Table of Contents

Introduction

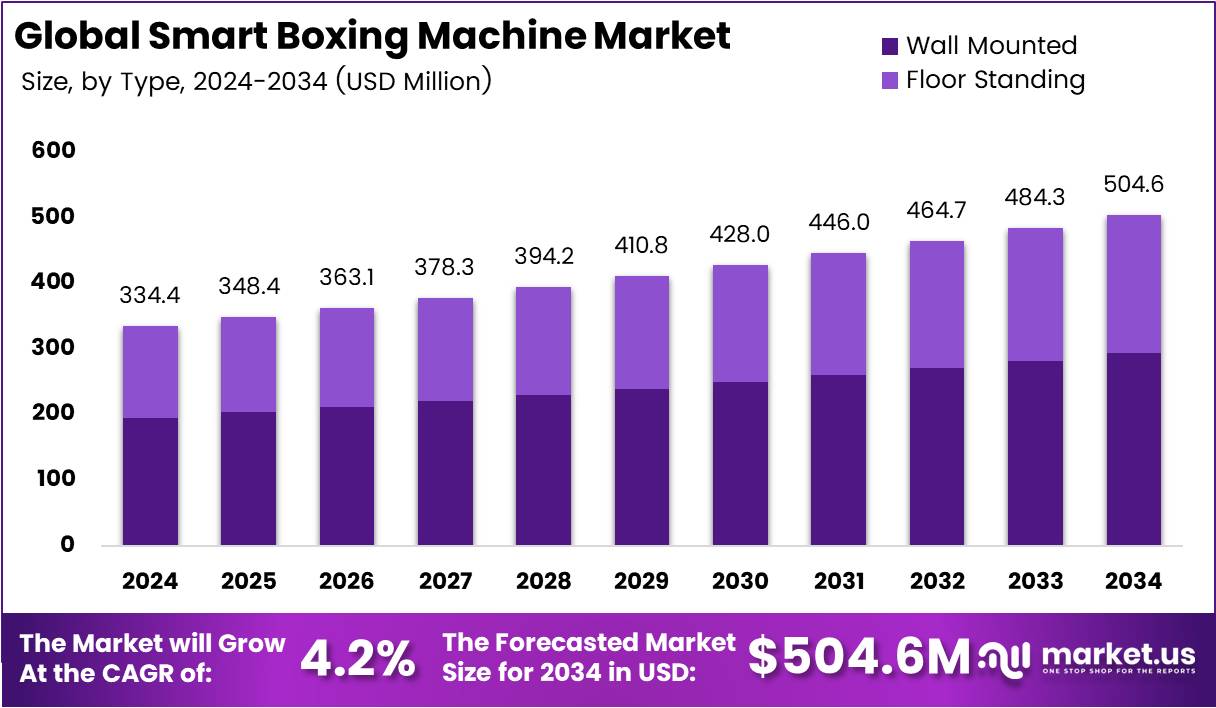

The global smart boxing machine market is gaining momentum as consumers embrace technology-driven fitness solutions. Valued at USD 334.4 Million in 2024, the market is projected to reach USD 504.6 Million by 2034, advancing at a CAGR of 4.2%. Increasing demand for interactive workouts and AI-driven equipment is propelling this expansion.

Transitioning from traditional fitness routines, smart boxing machines are reshaping home-based exercise. With integrated sensors, AI feedback, and gamified experiences, these machines meet the growing consumer preference for convenience and personalization. Governments promoting healthier lifestyles and the rising adoption of smart fitness devices further strengthen market growth.

Key Takeaways

- The Global Smart Boxing Machine Market size is expected to be worth around USD 504.6 Million by 2034, from USD 334.4 Million in 2024, growing at a CAGR of 4.2%.

- In 2024, Wall Mounted held a dominant market position in the By Type segment, with a 58.3% share.

- In 2024, Electric held a dominant market position in the By Power Source segment, with a 69.2% share.

- In 2024, Residential held a dominant market position in the By Application segment, with a 67.9% share.

- In 2024, Online held a dominant market position in the By Distribution Channel segment, with a 58.4% share.

- Asia Pacific holds the largest share of the Smart Boxing Machine market, with 45.8% of the market share, valued at USD 153.1 Million.

Market Segmentation Overview

In the By Type segment, wall mounted machines dominate with 58.3% share in 2024. Compact and space-saving, these machines are ideal for home gyms and apartments. Floor standing machines follow, mainly adopted by commercial facilities and larger setups.

In the By Power Source segment, electric models hold 69.2% share in 2024. They provide consistent performance, making them the preferred option for residential use. Battery-operated models, while portable, face adoption challenges due to limited battery life.

In the By Application segment, residential use leads with 67.9% share in 2024. The shift toward home fitness drives this demand, offering cost-effective and personalized solutions. Commercial adoption, though smaller, is expanding with gyms integrating smart equipment to attract users.

In the By Distribution Channel segment, online channels dominate with 58.4% share in 2024. E-commerce platforms enable easy comparison and direct purchase. Offline retail remains relevant, offering hands-on experience, but faces slower growth compared to online sales.

Drivers

One major driver is the rising interest in smart fitness technology. Consumers increasingly seek engaging, AI-powered workout solutions that provide real-time feedback, enhancing motivation and performance.

Another driver is the growing trend of home-based fitness. Post-pandemic, many households have invested in fitness equipment, with smart boxing machines benefiting from this sustained demand.

Use Cases

Smart boxing machines are widely used in home gyms, where individuals enjoy interactive workouts tailored to personal goals. Their AI feedback and progress tracking create a professional training experience at home.

They are also used in commercial gyms to attract customers seeking advanced fitness solutions. Features like gamified training and group sessions enhance engagement, differentiating gyms from competitors.

Major Challenges

Limited consumer awareness remains a barrier. Many potential users are unaware of smart boxing technology’s benefits, slowing adoption despite market growth.

Maintenance challenges also pose issues. Advanced sensors and AI components require specialized servicing, raising costs and discouraging some consumers.

Business Opportunities

Emerging markets present strong growth opportunities. Rising middle-class populations in Asia-Pacific and Latin America are driving fitness awareness and equipment adoption.

Integration with wearables opens another opportunity. Linking smart boxing machines with health tracking devices enhances data-driven workouts, appealing to health-conscious users.

Regional Analysis

Asia Pacific dominates the global market with 45.8% share in 2024, valued at USD 153.1 Million. Strong adoption of fitness technology and expanding e-commerce platforms in China and Japan fuel this growth.

North America follows with steady expansion driven by high disposable income, government-backed health initiatives, and consumer demand for AI-based fitness equipment.

Recent Developments

- In August 2025, Giant Ideas, LLC acquired Mayweather Boxing + Fitness and KickHouse to expand its boutique fitness portfolio.

- In December 2024, Growl raised USD 4.75 Million to develop an AI-driven boxing bag for at-home coaching.

- In January 2024, WaterRower Inc. acquired CityRow to add digital content and software to its fitness product range.

- In February 2024, FitLab acquired Assault Fitness and RPM Training to strengthen its integrated fitness platform.

Conclusion

The smart boxing machine market is on a steady growth path, fueled by AI integration, rising home fitness adoption, and expanding e-commerce channels. With innovation in virtual training, health monitoring, and AR-driven experiences, the market is expected to remain a significant part of the global fitness-tech industry through 2034.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)