Table of Contents

Introduction

According to Telecom Cloud Statistics, Telecom Cloud, or Telco Cloud, revolutionizes the telecommunications sector by transferring traditional services onto cloud-based Infrastructure. It utilizes virtualization technologies like Network Function Virtualization (NFV) and Software-Defined Networking (SDN), combined with cloud infrastructure, service orchestration, and edge computing.

This method offers cost-effectiveness and scalability and facilitates the swift introduction of new services, ultimately boosting efficiency and customer satisfaction.

Through stringent security measures, Telecom Cloud guarantees data protection and adherence to regulations. It empowers telecom operators to adjust to market shifts, encourage innovation, and enhance service delivery to their clientele.

Editor’s Choice

- In 2023, the total telecom cloud market revenue reached 28.1 billion USD.

- By 2032, public cloud revenues are anticipated to reach 55.51 billion, private cloud revenues 41.85 billion, and hybrid cloud revenues 30.24 billion.

- The global telecom cloud market is characterized by a distribution of computing services, with Software as a Service (SaaS) dominating the landscape with a significant market share of 50%.

- AWS (Amazon Web Services) holds the largest market share in the public cloud sector at 16%.

- Microsoft Azure Stack has steadily increased in popularity, climbing from 14% in 2017 to 41% in 2023, indicating a growing preference for Microsoft’s cloud platform among private cloud users.

- Backup or disaster recovery is the most common application among hybrid cloud models, with 73% of workload deployments utilizing hybrid cloud models to ensure data protection and business continuity.

- Those with revenues exceeding USD 30 billion lead the investment charge, allocating an average annual investment of 348 million USD towards telco cloud transformation.

Global Telecom Cloud Market

Global Telecom Cloud Market Size

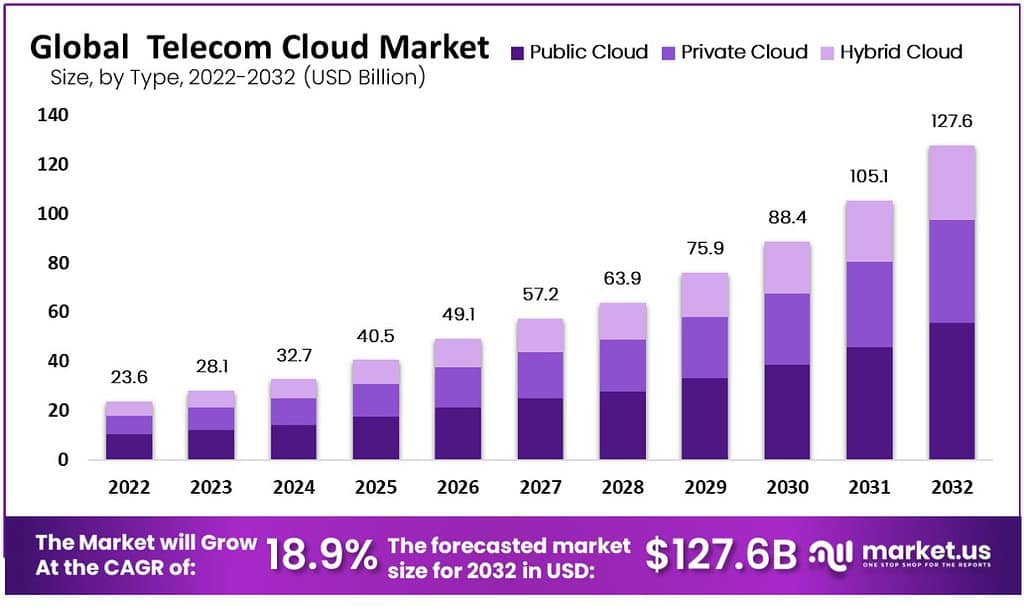

- The global telecom cloud market revenue, denoted in USD billion, has shown a consistent upward trajectory over the years at a CAGR of 18.9%, indicative of its robust growth and significance in the telecommunications sector.

- In 2022, the revenue stood at 23.6 billion, marking the beginning of a promising trend.

- Subsequent years they witnessed steady expansion, with revenues reaching 28.1 billion in 2023 and escalating to 32.7 billion in 2024.

- As we advance into the early 2030s, the telecom cloud market is anticipated to surpass the milestone of 100 billion USD, with revenues projected at 105.1 billion in 2031 and 127.6 billion in 2032.

Telecom Cloud Market Size – By Type

- In 2022, the total market revenue reached 23.6 billion USD, with public cloud revenue at 10.27 billion, private cloud revenue at 7.74 billion, and hybrid cloud revenue at 5.59 billion.

- Over the subsequent years, all segments experienced consistent expansion. By 2032, the market is projected to soar to 127.6 billion USD, with significant contributions from public, private, and hybrid cloud deployments.

- Public cloud revenues are anticipated to reach 55.51 billion, private cloud revenues at 41.85 billion, and hybrid cloud revenues at 30.24 billion.

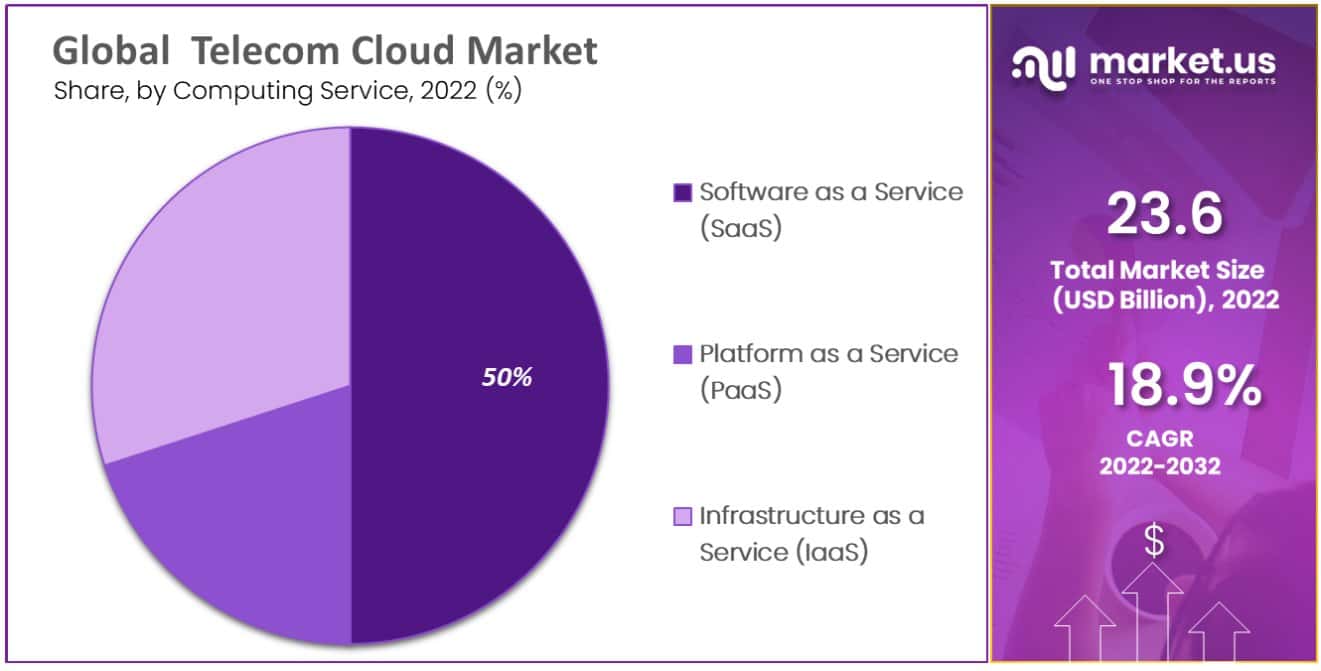

Global Telecom Cloud Market Share – By Computing Service

- The global telecom cloud market is characterized by a distribution of computing services, with Software as a Service (SaaS) dominating the landscape with a significant market share of 50%.

- Following closely behind is Platform as a Service (PaaS), with a share of 20%, while Infrastructure as a Service (IaaS) commands a 30% share.

- This breakdown highlights the prevalence of SaaS solutions, indicating a substantial reliance on software-based services within the telecommunications industry.

Public Cloud Statistics

Average Spend Per Employee

- Public cloud statistics reveal a consistent upward trend in average spending per employee across various types of public cloud services from 2020 to 2028.

- Business Process as a Service (BPaaS) saw gradual growth, starting at 13.74 USD in 2020 and reaching 21.51 USD by 2028.

- Desktop as a Service (DaaS) also experienced a steady increase, beginning at 0.36 USD in 2020 and climbing to 1.57 USD in 2028.

- Infrastructure as a Service (IaaS) witnessed substantial growth over the years, with spending per employee escalating from 19.12 USD in 2020 to 99.53 USD in 2028.

- Platform as a Service (PaaS) and Software as a Service (SaaS) exhibited similar patterns of growth, with PaaS spending per employee rising from 13.33 USD in 2020 to 67.54 USD in 2028, and SaaS expenditure per employee increasing from 46.43 USD in 2020 to 103.6 USD in 2028.

Key Players in the Public Cloud Sector

- Several key players dominate the market in the public cloud sector, each contributing to its evolution and expansion.

- AWS (Amazon Web Services) holds the largest market share at 16%, followed closely by Microsoft Cloud with 14%.

- Google Cloud and Salesforce each capture 5% of the market share, while IBM Cloud and Alibaba Cloud trail slightly behind, holding 4% and 3%, respectively.

- SAP and Adobe Cloud each secure a 3% share, while ServiceNow claims 2%.

- Collectively, these leading companies represent a significant portion of the public cloud market, showcasing their prominence and influence in shaping its landscape.

- However, a notable portion of the market, accounting for 44%, remains distributed among various other players, highlighting the diverse ecosystem within the sector.

Public Cloud Market Revenue in Different Nations

- The public cloud market demonstrates varying revenue figures across different nations, reflecting diverse levels of adoption and investment in cloud services.

- The United States leads the pack with a substantial revenue of 330.5 billion USD, underscoring its position as a global leader in cloud technology and innovation.

- China follows with a significant revenue of 69.01 billion USD, reflecting the country’s growing digital economy and investment in cloud infrastructure.

- Germany and the United Kingdom also boast considerable revenues of 27.02 billion USD and 26.73 billion USD, respectively, highlighting their strong presence in the European cloud market.

- Japan, France, Canada, and Australia each contribute notable figures ranging from 11.55 billion USD to 21.44 billion USD, indicating widespread adoption of cloud services across these regions.

Private Cloud Statistics

Current Usage of Private Cloud Platform Services

- Private cloud platform services have experienced dynamic shifts in usage worldwide from 2017 to 2023, with various service types witnessing fluctuations in adoption rates.

- Microsoft Azure Stack has steadily increased in popularity, climbing from 14% in 2017 to 41% in 2023, indicating a growing preference for Microsoft’s cloud platform among private cloud users.

- Conversely, VMware vSphere/vCenter, initially dominant at 42% in 2017, has experienced a gradual decline, dropping to 28% by 2023.

- Similarly, Microsoft System Center peaked at 28% in 2022 after steadily rising since 2017.

- In contrast, VMware vCloud Director has seen a downward trend, decreasing from 27% in 2019 to 18% in 2023.

- Once a prominent player, OpenStack has also witnessed a decline in adoption, falling from 30% in 2020 to 11% in 2023.

Hybrid Cloud Statistics

Deployment of Hybrid Cloud Models for Various Workloads

- Hybrid cloud models have become increasingly prevalent across workloads, reflecting multiple deployment scenarios in the hybrid workplace.

- Among these, backup or disaster recovery stands out as the most common application, with a significant 73% of workload deployments utilizing hybrid cloud models for ensuring data protection and business continuity.

- Application development closely follows, with 70% of deployments leveraging hybrid cloud environments to facilitate agile and scalable development processes.

- Archiving represents another prominent use case, with 54% of workload deployments utilizing hybrid cloud models for efficient data storage and data management.

- Additionally, cloud bursting, which involves seamlessly scaling workloads between on-premises infrastructure and the cloud, is utilized by 51% of deployments to handle fluctuating demands efficiently.

Motivations for Organizations for Using Hybrid Cloud Services

- Managing security is a primary concern, with 43% of organizations opting for hybrid cloud environments to enhance data protection and ensure compliance with stringent security standards.

- Additionally, the desire for a more agile and scalable development environment motivates 42% of organizations to embrace hybrid cloud, enabling them to adapt quickly to changing market demands and accelerate application development cycles.

- Moreover, pursuing business agility and innovation motivates 40% of organizations to embrace hybrid cloud, empowering them to explore new opportunities and drive digital transformation initiatives.

- Cost reduction is also a significant factor, with 34% of organizations leveraging hybrid cloud to optimize cloud service expenses while simultaneously achieving business resilience and disaster recovery objectives, reflecting the multifaceted benefits of hybrid cloud adoption in today’s dynamic business landscape.

Investments in Telecom Cloud

Average Annual Investment in Telco Cloud Transformation Per Year

- Telcos, categorized by their annual revenue brackets, exhibit varying levels of investment in cloud transformation initiatives.

- Those with revenues exceeding USD 30 billion lead the investment charge, allocating an average annual investment of 348 million USD towards telco cloud transformation.

- Meanwhile, telcos generating between USD 21 billion and USD 30 billion in revenue allocate a slightly lower but still substantial average annual investment of 306 million USD.

- Telcos, with revenues ranging from USD 11 billion to USD 20 billion, invest significantly less, with an average annual investment of USD 155 million.

- Finally, telcos with revenues between USD 5 billion and USD 10 billion allocate the lowest average annual investment of 90 million USD towards telco cloud transformation.

Technological Advancements in 5G Technology Benefiting Telecom Cloud

- One of the most significant advancements in the telecommunications industry is the introduction of 5G networks.

- With their rapid speeds, minimal latency, and ability to accommodate numerous devices, 5G technology is poised to revolutionize our connectivity and device interactions.

- Compared to previous networks, 5G offers up to 100 times faster speeds, facilitating seamless streaming, quicker downloads, and improved cloud gaming experiences.

- Moreover, 5G networks can support many connected devices simultaneously, paving the way for large-scale IoT applications. Statista predicts that by 2025, there will be approximately 3.6 billion 5G connections worldwide, highlighting the significant potential of this transformative technology.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)