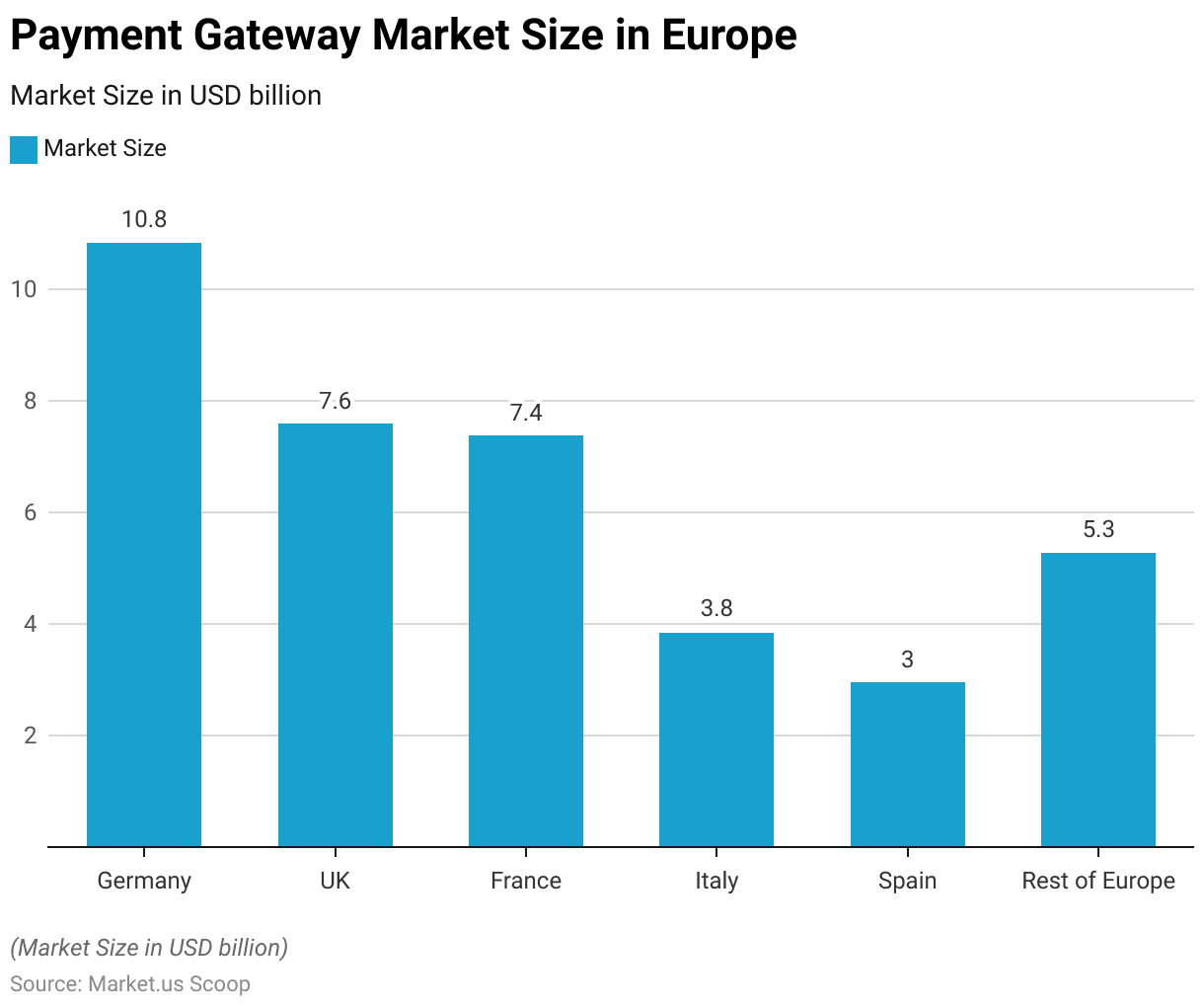

Europe

- The European payment gateway market showcases notable diversity and growth across various countries.

- Germany leads the region with a market size of USD 10.82 billion, reflecting its strong economy and advanced technological infrastructure.

- The United Kingdom follows closely behind, with a market size of USD 7.59 billion. Driven by its established financial services sector and high levels of e-commerce activity.

- France and Italy also contribute significantly, with market sizes of USD 7.37 billion and USD 3.84 billion, respectively. Highlighting their positions as key players in the European payment gateway landscape.

- Spain adds to the regional market with a size of USD 2.95 billion.

- Additionally, the rest of Europe collectively accounts for USD 5.27 billion. Indicating a diverse array of markets with varying levels of adoption and demand for payment gateway solutions.

- Overall, Europe represents a vital hub for the global payment gateway market. Characterized by innovation, regulation, and consumer preferences driving the evolution of digital payment ecosystems.

(Source: Statista)

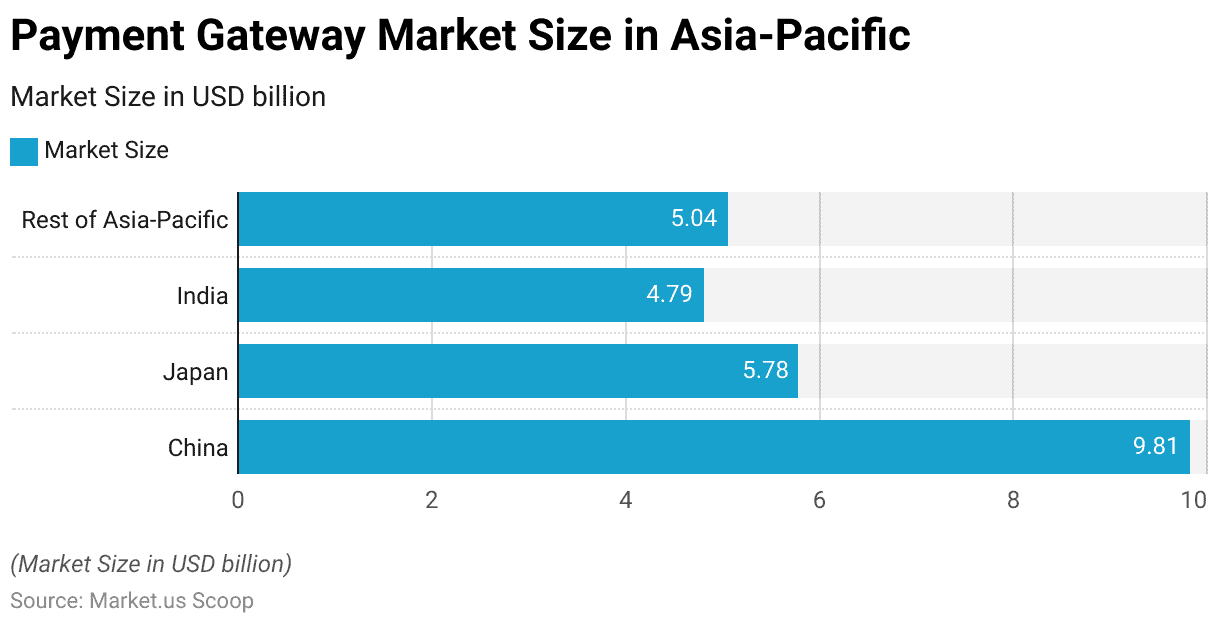

Asia- Pacific

- In the Asia-Pacific region, the payment gateway market demonstrates considerable growth and diversity across critical countries.

- China leads the region with a market size of USD 9.81 billion. Driven by its large population, thriving e-commerce sector, and rapid digitalization initiatives.

- Japan follows closely behind, with a market size of USD 5.78 billion, reflecting its mature economy and technological advancements.

- India also contributes significantly, with a market size of USD 4.79 billion. Fueled by increasing internet penetration and smartphone adoption, particularly in urban centers.

- Additionally, the rest of Asia-Pacific collectively accounts for USD 5.04 billion. Indicating a diverse mix of markets with varying levels of development and demand for payment gateway solutions.

- Overall, the Asia-Pacific region represents a dynamic and rapidly evolving landscape for the global payment gateway market. Offering substantial growth opportunities driven by growing consumer behaviors and technological advancements.

(Source: Statista)

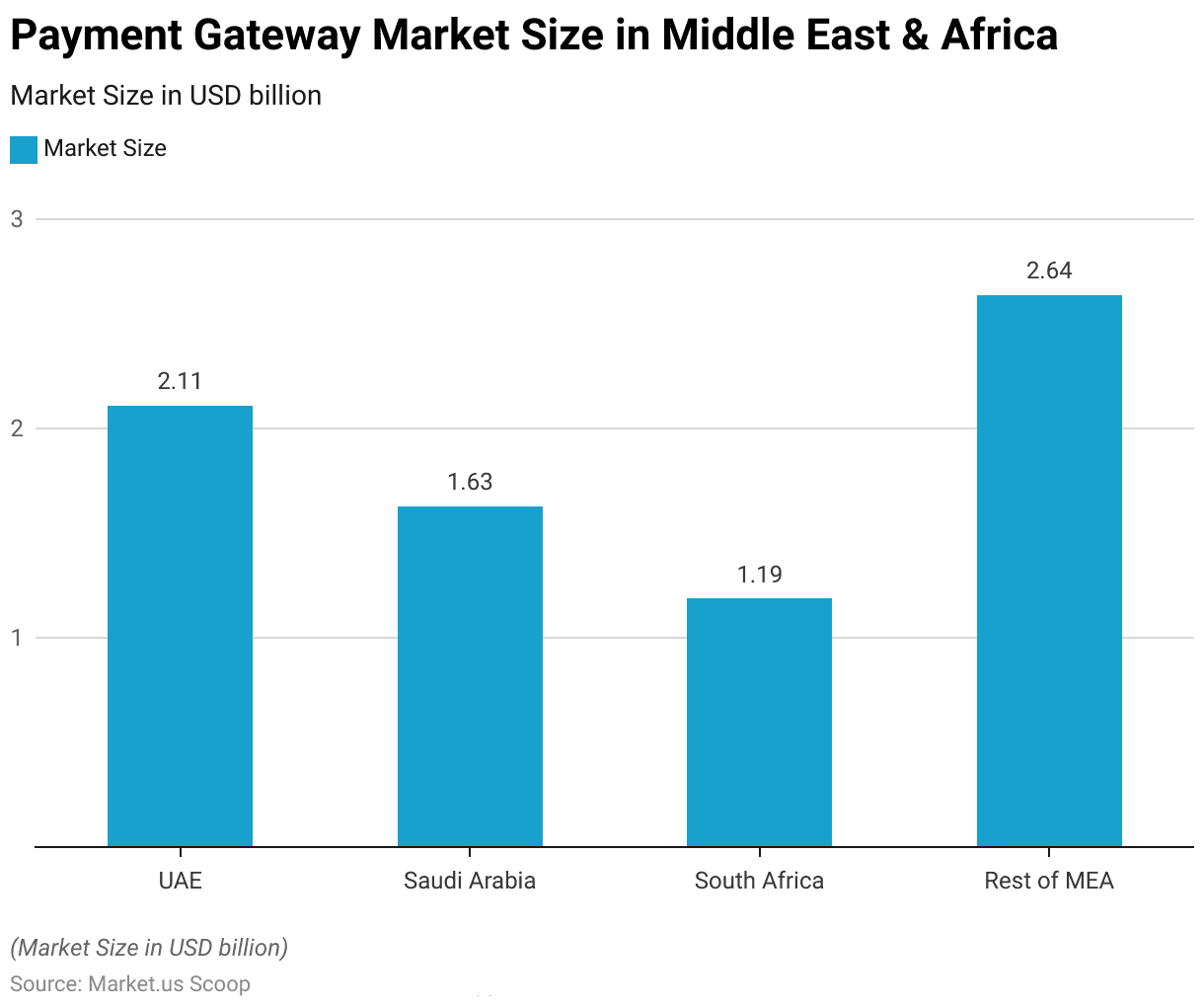

Middle East & Africa

- In the Middle East & Africa (MEA) region, the payment gateway market shows varying levels of development and growth across different countries.

- The United Arab Emirates (UAE) leads the region with a market size of USD 2.11 billion. Driven by its status as a regional financial hub and growing digital economy.

- Saudi Arabia follows with a market size of USD 1.63 billion. Reflecting its efforts to diversify its economy and embrace digital transformation.

- South Africa contributes significantly to the regional market with a size of USD 1.19 billion. Driven by its large and increasingly connected population.

- The rest of MEA collectively accounts for USD 2.64 billion. Showcasing a mix of emerging markets with growing demand for digital payment solutions.

- Overall, the MEA region presents opportunities for further expansion and innovation in the payment gateway market. Fueled by increasing internet penetration, urbanization, and the adoption of mobile technology.

(Source: Statista)

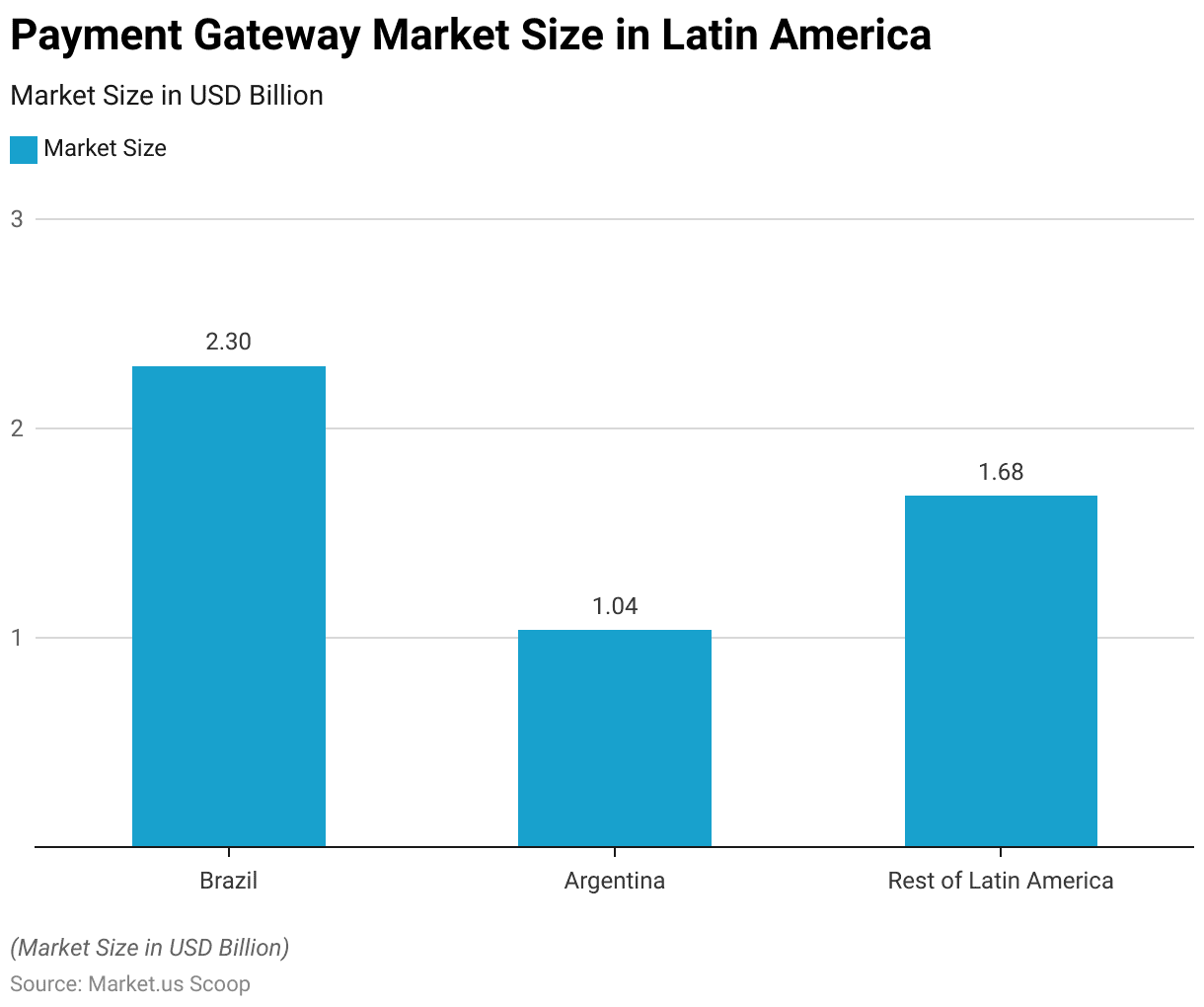

Latin America

- The payment gateway market in Latin America exhibits diverse characteristics across its constituent countries.

- Brazil leads the region with a market size of USD 2.3 billion. Driven by its sizable population, robust e-commerce sector, and increasing adoption of digital payment solutions.

- Argentina follows with a market size of USD 1.04 billion. Indicating a significant presence of payment gateway services in the country’s evolving financial landscape.

- Additionally, the rest of Latin America accounts for USD 1.68 billion. Showcasing a mix of emerging markets with growing opportunities for digital payment technology.

- These figures underscore the region’s potential for further expansion and innovation in the payment gateway market. Driven by increasing internet connectivity, smartphone penetration, and changing consumer preferences towards cashless transactions.

(Source: Statista)

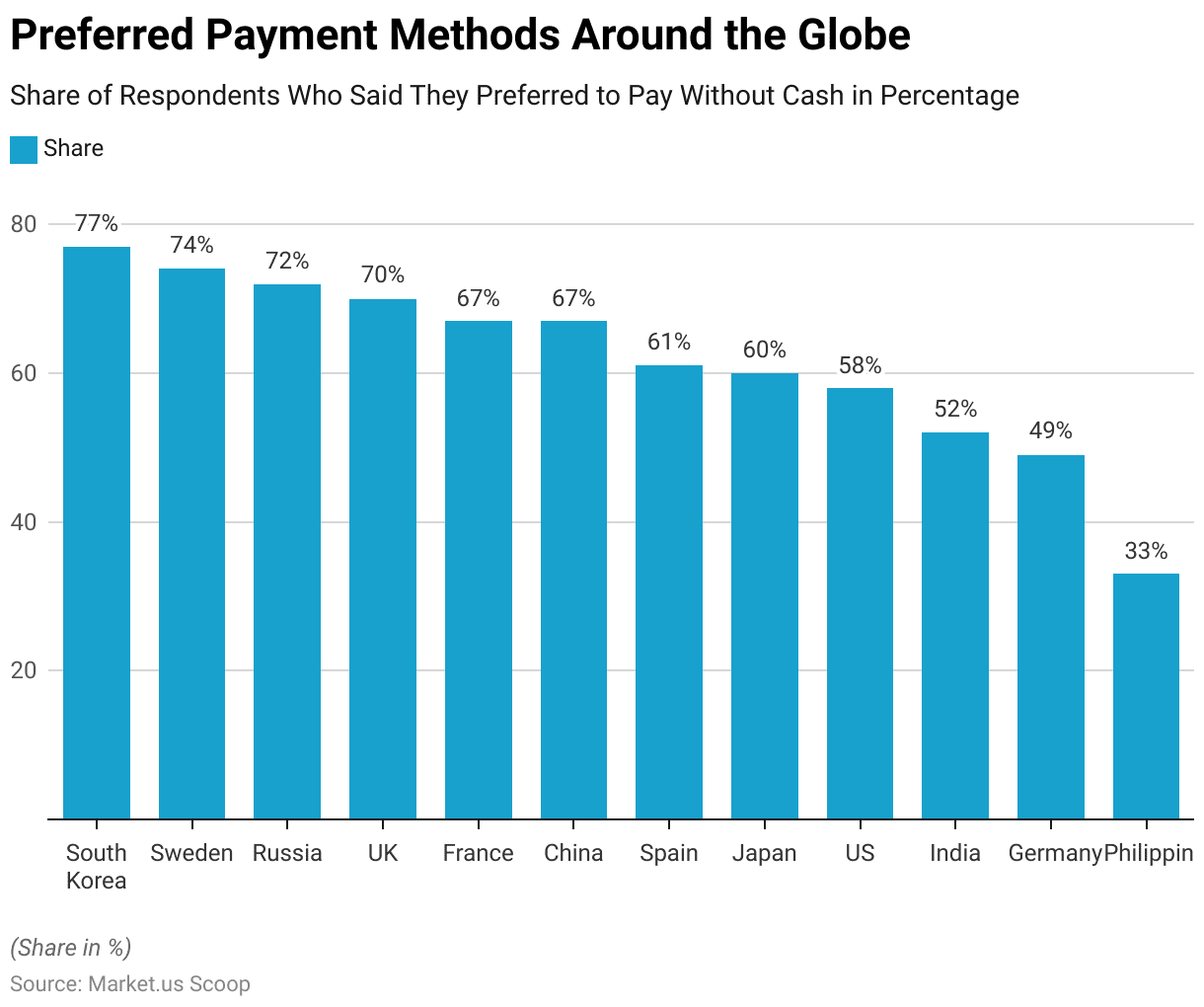

Preferred Payment Gateway Methods Statistics

- In 2020, a survey of global payment preferences revealed a notable inclination towards cashless transactions, with South Korea leading the trend, with 77% of respondents expressing a preference for non-cash payments.

- Following closely, Sweden and Russia stood at 74% and 72%, respectively, reflecting the widespread adoption of digital payment methods in these countries.

- The United Kingdom and France also demonstrated a strong propensity towards cashless transactions, with 70% and 67% of respondents favoring non-cash options, respectively.

- China and Spain mirrored this sentiment, with 67% and 61% of respondents embracing cashless payments.

- Meanwhile, Japan and the United States registered slightly lower but substantial figures at 60% and 58%, respectively.

- India and Germany showed moderate preferences for non-cash payments at 52% and 49%, respectively, suggesting a gradual shift towards digital transactions in these regions.

- The Philippines exhibited a comparatively lower preference for cashless transactions, with 33% of respondents indicating a preference for non-cash payment methods.

- These findings underscore the global trend towards digitalization in financial transactions, with most respondents across various countries expressing a preference for cashless payment options.

(Source: Global Web Index)

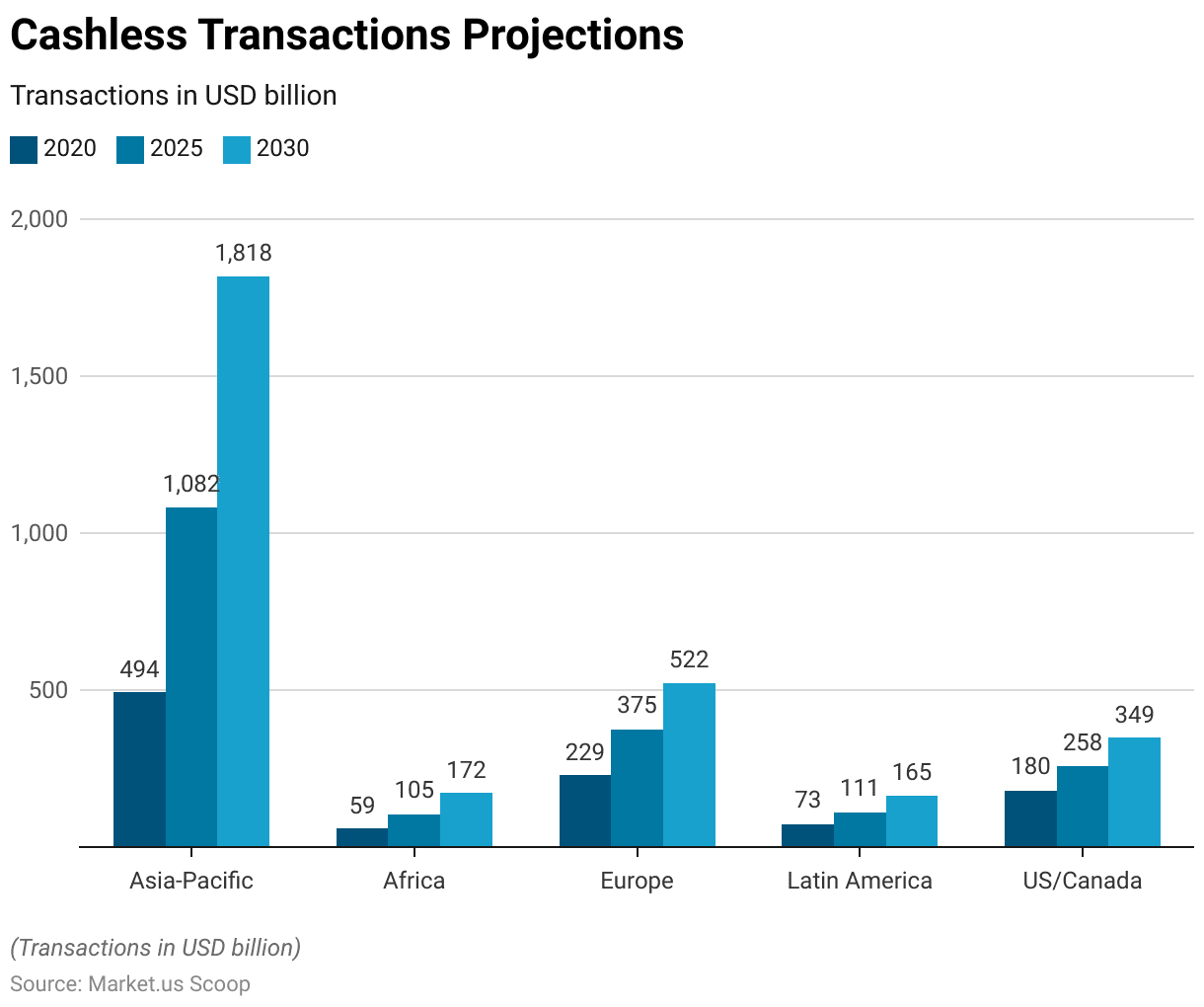

Cashless Transactions Statistics

- Cashless transactions have experienced significant growth across regions from 2020 to projected figures in 2025 and 2030.

- In the Asia-Pacific region, the volume of cashless transactions is set to soar from 494 billion USD in 2020 to 1,818 billion USD by 2030, reflecting the region’s rapid digitalization and expanding e-commerce landscape.

- Similarly, Africa is expected to grow substantially, with cashless transactions rising from 59 billion USD in 2020 to 172 billion USD by 2030, driven by increasing smartphone penetration and financial inclusion initiatives.

- Europe and Latin America also anticipate significant increases in cashless transaction volumes, with Europe projected to reach 522 billion USD by 2030 and Latin America expected to get 165 billion USD.

- The US and Canada are poised for steady growth, with cashless transactions forecasted to increase from 180 billion USD in 2020 to 349 billion USD by 2030, underscoring the ongoing shift towards digital payments in North America.

- These projections indicate a global trend towards cashless transactions driven by technological advancements, changing consumer preferences, and efforts to improve financial efficiency and transparency.

(Source: PWC)

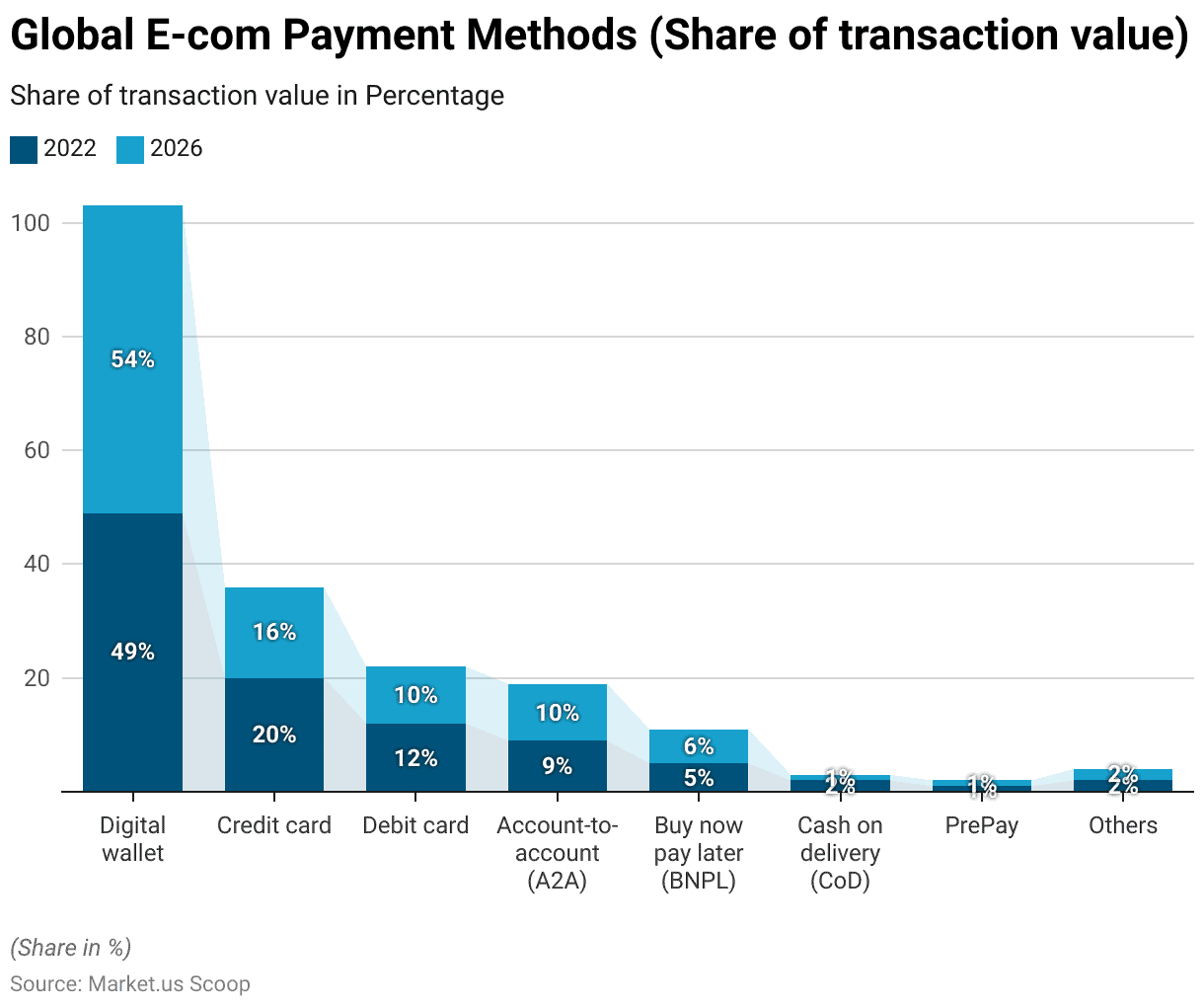

Global E-com Payment Gateway Methods Statistics

- From 2022 to 2026, there is a notable shift in the distribution of global e-commerce payment methods by share of transaction value.

- Digital wallets are expected to experience the most significant increase, rising from 49% in 2022 to 54% in 2026, indicating a growing consumer preference for this convenient and secure payment method.

- Conversely, credit card usage is projected to decline from 20% to 16%, reflecting a slight decrease in reliance on traditional card-based payments.

- Debit card transactions are also expected to decrease from 12% to 10%, while account-to-account (A2A) transfers are set to increase slightly from 9% to 10%.

- Buy now pay later (BNPL) options are anticipated to gain traction, with their share rising from 5% to 6% over the same period.

- Cash on delivery (CoD) and PrePay methods are expected to decline, indicating a shift away from cash-based transactions in favor of digital alternatives.

- These trends reflect the evolving landscape of e-commerce payments, driven by technological advancements, changing consumer preferences, and the emergence of new payment solutions.

(Source: FIS)

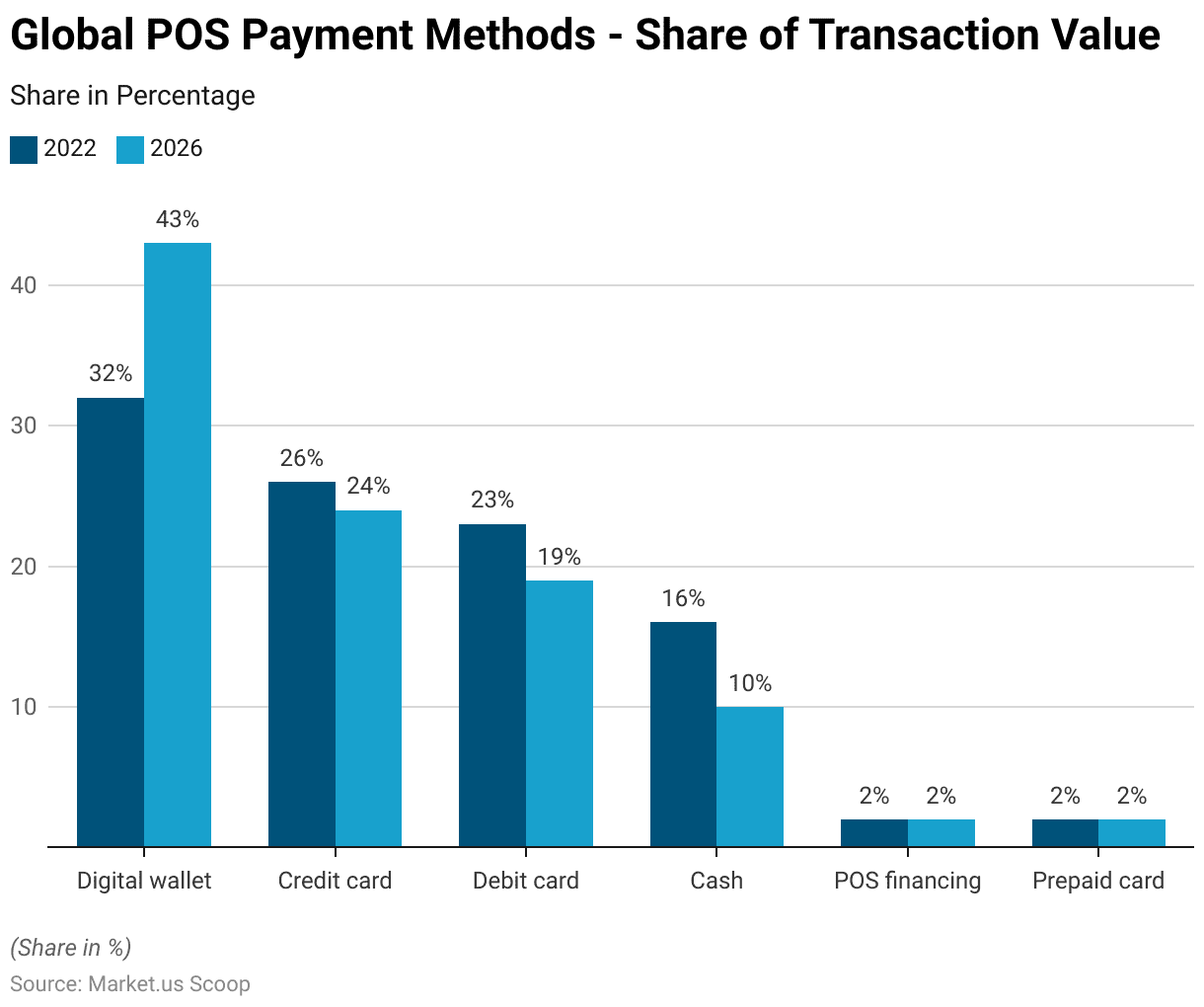

Global POS Payment Gateway Methods Statistics

- Between 2022 and 2026, there are notable shifts in the distribution of global point-of-sale (POS) payment methods by share of transaction value.

- Digital wallets are expected to experience a substantial increase. Rising from 32% in 2022 to 43% in 2026, indicating a growing preference for this convenient and secure payment option among consumers.

- Credit card usage is projected to decline slightly from 26% to 24%, while debit card transactions are expected to decrease from 23% to 19%.

- Cash transactions at POS terminals are anticipated to decline significantly from 16% to 10%, reflecting a broader trend toward cashless payments.

- POS financing and prepaid card usage are expected to remain relatively stable at 2% each throughout the forecast period.

- These trends underscore the increasing adoption of digital payment solutions at point-of-sale locations, driven by technological advancements and changing consumer behaviors toward cashless transactions.

(Source: FIS)

India’s UPI as a Rising Payment Powerhouse

- UPI, or Unified Payments Interface, is India’s foremost digital payments platform, offering real-time mobile payment capabilities grounded in open banking principles.

- Launched by the National Payment Corporation of India (NPCI) and Reserve Bank of India (RBI) in 2016, UPI aims to foster financial inclusion, promote digital payment usage, and reduce reliance on cash transactions.

- UPI facilitates seamless fund transfers between bank accounts, accessible 24/7/365, with instant processing and zero fees.

- Its user-friendly setup and robust security features, including single-click two-factor authentication via UPI PIN and mobile SIM card, ensure safe transactions without divulging sensitive bank details.

- Leveraging tokenization, consumers share their UPI ID (Virtual Payment Address) with merchants to transact. UPI’s adaptable architecture integrates with various payment sources and is supported by nearly every Indian bank through mobile applications.

- At checkout, consumers can select UPI alongside other payment methods, including digital wallets like Paytm, Google Wallet, BHIM, PhonePe, and WhatsApp.

- The success of UPI has propelled significant growth in Account-to-Account (A2A) transactions and digital wallets’ transaction value share, projected to reach 24% and 54%, respectively, by 2026.

- Furthermore, UPI’s influence extends to digital wallet usage at point-of-sale terminals, with their transaction value share rising from 25% in 2021 to 35% in 2022, expected to surge to 50% by 2026, mainly displacing cash transactions as intended.

(Source: FIS)

Growth of Digital Payments

- In 2021, the trend towards cashless and digital payments continued, reaching record highs in advanced economies (AEs) and emerging and developing economies (EMDEs).

- The total value of cashless payments increased by 14% in AEs and 15% in EMDEs.

- Credit transfers accounted for most of the growth in value as a percentage of GDP, with e-money payments experiencing the most robust growth at 27%, followed by card payments and credit transfers at 4% each.

- The volume of cashless payments also surged, rising by 11% in AEs and 34% in EMDEs, primarily driven by increased card usage. The growth in card payments per person exceeded previous years, indicating sustained adoption of card payments.

- However, variations were observed among countries. With EMDEs experiencing more substantial growth in credit transfers per person than AEs.

- Additionally, e-money payments per person were more prevalent in EMDEs than in AEs, while direct debits were more common in AEs than in EMDEs. On average, consumers and businesses in AEs conducted twice as many digital transactions per person as those in EMDEs.

(Source: BIS)

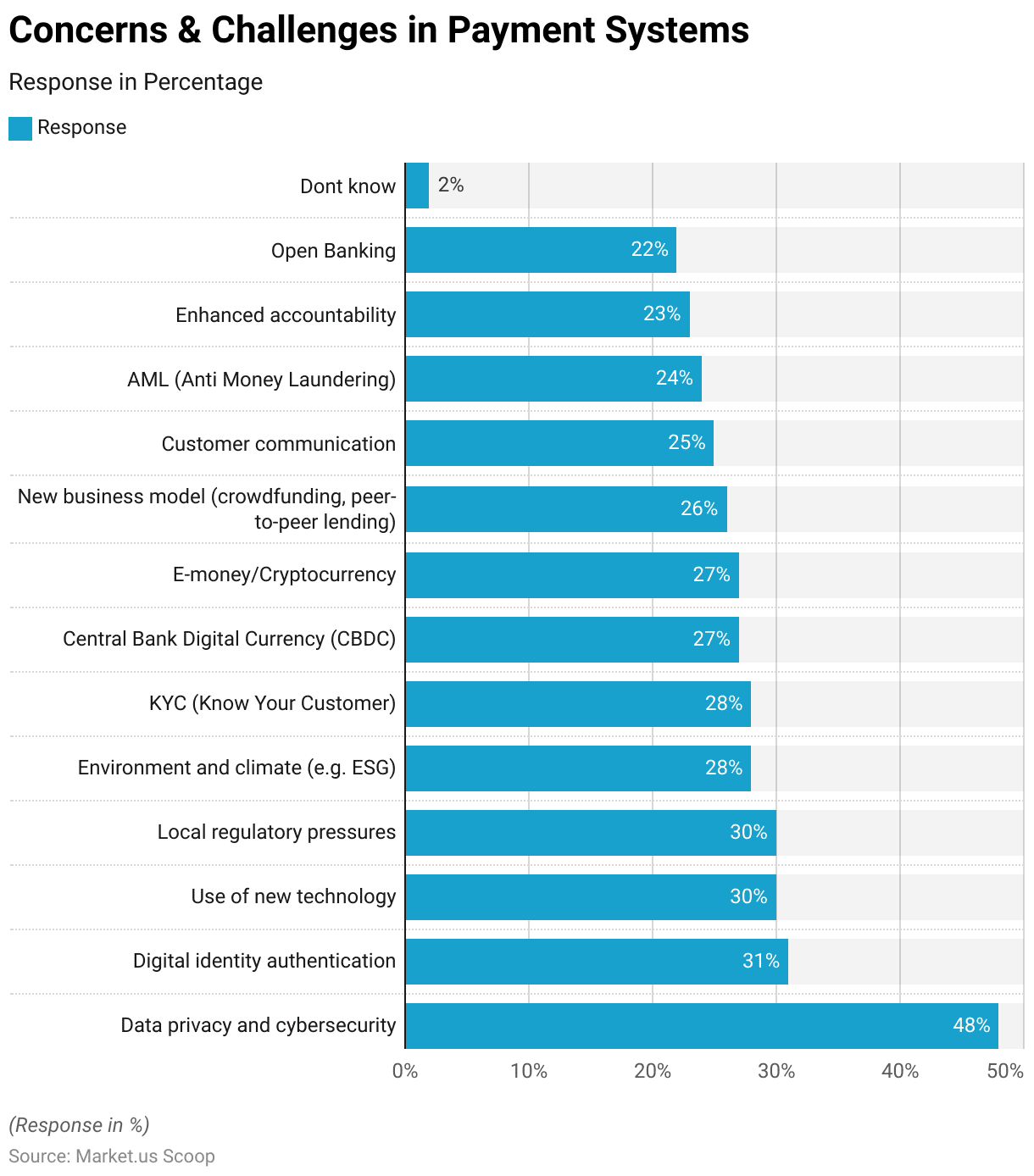

Payment Gateway Challenges and Concerns Statistics

- Data privacy and cybersecurity emerge as the leading concerns, garnering 48% of responses, reflecting the escalating apprehension surrounding digital information protection.

- Following closely behind is digital identity authentication, with 31% indicative of the growing significance of verifying online identities securely.

- Similarly, the use of new technology, at 30%, underscores the evolving landscape where regulatory frameworks struggle to keep pace with technological advancements.

- Local regulatory pressures, also at 30%, highlight the complexities of navigating diverse regional compliance requirements.

- Environmental and climate regulations, at 28%, denote a rising awareness of ESG (Environmental, Social, and Governance) considerations.

- Other notable concerns include KYC (Know Your Customer) obligations and Central Bank Digital Currency (CBDC), both at 27%, reflecting the financial sector’s regulatory challenges.

- The survey also reveals concerns about emerging business models such as crowdfunding and peer-to-peer lending, with 26%.

- Customer communication, AML (Anti Money Laundering), and enhanced accountability follow closely, demonstrating the multifaceted nature of regulatory risks.

- Open Banking, at 22%, signifies ongoing transformations in financial services.

- Further, these findings underscore the intricate regulatory landscape organizations must navigate to ensure compliance and mitigate risks effectively over the next five years.

(Source: PWC)

Recent Developments

Acquisitions and Mergers:

- Five9’s Acquisition of Aceyus: In August 2023, Five9 acquired Aceyus, a company specializing in data integration and analytics, to enhance its capabilities in optimizing customer experiences. This strategic move aims to strengthen Five9’s position in the contact center analytics market.

- SAP’s Acquisition of Askdata: In July 2022, SAP SE announced the acquisition of Askdata, a startup specializing in search-driven analytics. This acquisition enhances SAP’s ability to assist businesses in making informed decisions through AI-driven natural language searches.

New Product Launches:

- Gladia’s Multilingual Real-Time Audio Transcription and Analytics Engine: In October 2024, Gladia launched a multilingual real-time audio transcription and analytics engine, aiming to assist contact centers in automating and streamlining processes. This product supports over 100 languages, offering exceptional accuracy in transcription.

Funding:

- Invoca’s $83 Million Funding Round: In June 2022, Invoca, a platform utilizing AI to analyze calls for marketing and customer agent training, raised $83 million, valuing the company at $1.1 billion post-money. This funding underscores the desirability of contact center technology in the market.

Technological Advancements:

- Integration of AI and Automation: Contact centers are increasingly adopting AI and automation technologies to enhance customer service efficiency. The integration of these technologies is expected to grow. AI-driven analytics plays a pivotal role in understanding customer behavior and improving service delivery.

Conclusion

Payment Gateway Statistics – In conclusion, payment gateways facilitate secure online transactions between businesses and consumers.

The global market for payment gateways is experiencing significant growth, driven by the increasing popularity of e-commerce and technological advancements.

Further, major players like PayPal, Stripe, and Square offer a wide range of services tailored to meet the diverse needs of businesses worldwide.

The industry will continue prioritizing data privacy, cybersecurity, and adherence to regulations. Advancements in technologies like AI and blockchain are expected to drive further improvements in payment processing.

Ultimately, payment gateways are essential for businesses to embrace digital payments and remain competitive in the modern digital landscape.

FAQs

A payment gateway is a technology that securely facilitates online transactions by transmitting sensitive information between a website, mobile app, or point-of-sale system and the payment processor or acquiring bank.

When a customer purchases online, the payment gateway encrypts their payment information (such as credit card details) and sends it securely to the payment processor for authorization. Once authorized, the payment gateway returns a confirmation to the merchant, completing the transaction.

Payment gateways benefit businesses, including e-commerce stores, retail shops, service providers, non-profits, and subscription-based businesses.

Payment gateways typically support various payment methods. Including credit and debit cards, digital wallets (such as Apple Pay and Google Pay), bank transfers, ACH payments, and alternative payment methods specific to certain regions.

Yes, reputable payment gateways adhere to industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), to ensure the security and integrity of transactions. Compliance with these regulations helps protect customer data and reduce the risk of fraud.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)