Table of Contents

- Introduction

- Editor’s Choice

- Directed Energy Weapons Market Overview

- Directed Energy Weapon Warfare Market Overview

- Types of Directed Energy Weapons Statistics

- History and Evolution of Directed Energy Weapons Statistics

- Air Force Directed Energy Weapons Programs

- Investments in Directed Energy Weapons

- Conclusion

- FAQs

Introduction

Directed Energy Weapons Statistics: Directed Energy Weapons (DEWs) represent modern military advancements, utilizing concentrated energy sources such as lasers, microwaves, and particle beams to precisely engage and incapacitate targets.

They offer precision, rapid response, and cost-effectiveness, finding applications in missile defense, countering drones, and achieving precise targeting.

Nevertheless, technical difficulties and ethical concerns present hurdles to fully harnessing their potential. Nonetheless, ongoing research seeks to improve DEW technology, strengthening its importance in current defense strategies.

Editor’s Choice

- In 2023, the Directed Energy Weapons market revenue stood at USD 5.3 billion.

- The Directed Energy Weapons Warfare market is projected to experience gradual growth, with estimated revenues of 2.64 billion in 2027.

- Millimeter wave weapons operate within the wavelength range of 1 to 10 millimeters and can generate power exceeding 1 kilowatt.

- High-power microwave weapons are capable of generating over 100 megawatts of power, which is approximately 150,000 times the power output of a typical household microwave oven.

- In October 2020, Raytheon Missiles and Defense received a contract from AFRL to conduct tests on the Counter-Electronic High-Power Microwave Extended-Range Air Base Defense (CHIMERA) system.

- A recent report by the U.S. Government Accountability Office reveals that the U.S. Department of Defense is investing approximately $1 billion annually in the development of “directed energy” weapons, which encompass high-energy lasers capable of targeting and disabling drones in flight.

- In September 2021, the UK Ministry of Defence granted approximately £72.5 million to UK industry consortia led by Raytheon UK and Thales to produce DEWs.

Directed Energy Weapons Market Overview

Global Directed Energy Weapons Market Size Statistics

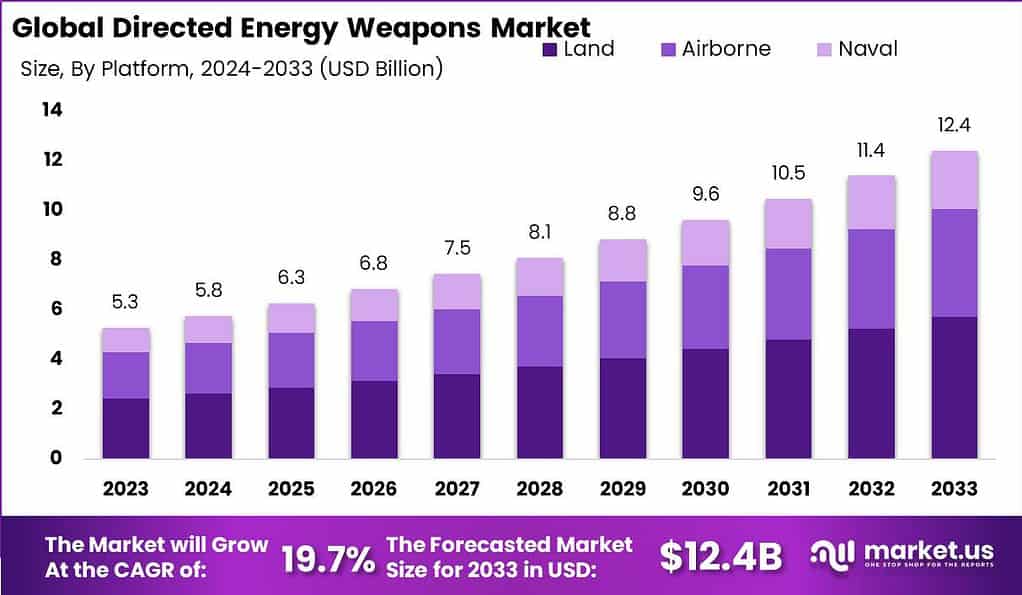

- The revenue generated by the Directed Energy Weapons (DEW) market is projected to witness steady growth over the next decade at a CAGR of 19.7%.

- In 2023, the market’s revenue stood at USD 5.3 billion, and it is expected to increase to USD 5.8 billion in 2024.

- This growth trend is anticipated to continue with the market reaching USD 6.3 billion in 2025, USD 6.8 billion in 2026, and USD 7.5 billion in 2027.

- As we move further into the future, the DEW market is poised for even more substantial expansion, with projected revenues of USD 8.1 billion in 2028, USD 8.8 billion in 2029, and USD 9.6 billion in 2030.

- The growth trajectory remains optimistic, with the market forecasted to surpass USD 10 billion in 2031, reaching USD 10.5 billion, and eventually crossing the USD 11 billion mark in 2032, standing at USD 11.4 billion.

- By 2033, the Directed Energy Weapons market is expected to attain a revenue of USD 12.4 billion.

- This upward trend is indicative of the increasing prominence and demand for directed energy weapons in various sectors, including defense and security, marking a promising outlook for the industry.

(Source: Market.us)

Directed Energy Weapon Warfare Market Overview

- The Directed Energy Weapon Warfare market has displayed a relatively stable revenue pattern over the years, with minor fluctuations.

- In 2018, the market’s revenue was recorded at USD 2.01 billion, showing a slight increase to USD 2.1 billion in 2019.

- However, in 2020, the revenue reverted to USD 2.01 billion, indicating a brief period of stagnation. Subsequently, in 2022, there was a modest rise, with the market reaching USD 2.16 billion.

- Looking ahead, the market is projected to experience gradual growth, with estimated revenues of USD 2.34 billion in 2024 and USD 2.64 billion in 2027.

- This consistent but measured expansion in the Directed Energy Weapon Warfare market reflects a persistent demand for such technologies in the defense sector, as they continue to evolve and play a crucial role in modern warfare strategies and systems.

(Source: Statista)

Types of Directed Energy Weapons Statistics

Millimeter Wave Weapons

- Millimeter wave weapons operate within the wavelength range of 1 to 10 millimeters and can generate power exceeding 1 kilowatt.

- One distinct advantage of millimeter wave weapons is their broader beam coverage compared to high-energy lasers, allowing them to impact multiple targets simultaneously.

(Source: Government Accountability Office)

High Power Microwave Weapons

- High-power microwave weapons emit microwaves with longer wavelengths compared to high-energy lasers and millimeter wave weapons.

- These weapons are capable of generating over 100 megawatts of power, which is approximately 150,000 times the power output of a typical household microwave oven.

- Similar to millimeter wave weapons, their broader beam size enables them to influence multiple targets simultaneously.

(Source: Government Accountability Office)

History and Evolution of Directed Energy Weapons Statistics

- During the mid-20th century, amid the Cold War tensions, Directed Energy Weapons (DEWs) transitioned from experimental concepts to becoming a focal point of organized government research.

- The intense arms race between the United States and the Soviet Union drove significant investments in defense technology, setting the stage for the actual development of DEWs.

- In 1983, President Ronald Reagan introduced the Strategic Defense Initiative, famously known as “Star Wars,” which played a pivotal role in the history of DEWs.

- Despite facing various challenges and political controversies, this initiative propelled DEWs to the forefront of defense research and development efforts.

- In 2002, initial funding for the development of an electromagnetic heating weapon was granted by the United States Department of Defense’s Joint Non-Lethal Weapons Directorate and the U.S. Air Force Research Laboratory.

- Subsequently, in 2004, private firms like Raytheon received financial support to advance their research efforts.

- The first model, known as Active Denial System I, underwent testing and saw deployment in Afghanistan in 2010. However, it was later withdrawn a few months after deployment and has not been used in military operations against enemy combatants since then.

- Starting in 2011, upgraded versions, including ADS II, and a more compact device named Silent Guardian, have been demonstrated in front of military personnel and volunteers.

- Silent Guardian, in particular, is specifically marketed to providers of security services and civilian law enforcement agencies.

(Source: Digital Daze, ACLU)

Air Force Directed Energy Weapons Programs

Tactical High-Power Operational Responder (THOR)

- The AFRL, in collaboration with industry partners, has developed the Tactical High-Power Microwave Operational Responder (THOR) technology demonstrator to create an effective Directed Energy Counter-Unmanned Aircraft System (DE C-UAS) primarily designed for short-range defense of air bases.

- THOR is accommodated within a standardized 20-foot transport container, making it compatible with C-130 transport aircraft for easy deployment.

- It’s reported that users can set up the system within three hours and operate its user interface with minimal training.

- According to the Air Force, THOR has completed a two-year testing phase and will serve as a foundation for subsequent prototype initiatives like Mjölnir.

(Source: Congressional Research Service)

Phaser High-Powered Microwave

- Raytheon‘s Phaser High-Powered Microwave system is designed to offer a short-range Counter-Unmanned Aircraft System (C-UAS) capability akin to THOR.

- The Air Force is said to have acquired a prototype Phaser system for $16.3 million to conduct tests and field assessments in international locations.

- Nevertheless, it remains uncertain whether the system has been put into operation beyond U.S. borders.

(Source: Congressional Research Service)

Counter-Electronic High-Power Microwave Extended-Range Air Base Defense (CHIMERA)

- In October 2020, Raytheon Missiles and Defense received a contract from AFRL to conduct tests on the Counter-Electronic High-Power Microwave Extended-Range Air Base Defense (CHIMERA) system.

- Unlike THOR and Phaser, which are tailored for short-range Counter-Unmanned Aircraft System (C-UAS) operations, the CHIMERA system is specifically designed to engage unmanned aerial systems (UAS) at more significant distances.

(Source: Congressional Research Service)

High-Energy Laser Weapon System (HELWS)

- The High-Energy Laser Weapon System (HELWS) serves as a mobile solution for Counter-Unmanned Aircraft Systems (C-UAS) in air base defense.

- This system includes a laser weapon and a multispectral targeting system mounted on an all-terrain vehicle (Polaris MRZR), with an effective range of up to 3 kilometers.

- Developed by Raytheon, the laser can fire numerous shots on a single charge from a standard 220-volt outlet and has an unlimited firing capacity when connected to an external power source like a generator.

- The Air Force acquired the initial HELWS in October 2019 and deployed it overseas for field assessments in April 2020.

- In April 2021, Raytheon was awarded a $15.5 million contract to deliver an upgraded HELWS version, which will be provided unmounted on pallets for potential use with different platforms.

(Source: Congressional Research Service)

Investments in Directed Energy Weapons

- A recent report by the U.S. Government Accountability Office reveals that the U.S. Department of Defense is investing approximately $1 billion annually in the development of “directed energy” weapons, which encompass high-energy lasers capable of targeting and disabling drones in flight.

- Japan is dedicating $2 billion from its defense budget for hypersonic technology research and development. ALTA has partnered with Mitsubishi Heavy Industries for research in HCM and HVGP, with HVGP anticipated to be operational by 2026.

- In July 2020, Australia released two defense documents guiding its 2016 Defence White Paper and Integrated Investment Program. These documents allocate AU$9.3 billion for hypersonic weapons and the advancement of technologies like directed-energy systems.

- The 2020 Defence Strategic Update and Force Structure Plan will manage funding for disruptive weapons tech, building on a previous commitment of AU$ 730 million for research in areas such as hypersonic weapons, advanced sensors, and directed-energy capabilities.

- India’s DRDO has invested $4.5 million in developing the HTDV prototype. Over the next five years, they plan to conduct three additional tests to transform it into a fully functional hypersonic weapon capable of carrying both conventional and nuclear warheads.

- In September 2021, the UK Ministry of Defence granted approximately £72.5 million to UK industry consortia led by Raytheon UK and Thales to produce DEWs.

(Source: Government Accountability Office, Defence News, The Engineer)

Conclusion

Directed Energy Weapons Statistics – In summary, Directed Energy Weapons (DEWs) are cutting-edge military technologies that offer precision, rapid response, and cost-effectiveness. They find applications in various areas, from missile defense to countering drones, and are continually evolving with increased power and integration capabilities.

While DEWs hold great promise for modern defense, they also raise ethical and legal considerations. Nonetheless, they remain a focal point of research and development, shaping the future of military and security operations.

FAQs

DEWs are advanced military systems that use focused energy, such as lasers, microwaves, or particle beams, to precisely engage and incapacitate targets.

DEWs offer advantages like precision, rapid response, infinite ammunition (no need for physical projectiles), reduced collateral damage, and cost-effectiveness.

DEWs include High-Energy Lasers (HEL), Microwave Weapons, and Particle Beam Weapons, each with specific applications.

DEWs find applications in missile defense, counter-drone operations, precision targeting, and non-lethal options like crowd control.

DEWs encounter technical challenges, such as power generation and propagation, and ethical considerations regarding their use.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)