Table of Contents

Factoring Market Overview

Factoring companies provide an essential financial tool that enables businesses to manage cash flow and optimize working capital. The factoring involves selling accounts receivable to a third party at a discount for immediate cash, transferring credit risk to the factor.

In contrast, accounts receivable financing encompasses broader methods. Such as lines of credit, using outstanding invoices as collateral without relinquishing ownership.

Both options improve liquidity and reduce reliance on traditional loans, though they vary in costs and administrative requirements.

Businesses must carefully evaluate their needs and the implications of each option to make informed financial decisions.

Market Drivers

The global factoring market is driven by rising demand for working capital as businesses strive to enhance liquidity for growth.

The growth of small and medium enterprises (SMEs) facing difficulties in securing traditional financing makes factoring an appealing choice.

Additionally, the expansion of international trade compels exporters to utilize factoring to manage cash flow and mitigate payment risks.

Economic volatility further leads companies to seek immediate cash flow through factoring amid potential delays in customer payments.

Technological advancements have streamlined the factoring process, improving accessibility while evolving regulations support alternative financing methods. Collectively, these factors position factoring as a vital tool for managing cash flow and optimizing finances.

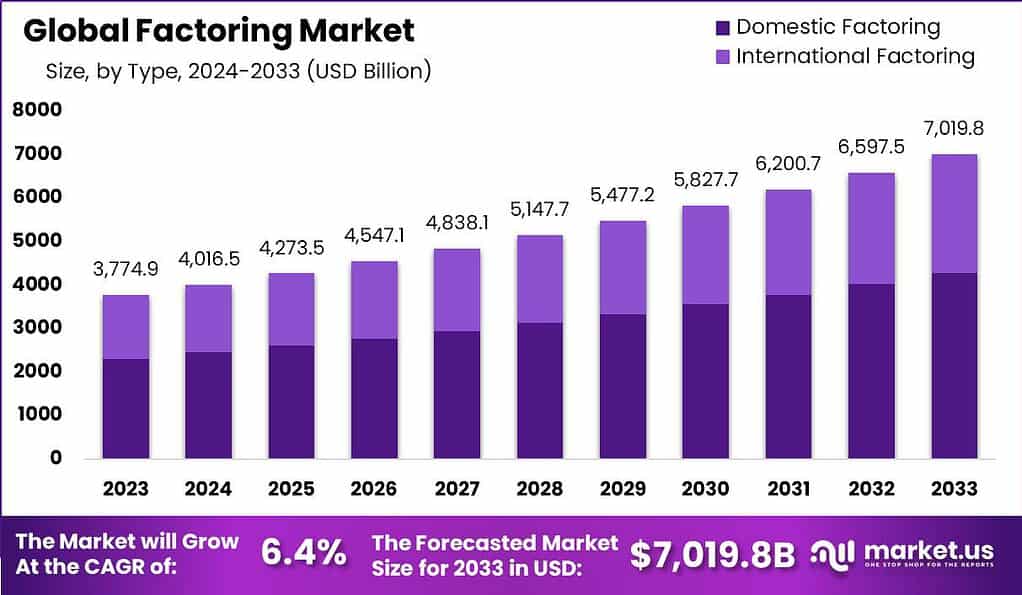

Market Size

The global factoring market is projected to reach USD 7,019.8 billion by 2033. With a steady CAGR of 6.4% from 2024 to 2033. The market is expected to total USD 4,016.5 billion in 2024.

List of Major Companies

These are the top 10 companies operating in the Factoring Market:

Citigroup

Company Overview

| Establishment Year | 1998 |

| Headquarter | New York, U.S. |

| Key Management | Jane Fraser (CEO) |

| Revenue (US$ Bn) | $ 78.4 Billion (2023) |

| Headcount | ~ 239,000 (2023) |

| Website | https://citigroup.com/ |

About Citigroup

Citigroup has been actively involved in the factoring companies/sector through its robust global trade finance and supply chain services. With a particular focus on reverse factoring.

This service helps businesses manage their working capital by allowing suppliers to receive early payments on invoices through Citigroup’s financing, which in turn supports supply chain efficiency.

In recent developments, Citigroup has streamlined its operations by divesting its “Bridge built by Citi” platform to Foro Holdings Inc. in September 2023 as part of its strategy to concentrate more on core services such as commercial lending and digital transformation.

Additionally, Citi continues to enhance its global operations, including expanding its digital and sustainability-linked factoring solutions. Which are aligned with the growing demand for more transparent and efficient financial services.

Geographical Presence

Citigroup has a presence in approximately 100 countries, prominently operating in North America, Latin America, Europe, the Middle East, Africa (EMEA), and Asia-Pacific. In the U.S., where it is headquartered, Citigroup offers a comprehensive range of financial services, including retail and investment banking.

Its Latin American operations are highlighted by Citibanamex in Mexico, while Europe features a significant presence in the U.K. and various other countries.

In Asia, Citigroup focuses on markets like China and India, providing tailored services to meet local needs. This extensive geographical reach enables Citigroup to capitalize on growth opportunities in emerging markets while maintaining a strong position in established regions.

Recent Developments

- In September 2024, Citigroup agreed to sell its global fiduciary and trust administration services business to JTC for $80 million.

- In September 2024, Citigroup teamed up with Apollo to provide financing to private equity firms and lower-rated U.S. companies.

MasterCard

Company Overview

| Establishment Year | 1966 |

| Headquarter | New York, U.S. |

| Key Management | Michael Miebach (CEO) |

| Revenue (US$ Bn) | $ 25.1 B (2023) |

| Headcount | ~ 33,400 (2023) |

| Website | https://mastercard.com/ |

About Mastercard

Mastercard is expanding its presence in the factoring companies and broader financial services sectors by leveraging its payment solutions and B2B expertise.

A key growth area is supply chain finance, which enhances cash flow and receivables management for businesses. Recently, Mastercard strengthened its services by acquiring cybersecurity firm Recorded Future for $2.65 billion in 2024, aimed at bolstering digital security across its payment ecosystems.

This move highlights Mastercard’s strategy to integrate advanced technologies, including artificial intelligence, to enhance security and efficiency in financial transactions critical to B2B operations.

Additionally, the company is broadening its offerings in digital payments, open banking, and small business support, solidifying its position in commercial finance.

Geographical Presence

MasterCard has a diverse presence across North America, Latin America, Europe, Asia-Pacific, and the Middle East and Africa.

It primarily serves the U.S. and Canada with a range of credit, debit, and prepaid card options. In Latin America, particularly Brazil and Mexico, the company sees growth potential driven by digital payment adoption.

Europe offers a stable regulatory environment, while Asia-Pacific is experiencing rapid growth in digital payments, especially in China and India. In the Middle East and Africa, MasterCard focuses on enhancing financial inclusion through mobile payments in markets like South Africa and Kenya.

Its adaptability and commitment to innovation position it well for continued success in the global payments industry.

Recent Developments

- In September 2024, MasterCard partnered with ZOOD to launch a virtual BNPL card, ZOOD Card, in Uzbekistan.

- In September 2024, MasterCard partnered with Mercuryo to introduce a euro-denominated crypto-debit card.

PayPal

Company Overview

| Establishment Year | 1998 |

| Headquarter | San Jose, California, U.S. |

| Key Management | John Donahoe (Chairman) |

| Revenue (US$ Bn) | $ 29.7 Billion (2023) |

| Headcount | ~ 27,200 (2023) |

| Website | http://paypal.com/ |

About PayPal

PayPal has made significant strides in the factoring companies and digital payment sectors by leveraging its vast online payment network to support businesses in managing cash flow and receivables.

Although PayPal is not directly involved in traditional factoring services, it offers alternative financial solutions that enhance liquidity for small and medium-sized enterprises (SMEs), including its “Buy Now, Pay Later” (BNPL) services through acquisitions such as Paidy in Japan. This acquisition, valued at $2.7 billion, has strengthened PayPal’s position in Asia’s fintech space.

Additionally, PayPal continues to innovate, recently launching new AI-driven tools such as Smart Receipts and the Fastlane checkout feature, designed to streamline the shopping experience for consumers and increase transaction efficiency for merchants.

Geographical Presence

PayPal is a leading digital payment platform with a significant geographical presence across key markets worldwide. Its largest market is the United States, followed by strong positions in the United Kingdom, Germany, Canada, and Australia.

The company is also expanding in emerging markets, including China and India, where digital payments are rapidly growing.

In Latin America, Mexico and Brazil are vital markets, while South Africa and the UAE represent its presence in the Middle East and Africa.

By forming partnerships with local institutions, PayPal aims to enhance its services and capitalize on the growing e-commerce landscape globally, positioning itself for continued growth in the competitive digital payments sector.

Recent Development

- In September 2024, PayPal launched PayPal Complete Payments, a safe and efficient all-in-one platform.

- In September 2021, PayPal acquired Paidy, a top buy now, pay later provider in Japan, strengthening its position in the domestic payments market.

JPMorgan

Company Overview

| Establishment Year | 1799 |

| Headquarter | New York City, United States |

| Key Management | Jamie Dimon (CEO) |

| Revenue (US$ Bn) | $ 158.1 Billion (2023) |

| Headcount | ~ 309,926 (2023) |

| Website | https://jpmorganchase.com/ |

About JPMorgan

JPMorgan Chase is expanding its financial services presence, focusing on factoring companies and supply chain finance.

The firm provides trade finance solutions, including factoring services that help businesses improve cash flow by selling receivables, supporting its strategy to enhance commercial banking and corporate finance.

In May 2023, JPMorgan strengthened its wealth management and commercial banking by acquiring most of First Republic Bank’s assets, which included approximately $173 billion in loans and $92 billion in deposits, significantly increasing its client base.

Additionally, the 2022 acquisition of Global Shares highlights its commitment to advancing digital and fintech capabilities, particularly in employee ownership services.

Geographical Presence

JPMorgan Chase & Co. is a prominent financial services firm with a robust global presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East.

Headquartered in the United States, it operates numerous branches focused on consumer banking. London serves as its European hub, supporting strong investment banking and asset management activities in Frankfurt and Paris.

In the Asia-Pacific region, the firm has invested heavily in China and Japan for corporate and investment banking.

Its operations in Latin America are centered in Brazil and Mexico, while Dubai is a key hub in the Middle East. This extensive footprint enables JPMorgan Chase to leverage local market expertise and sustain its leadership in the industry.

Recent Development

- In September 2024, JPMorgan Chase acquired 6.17% shares of Sibanye Stillwater.

- In August 2022, J.P. Morgan acquired Global Shares, a leading cloud-based provider of share plan management software.

Wells-Fargo

Company Overview

| Establishment Year | 1929 |

| Headquarter | San Francisco, California, U.S. |

| Key Management | Charles Scharf (CEO) |

| Revenue (US$ Bn) | $ 73.8 B (2022) |

| Headcount | ~ 238,698 (2022) |

| Website | https://www.wellsfargo.com/ |

About Wells Fargo

Wells Fargo plays a key role in the factoring companies/sector, offering comprehensive trade finance solutions to businesses seeking to improve cash flow and manage receivables.

The company provides factoring services through its Commercial Services Group, which helps clients accelerate cash flow and reduce credit risks.

Recently, Wells Fargo has been focusing on leadership in this space by appointing Marc Grossman as the head of Factoring and Specialty Asset-Based Lending, highlighting its commitment to growing its factoring services.

Additionally, Wells Fargo continues to innovate within the receivables financing space, leveraging technology for better visibility and automation in transactions.

In terms of acquisitions, the bank recently completed divestitures, such as the sale of its Corporate Trust Services unit, and continues to streamline its operations while expanding core financial services.

Geographical Presence

Wells Fargo & Company, headquartered in San Francisco, has a significant geographical presence both domestically and internationally.

In the United States, it operates branches and ATMs across all 50 states, with a strong concentration in California, Texas, and Florida, emphasizing community banking tailored to local markets.

Internationally, Wells Fargo has a presence in Canada, several Latin American countries, Europe, and the Asia-Pacific region, focusing on corporate and investment banking services.

Its strategic approach involves segmenting markets to meet specific local needs, enhancing customer relationships, and identifying expansion opportunities, all while navigating diverse regulatory environments. This extensive network positions Wells Fargo as a leading financial services provider.

Recent Developments

- In September 2024, Wells Fargo partnered with Cedar Valley Habitat for Humanity to support a family in need in Cedar Rapids.

- In August 2024, Wells Fargo agreed to sell the non-agency third-party servicing segment of its Commercial Mortgage Servicing business to Trimont.

Amex

Company Overview

| Establishment Year | 1850 |

| Headquarter | New York City, United States |

| Key Management | Stephen J. Squeri (Chairman & CEO) |

| Revenue (US$ Bn) | $ 60.5 Billion (2023) |

| Headcount | ~ 74,600 (2023) |

| Website | https://americanexpress.com/ |

About American Express

American Express is expanding its presence in the B2B payments sector, particularly in factoring companies and receivables financing.

In 2023, it acquired Nipendo, a B2B automation platform that streamlines procure-to-pay processes, enhancing American Express’s capability to provide end-to-end payment solutions for improved efficiency and transparency.

Nipendo utilizes AI and machine learning to optimize invoice processing and payments, complementing American Express’s existing business payment offerings.

The company is also strengthening its B2B ecosystem through previous acquisitions, such as Acompay in 2019, and collaborations with firms like BillTrust and Versapay, solidifying its position as a key player in the B2B financial services market.

Geographical Presence

American Express Company (Amex), headquartered in New York City, operates globally and focuses on affluent consumers and businesses.

North America, particularly the U.S. and Canada, offers a wide range of credit and charge cards. Its presence in Latin America includes Mexico, Brazil, and Argentina, where tailored products cater to local markets.

In Europe, the U.K., Germany, and France are key markets, while in the Asia-Pacific region, Japan and China are significant growth areas.

The company also targets the Middle East and Africa, particularly in the UAE and South Africa. American Express leverages its strong brand, strategic partnerships, and technological innovations to enhance customer experience and maintain its competitive position in the premium market segment worldwide.

Recent Developments

- In August 2024, American Express launched a new Centurion Lounge at Salt Lake City International Airport.

- In January 2023, American Express acquired Nipendo, a company that helps global businesses automate and streamline their B2B payment processes.

Discover-Financial

Company Overview

| Establishment Year | 1985 |

| Headquarter | Riverwoods, Illinois, U.S. |

| Key Management | Michael Rhodes (CEO) |

| Revenue (US$ Bn) | $ 20.6 Billion (2023) |

| Headcount | ~ 21,100 (2023) |

| Website | http://discover.com/ |

About Discover Financial

Discover Financial Services, traditionally recognized for its credit card and consumer banking services, is increasingly venturing into the B2B payments and factoring companies/sector, which involves financing receivables to assist businesses with cash flow management.

The company is enhancing its digital payment services by investing in and partnering with various fintechs to improve automated payment solutions for B2B customers.

Although Discover has not made significant acquisitions in factoring recently, it is focused on strengthening its digital infrastructure to provide small and medium-sized enterprises with innovative credit management and receivables financing solutions.

This strategic direction positions Discover to serve better businesses seeking sophisticated and efficient financial solutions.

Geographical Presence

Discover Financial Services, founded in 1985 and headquartered in Riverwoods, Illinois, is a leading financial services company primarily known for its credit card offerings, payment processing services, and banking solutions.

While it operates mainly in the United States, where it is one of the largest credit card issuers, its international presence is limited, but it is expanding through partnerships, notably with Diners Club International, enhancing acceptance in several countries.

Discover is focused on digital expansion and enhancing its mobile banking capabilities, aiming to attract a broader customer base and explore growth opportunities in both existing and new markets.

Recent Developments

- In July 2024, Discover Financial Services opened its Shine Bright Community Center in Whitehall, Ohio, the US.

- In May 2024, Discover Global Network and PhotonPay announced their plans to introduce the PhotonPay Commercial Card.

HSBC

Company Overview

| Establishment Year | 1865 |

| Headquarter | London, England, UK |

| Key Management | Georges Elhedery (Group Chief Executive) |

| Revenue (US$ Bn) | $ 62.6 Billion (2023) |

| Headcount | ~ 221,000 (2024) |

| Website | http://www.hsbc.com/ |

About HSBC

HSBC Holdings plc remains a key player in the factoring companies and trade finance sector through its Global Trade and Receivables Finance (GTRF) division, which offers solutions to enhance cash flow and manage receivables.

By integrating factoring services with broader trade finance offerings, HSBC enables businesses to unlock working capital from their receivables.

In 2023, the bank significantly strengthened its UK presence by acquiring Silicon Valley Bank UK, enhancing its services for tech-focused businesses and startups.

This acquisition aligns with HSBC’s strategy to expand in key sectors like technology and finance, contributing to a 30% revenue increase in 2023, driven by higher interest rates and growth initiatives.

Geographical Presence

HSBC Holdings plc, one of the largest banking and financial services organizations globally, operates in approximately 64 countries and territories across Europe, Asia, North America, Latin America, the Middle East, and Africa.

Its expansive network includes over 3,800 offices, with key markets such as the United Kingdom, Hong Kong, and the United States.

The bank focuses on both established and emerging markets, emphasizing sustainable finance and digital banking innovation.

While HSBC faces challenges like regulatory compliance and geopolitical tensions, its geographical diversification positions it strategically to leverage global trends and capture growth opportunities in the evolving financial landscape.

Recent Development

- In September 2024, HSBC UK partnered with Asda to introduce a new sustainability-linked enhancement.

- In September 2024, HSBC partnered with Quantinuum to secure tokenized gold from potential quantum vulnerabilities.

Deutsche-Bank

Company Overview

| Establishment Year | 1870 |

| Headquarter | Frankfurt, Germany |

| Key Management | Christian Sewing (CEO) |

| Revenue (US$ Bn) | $ 66.8 Billion (2022) |

| Headcount | ~ 90,130 (2023) |

| Website | http://www.db.com/ |

About Deutsche Bank

Deutsche Bank is actively involved in the factoring companies/sector through its trade finance and working capital solutions, helping businesses manage cash flow by selling receivables.

This service enhances liquidity and mitigates credit risks across various industries. In October 2023, the bank strengthened its UK presence by acquiring Numis.

This move enhances its corporate finance capabilities, including advisory and broking services, which are in line with its Global Hausbank strategy.

Additionally, Deutsche Bank is advancing its digital transformation by partnering with Oracle to modernize its database infrastructure, supporting essential functions like payment processing and regulatory reporting.

Geographical Presence

Deutsche Bank AG, headquartered in Frankfurt, Germany, has a robust geographical presence across over 70 countries. It operates through four main segments: Corporate Bank, Investment Bank, Private Bank, and Asset Management.

Key markets include Germany, where it has extensive operations. The United States is a crucial hub for investment banking and corporate banking and has significant offices in Asia-Pacific, particularly in China and Japan.

The bank also maintains a strategic presence in the Middle East and Africa, notably in the UAE and South Africa. It allows it to serve a diverse client base ranging from individuals to large corporations, thereby positioning itself well for growth in emerging markets.

Recent Development

- In October 2023, Deutsche Bank AG completed its acquisition of Numis Corporation Plc, advancing its Global Hausbank strategy to become the main financial services contact for clients and strengthen relationships with UK corporates.

- In June 2021, Deutsche Bank and Oracle announced a multi-year partnership to modernize the bank’s database technology and expedite its digital transformation.

DBS

Company Overview

| Establishment Year | 1968 |

| Headquarter | Marina Boulevard, Singapore |

| Key Management | Piyush Gupta (CEO) |

| Revenue (US$ Bn) | $ 21.1 Billion (2023) |

| Headcount | ~ 36,000 (2022) |

| Website | http://www.dbs.com.sg/ |

About DBS Bank

DBS Bank is expanding its presence in the factoring sector as part of its trade finance and working capital solutions, helping businesses manage cash flow by selling receivables.

The bank focuses on supporting small and medium-sized enterprises (SMEs) through innovative financing options, including hybrid products that combine factoring with sustainability-linked features.

In 2023, DBS enhanced its position by acquiring Citigroup’s consumer banking business in Taiwan, becoming the largest foreign bank in the region by assets significantly increasing its loan, deposit, and credit card portfolios.

Additionally, DBS is enhancing its digital banking capabilities with AI-driven tools across key markets like India, Taiwan, and Singapore, demonstrating its commitment to leveraging technology to meet businesses’ financing needs.

Geographical Presence

DBS Bank, headquartered in Singapore, is one of Asia’s largest financial services groups. Its geographical presence spans Singapore, where it holds a significant market share, and key Southeast Asian markets, including Indonesia, Malaysia, Thailand, and the Philippines.

In East Asia, DBS operates in Hong Kong and China, while it also has a footprint in South Asia with services in India and Bangladesh. The bank maintains a presence in Western markets through representative offices in the United States and the United Kingdom.

Known for its digital banking innovations, DBS offers a wide range of services, including retail and corporate banking, wealth management, and investment banking, positioning itself as a leading player in the financial sector.

Recent Developments

- In June 2024, DBS Bank awarded a US$295.5 million sustainability-linked loan to City Developments Limited.

- In April 2024, DBS Bank partnered with PT. Indo-Rama Synthetics Tbk to improve its sustainability goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)