Table of Contents

- Introduction

- Editor’s Choice

- Global Wearable Sensors Market Overview

- Types of Wearable Sensors

- Top Wearable Device Companies

- Overall Wearable and Sensor Shipments Worldwide

- Number of Connected Wearable Devices Worldwide – By Region

- Use of Wearable Sensors and Electronic Devices in Clinical Trials

- Technological Advancements in Wearable Sensor Technology

- Regulations for Wearable Sensors

Introduction

According to Wearable Sensors Statistics, Wearable sensors are pivotal in health and technology, enabling real-time monitoring of physiological signals and environmental factors through devices like smartwatches and fitness trackers.

These sensors detect heart rate, movement, temperature, and more, utilizing technologies such as optical and electrochemical sensors.

Data collected wirelessly transmits to smartphones or computers, where algorithms process it for insights. Applications range from health monitoring to sports performance optimization and environmental assessment.

Challenges include ensuring accuracy, privacy, user compliance, and regulatory adherence. As technology evolves, wearable sensors promise even greater advancements in personalized healthcare and lifestyle management.

Editor’s Choice

- The global wearable sensors market revenue is projected to reach USD 10.19 billion by 2032.

- In the wearable device market, the top five companies have demonstrated varied growth trajectories. Apple has shown significant performance with a growth of 33.10% in Q4 2022, followed by 24.50% in Q1 2023, 21.10% in Q2 2023, 20.60% in Q3 2023, and a resurgence to 25.30% in Q4 2023.

- In 2022, there was a slight decline for Apple, which shipped 146.3 million units, while Xiaomi’s shipments decreased to 34.7 million units. Samsung shipped 43.1 million units, and other vendors collectively shipped 205.3 million units.

- The global shipments of wearable medical sensors are likely to expand to 160 million units in 2024.

- The use of wearable sensors and tracking devices in clinical trials has seen a significant increase from 2016 to 2021.

- In 2023, the market for wearable medical technology exceeded $100 billion, driven by innovations in sensor technology and the integration of artificial intelligence (AI) for real-time health monitoring and data analysis.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical wearables, and devices must conform to the Wearable Medical Devices Rules, 2017. The country is also increasingly aligning with global standards to facilitate the entry of innovative health technologies.

Global Wearable Sensors Market Overview

Global Wearable Sensors Market Size

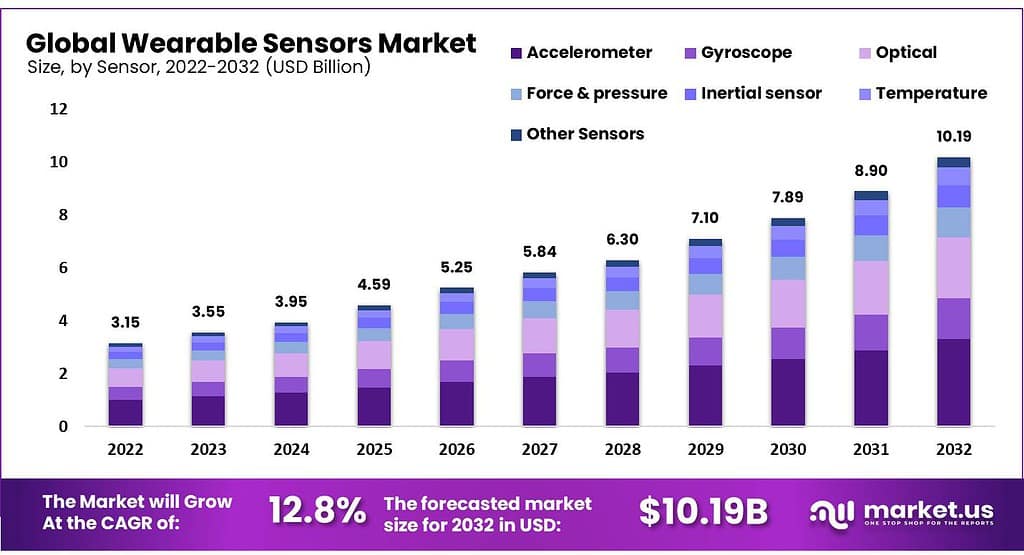

- The global wearable sensors market has experienced substantial growth over the past decade at a CAGR of 12.8%.

- In 2022, the market revenue was valued at USD 3.15 billion, and this upward trend is expected to continue.

- The growth trajectory continues into the next decade, with revenues projected at USD 7.89 billion in 2030, USD 8.90 billion in 2031, and an impressive USD 10.19 billion by 2032.

Types of Wearable Sensors

- Key types of wearable sensors include accelerometers, gyroscopes, magnetometers, heart rate sensors, temperature sensors, and pressure sensors.

- Accelerometers measure motion and orientation changes, utilizing microelectromechanical systems (MEMS) technology to detect movement in three dimensions.

- Gyroscopes complement accelerometers by measuring angular velocity, enhancing the precision of motion tracking in applications like fitness monitoring and navigation.

- Magnetometers detect magnetic fields and, when integrated with accelerometers and gyroscopes, form inertial measurement units (IMUs) that provide comprehensive motion-tracking data.

- Heart rate sensors typically use photoplethysmography (PPG) technology, which involves light-based measurement to detect blood volume changes in the microvascular bed of tissue, providing accurate heart rate readings.

- Temperature sensors in wearables monitor body or skin temperature, which is crucial for health applications that require continuous temperature tracking.

- Pressure sensors measure force or pressure exerted on the sensor surface and are often used in applications like gait analysis and posture monitoring.

Top Wearable Device Companies

- In the wearable device market, the top five companies have demonstrated varied growth trajectories.

- Apple has shown significant performance with a growth of 33.10% in Q4 2022, followed by 24.50% in Q1 2023, 21.10% in Q2 2023, 20.60% in Q3 2023, and a resurgence to 25.30% in Q4 2023.

- Imagine Marketing’s growth rates were more modest but steady, starting at 4.30% in Q4 2022 and increasing through 2023, peaking at 9.80% in Q3 before a slight drop to 3.90% in Q4.

- Samsung maintained consistent growth with figures of 7.90% in Q4 2022 and around 7-9% throughout 2023.

- Huawei’s growth was also stable, beginning at 5.90% in Q4 2022 and varying between 5.90% and 7.40% across the four quarters of 2023.

- Xiaomi exhibited a similar pattern, starting at 5.50% in Q4 2022 and experiencing steady growth, peaking at 8.40% in both Q3 and Q4 of 2023.

- The “Others” category also saw substantial contributions, with growth percentages ranging from 43.40% in Q4 2022 to 46.70% in Q4 2023, highlighting the competitive landscape and the presence of numerous emerging players.

Overall Wearable and Sensor Shipments Worldwide

Wearables Unit Shipments Worldwide – By Vendor

- The global Smart Wearables market has seen substantial growth in unit shipments across major vendors from 2015 to 2022. Apple, Xiaomi, Samsung, and other vendors have all contributed to this upward trend.

- In 2015, Apple shipped 11.6 million units, while Xiaomi led with 12.0 million units, Samsung shipped 3.2 million units, and other vendors collectively shipped 27.4 million units.

- In 2022, there was a slight decline for Apple, which shipped 146.3 million units, while Xiaomi’s shipments decreased to 34.7 million units. Samsung shipped 43.1 million units, and other vendors collectively shipped 205.3 million units.

Wearable Medical Sensor and Device Shipments Worldwide

- The global shipments of wearable medical sensors and devices have exhibited a robust growth trajectory in recent years.

- In 2021, the market saw shipments totaling 85 million units.

- The upward trend is expected to continue, with projections indicating shipments will reach 130 million units in 2023 and further expand to 160 million units in 2024.

Number of Connected Wearable Devices Worldwide – By Region

- The number of connected wearable devices worldwide has surged significantly across all regions from 2015 to 2022.

- In 2015, North America led the market with 38.65 million connected wearable devices, followed by the Asia Pacific with 30.4 million, and Western Europe with 16.75 million devices. Central and Eastern Europe, Latin America, the Middle East, and Africa had 5 million, 1.83 million, and 4.09 million devices, respectively.

- By 2022, the Asia Pacific region led with 311 million devices, followed by North America with 439 million and Western Europe with 192 million. Central and Eastern Europe, Latin America, the Middle East, and Africa continued to grow, reaching 68 million, 49 million, and 46 million devices, respectively.

Use of Wearable Sensors and Electronic Devices in Clinical Trials

- The use of wearable sensors and tracking devices in clinical trials has seen a significant increase from 2016 to 2021.

- In 2016, a total of 102 clinical trials utilized these technologies, including 22 smart devices, 21 wristbands, 18 activity trackers, 23 sensors, six remote monitoring devices, and one wearable device.

- In 2021, the upward trend continued with a total of 213 clinical trials. This year saw a substantial increase in the use of smart devices (59) and wristbands (40), while the use of activity trackers remained stable at 28. Sensors were used in 26 trials, remote monitoring devices in 22, and wearable devices in 10.

Technological Advancements in Wearable Sensor Technology

- Technological advancements in wearable sensors have significantly enhanced their capabilities and applications in recent years.

- In 2023, the market for wearable medical technology exceeded $100 billion, driven by innovations in sensor technology and the integration of artificial intelligence (AI) for real-time health monitoring and data analysis.

- Modern wearable sensors, such as the Tunable, Ultrasensitive, Nature-inspired, Epidermal Sensor (TUNES), can detect a wide range of physiological signals, from minute pulses to muscular contractions and respiration.

- This rapid technological progress is projected to sustain a compound annual growth rate (CAGR) of 15% up to 2030, reflecting the increasing demand for sophisticated, user-friendly health monitoring solutions.

Regulations for Wearable Sensors

North America

- The regulatory landscape for wearable sensors varies significantly across countries, reflecting differing national priorities and healthcare systems.

- In the United States, the Food and Drug Administration (FDA) classifies wearable sensors that provide medical data or aid in medical diagnostics as medical devices.

Europe

- In Europe, wearable sensors are regulated under the Medical Device Regulation (MDR), which requires CE marking to demonstrate conformity with health, safety, and environmental protection standards.

- The European Union’s General Data Protection Regulation (GDPR) also imposes stringent requirements on data privacy and protection for wearable devices, given their propensity to collect sensitive health data.

Asia-Pacific

- In China, wearable sensors used for health monitoring must comply with regulations set by the National Medical Products Administration (NMPA), which involves a comprehensive review process similar to the FDA.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates medical wearables, and devices must conform to the Medical Devices Rules, 2017. The country is also increasingly aligning with global standards to facilitate the entry of innovative health technologies.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)