Table of Contents

- Introduction

- Editor’s Choice

- Same-Day Delivery Market Overview

- Delivery Service Options with Highest Interest in Online Shopping

- Online Retailers Offering Same-day Delivery Statistics

- Same-day Delivery Usage Statistics

- Expected Times for Faster Delivery of Online Purchases

- Most Popular Home Delivery Timelines Worldwide

- Customer Willingness to Pay for Premium Delivery

- Expectations of Same-Day Delivery Prices Statistics

- Customer Delivery Time Expectations

- Standard Time Frames of Online Delivery in Europe and North America

- Importance of Delivery and Return Options for Online Shoppers

- Importance of Same-day Delivery Statistics

- Impact of Same-Day Delivery on Consumer Shopping Behaviors Statistics

- Key Reasons Why Consumers Opt for Same-Day Delivery Statistics

- Top Reasons Consumers Forego Same-Day Delivery Statistics

- Recent Developments

- Conclusion

- FAQs

Introduction

Same-Day Delivery Statistics: Same-day delivery refers to a logistics service that enables products to be delivered to customers within the same day of placing an order. Driven by increasing consumer demand for convenience and speed.

Moreover, major players in this market include e-commerce giants like Amazon and Walmart, local retailers, and third-party logistics providers. All of whom are enhancing their service offerings to remain competitive.

Benefits include improved customer satisfaction, increased sales, and competitive advantage, while challenges encompass logistical complexities, cost implications, and geographical limitations.

The market is evolving with trends such as the integration of technology. A focus on sustainability and shifting consumer preferences toward personalized delivery options. Positioning same-day delivery as a crucial component of modern retail strategies.

Editor’s Choice

- In 2023, the global same-day delivery market generated revenue of USD 10.1 billion.

- By 2015, the share of retailers providing same-day delivery reached 10%. Demonstrating a clear shift towards prioritizing speed and convenience in e-commerce operations in the UK.

- In 2023, customer attitudes toward paying extra for premium delivery services revealed a diverse range of preferences. A significant 46% of respondents indicated a willingness to pay for same-day delivery. Underscoring a strong demand for the fastest available shipping option.

- In Slovakia in 2023, consumer willingness to pay for same-day delivery services displayed a diverse range of price sensitivities. The majority, 37% of respondents, indicated they are willing to pay between 4.5 to 6.5 euros for same-day delivery. Suggesting a moderate price point is the most acceptable to consumers.

- In a 2017 survey conducted in Germany regarding the importance of same-day delivery. Respondents expressed a variety of opinions, indicating differing levels of enthusiasm and skepticism about the service. A significant 37% of respondents believed that same-day delivery is a “game changer”. Highlighting its potential to alter consumer behaviors and expectations significantly.

- Consumers are increasingly favoring same-day shipping due to its convenience and speed, with several key reasons driving its popularity. A significant 76% of consumers opt for same-day delivery when it is offered for free, highlighting the appeal of cost-saving opportunities.

- Many consumers choose to forego same-day shipping due to various reasons that do not align with their needs or budget, according to a report by the U.S. Postal Service Office of the Inspector General. A significant 81% of people avoid same-day delivery because they find it too expensive, highlighting cost as a major barrier.

Same-Day Delivery Market Overview

Global Same-Day Delivery Market Size Statistics

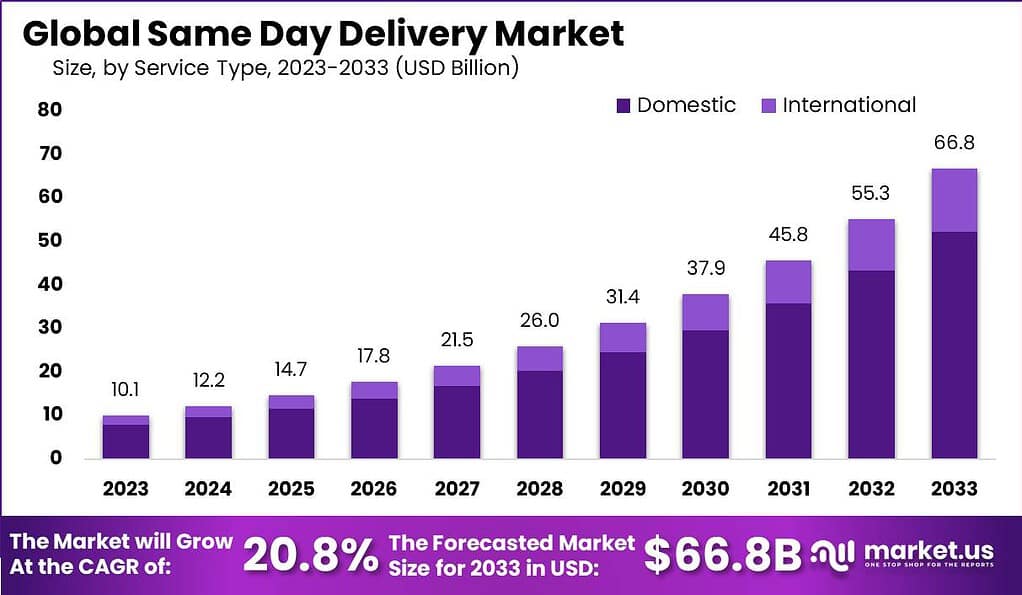

- The global same-day delivery market is expected to witness substantial growth over the forecast period from 2023 to 2033 at a CAGR of 20.8%.

- In 2023, the market generated revenue of USD 10.1 billion.

- This figure is projected to rise steadily, reaching USD 12.2 billion in 2024 and USD 14.7 billion in 2025.

- By 2026, the market revenue is anticipated to climb to USD 17.8 billion. Followed by an increase to USD 21.5 billion in 2027 and USD 26.0 billion in 2028.

- The upward trend continues with projected revenues of USD 31.4 billion in 2029 and USD 37.9 billion in 2030.

- By 2031, the market is expected to generate USD 45.8 billion. Reaching USD 55.3 billion in 2032 and ultimately USD 66.8 billion by 2033.

- This significant growth highlights the increasing demand for rapid delivery services on a global scale.

(Source: market.us)

Global Same-Day Delivery Market Size – By Service Type Statistics

2023-2027

- The global same-day delivery market is segmented into domestic and international services. This is forecasted to experience substantial growth from 2023 to 2027.

- In 2023, the market began at USD 10.1 billion, with domestic services contributing USD 7.91 billion and international services accounting for USD 2.19 billion.

- The market is projected to expand to USD 12.2 billion in 2024, with domestic and international revenues increasing to USD 9.55 billion and USD 2.65 billion, respectively.

- This upward trajectory is expected to continue. With the market reaching USD 14.7 billion in 2025, USD 17.8 billion in 2026, and USD 21.5 billion in 2027. Driven by domestic revenues of USD 11.51 billion, USD 13.94 billion, and USD 16.83 billion alongside international figures of USD 3.19 billion, USD 3.86 billion, and USD 4.67 billion respectively.

2028-2033

- By 2028, the market size is anticipated to grow to USD 26.0 billion. With domestic delivery revenues at USD 20.36 billion and international at USD 5.64 billion.

- The trend continues with the market expanding to USD 31.4 billion in 2029, USD 37.9 billion in 2030, and USD 45.8 billion in 2031. Where domestic services contribute USD 24.59 billion, USD 29.68 billion, and USD 35.86 billion. International services generate USD 6.81 billion, USD 8.22 billion, and USD 9.94 billion respectively.

- By 2032, the market is expected to reach USD 55.3 billion. With domestic and international revenues of USD 43.30 billion and USD 12.00 billion.

- By 2033, the total market is projected to soar to USD 66.8 billion. Supported by domestic revenues of USD 52.30 billion and international revenues reaching USD 14.50 billion.

- This growth trajectory underscores the robust demand and expanding scope of same-day delivery services globally.

(Source: market.us)

Same-day Delivery Market Size – By End User Statistics

- The size of the same-day delivery market in the United States. Segmented by end-user categories (B2C, B2B, C2C), has demonstrated a consistent growth pattern from 2018 to 2022.

- In 2018, the B2C segment generated USD 3 billion, the B2B segment USD 1.1 billion, and the C2C segment USD 0.7 billion.

- The following year, 2019, saw increases across all segments, with B2C revenues rising to USD 3.8 billion, B2B to USD 1.4 billion, and C2C to USD 0.9 billion.

- The upward trajectory continued into 2020, with revenues reaching USD 4.6 billion for B2C, USD 1.7 billion for B2B, and USD 1.1 billion for C2C.

- By 2021, the market expanded further to USD 5.3 billion in B2C, USD 1.9 billion in B2B, and USD 1.2 billion in C2C.

- In 2022, the B2C segment led with USD 6 billion, followed by B2B with USD 2.2 billion, and C2C contributed USD 1.4 billion. Highlighting a continuous and robust growth in demand across all market segments.

(Source: Statista)

Same-day Delivery Market Share – By Service Type Statistics

- In 2018, the market share of same-day delivery services in the United States was distributed among three main service types.

- The Regular service type held the largest share, accounting for 45% of the market.

- This was followed by the Priority service type, which captured 30% of the market.

- The Rush service type comprised 25% of the market share, indicating a substantial demand for faster delivery options among consumers and businesses alike.

- This segmentation reflects diverse consumer preferences and needs for delivery speed within the same-day delivery ecosystem.

(Source: Statista)

Delivery Service Options with Highest Interest in Online Shopping

- In 2024, preferences for delivery service options among online shoppers demonstrated a significant interest in combined delivery solutions.

- The most popular option, preferred by 37% of respondents, was to combine orders into a single delivery at the end of the week.

- Closely following this, 36% of consumers showed interest in combining their deliveries into a single delivery when there are multiple deliveries in their area, highlighting an emphasis on efficiency and possibly environmental consciousness.

- In contrast, options that involved additional costs for enhanced service speeds or convenience were less favored.

- Only 20% of respondents were willing to pay for faster delivery services, and 19% would pay for more convenient delivery timing.

- This data suggests that while there is a notable segment of the market that values speed and convenience. A larger proportion of consumers are attracted to delivery options that minimize the frequency of deliveries. This could be motivated by concerns over costs or the environmental impact of shipping practices.

(Source: Statista)

Online Retailers Offering Same-day Delivery Statistics

- Between 2010 and 2015, the proportion of online retailers in the United Kingdom offering same-day delivery services exhibited a gradual increase.

- In 2010, only 4% of retailers provided this service.

- By 2011, this figure had slightly risen to 4.7%, indicating a developing interest in enhancing delivery options to improve customer satisfaction and competitive edge.

- The trend continued upwards, with 6.4% of retailers offering same-day delivery in 2012 and 7.1% in 2013, reflecting growing consumer demand for faster delivery times.

- By 2015, the share of retailers providing same-day delivery reached 10%, demonstrating a clear shift towards prioritizing speed and convenience in e-commerce operations in the UK over five years.

- This steady growth underscores the increasing importance of same-day delivery as a critical service offering among online retailers in the UK, aiming to meet evolving consumer expectations.

(Source: Statista)

Same-day Delivery Usage Statistics

Type of Merchant By Same-day Delivery Statistics

- Between 2020 and 2021, the share of online shoppers utilizing same-day delivery services in the United States showed significant growth among different types of merchants.

- In 2020, 24% of consumers used same-day delivery services from web-only merchants.

- This figure rose notably to 36% by 2021.

- Similarly, the use of same-day delivery from store-based retailers also increased, from 14% of online shoppers in 2020 to 26% in 2021.

- This trend underscores a growing consumer preference for quicker delivery options across both purely online and traditional retail merchants enhanced by their online presence.

(Source: Statista)

Same-day Delivery By Product Category Statistics

- As of February 2018, there was a notable discrepancy between the same-day delivery services received by Internet users in the United States and the services they desired across various categories.

- Groceries led the disparity, with only 19% of users having received same-day delivery while 64% expressed a desire for it.

- Healthcare products showed a significant gap as well, with only 4% of users receiving same-day delivery compared to 46% who wanted such a service.

- Specialty snacks, alcohol, and household products also revealed substantial gaps in service satisfaction versus demand, with actual service usage at 7%, 5%, and 5%, respectively. Versus desires at 42%, 41%, and 28%.

- Similarly, for pet products and beauty products, only 4% reported receiving same-day deliveries. While 28% and 26%, respectively, wished for it.

- Electronics and appliances had slightly lower gaps, with 4% and 2% having received deliveries, against desires of 24% and 22%.

- Lastly, clothing, shoes, and accessories saw 2% having received deliveries while 21% desired the service.

- This data underscores a significant market opportunity for expanding same-day delivery services across a variety of product categories to meet the higher consumer demand.

(Source: Statista)

Expected Times for Faster Delivery of Online Purchases

- In 2023, expectations for faster delivery times varied significantly across different categories among online shoppers worldwide.

- For grocery items, high demand for speed was evident, with 64% of shoppers expecting delivery within less than 24 hours and 40% within less than two hours.

- Health and pharmaceutical products also saw elevated expectations, with 53% of consumers anticipating deliveries in less than 24 hours and 34% in less than two hours.

- Alcohol and financial products followed closely, with around half expecting delivery in less than 24 hours (49% and 50%, respectively) and about a third in less than two hours (32% each).

- Household products, beauty, and technology also showed considerable demand for rapid delivery. For household items, 40% expected delivery in less than 24 hours and 21% in less than two hours; beauty products saw expectations at 38% and 20%, respectively, while technology had 35% and 17%, respectively.

- Luxury items, toys, and second-hand products had roughly a third of shoppers expecting delivery within 24 hours and about 17% within two hours.

- Clothing, fashion, and automotive accessories categories shared similar expectations, with 32% of consumers expecting deliveries in less than 24 hours and 16% in less than two hours.

- This data reflects a strong consumer desire for expedited delivery across a diverse range of product categories globally.

(Source: Statista)

Most Popular Home Delivery Timelines Worldwide

- In 2021, the preferences for home delivery timelines varied significantly across various categories worldwide, reflecting distinct consumer expectations tailored to the nature of the products.

- Grocery deliveries showcased a strong preference for quicker service, with 12% of deliveries expected within the hour and 30% on the same day. The next-day delivery was preferred by 22% of customers. While 13% were comfortable with a timeline of 2-3 business days.

- Alcohol deliveries also indicated a leaning towards speed, with 10% within the hour and 20% on the same day, followed by 16% for next-day delivery. Brand-name food products saw 9% of deliveries within the hour and 22% the same day, suggesting a similar urgency to groceries.

- Back-to-school supplies, however, showed more flexibility, with only 5% within the hour and 14% on the same day, but a higher tolerance for 2-3 business days at 23%.

- Health and beauty products reflected the greatest patience, with only 5% expecting delivery within the hour, 15% the same day, and the largest share, 31%, comfortable with 2-3 business days.

- For appliances, urgency was lower, with just 3% within the hour and 10% on the same day. Still, a significant 33% expected delivery within 2-3 business days, showing a willingness to wait for such substantial purchases.

- Apparel and footwear, as well as home furnishings, similarly showed lower urgency for same-day deliveries at 11% and 9%, respectively, but had a high preference for delivery within 2-3 business days (39% and 32%).

- This range in delivery expectations illustrates how consumer urgency varies widely depending on the product category, with perishable or essential items like groceries demanding faster delivery compared to non-essential, bulky, or luxury items like appliances and home furnishings.

(Source: Statista)

Customer Willingness to Pay for Premium Delivery

- In 2023, customer attitudes toward paying extra for premium delivery services revealed a diverse range of preferences.

- A significant 46% of respondents indicated a willingness to pay for same-day delivery, underscoring a strong demand for the fastest available shipping option.

- Next-day delivery was also popular, with 28% of respondents prepared to pay more for quicker service.

- Nominated delivery, which allows customers to choose a specific delivery date. It was preferred by 11% of respondents, while only 5% were willing to pay extra for two-day delivery.

- Despite these preferences for faster service, a noteworthy 51% of customers expressed that they would never pay extra for premium delivery, indicating a substantial segment of the market that prioritizes cost over speed.

- This data highlights the varied consumer expectations in the online shopping sector, where nearly half of the customers see value in expediting their purchases. At the same time, a slight majority remain reluctant to incur additional costs for faster delivery options.

(Source: Statista)

Expectations of Same-Day Delivery Prices Statistics

- In Slovakia in 2023, consumer willingness to pay for same-day delivery services displayed a diverse range of price sensitivities.

- The majority, 37% of respondents, indicated they are willing to pay between 4.5 to 6.5 euros for same-day delivery, suggesting a moderate price point is the most acceptable to consumers.

- A significant 26% of consumers preferred a lower price bracket, up to 3 euros, reflecting a considerable segment focused on cost-efficiency.

- Meanwhile, 17% of respondents were comfortable with paying a slightly higher price, ranging from 3.5 to 4 euros.

- At the higher end of the spectrum, only a small fraction, 3%, were willing to pay between 7 to 8.5 euros, indicating limited acceptance for premium pricing.

- Surprisingly, another 17% of respondents were prepared to pay over 9 euros for same-day delivery services. Suggesting that a segment of the market sees high value in the immediacy provided by such services.

- This range of responses highlights varied consumer valuations of the convenience offered by same-day delivery in Slovakia.

(Source: Statista)

Customer Delivery Time Expectations

- In 2023, customer expectations regarding delivery times for online shopping varied notably across several countries.

- In the United States, a significant portion of consumers had high expectations for rapid delivery, with 23% expecting overnight or next-day delivery and 37% expecting delivery within two days.

- Similarly, in the UK, 25% of consumers expected overnight or next-day delivery, with 34% anticipating delivery within two days.

- Germany also showed a strong preference for quick delivery, with 20% expecting overnight or next-day delivery and 37% within two days.

- In Canada, though expectations were slightly more moderate, 23% still expected overnight or next-day delivery, and 26% within two days, but a higher proportion, 31%, were comfortable with a 3-4-day delivery timeframe.

- France and Italy showed similar patterns, with 20% and 24% of consumers, respectively, looking for overnight or next-day delivery, but more were willing to wait 3-4 days (31% in France, 32% in Italy).

- Spain also demonstrated a more relaxed attitude towards delivery times compared to other countries, with 21% expecting overnight or next-day delivery and 33% within two days.

- Australia’s expectations were broadly spread across different delivery times, with 20% expecting overnight or next-day delivery and a similar distribution across 2-day and 3-4-day periods.

- Across these countries, while there is a clear demand for quick delivery options such as overnight or next-day, a substantial number of consumers are also willing to accept longer delivery windows, particularly in the 3-4-day range, indicating a balance between the desire for speed and acceptance of practical delivery timeframes.

(Source: Statista)

Standard Time Frames of Online Delivery in Europe and North America

- In 2023, the standard time frames for online delivery varied between Europe and North America, reflecting different consumer expectations and logistical capabilities across these regions.

- In Europe, 12% of online deliveries were made on the same or next day. This compared to 7% in North America, indicating a slightly higher efficiency or demand for rapid delivery services in European markets.

- For two-day deliveries, 29% of European customers received their orders within this timeframe, significantly higher than the 19% in North America.

- The most common delivery timeframe in both regions was 3-4 days. With 44% in Europe and a slightly higher 48% in North America.

- Deliveries within 5-7 days accounted for 15% in Europe and 22% in North America. Shows a greater acceptance or necessity for longer delivery periods in North American regions.

- For deliveries taking more than seven days, only 1% of European deliveries fell into this category, compared to 5% in North America. Further emphasizing the quicker turnaround times typically seen in European online retail compared to that of North America.

- This data illustrates clear regional differences in delivery expectations and performance between Europe and North America.

(Source: Statista)

Importance of Delivery and Return Options for Online Shoppers

- In 2022, online shoppers in the United States placed high importance on delivery and return options, with free services being particularly valued.

- Free delivery was the most highly rated, and considered important by 82% of respondents. Closely followed by free returns, valued by 81% of respondents. These options likely reflect consumer preferences for cost savings and flexibility in online shopping.

- Next-day delivery was also significant, with 58% of shoppers indicating its importance, demonstrating a strong demand for speed and convenience.

- More than half of the respondents, 54%, appreciated home pick-up services for returning products. Which adds a layer of convenience by eliminating the need to visit a postal service for returns.

- Same-day delivery was important to 53% of respondents, underscoring a notable interest in receiving items as quickly as possible.

- Lastly, 45% of shoppers valued paperless returns, such as those facilitated by QR codes. Highlighting an appreciation for more streamlined, environmentally friendly, and hassle-free return processes.

- This array of preferences shows that quick delivery services are essential. Free services and convenient return options play a critical role in shaping the online shopping experience in the US.

(Source: Statista)

Importance of Same-day Delivery Statistics

- In a 2017 survey conducted in Germany regarding the importance of same-day delivery, respondents expressed a variety of opinions. Indicating differing levels of enthusiasm and skepticism about the service.

- A significant 37% of respondents believed that same-day delivery is a “game changer,” highlighting its potential to alter consumer behaviors and expectations significantly.

- Furthermore, 42% described it as an “interesting trend,” suggesting a strong curiosity and positive outlook toward the evolution of delivery services.

- On the other hand, 15% of the participants dismissed it as “much ado about nothing,” showing a notable degree of skepticism about its impact.

- A small minority, each at 2%, felt it was “too early to say,” expressed “no opinion,” or provided “no specification” on their views.

- This diversity in responses underscores the mixed perceptions of same-day delivery’s value and impact among consumers in Germany.

(Source: Statista)

Impact of Same-Day Delivery on Consumer Shopping Behaviors Statistics

- Same-day delivery is significantly reshaping consumer behavior in the online shopping landscape.

- Approximately 49% of customers are more likely to shop online if same-day delivery is available, underscoring the strong draw of immediate gratification.

- Moreover, a notable 51% of online consumers aged between 18 and 34 years expect same-day delivery services, which highlights generational preferences for rapid fulfillment.

- This feature notably increases a retailer’s competitive edge, with an impressive 85% of retailers experiencing enhanced market presence due to offering same-day delivery.

- Furthermore, about 28% of individuals prefer same-day delivery as it saves them the time they would otherwise spend visiting a physical store.

- This convenience also leads to 21% of shoppers visiting physical stores less frequently.

- Additionally, 19% of consumers are willing to pay a premium for the convenience of receiving their purchases on the same day.

- To manage costs, 18% of shoppers look for coupons or promo codes that can help offset shipping costs, while 15% end up paying more in shipping charges.

- Lastly, the availability of same-day delivery encourages 14% of consumers to delay their purchases until the last minute.

- This data vividly illustrates the profound impact that same-day delivery services are having on consumer shopping behaviors and expectations.

(Sources: UPS, Shipsy)

Key Reasons Why Consumers Opt for Same-Day Delivery Statistics

- Consumers are increasingly favoring same-day shipping due to its convenience and speed, with several key reasons driving its popularity.

- A significant 76% of consumers opt for same-day delivery when it is offered for free. Highlighting the appeal of cost-saving opportunities.

- Closely following, 75% choose this shipping method when they need an item as soon as possible, emphasizing the demand for quick service.

- Furthermore, 66% of consumers select same-day delivery for urgent needs, while 64% do so when they require a gift in a hurry, showing a common theme of immediacy in their shopping habits.

- Another 64% find same-day shipping attractive if the price is considered reasonable. Suggesting price sensitivity among consumers despite the demand for speed.

- Lastly, 58% specifically choose same-day delivery for quickly-needed health items, underscoring the critical role of timely delivery in health-related situations.

- These preferences collectively demonstrate the high value consumers place on the speed, convenience, and sometimes necessity of same-day delivery.

(Source: U.S. Postal Service Office of the Inspector General)

Top Reasons Consumers Forego Same-Day Delivery Statistics

- Many consumers choose to forego same-day shipping due to various reasons that do not align with their needs or budget, according to a report by the U.S. Postal Service Office of the Inspector General.

- A significant 81% of people avoid same-day delivery because they find it too expensive, highlighting cost as a major barrier.

- Additionally, 78% do not require the item immediately and, therefore, opt out of same-day delivery. Emphasizing a lack of urgency in their purchasing decisions.

- Another 67% of shoppers prefer the “click-and-collect” method over same-day delivery. Which indicates a preference for a more convenient pick-up option.

- Furthermore, 45% of consumers are not home to receive the items, making same-day delivery impractical for their lifestyle.

- Lastly, 21% find that the same-day delivery option is simply unavailable, reflecting limitations in service reach.

- Thus, these factors collectively explain why a substantial number of consumers decide against using same-day delivery services.

(Source: U.S. Postal Service Office of the Inspector General)

Recent Developments

Acquisitions and Mergers:

- DoorDash acquires Wolt: In late 2023, DoorDash acquired Wolt, a Finnish on-demand delivery service, for $8.1 billion. This acquisition expanded DoorDash’s same-day delivery capabilities across Europe. Allowing the company to enter new markets with a focus on fast deliveries in both urban and suburban areas.

- Instacart acquires Rosie: In 2023, Instacart acquired Rosie, an online grocery platform for local and independent retailers, for $250 million. This acquisition aimed to enhance Instacart’s same-day delivery services, particularly in smaller markets across the U.S., and further solidify its position in the grocery delivery space.

New Product Launches:

- Amazon introduces Same-Day Prime Delivery: In early 2024, Amazon launched Same-Day Prime Delivery for select cities, offering deliveries in as little as two hours for Prime members. This service covers a wide range of items, from groceries to electronics, with a projected 30% increase in same-day delivery orders by 2025.

- Walmart launches Express Delivery: In March 2023, Walmart introduced Express Delivery. Allowing customers to receive their orders in less than two hours for a flat fee. This service is part of Walmart’s strategy to compete with Amazon in the growing same-day delivery market.

Funding:

- Gopuff raises $1 billion for expansion: In 2023, Gopuff, a leader in instant delivery. Secured $1 billion in funding to expand its same-day delivery operations globally. The funds will help the company scale its delivery services, improve logistics, and increase warehouse locations in key markets.

- ShipBob raises $200 million for same-day logistics: In mid-2023, ShipBob, a cloud-based logistics platform, raised $200 million to build out its same-day delivery infrastructure. The funding will be used to enhance its technology and support small businesses with faster delivery solutions.

Technological Advancements:

- Autonomous delivery vehicles: By 2025, 40% of same-day deliveries in major urban areas are expected to be completed by autonomous vehicles and drones, reducing delivery times and costs.

- AI-powered route optimization: Predictive AI is being increasingly used in same-day delivery. By 2026, 50% of logistics companies are expected to adopt AI-driven route optimization software to improve efficiency and cut delivery times by 15%.

Conclusion

Same-Day Delivery Statistics – Same-day delivery has reshaped consumer expectations and retail dynamics by offering unparalleled convenience and speed.

Further, while it attracts consumers who value rapid service, the high costs associated with it deter a significant number, alternatives like “click-and-collect” continue to meet the needs of those without urgent requirements.

For retailers, the challenge lies in balancing the operational demands and costs of same-day delivery with consumer affordability.

Lastly, moving forward, the sustainability of same-day delivery will hinge on innovations in logistics, technology, and pricing strategies to enhance its accessibility and appeal in the competitive e-commerce landscape.

FAQs

Same-day delivery is a shipping option where customers receive their purchases on the same day they place an order.

Orders are processed and shipped from a nearby warehouse or store location to ensure that the delivery can be completed within the same day.

Typically, products like groceries, electronics, pharmaceuticals, and other essentials are eligible, depending on the retailer’s capabilities and inventory location.

The cost can vary widely depending on the retailer, the size and weight of the item, and the distance from the distribution center or store. Some retailers offer it as a premium service, while others may provide promotional or membership-based free same-day delivery.

Most retailers have specific cut-off times, often in the early afternoon. To ensure there is enough time to process and deliver the order by evening.