Introduction

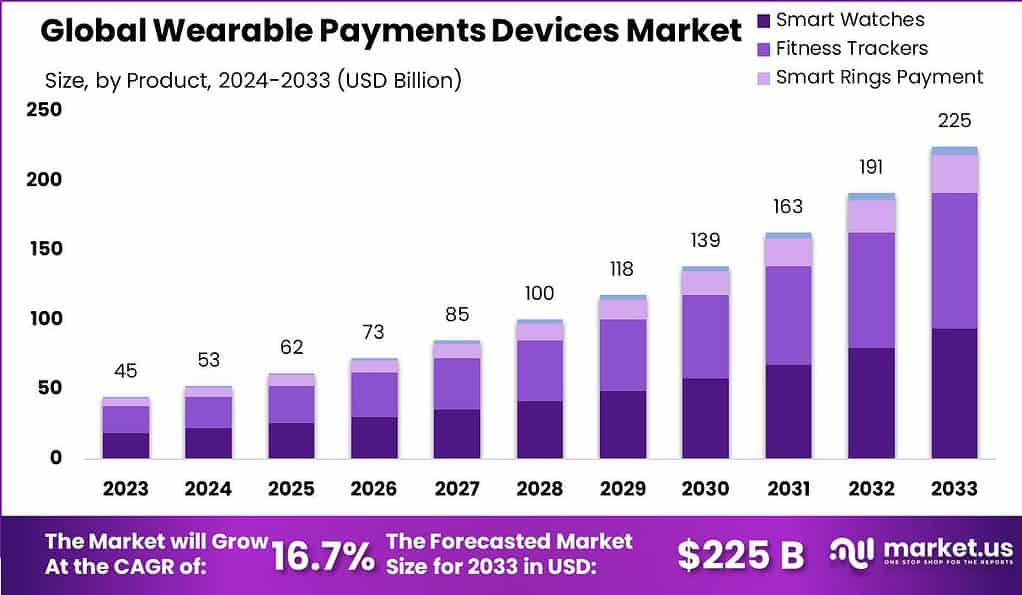

The wearable payment devices market has emerged as a dynamic and rapidly expanding sector within the financial technology landscape. Characterized by its innovation and integration of technology into everyday wearable items, this market facilitates seamless, secure, and convenient transactions for users globally. Recent data indicates that the market size for wearable payment devices was estimated at USD 45 billion in 2023, with projections suggesting growth to USD 225 billion by 2033, reflecting a compound annual growth rate (CAGR) of 16.7% during the forecast period. This remarkable growth trajectory can be attributed to a surge in demand for contactless payment solutions, driven by heightened consumer awareness around hygiene and the efficiency of cashless transactions post-pandemic.

Further fueling the market’s expansion are advancements in wearable technology, encompassing everything from smartwatches and fitness bands to payment-enabled fashion accessories. These devices not only offer the convenience of cashless payments but also integrate a wide array of functions, including fitness tracking, notifications, and more, thus enhancing their appeal to tech-savvy consumers. The market’s growth is further supported by the increasing adoption of Near Field Communication (NFC) technology and the proliferation of Internet of Things (IoT) devices, which together are creating a more connected and interactive consumer payment experience.

Key Takeaways

- The wearable payment devices market is projected to grow at a CAGR of 16.7% from 2024 to 2033.

- The market size for wearable payment devices is estimated to reach USD 225 billion by 2033.

- In 2023, the number of wearable payment users increased by 40.6% compared to 2022, reaching 173.3 million.

- By 2025, the number of wearable payment users is forecasted to reach 278.3 million.

- In 2023, 79% of smartwatch owners utilized their devices for contactless payments, up from 53% in 2021.

- Apple Pay on the Apple Watch accounted for over 5% of global contactless transactions on Visa’s network in 2023, up from 1% in 2019.

- Approximately 17 million individuals in the UK are ready to pay with wearable devices, with 26% of them expecting to initiate payments through this method.

- The number of wearable devices in use is predicted to grow by 1,500% by 2024.

- In 2023, the fitness trackers segment captured more than a 43.6% share of the wearable payment devices market.

- The quick response (QR) & barcodes segment held a dominant market position in 2023, capturing over a 36.2% share.

- In 2023, the retail & grocery stores segment held a dominant market position, capturing more than a 31.4% share.

- Europe held a dominant market position in 2023, capturing over a 30.7% share of the wearable payment devices market.

- Europe’s dominance is attributed to its strong financial infrastructure, high consumer adoption of digital payment methods, and supportive regulatory environment.

- The fitness trackers segment is popular due to the widespread adoption of fitness trackers by consumers seeking health monitoring and convenient payment solutions.

- QR codes & barcodes are popular due to their universal applicability and ease of use in payment transactions.

- Retail & grocery stores lead in adoption due to the high frequency of transactions in these settings.

Wearable Payments Devices Trends

- Rapid Market Growth: The global wearable payments market is expected to experience a substantial CAGR of 16.7%, reaching USD 139 billion by 2030. This growth is primarily fueled by the digital revolution in Asia-Pacific’s emerging economies, such as China, India, Singapore, and South Korea. The transition towards cashless payments, driven by the convenience of wearable technologies, is a key factor behind this expansion.

Technological Advancements:

- Wearable payment devices are evolving, with Near Field Communication (NFC), Radio Frequency Identification (RFID), and Host Card Emulation (HCE) technologies leading the way. Major companies like Apple, Samsung, and Huawei are at the forefront, introducing innovative solutions that enhance the user experience by facilitating easier and more secure transactions.

- Wearables are not just limited to fitness trackers and smartwatches anymore. The introduction of payment rings, for instance, offers a novel way to conduct transactions. These devices, exemplified by Quontic Bank’s payment ring, offer both convenience and a unique value proposition by eliminating the need to carry traditional wallets or even use digital wallets stored on smartphones. Such innovations are part of banks’ broader strategies to stand out in a crowded digital banking landscape.

- Security and Biometrics Integration: Security concerns are being addressed through the integration of biometric technologies, which are being used to enhance the security of transactions made through wearable devices. Biometric payment systems, which can include fingerprint, facial patterns, and voice recognition, are becoming increasingly popular for providing secure and seamless end-user experiences.

- Diverse Applications: The wearable payment device market is not just limited to fitness trackers or smartwatches; it now includes innovative formats like payment rings. These devices offer a unique blend of convenience and security, tied to a single account or bank, presenting a novel way to conduct transactions without the need for physical wallets or cards.

- Market Challenges: Despite the promising growth, the sector faces challenges such as the limited battery life of devices, high costs, and security concerns. These issues may impede market growth to some extent, highlighting the need for continuous innovation and consumer education.

- Future Directions: Looking ahead, the wearable payments market is set to further diversify, with an increasing focus on enhancing customer experiences in sectors like transit and retail. The strategic adoption of wearable tech promises more efficient and seamless interactions, suggesting a bright future for this dynamic market.

- Consumer Adoption: There’s a growing consumer interest in wearable payment devices, with a study indicating that 17% of consumers have increased their use of apps on smartwatches or other wearable devices for purchases, seeking more contactless ways to conduct transactions. This trend is expected to continue, with contactless payments projected to grow globally to 49 billion transactions by 2023.

- Application in Retail and Events: The retail sector has been a significant adopter of wearable payment technologies, driven by the demand for cashless payments in stores and e-commerce. Additionally, the festival and life events sector is anticipated to see considerable growth in using wearable payment devices like wristbands, which offer attendees a convenient and secure way to make purchases without carrying cash.

Recent Developments

Product Launches by Leading Companies:

- In September 2020, Apple Inc. introduced the Apple Watch Series 6 and Apple Watch SE, along with the first fitness experience built for the Apple Watch. These products expanded health and wellness features and enabled payment through Apple Pay.

- Samsung Electronics announced the Galaxy Watch4 and Galaxy Watch4 Classic in August 2022. These smartwatches feature the new Wear OS Powered by Samsung, built jointly with Google, offering advanced hardware performance and a connected user experience.

- Garmin International, Inc., a unit of Garmin Ltd., announced new band designs for the vívofit jr. 3 kids’ fitness tracker lineup in May 2022, adding more variety and appeal to its product range.

- Xiaomi launched the wearable S1, a smartwatch, in December 2021. This launch was part of Xiaomi’s strategy to offer affordable wearable payment solutions.

Technological Innovations and Partnerships:

- BillBox, in collaboration with NSDL Payments Bank and Visa, unveiled TapTap, a wearable device facilitating contactless payments. This innovation is a testament to the growing trend of contactless payments in India.

- DIGISEQ partnered with Curve to offer wearable payments across Europe, combining DIGISEQ’s wearable technology expertise with Curve’s digital wallet technology for a seamless payment experience.