Table of Contents

Introduction

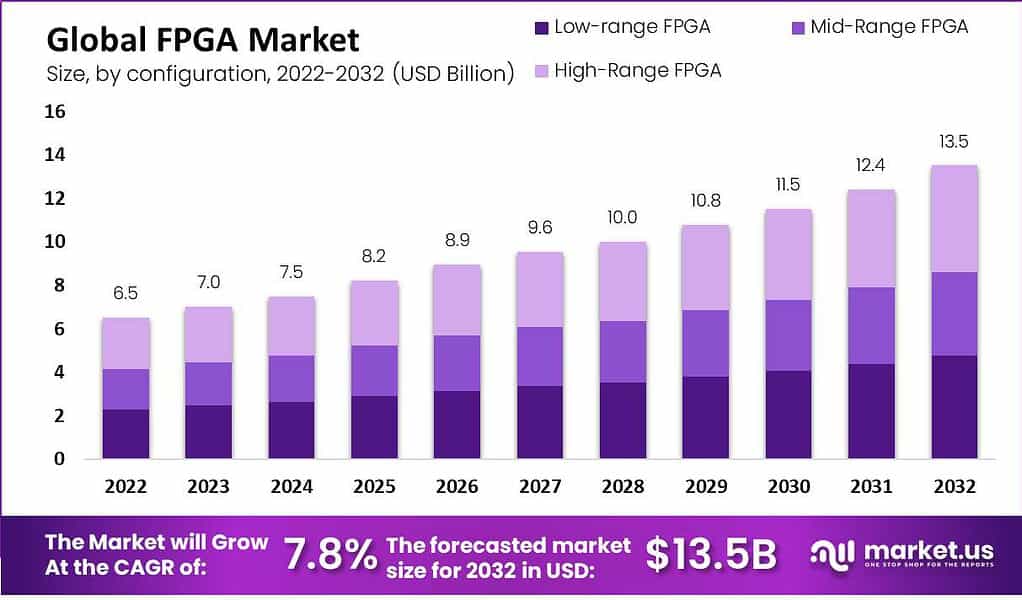

The Field-Programmable Gate Array (FPGA) Market has witnessed substantial growth, driven by evolving technological needs across various industries. In 2023, the market was valued at USD 7.0 billion and is anticipated to reach USD 13.5 billion by 2032, exhibiting a CAGR of 7.8% during this period. This growth trajectory underscores the market’s dynamic nature and the increasing reliance on FPGAs for diverse applications.

Several factors contribute to the expansion of the FPGA market. The adaptability of FPGAs, allowing for post-implementation reconfiguration, addresses the demand for customizable integrated circuits across sectors. This flexibility is particularly advantageous in the military and aerospace industries, where secure communication and data processing are paramount. Low-range FPGAs have emerged as a dominant segment due to their affordability and low power consumption, making them suitable for a wide array of consumer electronics, image analysis, and electronic networks applications. Meanwhile, SRAM technology continues to hold the largest market share, attributed to its high performance, integration, and re-programmability for various applications.

The Asia Pacific region stands out as the most lucrative market for FPGAs, spearheaded by China’s substantial investments in semiconductor equipment and initiatives to bolster domestic manufacturing capacities. Such efforts are anticipated to further propel the demand for FPGA, supported by the region’s vast consumer electronics industry and the rapid adoption of 5G technology. North America and Europe also contribute significantly to the market’s growth, with advancements in IT & Telecommunication and automotive industries driving FPGA adoption.

However, the market faces challenges, including high power consumption relative to Application Specific Integrated Circuits (ASICs) and the high cost associated with FPGA implementation and maintenance. Despite these challenges, the increasing demand for IoT and the growing applications in IT & Telecommunication present lucrative opportunities for the global FPGA market.

Recent developments in the Field-Programmable Gate Array (FPGA) industry highlight the sector’s focus on strategic growth and technological innovation. In May 2023, Intel Corporation launched its new Agilex 7 FPGAs with R-Tile, marking a significant advancement in FPGA capabilities with the introduction of CXL and PCIe 5.0. This development is expected to enhance the FPGA market’s growth by providing more advanced solutions for high-speed computing and networking applications. Additionally, AMD, Inc. strengthened its position in the automotive sector by releasing XA AU10P and XA AU15P processors in May 2023, optimized for Advanced Driver Assistance Systems (ADAS) sensor applications, showcasing the increasing application of FPGAs in automotive technology.

Moreover, the market has seen strategic movements aimed at enhancing technological capabilities and market reach. For example, QuickLogic Corporation announced a partnership with SkyWater Technology in March 2022 to port the eFPGA technology to the 90 nm RH90 radiation-hardened process, targeting mission-critical applications. This collaboration signifies the importance of FPGA technology in developing solutions that offer both flexibility and ruggedness for various commercial and defense uses. In a notable market consolidation move, AMD’s acquisition of Xilinx in February 2022, in an all-stock deal valued at USD 35 billion, aimed at extending AMD’s product portfolio across diverse growth markets, indicates the strategic importance of FPGA technologies in expanding data center businesses and exploring new market avenues.

Key Takeaways

- The Field-Programmable Gate Array (FPGA) market was valued at USD 7.0 billion in 2023.

- By 2032, the market is projected to reach USD 13.5 billion, indicating a notable growth trajectory.

- This growth corresponds to a CAGR of 7.8% between 2023 and 2032.

- The Asia Pacific region is forecasted to be the most lucrative market, with a significant market share of 37.8% in 2023. China is the top sales contributor.

- Low-range FPGA configurations dominated the market, holding a significant market share of 35.2% in 2022.

- The 20-90 nm node-size segment was dominant, offering high-temperature tolerance and low power consumption.

- The IT & Telecommunication segment was the dominant end-use industry, capturing the largest market share in 2022.

- FPGAs are extensively used in wireless and telecommunications, driving market growth in this segment.

- The military and aerospace industry is witnessing substantial growth in FPGA adoption, driven by reliability and lower power consumption.

- Intel Corporation, Xilinx Inc., and Qualcomm Technologies, Inc. are among the major players in the FPGA market.

FPGA Statistics

- In 2020, Infineon Technologies AG completed the acquisition of Cypress Semiconductor Corporation.

Efinix Inc. announced support for its quad-core, Linux-capable Sapphire RISC-V processor in March 2023.

ALDEC developed a COVID-19 lung infection detecting system based on FPGA. - Intel Corporation launched the “Intel Agilex 7 FPGA” family, aiming to enhance performance and power efficiency.

- Xilinx Inc. introduced the “Versal AI Series” FPGAs focused on accelerating artificial intelligence workloads.

- Qualcomm Technologies announced the “Snapdragon Smart Connectivity Suite” with integrated FPGA functionality for 5G network infrastructure.

- India’s electronics production is projected to surge to $300 billion by 2026, indicating substantial growth potential.

- The Cyclone V FPGA consists of a FPGA segment and a hard processor system (HPS) with a singleor dual-core 32-bit Arm Cortex-A9 MPCORE clocked at 925 MHz.

- FPGAs have been appreciated by 34% of respondents for their ability to lower total input costs, making them cost-effective solutions.

- SRAM-based FPGAs allow for volatile reprogramming in-circuit, while Antifuse-based FPGAs offer non-volatile programming.

- The resistance on the switch for ONO anti-fuse FPGAs is 300-500 ohms, and for amorphous anti-fuse FPGAs, it is 50-100 ohms.

- The Cyclone V FPGA consists of two primary elements: the FPGA segment and a hard processor system (HPS) centered around a singleor dual-core 32-bit Arm Cortex-A9 MPCORE clocked at 925 MHz.

- FPGAs offer advantages such as low latency, fast processing power, and cost-effectiveness.

- Brand-new FPGAs typically cost over $10,000, while smaller and more affordable options are also available.

- The global FPGA market is driven by increasing demand across various industries, including telecommunications, aerospace, and industrial automation.

- SoC FPGAs offer processing capabilities tailored to diverse applications, such as controlling industrial motors and handling video processing tasks.

- The Stratix 10 SX FPGA targets high-performance applications like communication systems and high-performance computing, with quad-core 64-bit Arm Cortex-A53 processors.

- Configurable Logic Blocks (CLBs) are the core elements of FPGAs, allowing for custom digital circuit designs without custom silicon.

- FPGAs offer advantages such as low latency, fast processing power, and cost-effectiveness, making them valuable tools across various industries.

Use Cases Of FPGA

- Networking Equipment: FPGAs are widely utilized in high-end networking gear due to their ability to process data packets efficiently, enhancing telecom infrastructure.

- Telecommunications: They help telecom service providers enhance bandwidth and establish networks compatible across different generations, from 3G to LTE and beyond.

- Military and Aerospace: For applications requiring high reliability and low power consumption, FPGAs offer superior integration and are extensively used in radar, imaging, and secure communications.

- Data Centers: FPGAs contribute to the acceleration of web searches and are instrumental in AI applications, offering flexibility and speed without the complexity of developing custom ASICs. Microsoft’s Bing, for instance, achieved a 50% increase in throughput by using FPGAs.

- Artificial Intelligence and Machine Learning: Due to their programmability, FPGAs allow quick testing of AI algorithms, facilitating rapid market entry for new technologies.

- Automotive Industry: FPGAs are essential in developing advanced driver assistance systems (ADAS) and in-vehicle infotainment systems, providing high-performance processing for real-time applications.

- Consumer Electronics: Used in video game consoles and computers for faithful recreations of vintage systems, offering a flexible alternative to emulation.

- Industrial Automation: FPGAs serve in the automation of factories and industrial processes, improving efficiency and productivity.

- Image Processing: They are explored extensively for IoT security, interfacing with IoT devices, and processing high-definition images and videos in smart cities.

- Healthcare: In the medical field, FPGAs are used for imaging devices and diagnostic equipment, benefiting from their high processing power and reconfigurability.

Recent Developments

- Intel Agilex 7 FPGA Launch: Intel announced the Agilex 7 FPGA, the first FPGA with PCIe 5.0 and CXL capabilities, offering unparalleled bandwidth and interface capabilities for data center, telecommunications, and financial services applications.

- F-Tile Equipped Agilex 7 FPGAs: Intel launched Agilex 7 FPGAs equipped with F-Tile, boasting the industry’s fastest FPGA transceivers, aiming to address the most bandwidth-intensive applications in data centers and high-speed networks.

- China’s Influence on the Market: China is playing a crucial role in the expansion of the FPGA market due to its status as the world’s largest manufacturing hub for consumer electronics. The popularity of AI and smart homes in China is anticipated to offer significant growth opportunities for FPGA manufacturers over the next decade.

- Cloning Concerns: Cloning of FPGA designs poses a significant challenge in the market, as it can lead to intellectual property theft and misuse, impacting the financial and operational aspects of FPGA manufacturers.

Partnership and Product Launches

- Lattice announced its Lattice Avant-E FPGAs in December 2022, focusing on edge applications like data processing and AI.

- QuickLogic Corporation announced its PolarPro 3 family of low-power, SRAM-based FPGAs in February 2022, aimed at addressing semiconductor supply availability challenges.

- In March 2022, QuickLogic Corporation partnered with SkyWater Technology to port the eFPGA technology to the 90 nm RH90 radiation-hardened process for mission-critical applications.

- AMD and Xilinx entered into a definitive agreement in February 2022, where AMD acquired Xilinx in an all-stock deal valued at USD 35 billion, aiming to extend AMD’s product portfolio across diverse growth markets.

Conclusion

The FPGA market is positioned for robust growth fueled by technological advancements, increasing applications across industries, and strategic initiatives by leading market players. The continuous innovation in FPGA technology, coupled with the sector’s evolving needs, indicates a promising future for this market.