Table of Contents

- Introduction

- Editor’s Choice

- Legal Process Outsourcing Market Overview

- Industry Profile for Legal Occupations

- Current and Planned Legal Process Outsourcing (LPO) – By-Service

- LPO Provider Statistics

- Top Countries and Regions Where Law Firms Prefer to Outsource

- Time Management in Legal Process Outsourcing

- New Trends in Legal Process Outsourcing

Introduction

According to Legal Process Outsourcing Statistics, Legal Process Outsourcing (LPO) involves delegating legal tasks to external service providers, enabling organizations to focus on core activities while accessing cost-effective and scalable solutions.

LPO offers access to specialized expertise, leveraging advanced technologies to streamline processes and ensure confidentiality and compliance with regulations.

While globalization has facilitated the expansion of LPO services worldwide, effective risk management is essential to mitigate potential drawbacks.

Future trends in the LPO industry may include increased adoption of AI-driven solutions and a heightened focus on cybersecurity by Generative AI in Legal with the help of Legal AI Software.

In essence, LPO presents a strategic opportunity for organizations to optimize legal operations, reduce costs, and enhance efficiency.

Editor’s Choice

- In 2023, the total Legal Process Outsourcing (LPO) market revenue stood at $15.3 billion.

- The market culminates in a total revenue of $132.6 billion by 2033, with off-shore outsourcing contributing $105.28 billion and on-shore outsourcing generating $27.32 billion.

- In the competitive landscape of the global Legal Process Outsourcing (LPO) market, Cobra Legal Solutions LLC leads with a share of 15%.

- The global Legal Process Outsourcing (LPO) market is geographically diverse, with the Asia-Pacific (APAC) region dominating the market with a substantial 63% share.

- In 2014, legal opinions were the most commonly outsourced service, with 67% currently outsourced and an additional 23% planned for outsourcing.

- The geographical reach of Legal Process Outsourcing (LPO) providers is prominently led by India, which accounts for 59% of the market.

- For onsite services, administrative skills are priced between $60 and $320 per day, with an average rate of $201.

Legal Process Outsourcing Market Overview

Global Legal Process Outsourcing Market Size

- The global Legal Case Management Software Market is anticipated to be USD 5.9 billion by 2033. It is estimated to record a steady CAGR of 13.4% in the Forecast period 2023 to 2033. It is likely to total USD 1.9 billion in 2024.

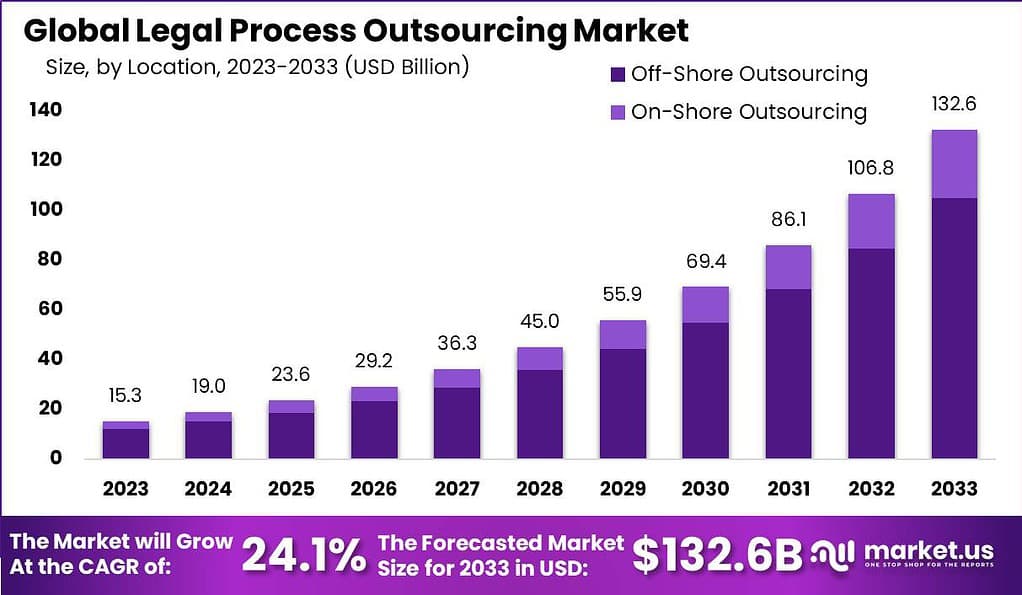

- The global Legal Process Outsourcing (LPO) market has experienced significant growth in recent years, with revenues rising from $15.3 billion in 2023 to an estimated $132.6 billion by 2033.

- In 2024, the market is projected to reach $19.0 billion, and by 2025, it is expected to grow to $23.6 billion.

- The growth momentum is expected to persist, with revenues hitting $69.4 billion in 2030, $86.1 billion in 2031, and $106.8 billion in 2032, culminating in a remarkable $132.6 billion by 2033.

Global Legal Process Outsourcing Market Size – By Location

- The global Legal Process Outsourcing (LPO) market, segmented by location, demonstrates a notable growth trajectory from 2023 to 2033.

- In 2023, the total market revenue stood at $15.3 billion, with off-shore outsourcing contributing $12.15 billion and on-shore outsourcing generating $3.15 billion.

- The market culminates in a total revenue of $132.6 billion by 2033, with off-shore outsourcing contributing $105.28 billion and on-shore outsourcing generating $27.32 billion.

Competitive Analysis of the Global Legal Process Outsourcing Market

- The global Legal Process Outsourcing (LPO) market is characterized by a diverse competitive landscape with several key players holding significant market shares.

- Cobra Legal Solutions LLC leads the market with a share of 15%, followed closely by Clairvolex and Evalueserve, each holding 12%.

- CPA Global Ltd. controls 11% of the market, while Exigent and Integreon Managed Solutions Inc. each account for 9%.

- Infosys Ltd. holds an 8% share, reflecting its substantial presence in the industry.

- Clutch Group commands 10% of the market.

- Additionally, other key players collectively contribute to 14% of the market share, indicating a competitive and dynamic market environment.

Regional Analysis of the Global Legal Process Outsourcing Market

- The global Legal Process Outsourcing (LPO) market is geographically diverse, with the Asia-Pacific (APAC) region dominating the market with a substantial 63% share.

- North America follows, accounting for 20% of the market, reflecting its significant demand for cost-effective legal services and advanced technological integration.

- Europe holds an 8% share, indicating a growing acceptance of LPO solutions within its legal sector.

- Latin America contributes 6% to the global market, while the Middle East and Africa (MEA) region accounts for the remaining 3%.

Industry Profile for Legal Occupations

Industries with the Highest Levels of Employment in Legal Occupations

- In the United States, legal occupations are most prevalent in several key industries, with the highest levels of employment found in the Legal Services sector.

- This industry employs 753,360 individuals, accounting for 63.45% of its total workforce.

- Local government, excluding schools and hospitals, employs 98,390 legal professionals, representing 1.79% of its employment.

- State government, excluding schools and hospitals, follows with 94,610 legal workers, making up 4.46% of its workforce.

- The combined category of federal, state, and local government (excluding schools, hospitals, and the U.S. Postal Service) employs 76,210 individuals in legal roles, constituting 3.56% of its total employment.

- Additionally, the insurance carriers’ industry employs 32,910 legal professionals, which accounts for 2.69% of its workforce.

Top Paying Industries for Legal Occupations

- The top-paying industries for legal occupations in the United States offer lucrative salaries, reflecting the specialized nature of these roles.

- In the Other Ambulatory Health Care Services industry, legal professionals earn an hourly mean wage of $134.25, translating to an annual mean wage of $279,240, despite accounting for only 0.05% of the industry’s employment with 160 individuals.

- The Promoters of Performing Arts, Sports, and Similar Events industry employs 210 legal professionals, or 0.13% of its workforce, with an hourly mean wage of $123.32 and an annual mean wage of $256,500.

- Legal occupations in the Water, Sewage, and Other Systems industry, though comprising just 0.07% of employment with 40 workers, offer an hourly mean wage of $121.56 and an annual mean wage of $252,850.

- Support Activities for Rail Transportation also employs 40 legal professionals, representing 0.1% of its workforce, with an hourly mean wage of $120.78 and an annual mean wage of $251,210.

Current and Planned Legal Process Outsourcing (LPO) – By-Service

- In 2014, the landscape of legal process outsourcing (LPO) services was marked by varied levels of current outsourcing and planned future outsourcing across different legal services.

- Legal opinions were the most commonly outsourced service, with 67% currently outsourced and an additional 23% planned for outsourcing.

- Legal counsel followed closely, with 65% currently outsourced and 15% planned for future outsourcing.

- Patent review and drafting services saw 57% of current outsourcing, with 14% planned for outsourcing.

- Legal research and analysis had 56% currently outsourced and a notable 26% planned for future outsourcing.

- Negotiation support and paralegal support services were each currently outsourced by 43%, with future outsourcing plans at 14% and 17%, respectively.

- Contract drafting services were currently outsourced at 37%, with 18% planned for outsourcing.

- E-Discovery services showed 35% current outsourcing and a significant 25% planned for future outsourcing.

LPO Provider Statistics

LPO Employee Headcount – By Service

- The distribution of employee headcount in the Legal Process Outsourcing (LPO) sector is varied across different service towers.

- Litigation services account for the largest share, with 26% of the total LPO workforce.

- Intellectual Property (IP) services follow with 14%, while Corporate Compliance services employ 12% of the workforce.

- Procurement services represent 9% of the employee headcount, and Resources services account for 7%.

- Property services employ 4% of LPO professionals, while Employment services have a 3% share.

- Consulting services constitute 1% of the workforce.

Geographical Reach of LPO Providers

- The geographical reach of Legal Process Outsourcing (LPO) providers is prominently led by India, which accounts for 59% of the market.

- The United States follows with a 22% share, reflecting its significant involvement in the LPO sector.

- The United Kingdom holds 6% of the market, while the broader Asia-Pacific (APAC) region, excluding India, contributes 4%.

- Western Europe represents 3% of the market, and Eastern Europe accounts for 2%.

- Other regions collectively make up the remaining 4% of the market.

Top Countries and Regions Where Law Firms Prefer to Outsource

- Law firms show distinct preferences for outsourcing legal services to various countries and regions.

- The Republic of Ireland leads the list, with 44.60% of firms favoring it as an outsourcing destination.

- Australia and New Zealand are preferred by 40.10% of firms, while 38.10% opt for the United States.

- Scotland is chosen by 34.70% of law firms for outsourcing, followed by India at 22.30% and South Africa at 21.80%.

- Eastern Europe attracts 10.90% of outsourcing preferences, with Asia accounting for 8.90% and the Philippines at 4.50%.

Time Management in Legal Process Outsourcing

Tasks In-House Lawyers Wish They Had More Time to Do

- In-house lawyers express a strong desire to dedicate more time to various tasks that enhance their strategic and operational effectiveness.

- According to a survey, 28% of respondents wish they had more time to conduct strategic planning, while 27% would like to focus on improving internal processes, management, and efficiencies.

- Nineteen percent of in-house lawyers aim to increase their interactions and coordination with the business.

- Improving the legal skills of their staff is a priority for 13% of respondents, and 8% wish to engage more in negotiating large deals.

- An additional 6% of in-house lawyers have other tasks they would like to allocate more time to.

New Trends in Legal Process Outsourcing

- In 2024, the Legal Process Outsourcing (LPO) market is experiencing several notable trends driven by technological advancements and shifting business needs.

- One major trend is the increased adoption of Robotic Process Automation (RPA), which streamlines repetitive tasks such as data entry and document management, thereby enhancing efficiency and reducing errors.

- Additionally, there is a growing focus on cybersecurity outsourcing as businesses seek specialized expertise to protect sensitive data amidst rising cyber threats.

- Cloud outsourcing continues to gain traction, offering scalability and flexibility for various legal processes, including data storage and software development.