Table of Contents

According to Identity Theft Statistics, Identity theft refers to the fraudulent acquisition and use of someone’s personal information without their consent, typically for financial gain. It is a serious crime that can have devastating consequences for individuals, affecting their financial stability, reputation, and overall well-being.

Editor’s Choice

- About 5.7 million cases of Fraud and Theft were reported to FTC as of July 2023.

- Theft cost victims a staggering $56 billion globally in 2022.

- Approximately 14.4 million credit card numbers were exposed to data breaches in the United States in 2022, leading to potential theft cases.

- Social security number breaches accounted for 88% of all exposed records in data breaches in the United States.

- Synthetic identity theft, where criminals combine real and fabricated information to create new identities, accounted for nearly 80% of all credit card fraud losses.

- According to the survey, 33% of respondents in the United States experienced theft or fraud in the past year.

- Identity theft is not limited to individuals; businesses are also at risk. In 2022, 46% of businesses reported experiencing at least one incident of theft or fraud.

Global Identity Theft Statistics

- In 2022, there were approximately 1.4 million reports of theft in the United States.

- Identity theft accounted for 54% of all reported fraud cases in the United States in 2022.

- According to a global study, theft affected around 33% of respondents in 2022.

- In the United States, the average financial loss per theft victim was $1,290 in 2022.

- Social Security number theft accounted for 36% of all theft cases in the United States in 2022.

- Synthetic identity theft, where fraudsters create new identities using a combination of real and fake information, is estimated to have cost businesses around $800 million in 2022 in the United States.

- Data breaches remain a significant source of stolen personal information. In 2022, there were 1,001 reported data breaches in the United States, exposing over 155 million records.

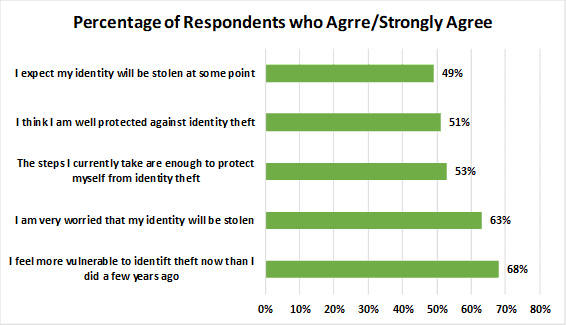

Global Attitudes on Online Identity Theft (January 2023)

Financial Identity Theft

- Financial identity theft accounted for 37% of all theft complaints received by the Federal Trade Commission (FTC) in 2022.

- The total financial losses due to theft reported by consumers in the United States exceeded $1.9 billion in 2022.

- Credit card fraud was the most common type of financial theft, representing 27% of all reported cases in 2022.

- Bank account or credit card fraud was reported by 36% of theft victims in the United States in 2022.

- The average out-of-pocket cost to victims of financial theft in the United States was $393 in 2022.

- In 2022, individuals aged 30 to 39 reported the highest rates of financial theft, accounting for 20% of all victims.

- Synthetic identity theft, a type of financial theft that involves creating a new identity using a combination of real and fake information, has been on the rise. It accounted for 80-85% of all new account fraud in the United States in 2022.

- Financial institutions incurred losses of approximately $1.5 billion due to synthetic identity fraud in 2022.

- Through tax refund fraud remains a significant concern. The IRS reported preventing approximately $2.3 billion in fraudulent tax refunds in 2022.

Child Identity Theft

- Approximately 1 million children in the United States were victims of theft in 2017.

- Children are 51 times more likely to be victims of theft compared to adults.

- The average age of child identity theft victims is 12 years old.

- In cases of child identity theft, 60% of the perpetrators are known to the victim, such as a family member or a close acquaintance.

- The most common type of is the misuse of the child’s Social Security number, accounting for approximately 66% of cases.

- Child identity theft can go undetected for years, with the average duration being 12 years before discovery.

- Child identity theft can have severe financial consequences, with an average cost of $2,303 per victim.

Identity Theft Victims by Age Group

Age Group: 18-29

- Percentage of theft victims: 34%

- Top methods used to steal identities: Data breaches, phishing, and social engineering.

Age Group: 30-39

- Percentage of theft victims: 21%

- The most common type of theft is financial theft.

Age Group: 40-49

- Percentage of theft victims: 18%

- Top vulnerability: Medical identity theft due to high healthcare activity

Age Group: 50-59

- Percentage of theft victims: 16%

- The most common method of theft is phishing attacks targeting personal information

Age Group: 60 and above

- Percentage of theft victims: 11%

- Common types of identity theft: Social Security theft, Medicare fraud

Theft Methods

Data Breaches

- In 2022, there were 1,001 reported data breaches in the United States alone, exposing over 155.8 million records.

- The average cost of a data breach in 2022 was $3.86 million globally.

Phishing and Social Engineering

- Phishing attacks accounted for 32% of all reported data breaches in 2022.

- In 2022, the Anti-Phishing Working Group (APWG) detected over 220,000 unique phishing websites.

Skimming

- Skimming accounted for 75% of all ATM-related fraud incidents in 2022.

- The average loss per cardholder from skimming incidents in the United States was $1,205 in 2022.

Dumpster Diving

- In a study conducted in 2022, 17% of theft cases involved information obtained through dumpster diving.

- The Fair and Accurate Credit Transactions Act (FACTA) requires businesses to take measures to prevent dumpster diving, such as shredding sensitive documents.

Mail Theft

- In 2022, there were 4,994 reported incidents of mail theft in the United States, a 20% increase from the previous year.

- Stolen mail is often used to obtain personal information, such as credit card statements and financial documents.

Online Theft

- Online identity theft incidents increased by 113% in 2022 compared to the previous year.

- Social media platforms were a primary source of personal information used in online theft cases.

Financial Impact of Identity Theft

- Identity theft cost in the United States reached $56 billion in 2022, with over 4.4 million cases reported.

- The average financial loss per theft victim in the United States was $1,107 in 2022.

- Credit card fraud accounted for the highest percentage (35%) of theft cases in the United States in 2022.

- In 2022, victims of theft spent an average of 34 hours resolving the associated problems.

- Globally, the total cost was estimated to be around $1.9 trillion in 2022.

- Identity theft losses in the European Union amounted to €1.8 billion in 2019.

- Business theft resulted in an average loss of $140,000 per incident in 2022.

- Synthetics, where criminals create fictitious identities using a combination of real and fake information, cost businesses around $6 billion in 2022.

- Tax-related theft resulted in fraudulent refunds worth $2.3 billion in the United States in 2022.

- The average out-of-pocket cost for victims of medical theft in the United States was $13,500 per incident in 2022.