Table of Contents

Market Overview

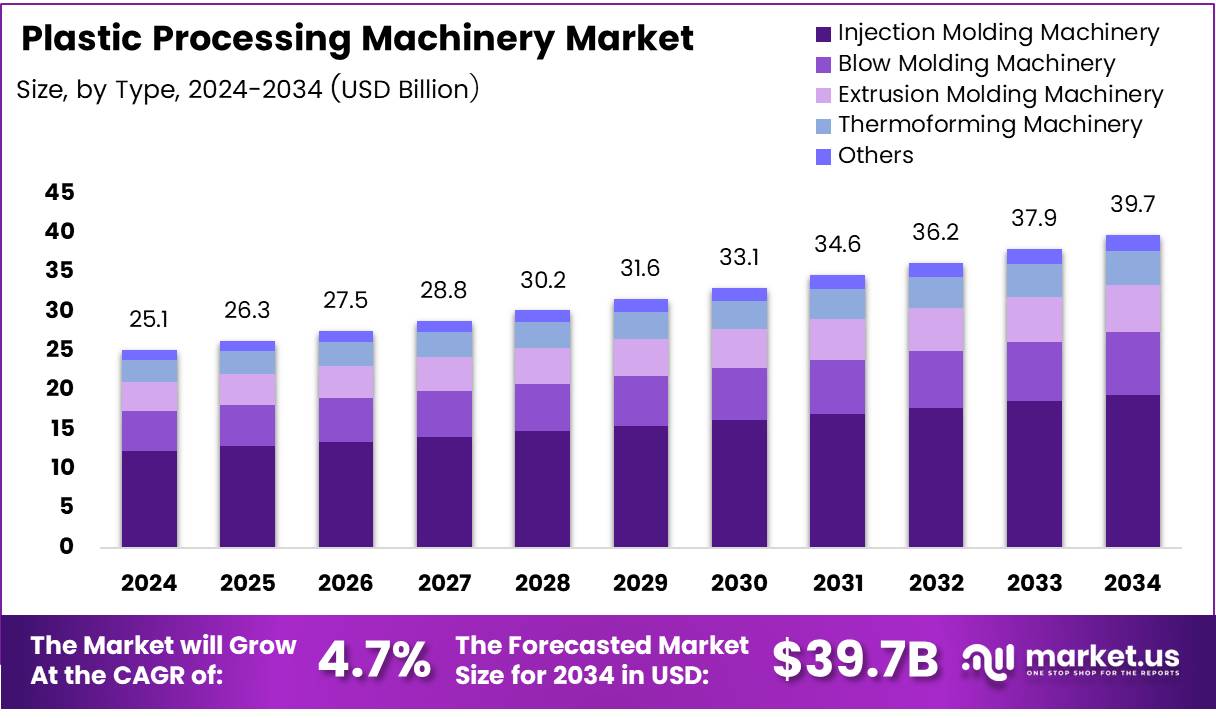

The Global Plastic Processing Machinery Market size is expected to be worth around USD 39.7 Billion by 2034, from USD 25.1 Billion in 2024, growing at a CAGR of 4.7% during the forecast period.

The plastic processing machinery market is growing fast due to rising demand across industries. Key sectors include packaging, automotive, construction, and healthcare. Injection moulding machines produce 40% of all plastic goods, making them vital to manufacturing. They offer speed, precision, and high-volume output.

New technologies drive opportunity in this market. The MF Series Heavy Duty Thermoforming Machine offers 40 cycles/min, boosting deep-draw production. This increases efficiency and lowers operational costs. Businesses seek faster machines to meet demand and cut downtime.

Governments support industry growth with funding and tax relief. Asia-Pacific leads with smart factory investments. Europe backs green manufacturing and recycling. These actions help firms upgrade machines and meet global standards. Stricter environmental rules shape market direction. Companies adopt energy-efficient and automated machines. Demand grows for recyclable plastic solutions. This pushes innovation and improves ROI.

Manufacturers benefit from rising consumption and new tech. Investment in automation improves quality and speed. With strong backing and market demand, the plastic processing machinery market will grow steadily. Now is the time to invest in smart, efficient systems.

Key Takeaways

- Global plastic processing machinery market to reach USD 39.7 billion by 2034.

- Market to grow at 4.7% CAGR from 2025 to 2034.

- Injection molding machines held 51.2% share in 2024.

- Packaging segment led with 36.2% share in 2024.

- Asia Pacific held 39.8% share of global market.

Market Drivers

- Rising Packaged Goods Demand: Urbanization and higher incomes boost consumption of packaged food, beverages, and personal care products, driving plastic packaging machinery use.

- Automotive Lightweighting: Shift from metal to plastic parts in vehicles fuels demand for advanced molding and extrusion machines.

- Construction Growth: Rising infrastructure projects increase demand for plastic-based construction materials, supporting machinery sales.

- Tech Innovations: Automation, robotics, and smart controls enhance machine efficiency, output, and energy savings—attracting more manufacturers.

Challenges

- Environmental Regulations: Manufacturers face pressure to adopt sustainable machinery, requiring high investment.

- High Machinery Cost: Advanced machines are costly, limiting access for smaller firms.

- Raw Material Volatility: Fluctuating plastic prices hinder production and investment planning.

Segmental Insights

Type Analysis

Injection Molding led with 51.2% share in 2024 due to high demand across industries. Blow Molding supported packaging needs, Extrusion served construction, and Thermoforming catered to food packaging. Others had niche roles.

Industry Analysis

Packaging dominated with 36.2% share, driven by eco-friendly demand. Automotive, Construction, Consumer Goods, and Healthcare also contributed to market growth.

Regional Insights

Asia Pacific led with 39.8% share (USD 9.7B) in 2024, driven by strong manufacturing in China, India, and Japan.

North America growth here is fueled by demand for advanced plastic parts and adoption of 3D printing and recycling tech.

Europe strict regulations boost demand for sustainable, energy-efficient plastic machinery.

Middle East & Africa market is growing with infrastructure development and rising consumer spending.

Latin America gradual growth supported by packaging and automotive demand, especially in Brazil and Argentina.

Recent Developments

- In Nov 2024, IonKraft secured €3.5 million in equity funding to boost its efforts toward creating sustainable, circular solutions in the packaging industry. The investment will help scale their advanced barrier coating technology that enables easier recycling of plastic packaging.

- In Jan 2024, CMD Corporation acquired FAS Converting Machinery, a strategic move aimed at expanding CMD’s global footprint and enhancing its product portfolio in plastic converting and bag converting machinery.

- In Feb 2025, MacroCycle Technologies, a cleantech startup focused on circular plastics, raised $6.5 million in seed funding. The funds will be used to commercialize its innovative, low-energy technology designed to upcycle plastic waste into high-value materials.

- In Mar 2025, Epoch Biodesign raised €17 million to advance its mission of solving the plastic crisis through circular economy solutions. The company uses engineered enzymes to break down plastic waste and transform it into reusable chemicals.

Conclusion

The global plastic processing machinery market is set for steady growth, reaching USD 39.7 billion by 2034, driven by rising demand in packaging, automotive, and construction sectors. Technological innovations, government support, and a shift toward sustainability are key growth enablers. Despite challenges like high machinery costs and regulatory pressures, strong investment and demand for efficient, eco-friendly machines make this a promising market for the future.