Table of Contents

Introduction

Pressure Sensors Statistics: Pressure sensors play a vital role in measuring mechanical pressure and converting it into an electric signal. They operate based on principles like piezoresistive, capacitive, or piezoelectric, guaranteeing accurate pressure assessment.

These sensors find application in several industries, such as automotive, healthcare, industrial processes, consumer electronics, and aerospace. They are appreciated for their accuracy, compact dimensions, durability, and ability to offer digital information.

The pressure sensor market is growing due to increased automation and integration with IoT, solidifying its significance as an essential tool for supervising and controlling processes in various sectors.

Editor’s Choice

- The revenue of the global pressure sensors market is on a consistent upward trajectory at a CAGR of 8.4%.

- In 2023, the global pressure sensors market generated a revenue of USD 16 billion.

- APAC emerges as the dominant force in the global market, capturing the largest share at 38.0%.

- Dynament Ltd. and Membrapor AG. both hold a substantial 15% market share, showcasing their prominent positions in the pressure sensor market.

- An absolute sensor with a 10mV/V output yields a 0 – 50 mV output with a 5.0 VDC supply. These sensors are usually minimal, with pads or legs suitable for circuit board soldering.

- Optical pressure sensors have a measurement range spanning from 0 to 100 bar, boasting a remarkable resolution of 0.1% of the full scale.

- Capacitive sensors are capable of measuring pressures from vacuum levels (2.5 mbar or 250 Pa) to high pressures up to approximately 10,000 psi (70 MPa), making them suitable for both lower-pressure applications and moderately challenging environments.

Global Pressure Sensors Market Overview

Global Pressure Sensors Market Size Statistics

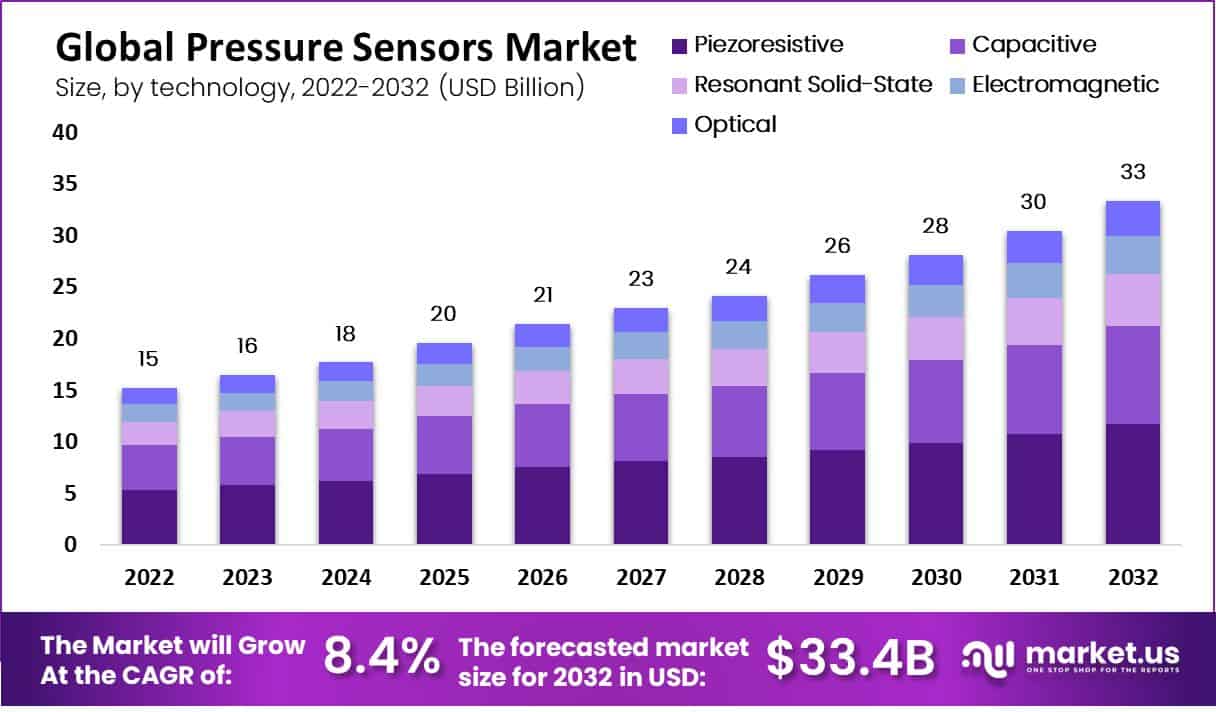

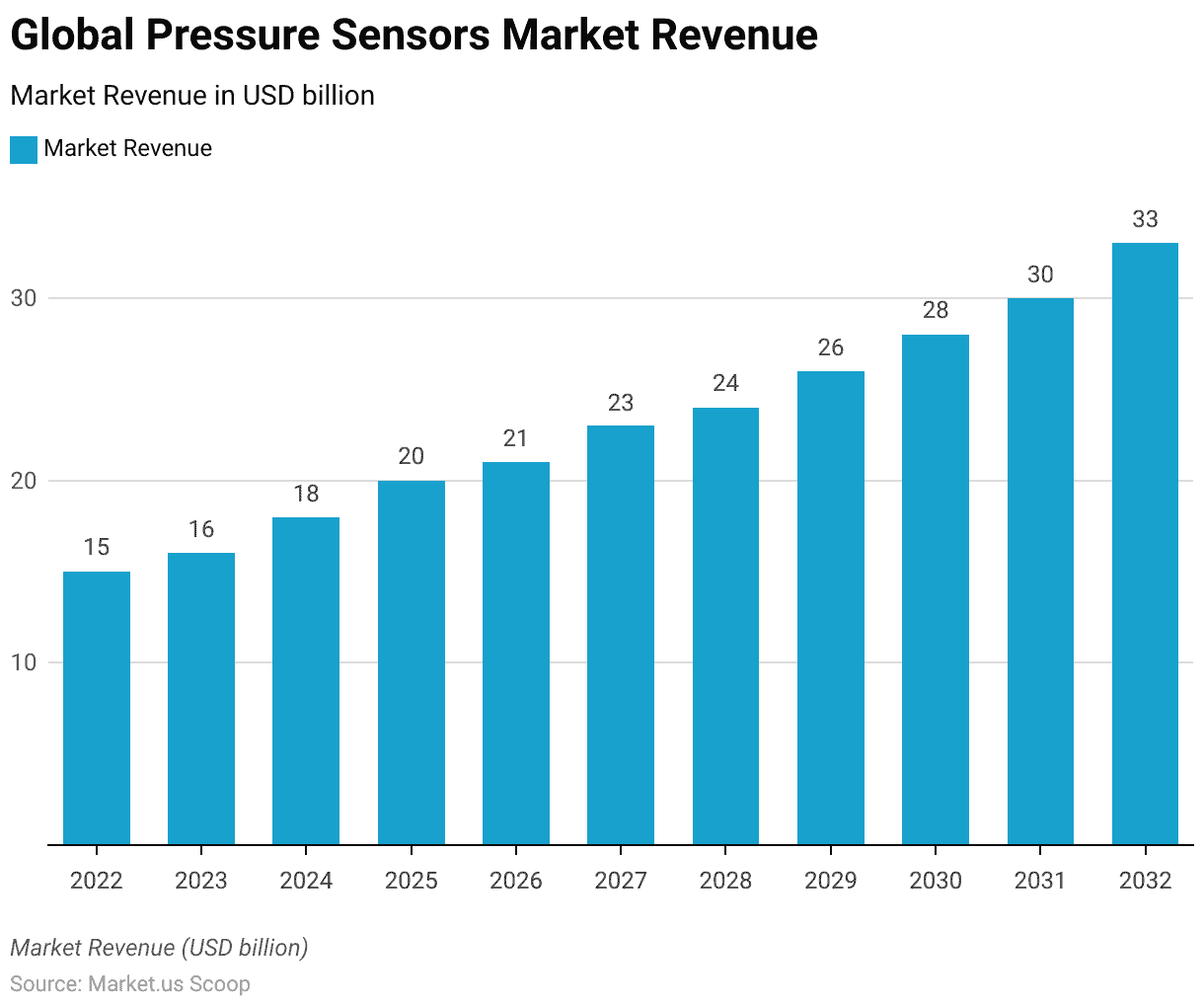

- The revenue of the global pressure sensors market is on a consistent upward trajectory at a CAGR of 8.4%, as indicated by the data from 2022 to 2032.

- In 2022, the market generated a revenue of USD 15 billion, which steadily increased to USD 16 billion in 2023, reflecting a promising start.

- The growth trend continued, with revenues reaching USD 18 billion in 2024 and USD 20 billion in 2025.

- As we look ahead, the market is projected to maintain its upward momentum, with anticipated revenues of USD 21 billion in 2026, USD 23 billion in 2027, and USD 24 billion in 2028.

- The growth is expected to accelerate further, with revenues reaching USD 26 billion in 2029, USD 28 billion in 2030, and a substantial USD 30 billion in 2031.

- By 2032, the global pressure sensors market is forecasted to achieve a revenue milestone of USD 33 billion, indicating robust growth and significant opportunities within the industry.

- This consistent upward trajectory suggests a promising outlook for businesses and investors in the pressure sensors market over the next decade.

(Source: Market.us)

Regional Analysis of Pressure Sensors Market Statistics

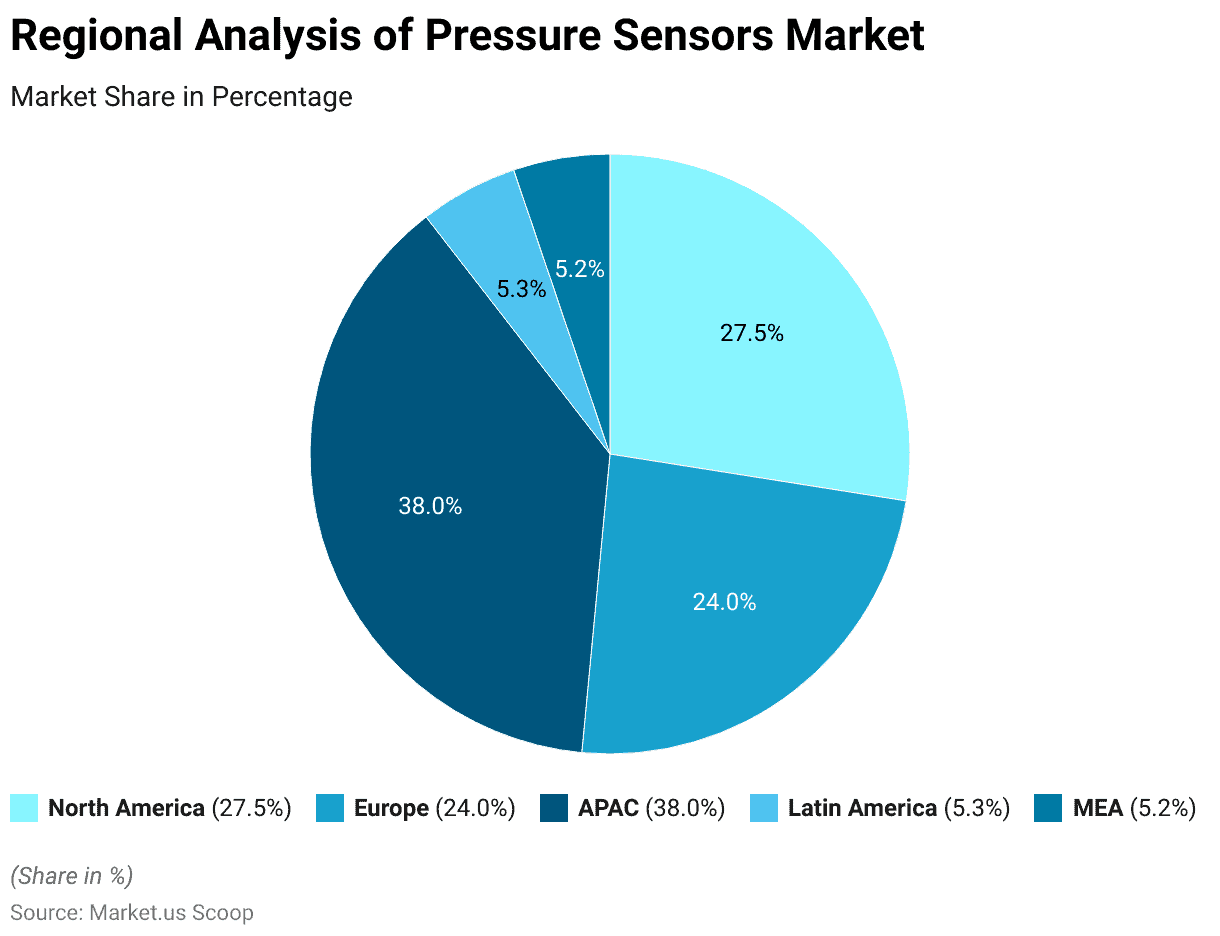

- The distribution of market share across different regions showcases a diverse landscape in the global market.

- North America commands a substantial market share, accounting for 27.5%.

- This region’s strong presence can be attributed to its technologically advanced industries, robust manufacturing sector, and high consumer demand for products and services that utilize pressure sensors.

- Europe follows closely behind with a market share of 24.0%.

- The European market is characterized by a diverse industrial landscape, encompassing automotive, healthcare, and industrial sectors, all of which rely heavily on pressure sensor applications.

- APAC emerges as the dominant force in the global market, capturing the largest share at 38.0%.

- This region’s remarkable market share is driven by its extensive manufacturing capabilities, particularly in countries like China, Japan, and South Korea.

- Latin America contributes a relatively smaller market share of 5.3%.

- While this percentage may appear modest in comparison to other regions, it still represents a significant market presence.

- MEA accounts for a similar market share of 5.2%. This region exhibits a developing market for pressure sensors, driven by sectors like oil and gas, construction, and healthcare.

(Source: Market.us)

Key Players in the Pressure Sensors Market Statistics

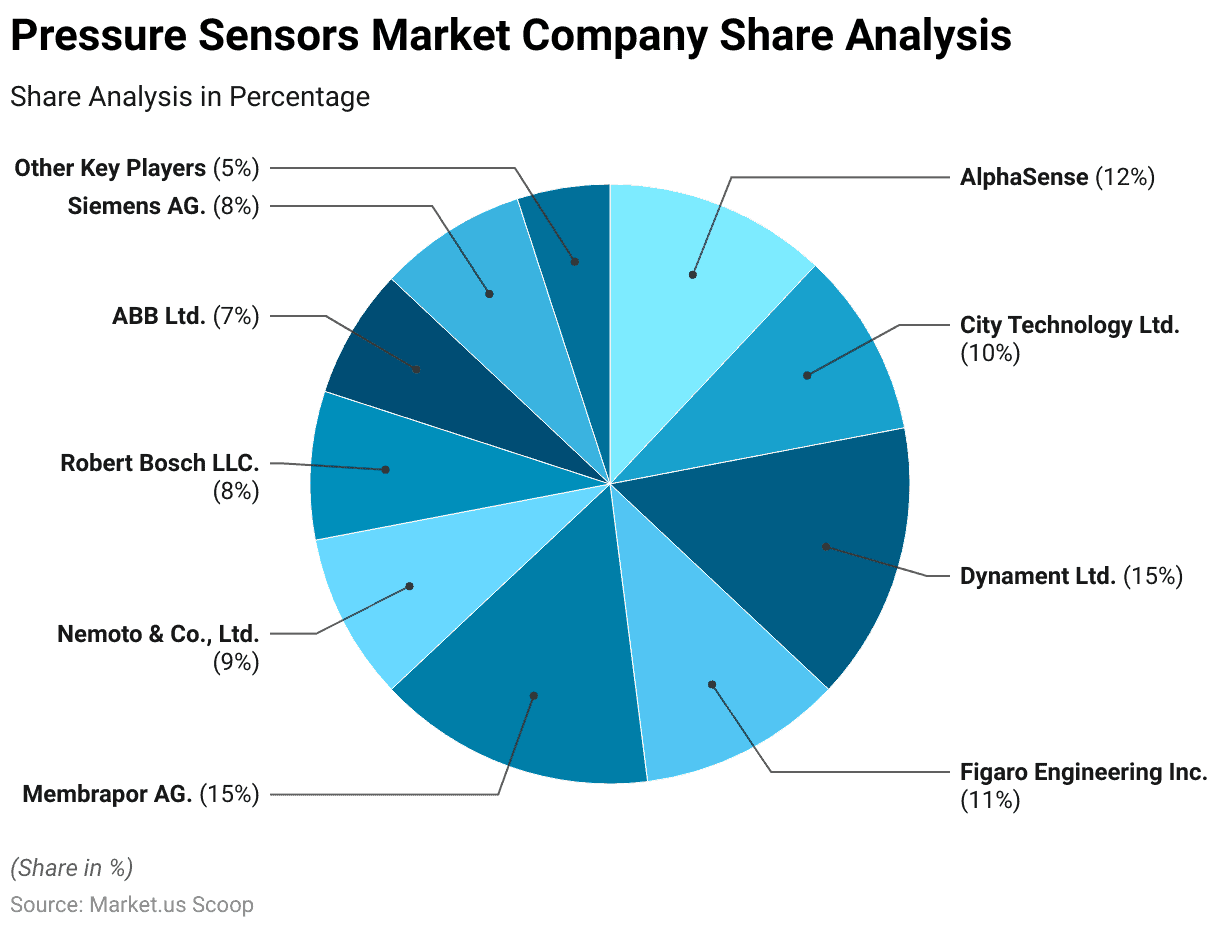

- In the competitive landscape of the pressure sensor market, several key players hold varying degrees of market share.

- Dynament Ltd. and Membrapor AG. both hold a substantial 15% market share, showcasing their prominent positions in the pressure sensor market. These companies are recognized for their advanced sensor technologies and innovative solutions.

- AlphaSense secures a noteworthy 12% market share, signifying its significant role in the industry. The company’s focus on cutting-edge sensor technology and its commitment to providing reliable solutions have solidified its reputation.

- City Technology Ltd. holds a respectable 10% market share. The company specializes in gas sensors, including those used in pressure-sensing applications.

- Figaro Engineering Inc. contributes 11% of the market share. The company is known for its expertise in gas and chemical sensors, including pressure sensors.

- Both Robert Bosch LLC. and Siemens AG. hold 8% of the market share each. These globally recognized conglomerates have diversified business portfolios that include pressure sensor technology.

- Nemoto & Co., Ltd. and ABB Ltd. maintain notable positions with 9% and 7% market shares, respectively. Nemoto is renowned for its gas sensors, including those used in pressure-sensitive applications.

- The remaining 5% of the market share is distributed among other significant players in the industry. While individually smaller in market share, collectively, these companies contribute to the overall diversity and competitiveness of the pressure sensor market.

(Source: Market.us)

Types of Pressure Sensors Statistics

Absolute Pressure Sensors

- For measuring air pressure, especially in applications like weather barometric readings and altimeters, absolute pressure sensors are the go-to choice.

- They establish absolute measurements by comparing the target pressure to the known pressure of an absolute vacuum, similar to measuring temperature in Kelvin, starting from 0 °K.

- An absolute sensor with a 10mV/V output yields a 0 – 50 mV output with a 5.0 VDC supply. These sensors are usually minimal, with pads or legs suitable for circuit board soldering.

- In contrast, a ‘transducer‘ is a comprehensive sensor with built-in signal conditioning for direct use in industrial settings.

- Typically, it provides a voltage output representing pressure, often within the 0 – 10V range, or generates an alternating signal in the 1 – 6 kHz range in some cases.

- In older transducers, lacking a “live zero” at the lowest measuring point can make distinguishing between a minimum pressure reading and a sensor or cable issue challenging, a significant concern in highly secure systems.

- A ‘pressure transmitter,’ meanwhile, uses a 4 – 20 mA output signal instead of voltage.

- These devices often need just a two-wire interface (supply and ground) and offer robust electrical noise immunity (EMI/RFI), typically operating within the 8 – 24 VDC supply voltage range.

(Source: Avnet Abacus)

Piezoelectric Pressure Sensors

- Piezoelectricity is generating electric charge in specific materials when subjected to mechanical stress.

- Piezoelectric pressure sensors utilize this phenomenon by measuring the voltage produced across a piezoelectric element due to applied pressure. These sensors are highly durable and find extensive use in various industrial applications.

- The piezoelectric effect relies on materials possessing specific crystal structure asymmetry. This includes natural crystals like quartz or tourmaline.

- Moreover, engineered ceramics can be crafted with the necessary polarization to render them piezoelectric. These ceramics offer greater sensitivity than natural crystals. Even a minimal 0.1% deformation can generate a valuable output.

- The output maintains linearity across a broad range, usually spanning from 0.7 KPa to 70 MPa (0.1 to 10,000 psi) with approximately 1% accuracy.

- Piezoelectric sensors, aside from their electronic components, are suitable for high-temperature applications, with certain materials functioning at temperatures as high as 1,000ºC. While sensitivity may vary with temperature, this can be mitigated by selecting appropriate materials.

(Source: Avnet Abacus)

MEMS Pressure Sensors

- Microelectromechanical systems (MEMS) devices merge tiny mechanical and electronic parts onto a silicon chip.

- The same manufacturing methods used for creating transistors and other components in integrated circuits (ICs) can also be applied to build mechanical elements like springs, flexible membranes, vibrating structures, valves, gears, and levers.

- This technology enables the production of various sensors, including various types of pressure sensors.

- It allows for the integration of precise sensors, robust processing, and wireless communication (e.g., Wi-Fi or Bluetooth) within a single IC.

- Furthermore, large quantities of these devices can be manufactured simultaneously, enjoying the same scaling benefits and cost efficiencies as traditional ICs.

- MEMS sensors excel due to their tiny size, facilitating quick response to minor pressure variations and opening doors to novel applications like implantable medical devices.

(Source: Avnet Abacus)

Optical Pressure Sensors

- The optical pressure sensors offer precise pressure measurements with temperature compensation.

- They have a measurement range spanning from 0 to 100 bar, boasting a remarkable resolution of 0.1% of the full scale.

- These sensors exhibit exceptional accuracy, with deviations of less than 1% of the full scale.

- Furthermore, they can accommodate up to 96 measurement points when used with a 16-channel si255, allowing for the connection of six sensors per channel. The pressure inlet port features a G 1/8th thread for secure and reliable pressure input.

(Source: Lunainc)

Capacitive Optical Sensors

- Capacitive sensors have a broad temperature operating range and can tolerate short-term overpressure conditions effectively.

- They are versatile, and capable of measuring pressures from vacuum levels (2.5 mbar or 250 Pa) to high pressures up to approximately 10,000 psi (70 MPa), making them suitable for both lower-pressure applications and moderately challenging environments.

- These sensors are inherently low-power as they don’t require DC flow through the capacitor.

- Passive variants may not need a power source; the excitation signal can come from an external reader. This feature makes them suitable for wearable or implanted medical devices, and advancements in technology allow the construction of flexible or molded sensors for various applications.

- Capacitive sensors offer advantages such as low hysteresis, reliable measurement repeatability, and minimal temperature sensitivity.

- They exhibit rapid response times, typically in milliseconds, and even faster in the case of MEMS devices.

(Source: Avnet Abacus)

Pressure Sensors Reliability and Repeatability Statistics

- For most applications, it’s crucial to have a differential pressure sensor that meets high standards of accuracy, repeatability, reliability, and stability.

- The objective is to ensure that HVAC systems operate at peak efficiency with minimal downtime.

- Therefore, pressure measurement instruments are required to incorporate dependable sensor technology capable of detecting even the slightest pressure differences while maintaining accuracy and reliability over time.

- While you may aim to save energy by precisely controlling temperature, the accuracy of the differential sensor plays a pivotal role.

- If the sensor’s accuracy shifts from +/- 0.25% to +/- 1.0% or more at any point, it can disrupt the precise control of the process and lead to increased energy costs.

- Having a repeatable pressure sensor with minimal long-term drift can also reduce the need for frequent calibration and verification, allowing systems to operate efficiently for longer periods.

- This aspect of technology and performance can provide customers with significant long-term savings.

(Source: Ashcroft)

Latest Trends in Pressure Sensor Technology

- In October 2019, Melexis introduced a specialized pressure sensor integrated circuit (IC) tailored for use in the engine’s EVAP (Evaporative Emission Control) system.

- This relative pressure sensing IC, designed for shallow pressure measurements in automotive contexts, highlights the company’s commitment to advancing hybrid vehicle technology.

- Serving as the central component of the EVAP system, the MLX90821 is capable of detecting even the tiniest vapor leaks.

- In January 2020, the Indian tire manufacturer JK Tire launched a tire pressure monitoring system (TPMS) using TREEL mobile solutions they had acquired earlier. These TREEL sensors are designed to track important tire data, such as pressure and temperature.

(Source: Melexis, JK Tire)

Recent Developments

Acquisitions and Mergers:

- TE Connectivity acquires First Sensor AG: In 2023, TE Connectivity, a global leader in connectivity and sensors, completed the acquisition of First Sensor AG. A German manufacturer of pressure sensors, for $320 million. This acquisition is expected to expand TE’s presence in the pressure sensor market, particularly in the medical and industrial sectors.

- Amphenol acquires MTS Systems: In 2023, Amphenol Corporation acquired MTS Systems. A leading provider of testing and sensing solutions, for $1.7 billion. This merger strengthens Amphenol’s portfolio in the pressure sensor segment, especially for automotive and industrial applications.

New Product Launches:

- Bosch launches BMP390 pressure sensor for drones: In mid-2023, Bosch Sensortec launched the BMP390, an ultra-small and precise pressure sensor designed for drones and wearable devices. The BMP390 offers altitude tracking with a precision of ±0.5 meters, making it ideal for applications like drone navigation and fitness tracking.

- Honeywell introduces PX3 series pressure transducers: In early 2024, Honeywell launched its PX3 series of heavy-duty pressure transducers. These sensors are designed for industrial applications, providing accurate pressure readings in harsh environments. With improved durability and accuracy, reducing sensor failure rates by 25%.

Funding:

- Sensirion secures $50 million for pressure sensor development: In 2023, Sensirion, a Swiss sensor manufacturer, raised $50 million to expand its pressure sensor product line. This funding will be used to develop next-generation sensors for automotive and medical applications. Including advanced miniature sensors for respiratory devices.

- Pressure Profile Systems raises $30 million for smart sensor technology: In late 2023, Pressure Profile Systems, a company specializing in tactile pressure sensing. Raised $30 million to develop new smart sensor technologies for robotics, healthcare, and consumer electronics.

Technological Advancements:

- AI-integrated pressure sensors: By 2025, 35% of pressure sensors are expected to include AI capabilities for predictive maintenance and real-time data analysis in automotive, industrial, and healthcare applications. AI integration is set to improve sensor performance and reduce downtime.

- Miniaturization of pressure sensors: The trend toward miniaturization is continuing, with pressure sensors becoming smaller and more energy-efficient. By 2026, 40% of new pressure sensors will be miniature, targeting wearables, drones, and medical devices. While maintaining high precision and reliability.

Conclusion

Pressure Sensors Statistics – In summary, pressure sensors are vital components used across industries for precise measurements, relying on principles like piezoresistive, capacitive, or piezoelectric effects. They offer versatility, and wide measurement ranges, and excel in accuracy and low power consumption.

These sensors find applications in automotive, healthcare, industrial processes, and consumer electronics, contributing to efficient monitoring and control.

Choosing the right sensor technology is crucial for maintaining accuracy and reliability, particularly in critical systems like HVAC or hybrid vehicle EVAP systems.

Stable, repeatable measurements can lead to energy savings and reduced downtime, ensuring long-term efficiency and cost-effectiveness. As technology advances, pressure sensors will continue to play a pivotal role in optimizing processes.

FAQs

A pressure sensor is a device that measures mechanical pressure and converts it into an electrical signal for various applications.

Common types include piezoresistive, capacitive, and piezoelectric pressure sensors.

Pressure sensors work by utilizing changes in electrical properties, such as resistance or capacitance, in response to applied mechanical pressure.

Pressure sensors are used in automotive, healthcare, industrial processes, consumer electronics, aerospace, and more.

Depending on the type and application, pressure sensors can measure a wide range, from vacuum levels to high pressures.