Table of Contents

Introduction

According to Retail Analytics Statistics, Retail analytics involves collecting and analyzing data to make informed business decisions in the retail sector. It helps retailers enhance the customer experience, optimize inventory, and improve pricing strategies. Key components include data collection, descriptive, predictive, and prescriptive analytics, as well as customer and store analytics.

Challenges include data quality and privacy considerations. Future trends point to increased use of AI, IoT integration, personalization, and sustainability efforts. In summary, retail analytics is essential for retailers, driving operational efficiency and profitability while shaping the industry’s future.

Editor’s Choice

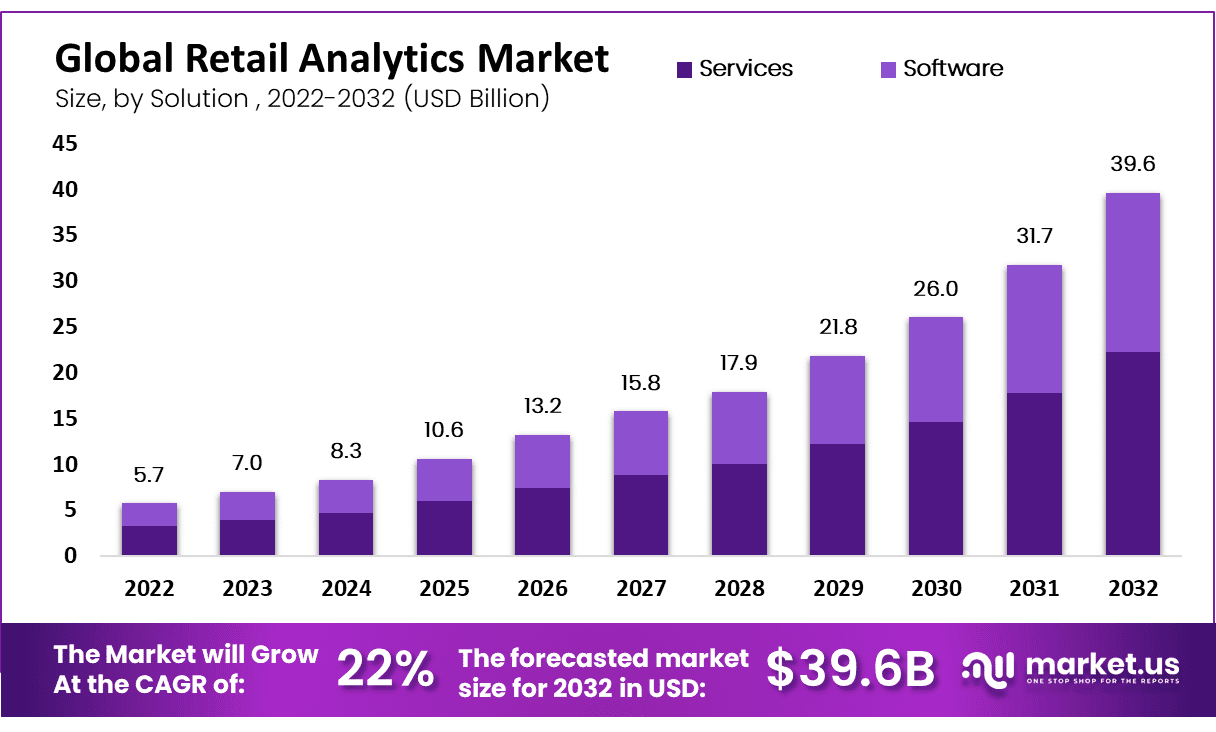

- The retail analytics market is experiencing robust growth at a CAGR of 22%.

- In 2022, the retail analytics market generated approximately USD 5.7 billion in revenue.

- In 2022, the total market revenue stood at USD 5.7 billion, with an equal split between services and software, both amounting to USD 3.0 billion.

- Cloud-based deployments dominate this landscape, commanding a significant 63% market share, highlighting the growing trend of businesses adopting cloud technology for their retail analytics needs.

- In the realm of retail, demographic data takes the lead, comprising a substantial 71% of the information gathered.

- A significant portion, approximately 69%, of consumers allocate most of their disposable income each month to in-store purchases.

- In 2016, a study conducted by Javelin Strategy & Research highlighted the substantial financial burden that fraud imposes on retailers, equating to more than 7.5% of their yearly earnings.

Global Retail Analytics Market Overview

Global Retail Analytics Market Size

- The retail analytics market is experiencing robust growth at a CAGR of 22%, with its revenue projected to witness significant expansion over the next decade.

- In 2022, the market generated approximately USD 5.7 billion in revenue.

- By 2027, the retail analytics market is poised to surpass USD 15.8 billion, demonstrating consistent growth.

- The upward trajectory remains intact in the following years, with projected revenues of USD 17.9 billion in 2028 and a significant leap to USD 21.8 billion in 2029.

- The market’s growth becomes even more pronounced as we look further into the future, with estimates suggesting a revenue of USD 26.0 billion in 2030, USD 31.7 billion in 2031, and a substantial USD 39.6 billion in 2032.

Retail Analytics Market Size – By Solution

- The global retail analytics market is poised for remarkable growth, as indicated by the revenue figures for the coming years.

- In 2022, the total market revenue stood at USD 5.7 billion, with an equal split between services and software, both amounting to USD 3.0 billion.

- The following years are expected to witness substantial expansion, with 2023 forecasted to reach USD 7.0 billion in total market revenue, with services and software contributing USD 4.0 billion and USD 3.0 billion, respectively.

- The growth trajectory remains consistent, reaching USD 21.8 billion in 2029, USD 26.0 billion in 2030, and USD 31.7 billion in 2031.

- The market is set for a significant milestone in 2032, with total revenue projected at USD 39.6 billion, supported by services at USD 22.0 billion and software at USD 17.0 billion.

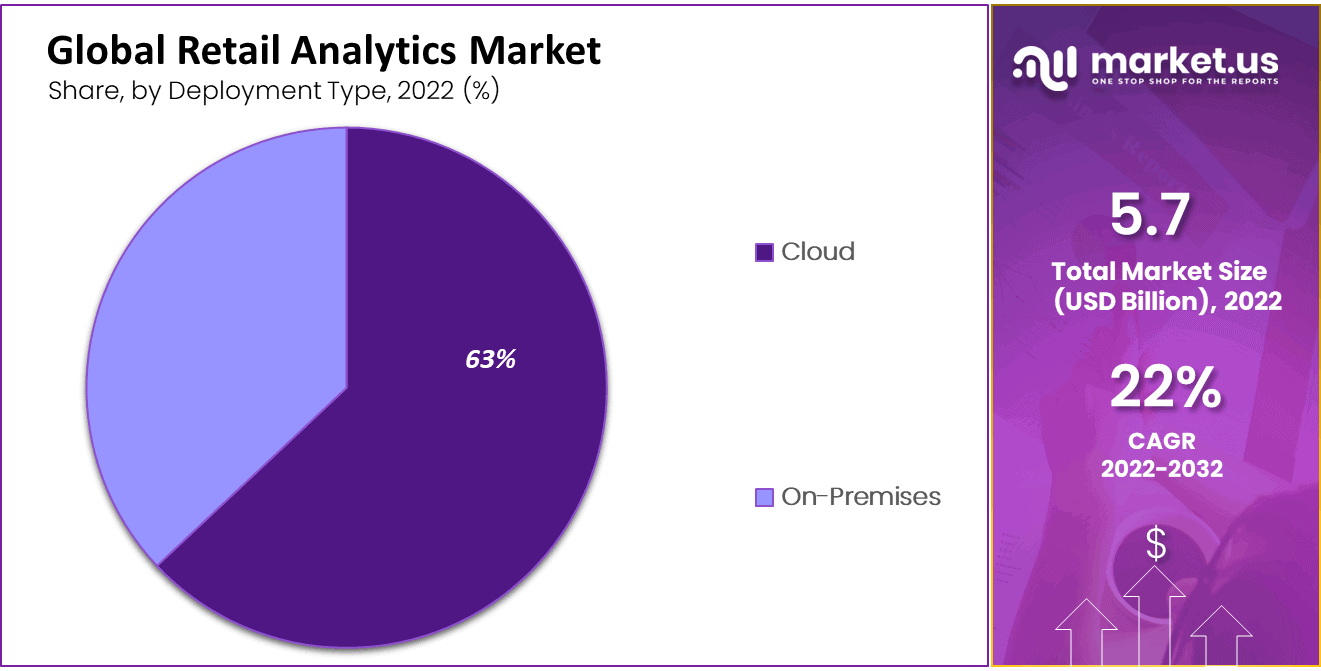

Global Retail Analytics Market Share – By Deployment Type

- The global retail analytics market is characterized by two primary deployment types, namely cloud and on-premises solutions, each contributing distinct market shares.

- Cloud-based deployments dominate this landscape, commanding a significant 63% market share, highlighting the growing trend of businesses adopting cloud technology for their retail analytics needs.

- On the other hand, on-premises deployments maintain a respectable 37% market share, signifying that a substantial portion of the market still values the control and security that come with housing analytics solutions within their infrastructure.

Types of Data Collected in Retail

- At the forefront, demographics data takes the lead, comprising a substantial 71% of the information gathered. This data provides crucial insights into the age, gender, and location of customers, helping retailers tailor their offerings to specific consumer segments.

- Social media activity closely follows, with 59%, indicating the growing significance of online presence and sentiment analysis in shaping marketing strategies.

- Online purchase and browsing data, at 57%, offer invaluable insights into customers’ online shopping habits, aiding in personalized recommendations and targeted marketing campaigns.

- Loyalty program activity data, at 55%, helps retailers reward and retain loyal customers effectively.

- Additionally, customer interactions and complaint data (53%) provide valuable feedback for improving customer service and overall satisfaction.

- Third-party research data (48%) and shopper ID in-store transaction data (48%) offer a holistic view of consumer preferences and shopping behavior.

- In-store movement and behavior (42%) data aids in optimizing store layouts and product placements.

- Mobile purchase and browsing data (30%) provide insights into the mobile shopping experience, while media and entertainment preferences (26%) help retailers align their offerings with customers’ broader interests.

Customer Retail Preferences Statistics

- A significant portion, approximately 69%, of consumers allocate most of their disposable income each month to in-store purchases.

- However, following the onset of the pandemic, around 40% of US shoppers decreased their overall retail expenditures.

- Before the pandemic, customers emphasized that the ability to try out products in a physical store held three times the influence compared to other factors when making a purchase decision.

- Furthermore, an overwhelming 87% of customers expressed their interest in gaining exclusive access to items or sales events hosted in physical retail stores.

- An equally high percentage, 81%, indicated their willingness to attend parties organized by these stores, while 80% expressed their readiness to participate in product demonstrations or tutorials hosted by physical retailers.

- Additionally, 71% of customers stated their inclination to engage in games or competitions organized by brick-and-mortar stores.

Mobile Retail Statistics

- Certainly, the majority, which is 65%, of e-commerce website visits originate from mobile devices.

- In terms of actual sales, 53% of e-commerce transactions are generated from these mobile sessions.

- Notably, fashion retailers achieve a high conversion rate of 89.3% when it comes to turning mobile website traffic into successful sales.

- Certainly, a significant 79% of individuals who use smartphones have completed an online purchase through their mobile devices within the past half-year.

- Approximately 37% of smartphone users also engage in in-store mobile payments at least once every six months.

E-commerce Analytics Statistics

- With the rapid expansion of global internet accessibility, which now spans more than five billion users worldwide, there is a continuous surge in online shopping.

- In the year 2022, the estimated value of e-commerce sales in the retail sector surpassed a remarkable 5.7 trillion U.S. dollars on a global scale, and these numbers are poised for further growth in the forthcoming years.

- As of 2022, the predominant share of online purchases across the globe is facilitated through online marketplaces.

- In the realm of online retail traffic, Amazon stands as the top contender, holding the leading position. This Seattle-based e-commerce titan offers a diverse array of services encompassing e-retail, computing solutions, consumer electronics, and digital content.

- Notably, in April 2023, Amazon’s .com website recorded an impressive 5.9 billion direct visits.

- However, when measured in terms of gross merchandise value (GMV), Amazon ranks third, trailing behind its Chinese counterparts, Taobao and Tmall.

Fraud Detection in Retail

- In 2016, a study conducted by Javelin Strategy & Research highlighted the substantial financial burden that fraud imposes on retailers, equating to more than 7.5% of their yearly earnings.

- Managing card-related fraud and addressing disputed credit card transactions, a process known as chargeback management, significantly strains their operational budgets, accounting for anywhere from 14% to 23% of expenditures.

- Another factor contributing to revenue depletion is the occurrence of false positives, which constitute 2.8% of lost revenues.

- Furthermore, Card Not Present (CNP) fraud, where scammers exploit online payment methods to circumvent face-to-face verification during point-of-sale transactions, is forecasted to result in a substantial cost of $71 billion for the global retail industry over the next five years.

- In 2021, Juniper’s predictions indicate that Card Not Present (CNP) fraud cases will predominantly originate from the United States and Asia, accounting for a combined 80%.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)