Table of Contents

Introduction

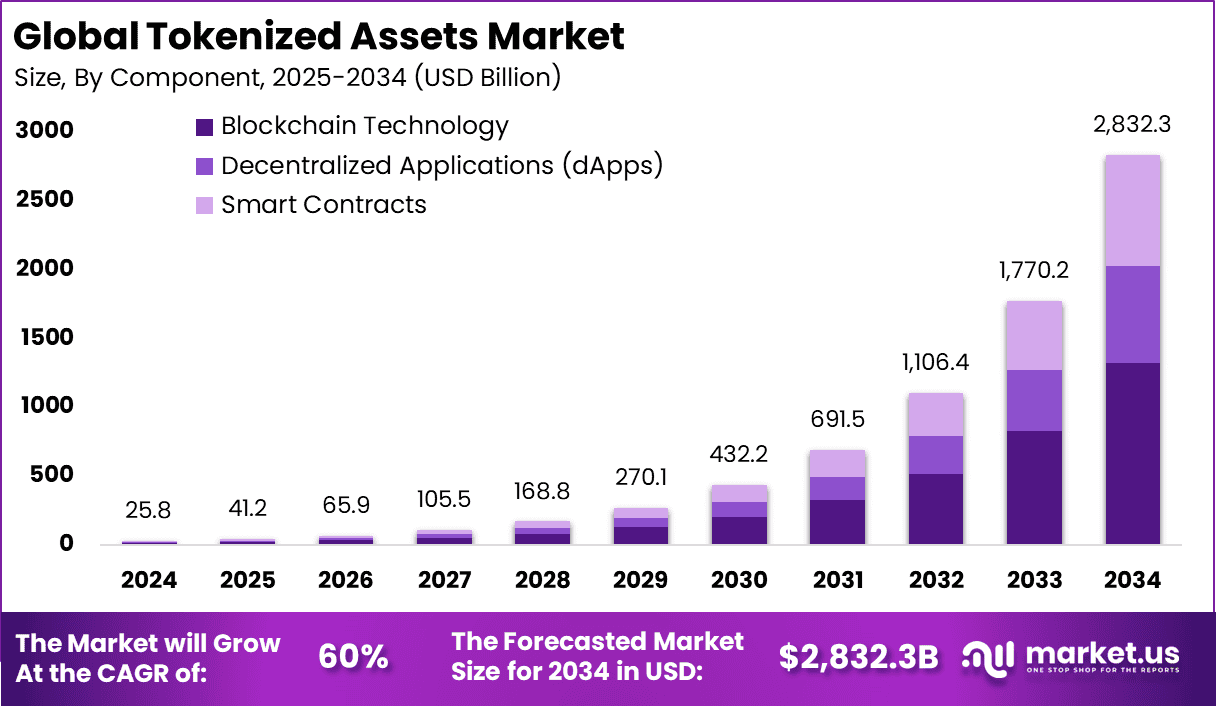

The global tokenized assets market is poised for extraordinary growth, projected to reach USD 2,832.3 billion by 2034, up from USD 25.8 billion in 2024. This market is expected to grow at a CAGR of 60% during the forecast period from 2025 to 2034, driven by increasing interest in blockchain technology and its ability to tokenize a variety of asset classes. North America holds a dominant position in the market, capturing 38.8% of the market share in 2024, with a revenue of USD 10.01 billion. The growing acceptance of tokenized assets in sectors such as real estate, finance, and commodities is playing a pivotal role in this market’s rapid expansion.

How Growth is Impacting the Economy

The rapid growth of the tokenized assets market is having a transformative impact on the global economy by facilitating more efficient and secure transactions across asset classes. Tokenization allows for fractional ownership, enabling broader participation in previously inaccessible markets, such as real estate and fine art. This democratization of investments is boosting market liquidity and driving increased capital flow across various industries.

Additionally, the integration of blockchain technology in tokenized asset transactions is reducing costs associated with intermediaries, promoting greater transparency, and speeding up the process of asset transfers. As tokenization continues to disrupt traditional financial systems, it is likely to foster innovation, open up new investment opportunities, and ultimately contribute to economic growth by enhancing financial inclusion and market accessibility.

➤ Unlock growth! Get your sample now! – https://market.us/report/tokenized-assets-market/free-sample/

Impact on Global Businesses

The explosive growth of the tokenized assets market is creating both opportunities and challenges for global businesses. Rising demand for blockchain-based asset platforms is leading to an increase in operational and development costs, particularly related to the creation and maintenance of secure blockchain infrastructure. These rising costs may impact smaller businesses and startups looking to enter the market.

In terms of supply chain shifts, businesses are increasingly investing in blockchain technology to streamline and secure supply chains, particularly in sectors such as real estate, commodities, and finance. Tokenized real estate, for instance, allows for faster transactions and reduced costs in property trading, while tokenized commodities can improve transparency and traceability in the global supply chain. Sector-specific impacts include the disruption of traditional banking and investment sectors, where tokenization is creating new investment opportunities and potentially diminishing the role of financial intermediaries.

Strategies for Businesses

To capitalize on the growth of the tokenized assets market, businesses should focus on enhancing their blockchain capabilities and ensuring compliance with regulatory standards. Developing user-friendly platforms for tokenized asset trading and providing educational resources on the benefits of tokenization will help attract new users. Companies should also form strategic partnerships with financial institutions and regulatory bodies to ensure seamless integration into existing financial systems.

As tokenized assets are becoming mainstream, businesses should prioritize security and transparency in their offerings, as trust will be crucial for widespread adoption. Exploring new market segments, such as tokenized art, luxury goods, and collectibles, could further expand business opportunities. Additionally, businesses should explore international markets where blockchain adoption is growing rapidly, particularly in Asia-Pacific and Europe.

Key Takeaways

- The tokenized assets market is projected to grow from USD 25.8 billion in 2024 to USD 2,832.3 billion by 2034, with a CAGR of 60%.

- North America leads the market with 38.8% share in 2024, valued at USD 10.01 billion.

- Tokenization is democratizing access to asset classes like real estate, art, and commodities.

- Rising blockchain infrastructure costs and regulatory challenges are influencing market dynamics.

- Businesses must focus on platform security, regulatory compliance, and user education to capitalize on growth opportunities.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=159308

Analyst Viewpoint

The tokenized assets market is currently undergoing a rapid transformation, fueled by strong demand for blockchain-based solutions that offer greater transparency, liquidity, and access to diverse asset classes. The market’s future outlook is exceptionally positive, with tokenization poised to disrupt traditional financial markets and investment structures. As businesses continue to innovate and regulatory frameworks evolve, tokenized assets will become more mainstream, offering significant opportunities for growth. Companies that prioritize scalability, compliance, and security will be well-positioned to thrive in this rapidly expanding market.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Real Estate | Tokenization of property allows for fractional ownership and easier access to the real estate market |

| Financial Services | Tokenized securities are gaining traction as they enable faster and more secure transactions |

| Commodities | Tokenization enhances the traceability, transparency, and liquidity of commodity trading |

| Art and Collectibles | Increasing interest in tokenized fine art and collectibles for fractional ownership and investment |

| Venture Capital | Tokenization is offering new ways for venture capitalists to invest in startups and emerging companies |

Regional Analysis

North America continues to lead the tokenized assets market, holding a 38.8% market share in 2024, with USD 10.01 billion in revenue. The region’s dominance is driven by the strong presence of blockchain technology companies, favorable regulatory environments, and high demand for tokenized asset solutions. Europe is also witnessing steady growth, particularly in the financial services and real estate sectors, as more businesses adopt blockchain-based platforms. The Asia-Pacific region is expected to see rapid growth, with increasing blockchain adoption in countries like China, Japan, and Singapore. Emerging markets in Latin America and the Middle East are also beginning to explore tokenized assets, further expanding the market’s global reach.

Business Opportunities

The tokenized assets market presents numerous business opportunities across a range of sectors, including real estate, finance, commodities, and collectibles. Companies can capitalize on the demand for tokenized real estate by developing platforms that enable fractional ownership of properties. Tokenized financial products, such as stocks and bonds, offer new opportunities for investment firms and banks to create innovative financial products. In the commodities market, tokenization can streamline trading processes, reduce costs, and increase liquidity. Additionally, the growing interest in tokenized art and luxury goods presents an opportunity for businesses to tap into the collectibles market by offering secure and transparent platforms for ownership.

Key Segmentation

The tokenized assets market is segmented into:

- By Asset Type: Real Estate, Financial Assets, Commodities, Art & Collectibles, Others

- By Technology: Blockchain, Smart Contracts

- By Application: Trading, Investment, Asset Management

- By Region: North America, Europe, Asia-Pacific, Rest of the World

Key Player Analysis

Key players in the tokenized assets market are focusing on blockchain innovation, regulatory compliance, and market expansion to capture significant market share. Companies are investing in the development of secure, scalable platforms that enable easy tokenization and trading of assets. Partnerships with financial institutions and real estate developers are crucial for expanding the range of tokenized assets and increasing market adoption. Additionally, companies are exploring new market segments, such as tokenized fine art and luxury goods, to diversify their offerings and attract a wider customer base.

- Compound Labs, Inc.

- MakerDAO

- Aave

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Balancer

- Bancor Network

- Badger DAO

- Others

Recent Developments

- Blockchain technology companies are increasingly collaborating with financial institutions to offer tokenized securities and investment products.

- Tokenized real estate platforms are gaining traction, enabling fractional ownership and simplified property transactions.

- New regulations are being introduced to support the growth of tokenized assets while ensuring security and compliance.

- The rise of NFTs (Non-Fungible Tokens) is contributing to the tokenization of art, collectibles, and luxury goods.

- International expansion is underway as blockchain adoption increases in Asia-Pacific and Latin America.

Conclusion

The tokenized assets market is set for explosive growth, driven by the increasing adoption of blockchain technology across various industries. With significant opportunities in sectors like real estate, finance, and art, the market is expected to disrupt traditional asset management systems. As businesses innovate and regulatory environments mature, tokenized assets will continue to grow, offering exciting opportunities for investors, developers, and financial institutions.