Table of Contents

Introduction

Semiconductor IP Statistics: Semiconductor Intellectual Property (IP) consists of pre-made and verified elements employed in the production of semiconductor chips.

These elements, such as processors and memory units, are safeguarded by intellectual property protections and reduce the workload and expenses for chip designers.

Semiconductor IP is used in various fields, including consumer electronics, automotive technology, and industrial automation, among others.

It can be tailored to specific needs, and its dependability is confirmed through rigorous testing. Users have flexibility in licensing Semiconductor IP, with options like royalties, permanent licenses, and subscriptions.

Editor’s Choice

- In 2023, the Semiconductor IP market revenue stood at USD 6.4 billion.

- Royalty-based IP sources claim the majority market share, commanding a substantial 70%.

- Arm Holdings Ltd. stands as the dominant leader with a substantial 41% market share. Reflecting its prominent position in the industry.

- North America leads the way with a substantial 31.0% market share, reflecting its prominence in the industry.

- Soft Semiconductor Intellectual Property (SIP) is typically provided in high-level languages like RTL, C++, Verilog, or VHDL, or sometimes as a netlist.

- Connectivity SIP, also called standards SIP, adheres to specific specifications like USB, PCI, IEEE1394 (known as “Firewire”), IrDA, Bluetooth, or 802.11.

- According to the 2020 IPnest Semiconductor Design IP Report. Arteris IP held the 12th position among the world’s largest semiconductor IP companies.

Semiconductor Industry Overview

- The semiconductor industry has undergone remarkable growth and transformation between 1996 and 2019, marked by significant percentage changes across various metrics.

- Total semiconductor trade surged from $294 billion to a staggering $1.655 trillion, representing a remarkable 463% increase.

- Cell phone subscriptions per 100 people witnessed an exponential rise, soaring from 2 to 104.9, a staggering 3,371% increase.

- Internet users per 100 people displayed an even more impressive growth, surging from 1.19 to 49.7, a remarkable 4,076% jump.

- The global semiconductor market’s total revenue increased substantially from $132 billion to $412 billion, marking a 212% rise.

- Semiconductor production experienced substantial expansion, with the total number of units produced soaring from 215 billion to 932 billion, a significant 333% increase.

- Transistor production witnessed an astonishing leap from 29.1 quadrillion to 262 sextillion, a staggering 900,343,543% growth.

- The average number of transistors per semiconductor surged from 135,237 to an astonishing 2,809,901,908, an extraordinary 2,077,661% increase.

- PC processor speeds experienced a notable advancement, with single-core speeds increasing from 133 MHz to 2,300 MHz, and quad-core speeds demonstrating a remarkable 1,629% increase.

- Furthermore, IC wafer capacity expanded significantly from 51.9 million to 230.5 million, marking a 344% growth.

- R&D spending in the semiconductor industry surged from $15.7 billion to $64.5 billion, a notable 311% increase.

- Process technology node reduced drastically from 350 nanometers to 7 nanometers, indicating a -98% change.

- Finally, the semiconductor content per electronic system increased from 18.8% to 26.3%. Reflecting a 40% growth during this transformative period in the semiconductor sector.

(Source: Semiconductors.org)

Semiconductor IP Market Statistics

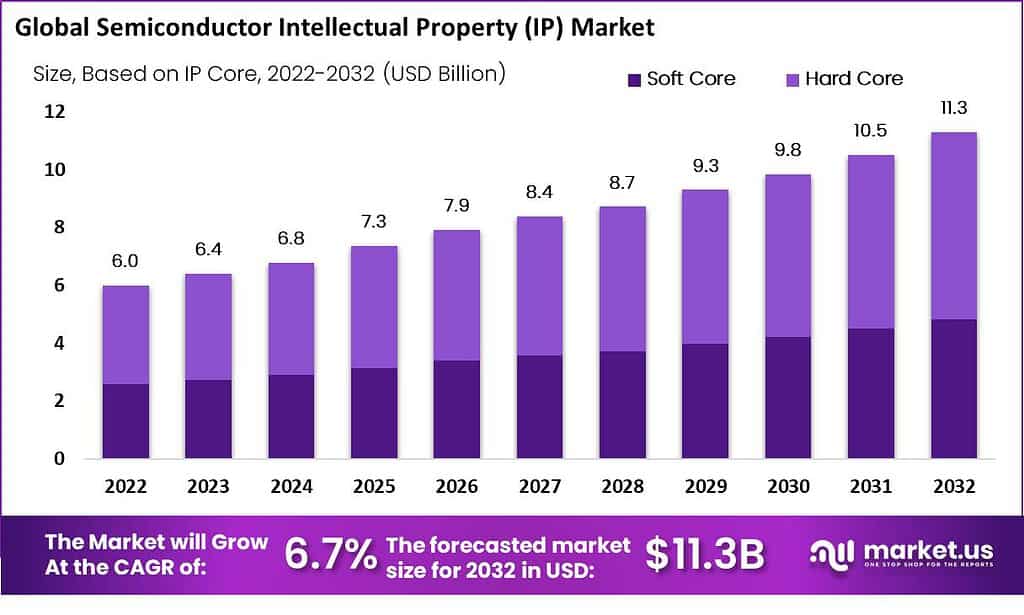

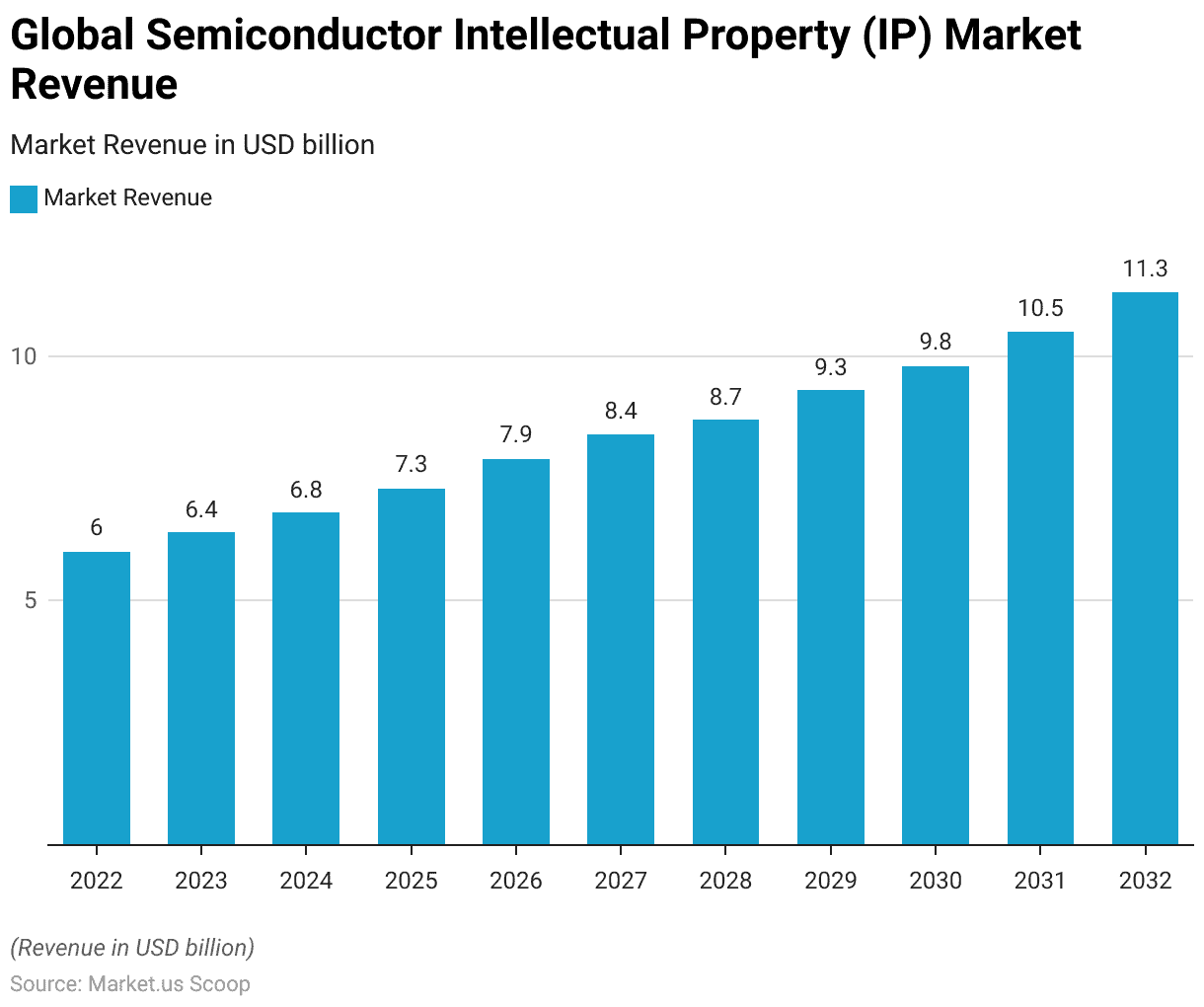

Global Semiconductor Intellectual Property (IP) Market Size Statistics

- The global Semiconductor Intellectual Property (IP) market is exhibiting a consistent and promising growth trajectory, with revenues projected to increase steadily over the next decade at a CAGR of 6.7%.

- In 2022, the market revenue stood at USD 6.0 billion, marking the starting point of this upward trend.

- The subsequent years are anticipated to witness a gradual but notable expansion. With revenues reaching USD 6.4 billion in 2023, USD 6.8 billion in 2024, and further climbing to USD 7.3 billion in 2025.

- This positive momentum is expected to continue. With revenues forecasted to reach USD 7.9 billion in 2026 and USD 8.4 billion in 2027.

- As we progress into the late 2020s, the market is projected to achieve even greater heights. With revenue figures reaching USD 8.7 billion in 2028, USD 9.3 billion in 2029, and USD 9.8 billion in 2030.

- Looking further into the future, the Semiconductor IP market is anticipated to breach the USD 10 billion mark by 2031. Reaching USD 10.5 billion, and continue its robust growth, with projections indicating revenues of USD 11.3 billion in 2032.

- These optimistic figures underscore the industry’s resilience and its role in driving technological advancements across various sectors.

(Source: Market.us)

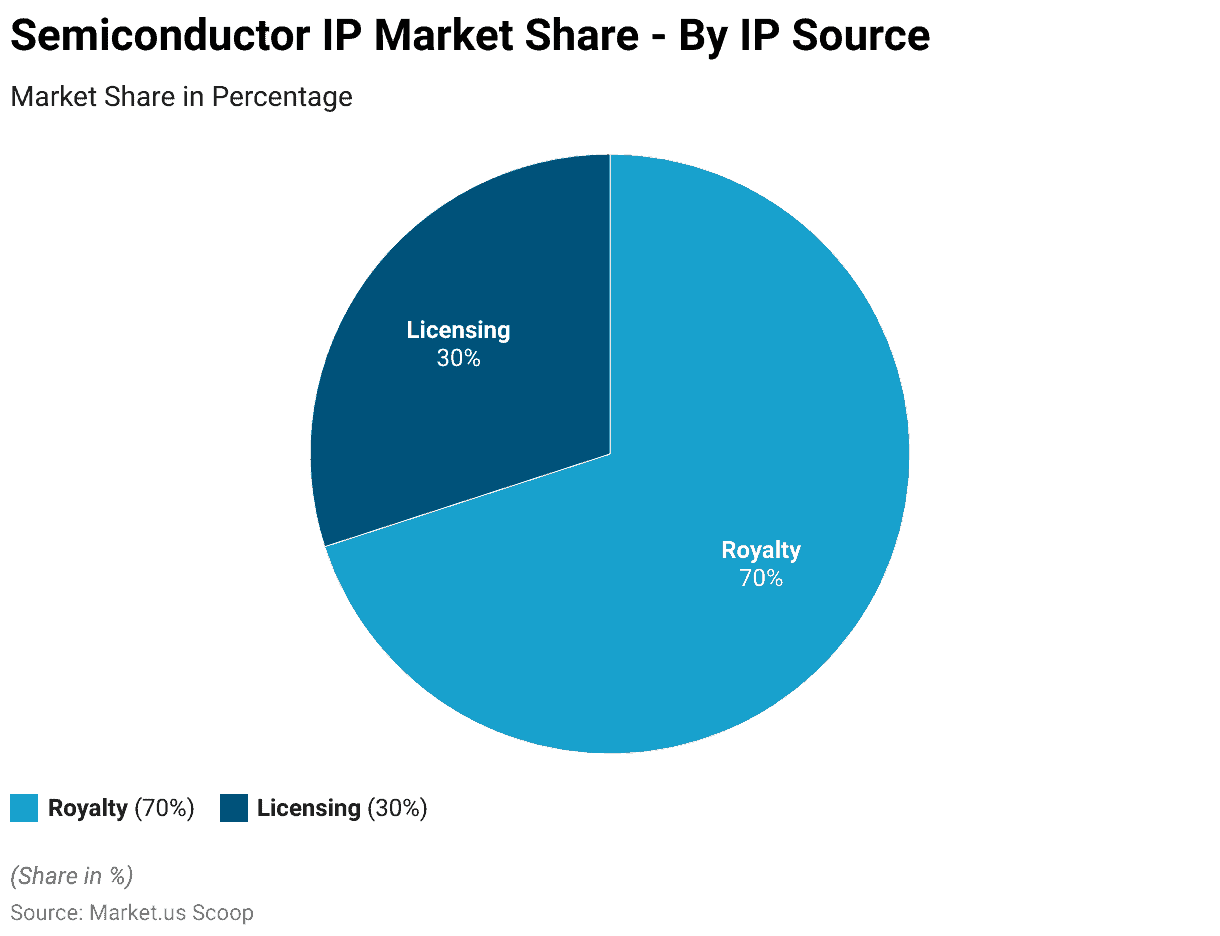

Global Semiconductor Intellectual Property (IP) Market Share – By IP Source Statistics

- The global market for Semiconductor Intellectual Property (IP) is segmented by IP source, with two primary categories.

- Royalty-based IP sources claim the majority market share, commanding a substantial 70%.

- In this model, users pay royalties based on their production volume using the IP. Making it a prevalent choice in the industry.

- On the other hand, licensing models hold a 30% share of the market.

- Licensing involves various payment structures, including one-time fees or recurring charges. Allowing users to access and utilize IP resources while offering flexibility in IP utilization.

- These two distinct IP source categories play a pivotal role in shaping the dynamics of the Semiconductor IP market worldwide.

(Source: Market.us)

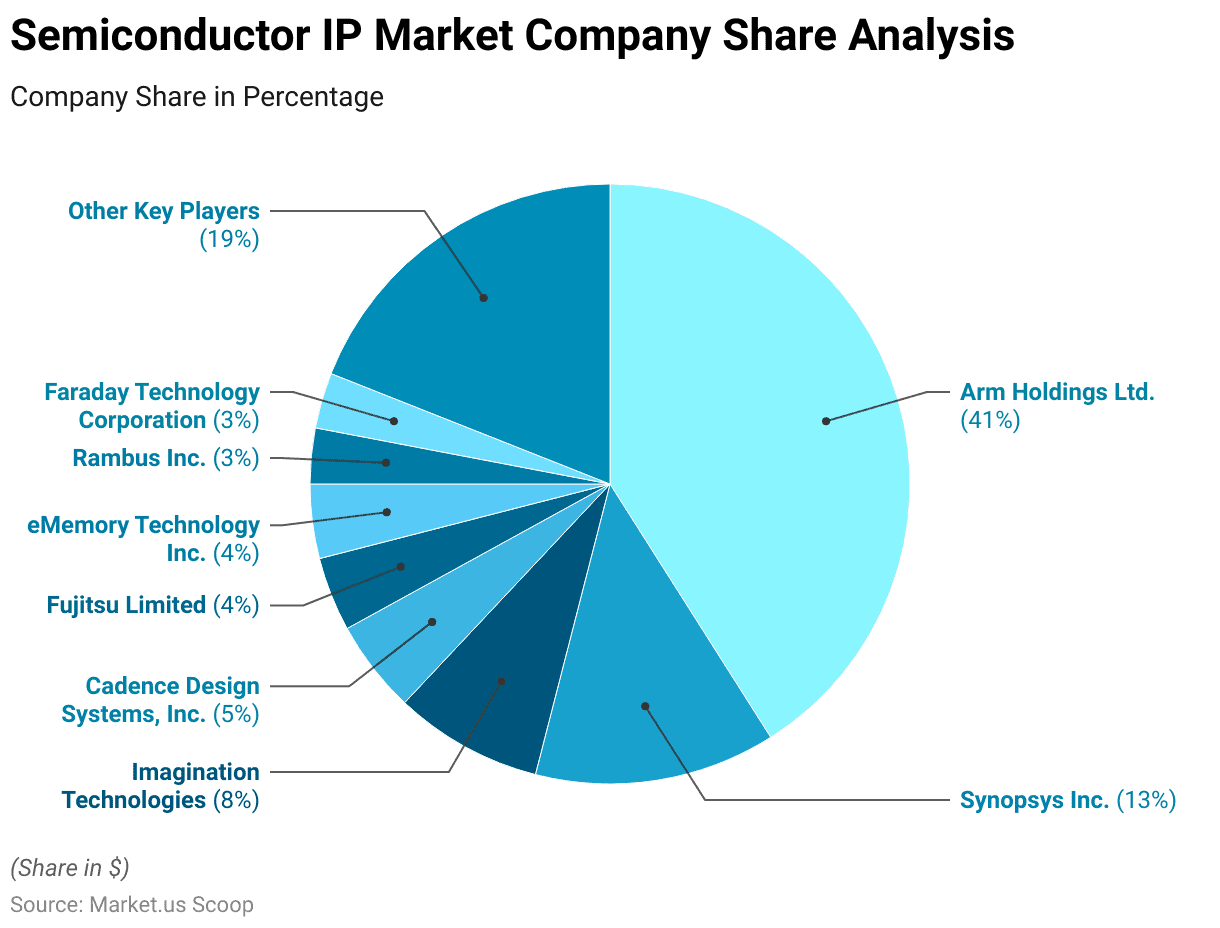

Key Players in the Global Semiconductor Intellectual Property (IP) Market Statistics

- In the global Semiconductor Intellectual Property (IP) market, several key players hold significant market shares.

- Arm Holdings Ltd. stands as the dominant leader with a substantial 41% market share. Reflecting its prominent position in the industry.

- Following Arm Holdings, Synopsys Inc. holds a notable 13% market share, underscoring its influence in the Semiconductor IP sector.

- Imagination Technologies, Cadence Design Systems, Inc., and Fujitsu Limited each contribute significantly with 8%, 5%, and 4% market shares, respectively.

- eMemory Technology Inc., Rambus Inc., and Faraday Technology Corporation also make valuable contributions, each holding 4%, 3%, and 3% of the market share, respectively.

- Together, these key players shape the competitive landscape. While other players collectively account for 19% of the market share, emphasizing the diversity within the Semiconductor IP industry.

(Source: Market.us)

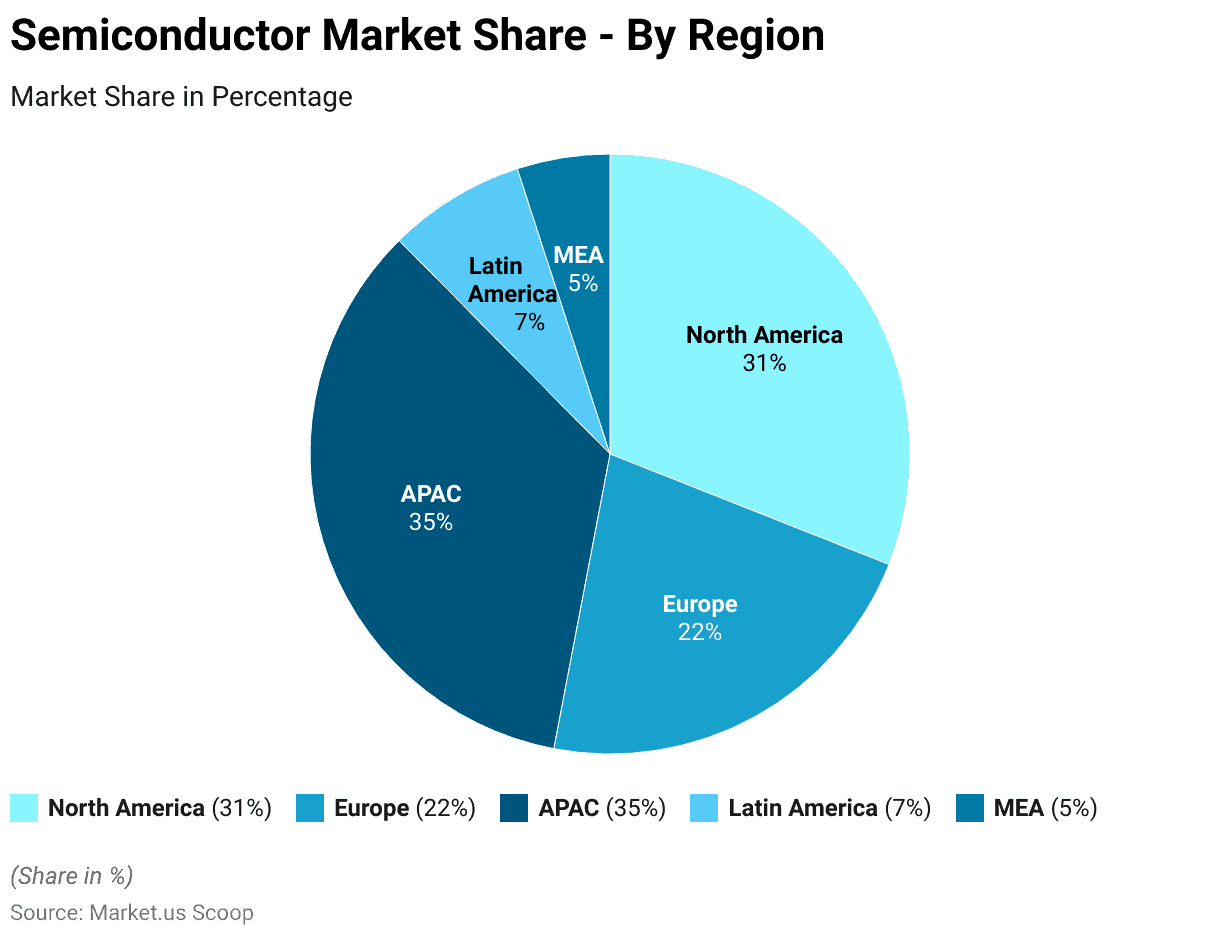

Regional Analysis of the Semiconductor Intellectual Property (IP) Market Statistics

- The global market for Semiconductor Intellectual Property (IP) is distributed across different regions, each contributing to its overall composition.

- North America leads the way with a substantial 31.0% market share, reflecting its prominence in the industry.

- Europe follows closely behind with a significant 22.0% market share, indicating a robust presence in the semiconductor IP sector.

- The Asia-Pacific (APAC) region commands the largest portion of the market at 34.6%. Showcasing its dominance as a key hub for semiconductor IP development and consumption.

- Latin America and the Middle East & Africa (MEA) regions hold 7.4% and 5.0% market shares, respectively. Contributing to the global landscape with their unique market dynamics.

- These regional variations in market share demonstrate the global reach and diverse geographical distribution of the Semiconductor IP market.

(Source: Market.us)

Types of Semiconductor IP Statistics

Soft SIP

- Soft Semiconductor Intellectual Property (SIP) is typically provided in high-level languages like RTL, C++, Verilog, or VHDL, or sometimes as a netlist.

- Soft SIP is portable, allowing it to be moved between foundry processes, but it’s not tailored to a specific process technology.

- As a result, its power, performance, and area characteristics are uncertain until applied to a specific process and library.

- Soft SIP’s value primarily comes from its functionality, reusability, availability, and potential compliance with industry standards like USB 1.0, ARM AMBA 1.0, PCI, or IEEE 802.11.

- Some soft SIP suppliers may also offer netlist or programming data. Facilitating its use in field programmable gate arrays (FPGAs) for validation or integration into a final product.

(Source: FSA)

Hard SIP

- Hard Semiconductor Intellectual Property (SIP) is typically provided in GDSII format, often with associated EDA views or models, and it’s specifically optimized for a particular foundry process.

- In some cases, it may be formatted as a “bit-stream” for FPGA use.

- Hard SIP usually includes a detailed datasheet similar to that of a standalone IC. Covering aspects like power consumption, speed, and physical dimensions.

- Examples of hard SIP include processors, standard cells, memory modules, phase-locked loops (PLLs), I/O interfaces, and analog components.

- Unlike soft SIP, hard SIP is less flexible when it comes to adapting to different foundry processes, and portable libraries, if available, aren’t typically customized for specific foundries.

- Some hard SIP providers conduct thorough silicon validation on test chips to ensure excellent quality and yield.

(Source: FSA)

Foundation SIP

- Foundation SIP typically comprises standard cell libraries, PLLs, I/Os, and compact macros.

- It’s commonly provided as hard SIP and often comes as a bundled package, rather than individual components.

- General-purpose foundation SIP might be offered for free by suppliers and foundries to attract customers. While specialized foundation SIP, like those optimized for low power or high performance. It is priced based on customer requirements, customization level, and supported process technology.

(Source: FSA)

Memory SIP

- Memory SIP, typically in hard SIP format, is specialized for specific process nodes and may come with memory compilers.

- It covers various memory types like SRAM, non-volatile memory (Flash, EEPROM), DRAM, and 1T-SRAM.

- High-density memory often includes redundancy for improved yield and error correction, along with integrated testing and repair capabilities.

- SRAM variants comprise single-port, dual-port, multi-port, CAMs, and customized designs focusing on area, power, or speed optimization.

- Memory can be generated using compiler tools tailored to foundry and process needs. Enabling users to customize aspects like aspect ratio and power management.

- In some instances, up to 25 different memory compilers may be required for a 130nm process node.

- Memory design adheres to specific guidelines for higher density but demands rigorous validation due to its vulnerability to defects and its substantial influence on silicon processes.

(Source: FSA)

Connectivity SIP

- Connectivity SIP, also called standards SIP, adheres to specific specifications like USB, PCI, IEEE1394 (known as “Firewire”), IrDA, Bluetooth, or 802.11.

- It can be provided in either soft or hard formats and is often tied to a particular version of the supported standard, which may undergo continuous updates.

- While “connectivity” typically pertains to off-chip interfaces, it can also encompass on-chip buses like AMBA or OCP.

(Source: FSA)

Top Semiconductor Vendors

- According to the 2020 IPnest Semiconductor Design IP Report, Arteris IP held the 12th position among the world’s largest semiconductor IP companies.

- Notably, in the Chip Infrastructure market category, which mainly focuses on on-chip interconnect IP, Arteris IP secured 2nd place, just behind Arm Holdings.

- Arteris IP achieved remarkable year-over-year revenue growth. Ranking as the second-highest in this regard among the top 15 semiconductor IP companies.

- With $34 million in revenue in 2019, Arteris IP garnered a substantial 31.3% share of the interconnect IP market.

- This growth stemmed from its success across global regions and its portfolio of products. Which includes FlexNoC Interconnect, Ncore Cache Coherent Interconnect, and CodaCache Last Level Cache IP.

- These IP solutions have found widespread adoption in cutting-edge applications, including automotive, 5G, machine learning, and infrastructure SoCs.

(Source: Design Reuse)

Recent Developments in Semiconductor IP

- Faraday introduced its LPDDR4X and LPDDR4X combo IP in June 2021, enabling speeds of up to 42Gbps.

- This IP is designed to work seamlessly with Samsung’s 14nm LPC processes and provides two pre-optimized configurations to support both in-line and corner-edge placement scenarios.

- In May 2021, Cadence Design Systems, Inc. introduced power-efficient Intellectual Property (IP) designed to comply with the PCI Express 5.0 standard.

- This IP is specifically crafted for applications in hyper-scale computing, networking, storage, and those utilizing TSMC N5 process technology.

- The complete PCIe 5.0 technology package consists of a corresponding controller, PHY, and verification IP (VIP). All are strategically aimed at System-on-Chip (SoC) designs that necessitate substantial bandwidth capabilities.

(Source: Cadence, Businesswire)

Recent Development

Acquisitions and Mergers:

- Synopsys acquires eSilicon: In 2023, Synopsys, a leading provider of semiconductor IP solutions, acquired eSilicon for $750 million. This acquisition strengthens Synopsys’ position in the semiconductor IP market, particularly in advanced node designs and AI-focused IP. Enhancing its portfolio in high-performance computing and networking.

- Arm Holdings merges with Ampere Computing: In early 2024, Arm Holdings announced a merger with Ampere Computing, a company specializing in server processors, for $1.5 billion. This deal enhances Arm’s capabilities in offering semiconductor IP for cloud and data center applications, leveraging Ampere’s expertise in power-efficient server architectures.

New Product Launches:

- Cadence introduces Tensilica AI processor IP: In 2023, Cadence launched its new Tensilica AI processor IP. Designed specifically for edge AI applications such as autonomous vehicles and IoT devices. This new IP offers up to 3x performance improvement over previous models, enabling faster data processing and power efficiency.

- Synopsys unveils DesignWare Bluetooth 5.3 IP: In mid-2023, Synopsys introduced DesignWare Bluetooth 5.3 IP, targeted at low-power wireless connectivity in IoT and wearable devices. This product enables 50% lower energy consumption compared to previous versions, enhancing battery life in smart devices.

Funding:

- SiFive secures $175 million to expand RISC-V IP offerings: In 2023, SiFive, a company focused on RISC-V semiconductor IP, raised $175 million in a Series E funding round. The funds will be used to develop advanced RISC-V processor designs and expand its IP portfolio. Focusing on automotive, AI, and IoT markets.

- Flex Logix raises $100 million for AI-focused IP development: In late 2023, Flex Logix, a semiconductor IP provider specializing in reconfigurable computing and AI. Secured $100 million to accelerate its development of IP for AI inferencing chips, targeting sectors like autonomous driving and edge computing.

Technological Advancements:

- AI and machine learning integration: By 2025, 40% of semiconductor IP solutions are expected to integrate AI and machine learning capabilities. Enabling more efficient chip designs for autonomous vehicles, cloud computing, and consumer electronics.

- Shift toward RISC-V architecture: The RISC-V open-source architecture is gaining traction, with 30% of semiconductor IP designs expected to adopt RISC-V standards by 2026. Particularly in the IoT and embedded systems markets.

Conclusion

Semiconductor IP Statistics – In summary, semiconductor Intellectual Property (IP) is a cornerstone of the semiconductor industry, facilitating innovation, rapid development, and efficient product launches.

The historical overview underscores the industry’s remarkable growth and transformation, marked by substantial increases in trade volume, internet usage, and semiconductor market revenue, alongside impressive advances in technology.

Key IP providers like Arteris IP and Faraday Technology Corporation have made notable contributions, catering to diverse applications such as automotive and 5G.

Semiconductor IP’s adaptability remains crucial, ensuring it continues to fuel innovation across various sectors.

FAQs

Semiconductor IP refers to pre-designed and verified components used in semiconductor chip manufacturing. These components, such as processors, memory blocks, and communication interfaces. These are protected by intellectual property rights and are essential for chip designers to save time and resources.

Semiconductor IP is crucial because it enables chip designers to leverage pre-designed and tested components, reducing development time and costs. It also allows for faster time-to-market and access to specialized expertise, promoting innovation in semiconductor products.

Semiconductor IP can be categorized into various types, including processors, memory, interface IP, analog IP, and more. These components serve different functions within a semiconductor chip.

Semiconductor IP can be licensed through various models, including royalties, perpetual licensing, and subscriptions. The choice of licensing model depends on the specific needs and preferences of the semiconductor company.

Semiconductor IP finds applications in a wide range of industries, including consumer electronics, automotive, industrial automation, healthcare, and telecommunications. It is used wherever semiconductor chips are integrated into products or systems.